Gold Will Stay On Top Amidst A Flurry Of Headwinds

The World Gold Council released a gold update indicating solid performance in 2017 supported by robust economy, US Fed raising interest rates three times and risk asset values ascend.

US dollar gold price surged to the highest annual gain since 2010.

Potential headwinds this year may not be as strong as many investors perceive it to be.

Image source: www.optionsellers.com

Investment Thesis

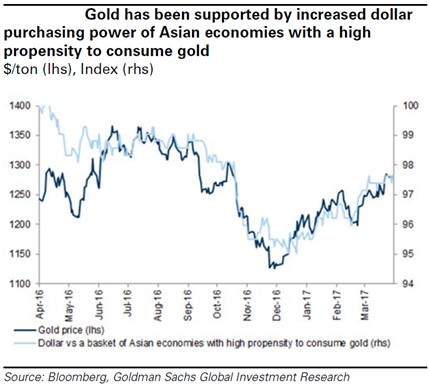

Based on the latest report of the World Gold Council, the gold market expects that growth in the world economy will be sustained and even accelerate towards 2018. The comprehensive review of the gold industry also stated that the improving economy would increase demand for gold attributed to higher incomes.

However, it does not automatically dictate a strong economic growth would imply higher gold prices. It would be in contradiction to the economic theorem that gold is always been a safe haven asset. We do know that gold prices are driven by investment demand.

In this commodity research, we will examine the veracity of facts speculated by the World Gold Council report that gold prices will perform satisfactorily in 2018.

We will also prove the market speculation that the yellow metal will outperform other asset classes. Similarly, this research will conclude on a positive note fostering investor confidence, citing the ability of gold to overcome risks and potential headwinds.

Investment Demand

There would be more buying of gold that will increase the investment demand. China, for example, epitomizes a great demand for retail gold. The country is next to India in the global consumer gold market. In November 2017, demand for gold bars in India rose 40% from year-ago levels. The number one gold consumer India had a strong momentum towards gold imports that soared 67% year-on-year in 2017.

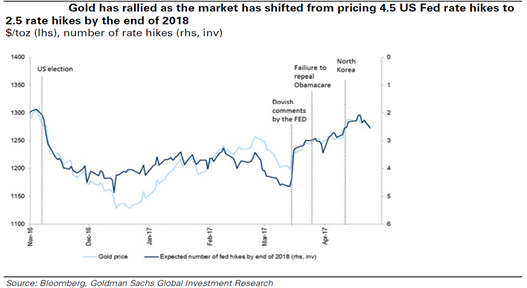

Source: Bloomberg, Goldman Sachs Global Investment Research

However, there is less gold coming out of the ground which should benefit gold investors this year. Gold mining (GDX) is down 3.33% as gold output was said to be at its weakest point since the financial crisis with downside risks only getting stronger.

The weak gold output was attributed to cash-strapped gold companies like Freeport-McMoran (FCX) whose shares fell -7.61% after closing down underperforming mines. This is attributed to changes in regulatory policies for miners in South Africa and Indonesia.

The historical relationship between gold mine expansionary capital expenditures and gold mine supply points to a production peak in 2017, and a decline in mine supply through 2020. Historically, falling gold supply was supportive for gold price partly because it meant that less material was available to meet jewelry and investment demand. Investors find buying a scarce commodity appealing.

Asset Classes & Prices

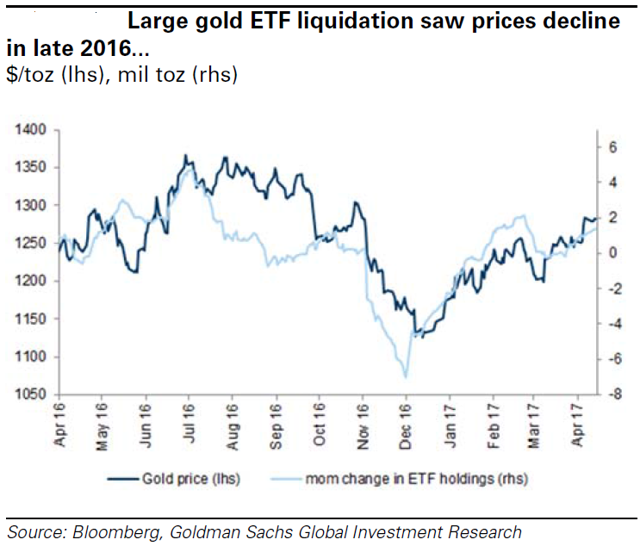

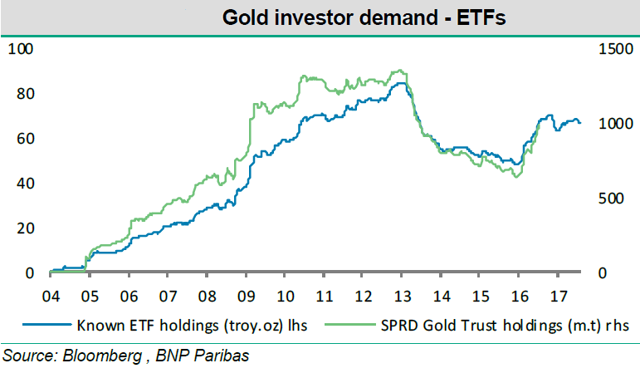

Chinese demand for gold was key in absorbing the Exchange Traded Fund (ETF) selling below $1,200 in late 2016. China imported 6 million tonnes. One of the primary reasons for the rebound in the gold price was the end of the selling pressure of the ETFs.

