More bad news for copper price

In New York trade on Thursday copper for delivery in September continued to drift lower after signs that cost deflation in the world's top producer Chile is only accelerating.

Copper futures were lasting trading at $2.17 per pound, a three week low. Amid a broad-based rally in industrial and precious metals, iron ore and coal, copper's performance has been disappointing with the metal trading flat year to date following a 26% decline in 2015.

Demand has been relatively robust, but so has production with below average disruptions this year. Another factor keeping a lid on the copper price is relentless cost cutting by producers.

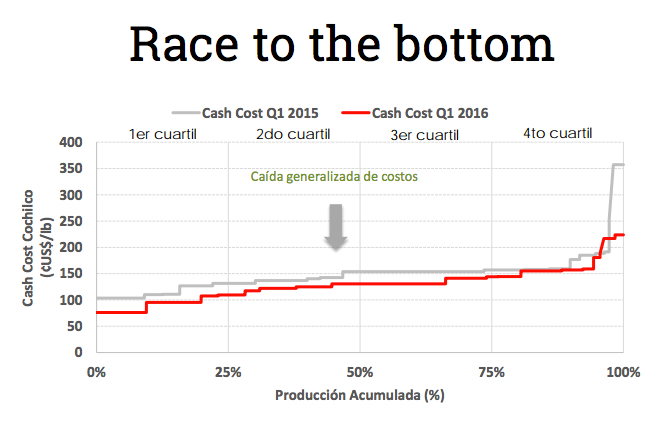

Chile's state copper commission Cochilco released a report this week detailing cost reductions in the country which is responsible for nearly 6 million tonnes of global annual production of 21 million tonnes.

Study shows the most efficient mines in top producer Chile now produce copper for less than $1 a pound after finding an additional 13% in savings this yearAccording to the study by the Chilean Copper Commission, mine level cash costs at Chile's 19 largest mines fell to an average of $1.285 per pound during the first three months of the year, down 13.3% or nearly 20c a pound from the same quarter of last year.

The best performing quartile now produce copper in Chile for less than $1 a pound and the extent of the cost reductions this year are striking for the fact that most of the currency and oil price savings would've have worked its way through the system by now.

The five largest mines in the South American country represent half of total production. BHP Billiton and Rio Tinto's giant Escondida mine alone produced 19% of the total followed by state-owned Codelco's El Teniente mine, Anglo American and Glencore-owned Collahuasi, Anglo's Los Bronces complex and Antofagasta's Los Pelambres.

Cochilco said the fall in output costs reflected improvement mine management, lower costs for electricity, services and shipping and lower treatment and refining charged by smelters. The longer-term trend of falling grades and increasingly contaminated concentrate at the world's biggest mines, coupled with increasing water costs in Chile makes the cost cutting even more remarkable.

As an indication that costs may even moderate from these levels BHP Billiton in half-year production review said it expects Escondida's costs to be slightly below its earlier guidance of $1.21 per pound for its 2016 financial year.

Cochilco has a downbeat price forecast for 2016 of $2.15 a pound ($4,740 a tonne) rising only slightly to $2.20 next year ($4,850). That compares to a 2015 average of $2.49 or $5,490.

Source: Cochilco