Gold Still Benefiting From Choppy Stock Market

Gold's immediate trend still up despite calming of global trade fears.

Gold price should remain elevated as long as equity market is choppy.

Emerging market trend is also supporting gold's near-term trend.

Gold kept its immediate-term uptrend intact on Monday despite a much calmer financial market. Gold has benefited from the recent headline-driven turbulence in the global equity market, yet even the temporary allaying of economic fears didn't dent gold's latest rally attempt. In this report I'll explain why gold can still benefit from the unresolved immediate-term condition of the financial market as well as from emerging market weakness. Regardless of how the "tariff tantrum" turns out, the metal's immediate trend remains up.

Gold prices were slightly higher on Monday despite a calming of fears over the trade dispute between the U.S. and China. Spot gold gained 0.3 percent at $1,336 while June gold futures were higher by $4, or 0.3 percent, closing at $1,340.

The most significant development behind gold's positive performance Monday was the decline in the U.S. dollar index, which has resumed its inverse correlation with the yellow metal after briefly threatening to break the link. Investors have shown a tendency to move cash during periods of heightened stock market volatility in recent days as trade-related fears have served as the main selling catalyst for stocks. Gold has benefited to some extent as safe-haven buying has increased, yet the demand for dollars has been stronger than the demand for gold until now.

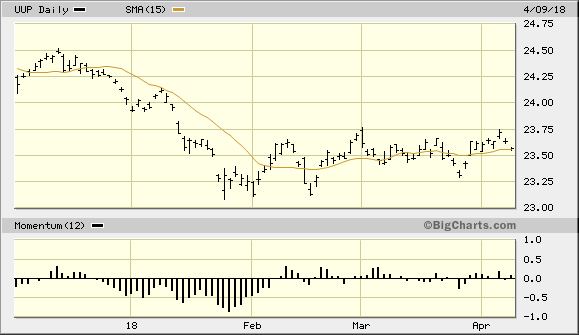

Shown here is the PowerShares DB US Dollar Index Bullish Fund (UUP), my dollar proxy, which sank back to its immediate-term (1-4 week) trend line, the 15-day moving average, after attempting yet another breakout attempt last week above its pivotal $23.75 level, which is the ceiling of a multi-week trading range in the dollar ETF. The pullback in the greenback has given gold some additional breathing room to establish support above its immediate-term trend line, which we'll examine next.

Source: BigCharts

What made gold's rise on Monday all the more impressive was that it was concurrent with a rally in global equities. Stocks rose Monday as the Trump administration downplayed investors' recent fears of a trade war with China. Traders remained cautious, however, as evinced by the sharp intraday reversal on Monday of a strong rally in the equity market. This action also shows that the choppiness and uncertainty which have plagued the stock market since last month is an ongoing problem which hasn't been resolved yet.

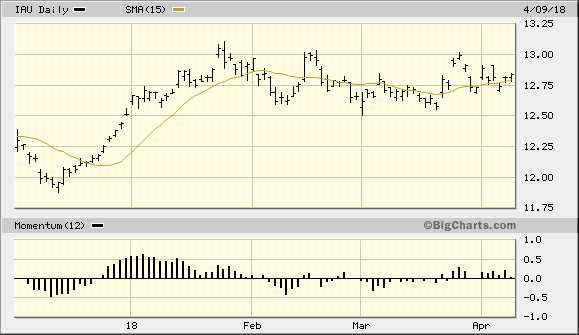

The iShares Gold Trust (IAU), my favorite gold trading vehicle, is shown here. As previously discussed, IAU should continue to benefit from the lingering weakness in the U.S. equity market. This weakness is clearly evident in the fact that NYSE-listed stocks making new 52-week lows have outnumbered new highs almost every day for over a month. Moreover, the 4-week trend of the stock market remains choppy and uncertain, which is bolstering the demand for gold based on its fear component.

Source: BigCharts

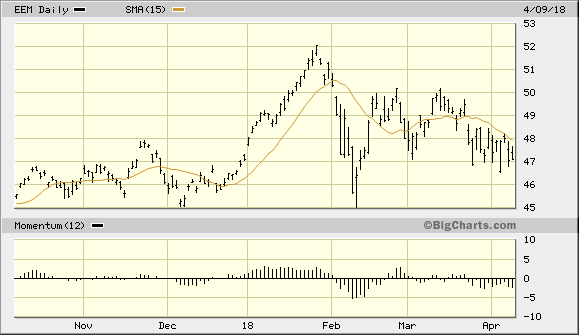

Another area of the market which has supported a benign outlook for gold has been the overall intermediate-term (3-6 month) trend of the emerging markets. The iShares MSCI Emerging Markets ETF (EEM) is a good proxy to use for the overall trend of emerging market stocks, and as you can see here the emerging markets have been under pressure since peaking in January. Emerging markets volatility has been a big concern for stock investors, and the weakness in the EEM has mirrored the weakness in the domestic equity market since January. What's more, EEM is also mirroring the trend in China's stock market and by association both EEM and China can be used as barometers of investor fear over a potential trade war. In other words, if selling pressure in the emerging markets intensifies from here gold should directly benefit from it as the metal's fear components would once again come into play.

Source: BigCharts

On a strategic note, IAU confirmed an immediate-term buy signal per the rules of the 15-day MA trading method two weeks ago. This signal is predicated on a 2-day higher close above the rising 15-day moving average. I've purchased a conservative trading position in the iShares Gold Trust after it confirmed the immediate-term (1-4) breakout signal on Mar 23. I'm using the $12.55 level as the initial stop loss on an intraday basis for this trade. Meanwhile longer-term investment positions in gold should be maintained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts