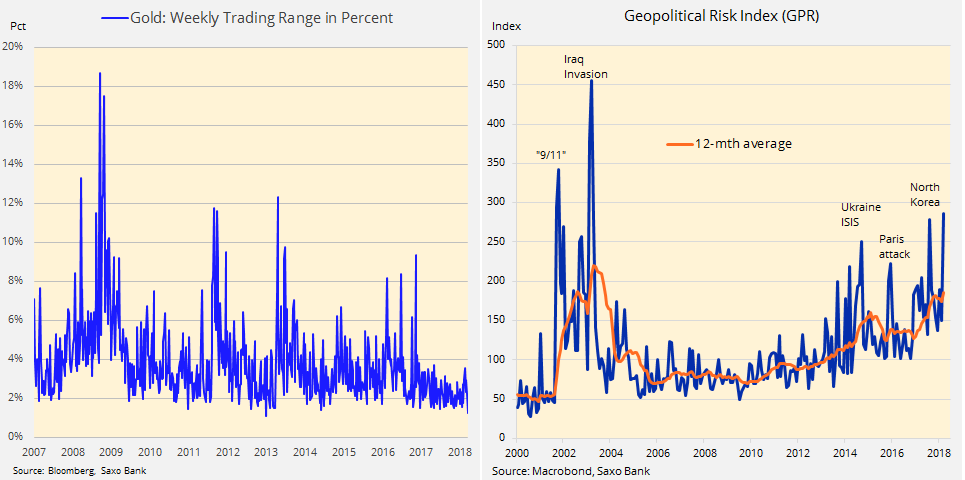

Gold price calm to shatter as geopolitical crisis index hits 15-year high

In a typically trenchant research note on Friday, Ole Hansen, chief commodity strategist at Saxo, warns that the calm on gold markets is likely to be shattered soon.

According to calculations by the Danish bank gold was set to experience its tightest weekly trading range in percentage terms since 2012 and in dollar terms since 2007.

Subdued dollar trading and the quiet on bullion boards came against a backdrop of geopolitical worry and volatility on financial markets:If the Fed fails to deliver a hawkish hike, gold is likely to find a bid with the focus returning to safe haven and diversification demand

Bouncing equity markets and US interest rate jitters - while a Fed hike is almost certain, the stance of the new chair isn'tRenewed tensions between Western powers and Russia over a nerve agent attack in the UKFears about the outcome of the hastily decided US-North Korea nuclear summitContinued turmoil in Washington as White House policies are overhauled and staff turned overImpact of America First agenda on trade with allies and rivals, particularly when it comes to increasingly autocratic China

Geopolitical Risk Index computed by Caldara and Iacoviello (March 2018) and is based on the frequency of words related to geopolitical tensions in international newspapers.Source: TradingFloor.com

Hansen points out that on the first score, gold's reaction could be positive - the five rate hikes seen so far in this current cycle all resulted gold selling off ahead of the move only to rally strongly once the announcement was made. But there's a big if.

Hansen says all of these hikes were characterized as being "dovish hikes", hence the potential negative impact this time round should Jerome Powell strike a more hawkish note (something recent economic data do not warrant).

If the Fed fails to deliver a hawkish hike, gold is likely to find a bid with the focus returning to safe haven and diversification demand:

Gold markets seeing one of the tightest trading ranges in six years while the geopolitical risk index sits at a 15-year high is unlikely to continue.

Gold was flirting with its lowest levels of 2018 on Friday. The most active gold futures contract on the Comex market in New York slid to a low of $1,309.50 an ounce in afternoon trade. The price of gold is still up $80 an ounce compared to this time last year.