India Credit Tightening Squeezes Sarine Profit

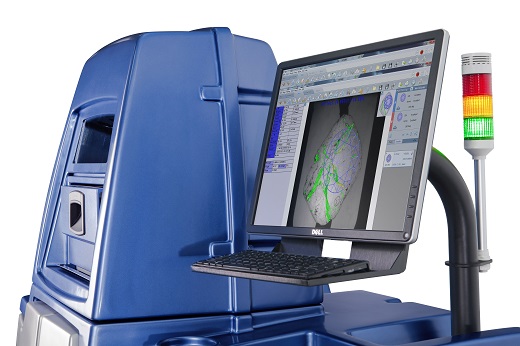

RAPAPORT... Sarine Technologies posted a loss in the first quarter ascredit problems in the Indian manufacturing sector led to softened demand forits equipment. The diamond-technology company reported a net loss of $1.4million, versus a profit of $3.1 million for the same period last year, thecompany said last week. The company's customers in India, its largest market,struggled to obtain credit from banks, leading to lower polished production. In addition, the lenders required some of the credit already extended to be returned by March 31, theend of the Indian fiscal year. Revenue for the period fell 34% to $10.9 million, with salesin India dropping 48% to $7 million for the January-to-March period. Thatdecrease outweighed a 58% increase to $1.3 million in Africa, Sarine'ssecond-largest market. North American sales rose 12% to $313,000, while revenuein Israel slumped 43% to $606,000. Although Sarine sold a record 33 of its Galaxydiamond-inclusion-mapping systems in the first quarter, those were for smallerstones, and have significantly lower gross margins than the models for largerstones, thereby failing to generate as much revenue, Sarine noted. Recurringrevenue from Galaxy services, including annual maintenance contracts and spareparts, accounted for 55% of total revenue. Custom reports, such as SarineProfile and Sarine Light, made up just under 3%. Growth in the man-made-diamond industry has affected the natural market, Sarine noted. However, it emphasized its diamond-inclusion-mapping technology and diamond reports are also applicable to synthetic diamonds. Image: The Sarine Galaxy. (Sarine Technologies)

RAPAPORT... Sarine Technologies posted a loss in the first quarter ascredit problems in the Indian manufacturing sector led to softened demand forits equipment. The diamond-technology company reported a net loss of $1.4million, versus a profit of $3.1 million for the same period last year, thecompany said last week. The company's customers in India, its largest market,struggled to obtain credit from banks, leading to lower polished production. In addition, the lenders required some of the credit already extended to be returned by March 31, theend of the Indian fiscal year. Revenue for the period fell 34% to $10.9 million, with salesin India dropping 48% to $7 million for the January-to-March period. Thatdecrease outweighed a 58% increase to $1.3 million in Africa, Sarine'ssecond-largest market. North American sales rose 12% to $313,000, while revenuein Israel slumped 43% to $606,000. Although Sarine sold a record 33 of its Galaxydiamond-inclusion-mapping systems in the first quarter, those were for smallerstones, and have significantly lower gross margins than the models for largerstones, thereby failing to generate as much revenue, Sarine noted. Recurringrevenue from Galaxy services, including annual maintenance contracts and spareparts, accounted for 55% of total revenue. Custom reports, such as SarineProfile and Sarine Light, made up just under 3%. Growth in the man-made-diamond industry has affected the natural market, Sarine noted. However, it emphasized its diamond-inclusion-mapping technology and diamond reports are also applicable to synthetic diamonds. Image: The Sarine Galaxy. (Sarine Technologies)