Ivanhoe Mines' DRC project likely Africa's top copper discovery shows fresh drilling results

Shares in Ivanhoe Mines (TSX: IVN) were up more than 3.6% Thursday morning after the Canadian miner released fresh drilling results from the Kakula section at its giant Kamoa copper project in Congo, which the company says could prove the discovery to be Africa's most significant deposit of the red metal ever found.

"Given the remarkable exploration success we have had to date at the Kakula Discovery (...) we believe that this new copper discovery is substantially richer, thicker and more consistent than other mineralization that we have found elsewhere on the Kamoa Project," Ivanhoe's executive chairman Robert Friedland said in a statement.

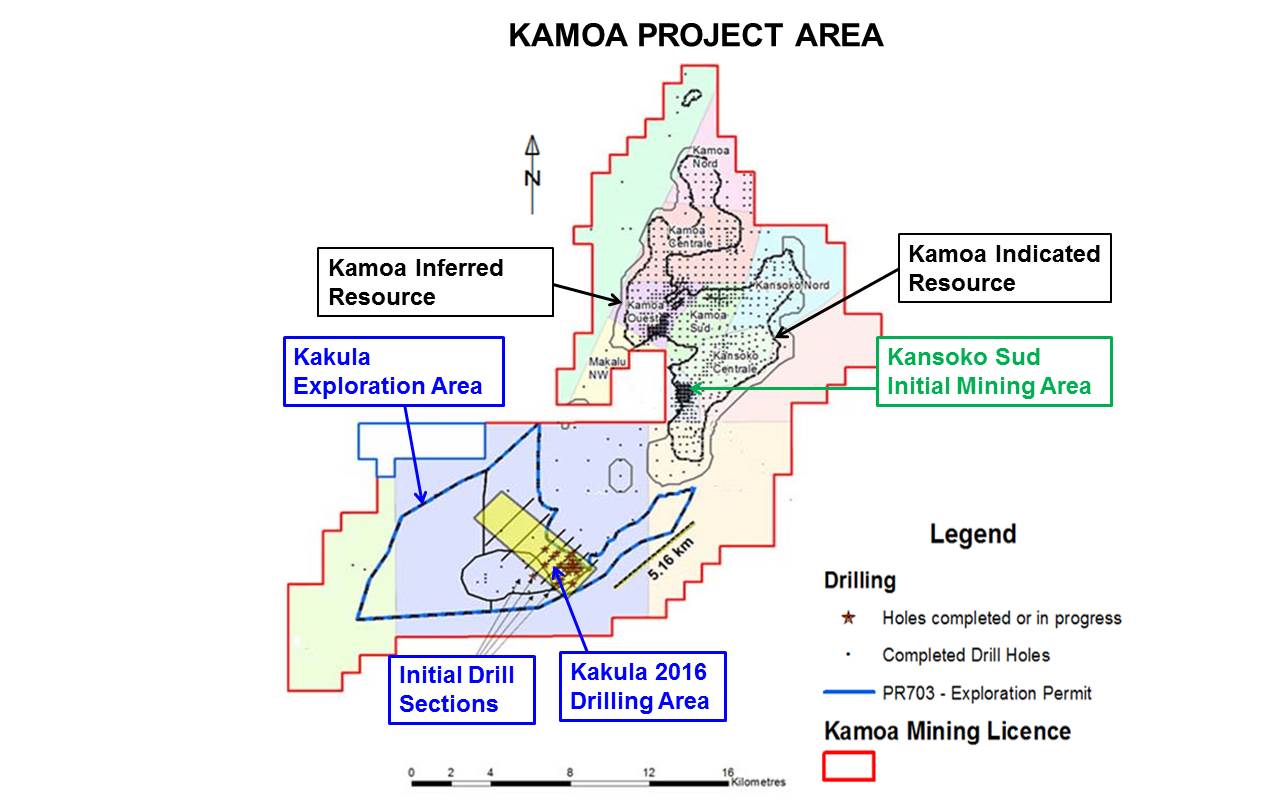

Kamoa is believed to be the world's largest undeveloped high-grade copper deposit.Development at Kamoa, already thought to hold the world's largest undeveloped high-grade copper discovery, is progressing ahead of plan, the company noted.

Originally estimated to begin operations in late 2018, the underground mine is now expected to reach the high-grade copper mineralization at the Kansoko Sud deposit during the first quarter of 2017.

This progress is partly being fuelled by the involvement of Zijin Mining, China's second-largest copper producer, which became a joint venture partner in the project last December after paying Ivanhoe $412 million for the stake.

The company, which is also China's largest listed gold producer, had previously acquired a nearly 10% stake in Ivanhoe for about $85 million.

Courtesy of Ivanhoe Mines.

Ivanhoe Mines estimates that Kamoa, discovered in 2007, holds the equivalent of at least 45 million tonnes of pure copper. The company aims to extract 300,000 tonnes per year once the mine is operating at full tilt.

Challenging scenario

Copper prices, however, are not helping to boost enthusiasm for the new mine. While other industrial metals and steelmaking raw materials have jumped in value this year, industry bellwether copper has been underperforming badly. The red metal is now trading flat year to date following a 26% decline in 2015 as a result of excess in the market.

Both analysts and companies are rather pessimist when it comes to forecast long-term prices for the metal.

World's No.1 copper miner Codelco has repeatedly said it expects the metal to trade at around $2 per pound for at least the next two years.

And last week, Goldman Sachs came out with a particularly bearish forecast, predicting double digit declines for the metal to a low of $1.80 per pound 12 months from now as a wall of new supply from Chile, Peru and Zambia hits the market.