Gold's Strength Will Outlast The Dollar's

Gold and the dollar are at a crossroads in terms of relative performance.

U.S. intervention to weaken the dollar is a possibility in coming months.

Regardless, global tensions virtually assure continued strength for gold.

The strange persistence of the strong dollar with the rising gold price has puzzled many participants this year. Some are even beginning to suggest that the dollar's inverse relationship with gold has been broken. In this report, I'll make the case that what we've seen so far this year has been an exception to the rule. The evidence I'll show here implies that we're likely to see a divergence between the U.S. currency's value and the gold price in the coming months. And while the dollar remains strong right now, gold will likely continue to outperform the greenback due to the threats facing the global economy.

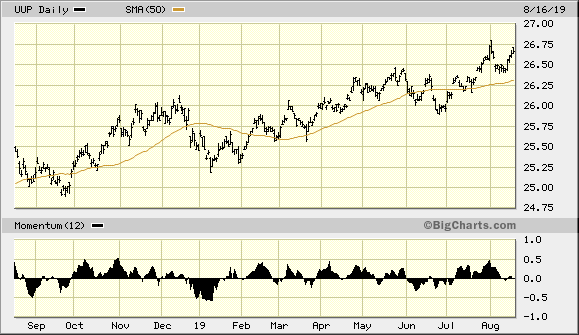

It has been a strange time indeed for the global financial market in 2019. For most of this year, the U.S. dollar index has strengthened, and in doing so has put downward pressure on commodity prices and other currencies. Normally, a strong dollar is mainly the result of a strong U.S. economy. In this case, however, the dollar's strength has as much to do with money flowing out of depressed emerging market assets and into the relative safety of the U.S. The dollar has been one of the main beneficiaries of this global flight to safety and its strength is reflected in the following graph of the Invesco DB U.S. Dollar Index Bullish Fund (UUP).

Source: BigCharts

A rising dollar index typically increases the purchasing power of U.S. wage earners due to the currency's appreciation relative to the price of consumer goods. But a strengthening dollar is also a double-edged sword in that it also results in lower commodity prices, which, in turn, hurts the earning power of export-dependent emerging countries. It also tends to depress oil prices and, if the dollar's strength continues long enough, will create a ripple effect which can destabilize the global economy. An example of this was in 1998 when the powerful strength of the dollar undermined the global financial market and resulted in a near-collapse of the commodity market. Then, as now, dollar strength created a downward spiral in energy prices and, eventually, hurt several major oil-dependent countries.

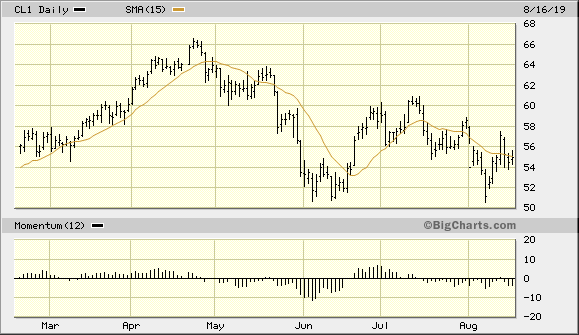

The crude oil market is beginning to show the strain of a persistently strong dollar. Below is the crude oil continuous contract price, which shows the extent to which the energy market is being hampered by the dollar. A strong dollar makes prices more expensive for countries which import oil.

Source: BigCharts

In the summer of 1998, which was the last time dollar strength precipitated a major global crisis, oil was in free-fall. This isn't the case now, although there are signs that other commodities - including natural gas - have been progressively weakened by the greenback's rising trend. It's also worth mentioning that the strong dollar "crisis" in the summer of '98 saw a temporary spike in the price of gold as investors rushed to safety when stocks and commodity prices were plunging. The gold futures price rallies nearly 10% in September that year during the worst part of the crisis. Thus there are some parallels between then and now despite the dollar being not nearly as strong now as it was then.

The main difference between 1998 and now is that the gold price has already established a longer-term rising trend, which means that gold buyers will have an easier time pushing prices higher. The steady persistence of fear - mainly in the form of trade war concerns - is also a constant support for the gold price. The following gold futures chart illustrates this established rising trend. However, as the gold price has over-extended from its 50-day moving average, a brief pullback or consolidative move (i.e. "pause that refreshes") is likely to occur before gold's next extended rally begins. Gold's intermediate-term (3-6 month) rising trend should, however, remain firmly intact despite any short-term weakness it may encounter.

Source: BigCharts

There's also a definite political incentive for the Trump administration to collaborate with the U.S. Treasury Department and the Fed at some point to weaken the dollar before the global economy becomes truly unhinged. A U.S. currency intervention would, of course, pave the way for China to accuse the U.S. of being a currency manipulator. But anything that weakens the dollar would also give additional support for the gold price due to its currency component. Between continued global market volatility and the possibility for a weaker dollar, gold stands to benefit in either case.

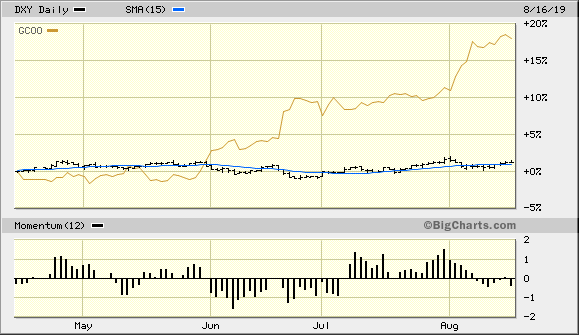

Turning our attention to the short-term technical picture, the U.S. dollar index (DXY) chart shows that it's struggling to stay above the 15-day moving average. The 15-day MA is a good indication of the strength of the dollar's immediate-term (1-4 week) trend, and while that trend is technically bullish, the dollar is badly lagging behind the gold price (GC00) in terms of relative performance, as the following graph shows.

Source: BigCharts

Since gold still enjoys a relative strength and price momentum advantage in the face of intensifying global market volatility, the yellow metal is more likely to continue outperforming the greenback in the intermediate-to-longer term. But to believe that a strong dollar and a strong gold price can continue coexisting is insupportable based on the historical inverse relationship between the two. In the final analysis, investors are likely to prefer gold to greenbacks as long as global safety concerns are paramount. Investors are, therefore, justified in maintaining intermediate-to-longer-term investment positions in gold and gold ETFs, as well as gold mining stocks.

On a strategic note, I'm currently long gold via the VanEck Vectors Gold Miners ETF (GDX). For this ETF, I'm using a level slightly under $27.00 as a stop-loss on an intraday basis. Participants who haven't done so should also book some profit in GDX after its impressive run of the last few weeks.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts