Happy New Year from The Mercenary Geologist

Despite the ongoing and deepening bear market for commodities and the junior resource sector, MercenaryGeologist.com continues to produce valuable analysis and research on commodities and equities. Our commitment to supply and demand fundamentals and contrarianism allows us to prosper in both good and bad markets.

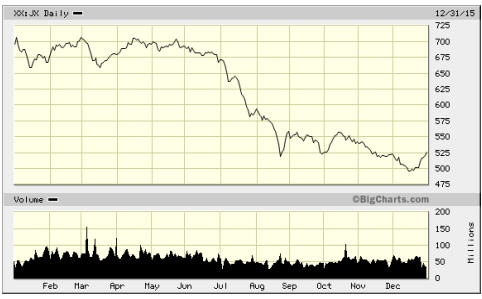

In 2015, the TSX Venture Index made its high of 707 on the year's first trading day, on the last trading day before PDAC, and again in mid-April. The junior market was narrowly range-bound between 660 until a summer doldrums downturn in early July that continued unabated to year's end. Yet another alltime closing low of 495 was set on December 15 at the culmination of tax-loss selling. As per usual, the Index rallied over the past two weeks and closed today at 526, down 26% for the year:

Since reaching its post-global economic high of 2440 pre-PDAC in 2011, the Toronto Venture Exchange Index has lost nearly over 78% of its value.

Everyone with tenure in our business remembers the post-Bre-X fallout from 1997-2003 as the mother of all resource sector bear markets. But folks, this one is fast approaching that dubious honor.

While many mining industry newsletter writers struggle with dwindling paid-subscriber bases, our sponsorship business model was stable over the year at nearly 6300 subscribers.

The majority of junior explorers and small to mid-tier miners are experiencing failure, malaise or simple indifference. Anchored by a secular view of commodities demand driven by worldwide population growth, we continue to selectively pick those companies built to survive for the long haul.

Despite the brutal bear market, we experienced a mostly positive short-term performance for our stock picks over the past 52 weeks.

Gold explorer and long-term sponsor Brazil Resources (BRI.V) was on board during the first quarter of 2015, with coverage commencing at 54 cents and spiking to 85 cents six weeks later.

My mid- to long-term bullish view of the uranium market led to a focus on this commodity in the spring and early summer. Companies included domestic ISR producer/developer Uranium Energy Corp (UEC.MKT). My timing was good as it gets in this market. The stock was at $1.41 when I initiated coverage in mid-March and it soared to $3.00 in less than three months.

I anticipate coverage of sister companies UEC and BRI again in 2016 as market conditions warrant.

In mid-April, two junior explorers came on board (Mercenary Musing, April 21, 2015).

First was uranium prospect generator CanAlaska Uranium Ltd (CVV.V), with 15 exploration projects in the Athabasca Basin, five of which are optioned or joint-ventured to other companies. I picked the company at 14 cents in mid-April and it spiked to 27.5 cents in four days on heavy volume before profittaking took it back down.

Next up was gold explorer Nevada Sunrise Gold (NEV.V). Unfortunately, this stock did not perform as I anticipated: It was picked at 34 cents, remained flat for a week, and then did not rally to that level again until changing focus to the next lithium bubble with a central Nevada property acquisition in the fall.

Integrated domestic uranium producer Energy Fuels Inc (UUUU.MKT; EFR.T) renewed its sponsorship in early June prior to closing acquisition of Wyoming ISR producer Uranerz Energy. My pick was at $4.70 and the stock went to $5.35 once the deal closed. My musing also contributed to the company's successful effort to gain a place in the Russell 3000 small cap index.

In late July, I covered another uranium company, past producer and developer Uranium Resources Inc (UREE.NASDAQ). URI is a long-lived ISR company that recently changed its primary focus from South Texas and New Mexico to central Turkey with acquisition of Anatolia Energy. The pick was at 83 cents and it went as high as 98 cents within a couple of weeks.

Note that the domestic uranium sector has taken a big downtick over the past few months and these aforementioned stocks can now be bought at significant discounts to the above prices. Given my mid- to long-term views of uranium supply-demand fundamentals, I remain a long-term shareholder of all of the above.

