Gold Weekly: Too Late To Ride The Wave?

Gold is quiet at the start of the week as investors prefer risk-on trades.

Speculators were bullish gold over Jan. 2-9, the CFTC shows.

ETF investors took some profit over Jan 5-12, according to FastMarkets' estimates.

The global macro backdrop is gold-positive. Brief analysis of the dollar and US real rates.

I am long GLD.

Introduction

Welcome to my Gold Weekly.

In this report, I wish to discuss mainly my views about the gold market.

To do so, I analyze the recent changes in net speculative positions on the COMEX (based on the CFTC statistics) and ETF holdings (based on FastMarkets' estimates) and draw some interpretations about investor and speculator behavior. I conclude the report by sharing my trading positioning.

While the CFTC statistics are public and free, the data about gold ETF holdings are from FastMarkets, an independent metals agency which tracks ETF holdings across the precious metals complex.

Speculative positioning

Source: CFTC.

According to the latest Commitment of Traders report (COTR) provided by the CFTC, money managers lifted substantially their net long position for a fourth week in a row over the reporting period (Jan 2-9) but spot gold prices weakened 0.8% from $1,320 per oz to $1,310 over the corresponding period.

The net long fund position - at 555.79 tonnes as of January 9 - increased 135.73 tonnes or 32% from the previous week (w/w). This was driven predominantly driven by long accumulation (+135.20 tonnes w/w), while shorts covered their positions by a marginal 0.52 tonne w/w.

The net long fund position already is up 250.30 tonnes or 82% since the start of the year after rising 182.55 tonnes or 149% in the whole of 2017.

Investment positioning

Source: FastMarkets.

ETF investors sold 3.21 tonnes of gold over Jan. 5-12, while spot gold prices strengthened 1.4% from $1,319 per oz to $1,337 over the corresponding period.

The wave of ETF selling in gold was concentrated on January 9 (-3.12 tonnes) and January 10 (-2.54 tonnes), which coincided with a drop of 0.60% and an increase of 0.31% in gold prices, respectively.

ETF investors have left their gold holdings little changed (-1.67 tonnes or -0.1%) since the start of the year. In the whole of 2017, ETF investors were net buyers of 173.38 tonnes of gold, which represents an increase of 8.8% in gold ETF holdings.

As of January 12, 2017, gold ETF holdings totaled 2,121.46 tonnes, according to FastMarkets' estimates.

My global macro view on gold

The global macro environment is presently supportive of precious metals, principally thanks to a notable weakness in the dollar.

Source: Net Dania.

The DXY continues to weaken this week after dropping 1.21% last week, its largest weekly loss since September 2016. Down ~1.5% in the year to date, the DXY is presently at its lowest since December 2014.

Several factors are at play to explain the weakness in the dollar.

On the domestic front, the Fed's monetary policy stance is dollar negative. As I explained in a previous article, the Fed has shown a clear intention to keep the neutral rate (R-star) low, evidenced by its regular dot-plot. By producing a ceiling for forward rates due to a contraction in term premiums, US Treasury yields have been capped, which in turn has exerted downward pressure on the dollar. Jerome Powell, set to replace Janet Yellen as Fed Chairman in February, is likely to keep the current Fed's stance unchanged in so far as Powell is the "continuity candidate." In this regard, the dollar is likely to weaken further.

Turning to the international front, the dollar weakness can be attributed to the strength in the euro and the yen. The strong euro is the result of stronger-than-expected macro data, and more importantly, a subtle change in the ECB's forward guidance, as the minutes of the December meeting revealed. The strength in yen was driven by expectations of a possible QE unwind this year after the BoJ unexpectedly cut its long-term purchases at its January meeting.

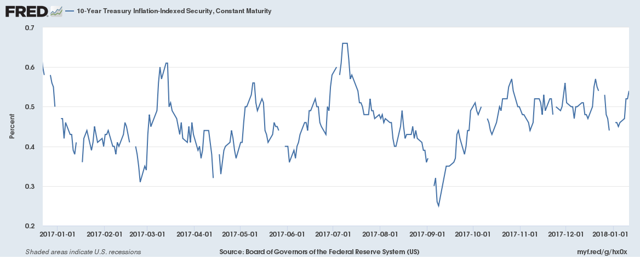

The second key macro parameter of gold is US real interest rates, as proxied by the 10-year US TIP yield.

Source: Fred.

US real rates have firmed since the start of the year, principally due to a rise in US nominal rates caused by a positive global macro environment and rumors (albeit denied) that China may express a diminished interest in US Treasuries.

But because the rise in US nominal yields also has been driven by rising inflation expectations on the back of a strong oil price, the move in US real rates has been more contained.

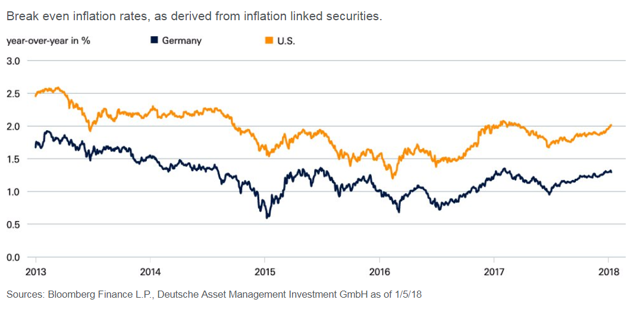

Pick-up in inflation expectations

Source: DB.

The sharp increase in US core CPI data, released last Friday, has boosted further inflation expectations, which is why US real interest rates have not moved higher.

Source: Credit Suisse.

US real rates are unlikely to rise significantly in the months ahead thanks to a steady rise in inflation expectations. This should thereby not undermine gold's spec/ETF positioning.

To sum up, I expect the macro backdrop for gold to remain friendly in the months ahead, especially due to a continued dollar weakness, driven by the Fed's cautious stance and rising expectations of monetary policy normalization in the rest of the developed world (ie, Europe, Japan, and UK). This should prompt speculators/ETF investors to bid gold.

Trading positioning

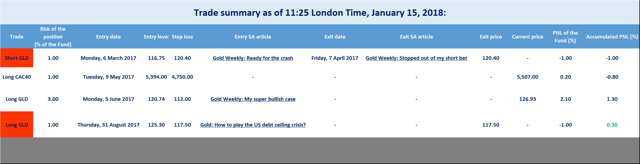

I have been long SPDR Gold Trust ETF (NYSEARCA:GLD) since last summer to express my bullish view on gold.

Source: Trading View.

GLD recorded a gain of 1.3% last week, marking a fifth straight week of gains.

Momentum-based indicators signal that the technical uptrend is strong and sustainable.

In this context, I expect GLD to eventually overcome its 2017 high of $128.32.

The bullish breakout pattern, which started this summer, is still in place, inducing me to keep my bullish bias on GLD intact.

For the sake of transparency, I will update my trading activity on my Twitter account and post my trade summary at the end of each report.

Final note

My dear friends, thank so much for showing your support by pressing the "Follow" button and sharing this article. I look forward to reading your comments below.

![]()

Disclosure: I am/we are long GLD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.