October Payrolls Soar to 531K, Smashing Expectations

After two months of dismal job reports, the BLS finally redeemed itself when moments ago it reported that in October the US gained some 531K jobs, well above the 450K consensus exp and above the 500K whisper number. The gain in payrolls was also bigger than all but 10 of the 75 forecasts in Bloomberg's survey.

As Bloomberg calculates, if payroll gains stay at the same pace as October's, in eight months the total payroll figure would be back at its record high.... that's also when the Fed would be finished zeroing-out QE. So, time for a rate hike in July?

Remarkably, the private payrolls print was a stellar 604K, with government jobs shrinking by 73K in October. Just as importantly, the Sept print was revised solidly higher, from 194K to 312K, as was August, up from 366K to 483K. With these revisions, employment in August and September combined is 235,000 higher than previously reported.

Also worth noting: gain in not seasonally adjusted payrolls last month was a whopping 1.56 million, which was more than the prior three months combined! As Bloomberg notes, "in terms of actual people actually heading to work, that's a whole lot more than we had in summer."

In any case, payrolls are now 4.2 million lower than the peak reached before the pandemic, February 2020. Naturally, this is better than the near-5 million we had in September.

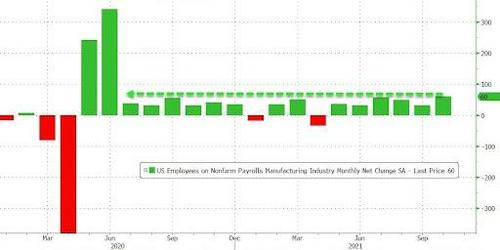

And there was some very good news for the US manufacturing sector which saw jobs jump by 60K in October, double the expected 30K.

We will have a more detailed breakdown later, but despite the solid headline print, leisure and hospitality hiring is still looking slower than before the delta wave... although it is picking up a bit, at +164,000 in October. August and September were also revised up a bit to +71,000 and +88,000, respectively.

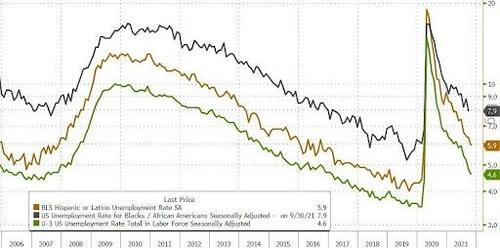

Validating the solid headline print was the Household survey which showed that the number of employed Americans jumped by 359K from 153.68K to 154.039K, and with the number of unemployed dropping from 7.674M to 7.419M, the unemployment rate dropped from 4.8% to 4.6%, below the 4.7% exp.

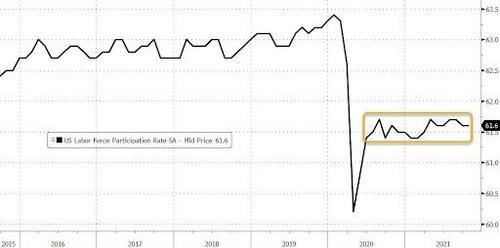

The labor participation rate was unchanged at 61.6% as the labor force rose modestly by just over 100K. Commenting on the flat print, Ross Mayfield, an analyst at Baird, sees the LFP rate as a "weak spot" again - "Would love to start to see that move higher as Covid wanes to show expanding labor supply and help ease some of those pressure. But a really strong report overall."

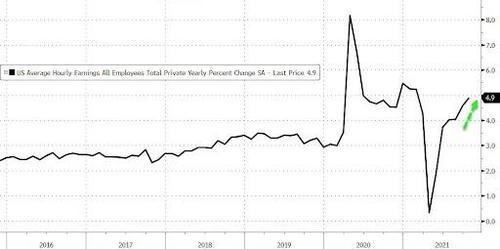

There was more good news, with average hourly earnings rising from 4.6% to 4.9% Y/Y, even if the monthly increase dipped modestly from 0.6% to 0.4%.

Digging a bit deeper, we find that wage growth is surging in leisure and hospitality, where it jumped 12.4% year-over-year, as retailers still can't find workers. But even in the rest of the labor market, wage growth of 5.9% is also basically the highest since the early 1980s.

Average weekly hours worked dipped slightly to 34.7 from 34.8. This measure had been elevated, as expected in a time when employers can't find workers they ask existing ones to work longer. So the dip in October could suggest that there's an ever-so-slight reduction in pressures.

Looking at the breakdown of job gains, growth was widespread in October, with notable job gains occurring in leisure and hospitality, in professional and business services, in manufacturing, and in transportation and warehousing. Employment in public education declined over the month.

The data will come as a relief to the battered White House, as it suggests the weaker August and September reports were indeed much affected by the delta variant, and not something more sinister. Commenting on the data, CFRA's Sam Stovall said that "This month's numbers played catch-up to the ADP reports of the past two months, demonstrating that the September BLS results were an anomaly."

Not everyone was impressed however: Katherine Judge, an economist at CIBC Capital Markets, said that "while better than expected, this print still leaves the unemployment rate 1.1%-points above the lows the Fed is aiming to see in the next two years."

Haris Khurshid, portfolio manager at Fate Capital Management, says the report was "relatively good" but he too had some reservations:

"I will add that there still is a record labor shortage, and this is feeding directly into the supply-chain issues we're seeing. While everyone is basically forecasting a record holiday shopping season, I'm not concerned with the demand, but rather the delays in shipping. We'll hopefully start seeing a consistent gradual improvement in the coming months within the labor market."

Commenting on the market's kneejerk reaction, Bloomberg Intelligence chief US rates strategist writes that "the Treasury knee-jerk reaction to the payroll report was for the curve to bear flatten with the three- and five-year sectors underperforming. This market appears to be thinking the report is good enough for the Fed to continue hiking beyond what is priced." He adds that "the belly of the curve should continue to attract the most attention, as the market searches for a terminal rate, which we think will be under 2% this cycle and probably not reached until 2024."

As for stocks, with futures trading at new all time highs, the meltup is poised to continue because as Baird's Mayfield says, this report was "kind of Goldilocks" as it's probably not a large enough beat to "really inspire the Fed to get much more hawkish," given the weaker participation rate.

"Definitely a positive. Eases any lingering stagflation fears and shows signs that Covid headwinds are waning."