Although my timing on stock picks was very good in 2015, our substantial gains documented above were mostly short-lived. Folks, remember that profit-taking is never a bad move and is an especially sound strategy in a bear markets. You must trade to make money!

Now on to our products posted during 2015:

I wrote 19 musings this year with most covering the gold and uranium markets. I did 47 interviews and made 26 television and video appearances. Our two regular radio programs, the bi-weekly Mercenary Musings Radio with Rob Graham with its focus on commodities and exclusive syndication to Kitco.com, and the Monthly Market Review with Kerry Lutz of the Financial Survival Network log thousands of listeners for every show.

Our streaming internet radio station MercenaryGeologist.FM remains strong with listeners regularly tuning in from 35 countries on a monthly basis.

Substantial growth occurred for our Twitter feed: @mercenarygeo now stands at over 52,000, a gain of 30% for the year; we are the clearly the industry leader in social media. We constantly manage the Twitter account to attract quality followers from the resource and investing sectors and eliminate spammers and robots. Our tweets cover a veritable menagerie of subjects that include business news, commodities, equities, geopolitics, geological phenomena, individual freedoms, libertarian ideals, outdoor hobbies, and American spectator sports.

Despite the demise of most North American mining investment conferences, my public speaking events were up to nine venues in 2015. I spoke in Vancouver, Calgary, Toronto, Hong Kong, New Mexico, Denver, New York, Atlanta, and New Orleans.

Kudos go to those who make my business thrive. Note that I am only the front man at MercenaryGeologist.com, and therefore, my sincere thanks goes to the dedicated staff that brings our bevy of products to you on a weekly basis.

My tech wizard Raffaele Della Peruta continues his invaluable back-end work on the website. Kirsty Hogg enters year six as our social media and promotions manager. Gwen Preston is in year three as editor. Steve Sweeney, an engineering graduate student at New Mexico Tech, is our new research assistant for the commodity and equity markets.

Thanks also to my workers, friends, and neighbors in New Mexico's South Valley who tend the farm animals and keep watch over the compound when I travel.

My appreciation to you as a loyal subscriber is unequivocal, for we will not be successful unless you continue to have interest in what I have to say and write. Rest assured that I will be honest in my opinions, outspoken in my ideas, and consistent in my core values. As always, we welcome and value your input and comments via [email protected]. .

An unabashed devotion to contrarian market ideas is what distinguishes us from the majority of mainstream speculators. We remain mindful that most money is made by early positioning before capital market sectors turn bullish. Contrarianism requires diligent research, market understanding, and most of all, patience and commitment to a well-defined investment strategy.

Frankly, I see no end in sight for the downturn of most hard commodities. That said, solid speculations and informed investments made now will provide the best returns when mining and energy markets inevitably turn positive.

Finally, we wish you and yours an abundance of holiday cheer and remain hopeful for a better 2016 for the many good companies in which we hold positions. May all your trades be to the upside.

May all your trades be to the upside.

Click here to access the audio interview.

The Mercenary Geologist Michael S. "Mickey" Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 35 years experience as an exploration geologist and analyst searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for over 20 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey's professional credentials and experience, he is highaltitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia.

Mickey is well-known and highly respected throughout the mining and exploration community due to his ongoing work as an analyst, writer, and speaker.

Contact: [email protected]

Disclaimer: I am a shareholder of all the companies mentioned in this musing and Uranium Resources Inc pays a fee of $4000 per month to sponsor this website. I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in any report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation or advice to buy or sell stock or any asset or investment. All of my presentations should be considered an opinion and my opinions may be based upon information obtained from research of public documents and content available on the company's website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. My opinions are based upon information believed to be accurate and reliable, but my opinions are not guaranteed or implied to be so. The opinions presented may not be complete or correct; all information is provided without any legal responsibility or obligation to provide future updates. I accept no responsibility and no liability, whatsoever, for any direct, indirect, special, punitive, or consequential damages or loss arising from the use of my opinions or information. The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and may not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.