In the same year, ETFs liquidated a considerable portion of their gold holdings. The decrease in ETF holdings was one of the sharpest in history. Gold price had to go down to incentivize buyers to absorb this large quantity.

Source: Bloomberg, Goldman Sachs Global Investment Research

During the ETF liquidation, the United Kingdom recorded large gold exports into Switzerland. Note that most ETFs keep physical gold in London. It is in Switzerland where gold was re-smelted and made suitable for retail customers. Switzerland then exported the gold with the bulk of it going to mainland China.

Popular author Jim Rickards believes that we are at the initial period of the third great bull market of the later generation. The first bull market started from 1971 to 1980, while the second commenced 1999 and ended 2011. The third bull market started last December 2015. Hence, he believes gold price could peak to $1,500 in 2018.

Mr. Rickards added that gold price is tied up to real interest rates. Although, surprisingly enough the elevated gold price is matched with high headwinds. The US Federal Reserve is believed to be not just hiking rates rather brings destruction to funds flow by unwinding the balance sheet. The author believes that real rates are extremely high but will come right down.

Analysts suggest watching the market behavior of retail investors, especially those who accumulated gold and silver between 2006 and 2011. That is the time when these precious metals peaked higher than $1,900. It's a rarity to see these retail gold investors selling into strength. This is because what investors could be trying to achieve is waiting for it to break even.

Source: Bloomberg, BNP Paribas

U.S. Dollar

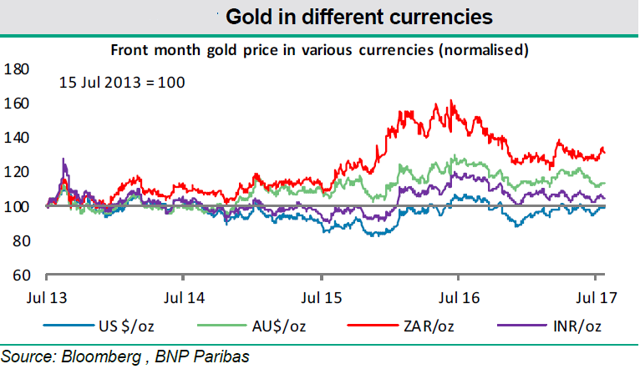

The trend in the US dollar is a weak one. The US Dollar Index (DXY) fell to a three-month low of -0.06%. This came after the dollar benchmark went lower by nearly 10% during 2017. This should, later on, create another tailwind for gold rates.

But on the contrary, gold prices have been climbing in the last few months. It is not due to strong economic growth and elevated incomes, rather because of the rekindling of the key economies outside the United States. Investors have started pulling out funds from the dollar currency as the global economy is thriving. In the process, gold benefits as an antagonist of the dollar currency.

Source: Bloomberg, BNP Paribas

Federal Reserve

The World Gold Council noted the unceasing global economic expansion would probably end up with a tighter monetary policy. Higher interest rates exceed the opportunity costs of investing gold. Hence, normalization of central banks' rate policy must be negative for gold prices.

However, the council noted that the implications for gold are rather distinct. This is attributed to the quantitative tightening that will lead the financial markets under pressure. In addition, governments and households must be more sensitive to changes in interest rates than in the past.

Source: Bloomberg, Goldman Sachs Global Investment Research

My Takeaway

The bull market may continue throughout this year. Analysts have been trumpeting this clarion call for some time now. However, stock markets have moved steadily higher while credit standards succumbed lower. Most investors are obviously wary of asset values. They are also cautious about the changing landscape of the central bank monetary policies and their risk exposures.

I believe that investors could take advantage of having portfolio exposures to gold as it has historically reduced losses in times of financial distress. This will occur in the event that global financial markets would undergo correction.

I expect gold price to undergo some pressures this year. Market expectations of bearish catalysts include a repricing of US interest rate hikes and a faster quantitative easing reduction on the back of the US tax reform effect and spur the already solid global economic growth.

Another headwind for gold would be a low near-term economic recession risk. The probability of a downturn is below normal over the next 2-3 years but has been rising steadily in economies that are seeing unusually easy financial conditions and tightening labor markets.

These include the US, Germany, the UK, and a few smaller G10 economies (such as Canada and Sweden). In contrast, medium-term recession risk remains subdued in countries with remaining slack, including Spain, Italy, and France.

Global economic momentum remains clearly very strong. Economists expect higher core inflation and five more Fed Funds rate increases as a result of tax cuts and higher expected growth.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written by Gold News business journalist, Hans Centena. Gold News is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Investing involves risk, including the loss of principal. Readers are solely responsible for their own investment decisions. If you found this article to be informative and would like to hear more about my investment research, please consider hitting the "Follow" button above.