Rates, returns, the dollar, and gold

I'm sure most of you have, like me, spent too much time reading and thinking about this issue in recent weeks. The first half of the year was so fun, so rewarding, with all the arguments for gold proving true. It is much less fun now seeing gains erode, seeing gold break down through technical barriers, seeing the US dollar rise and rise, and seeing US equities maintain a seemingly endless bull run that has become its own safe haven' for investment dollars.

My thoughts on gold have not changed much since two weeks ago, when the editorial titled Now versus Then laid bare the risk that gold would give up more ground in the near term despite bullish fundamentals. Since then the dollar has gained more ground to define a new 14-year high. The push: rising expectations around the rate hike. A 25 basis point hike is now fully priced in and the market has moved on, expecting Janet Yellen to raise the federal funds rate by 50 to 75 basis points.

Improved expectations for US economic performance are also helping lift the dollar, but that is always a conundrum. A rising dollar is difficult to sustain because dollar strength is such a drag on US multinationals, whose products become too expensive for international buyers.

Higher rates and a stronger dollar are also, of course, impacting bonds. US 10-year Treasury notes are now yielding 2.385%, up 30% since the election. And selling pressure is coming from all sides. Until the election reversed a 30-year bond bubble, US investors had been buying bonds for price increases (ironically, since they're designed to be yield instruments); now they are selling. At the same time some key central banks are reducing their treasury holdings: China sold $83 billion worth of US Treasuries between June and August, reducing their holdings to $1.16 trillion, while Saudi Arabia has sold about $30 billion or 25% of their US Treasuries since the start of the year.

With selling pressure on all sides, yields could well move higher. That poses a major challenge for a government that needs to service a debt load that has almost reached $20 trillion and that needs to sell yet more debt to finance Trump's huge infrastructure and defense spending plans.

A stronger dollar and higher Treasury yields don't bode well for US GDP growth. Estimates for real GDP growth in the fourth quarter currently sit around 2.5%. That means annual growth will come in around 1.6%, the slowest compounded annual growth rate since the end of the financial crisis in 2009.

Against that, equity valuations continue to rise as the market continues its Trump honeymoon. But the strong dollar will eat into profits and hurt earnings. As a result, price-to-earnings ratios will be way up when Q4 results come in. That could help temper enthusiasm for US stocks.

Much more could be said about all this, but I'd like instead to talk about base metals. So I'll end with a quote from someone at Sprott Asset Management, pulled from their weekly Sprott's Thoughts email:

"At the risk of appearing flippant, we would suggest Mr. Trump's unexpected triumph holds limited lasting relevance to the gold thesis. Given the gaping mismatch between total U.S credit market debt ($65 trillion) and GDP ($18.4 trillion), we are not sure a 2016 election-night victory by Jupiter, Apollo or Zeus could have significantly altered the economic landscape."

The article goes on to point out that historic expectations for real returns, of 5% in equity and 2.5% in fixed income markets, have fallen by half in the world of ultra low interest rates. The thing is that marginal returns eventually approach marginal costs. That means returns will remain challenged until nominal rates return to some kind of normal level...which is impossible given government debt loads.

That is the kind of big picture context to keep in mind. While rates remain low, marginal returns from equities and fixed income are capped, and at pretty low levels. Gold, which by contrast offers security and value in the kind of economically uncertain environment that would justify continued low rates, would benefit.

The only reason rates would rise is if inflation really picks up; that is also good for gold, which hedges against losses in fiat currency savings.

That's today's added thought on gold. Now to look at copper and zinc.

Copper

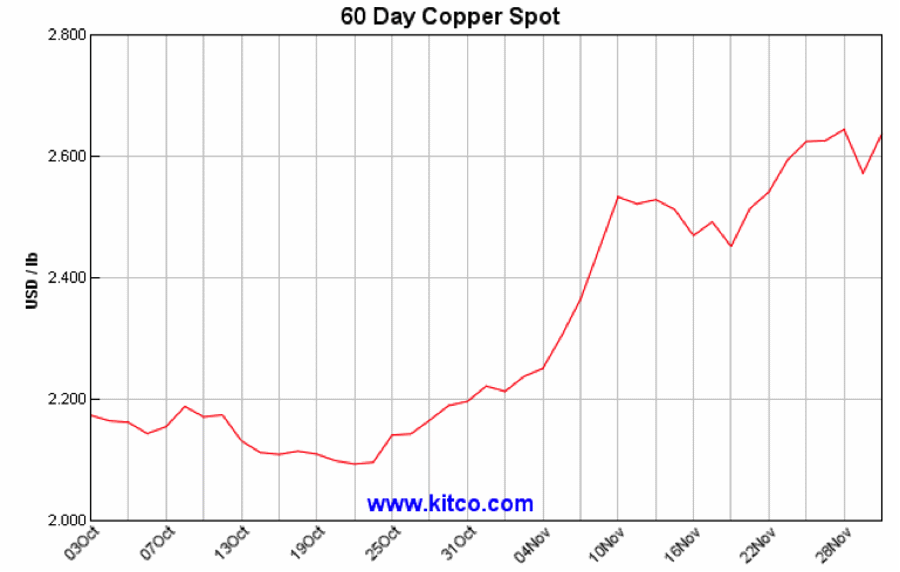

The copper market went nuts in November.

Many commentators are crediting Trump's infrastructure spending plans for copper's surge, but that is not the main driver.

For one, the rally began in late October, well before election day. The last days of October saw copper rise from $2.10 per lb. to $2.40 per lb. in a week. Why? Hard to say, though it seems copper speculators collectively decided the longtime narrative of chronic copper oversupply just wasn't correct.

That mentality gathered steam in early November at the London Metals Exchange Week, an industry gathering of metals players. I was not there but I heard copper talk centered on how Chinese demand had been running higher than expected and how production downgrades from major producers might mean a supply-demand gap. Against that, inventories were looking pretty thin. The oversupply narrative crumbled.

Speculative money started to respond. Fund money started flowing towards copper. The quantities were big enough that copper's rise created its own momentum: after a year of range-bound pricing, copper's break upwards triggered waves of trades, with short positions closing out, long positions being added, and new shorts being added only to be wiped out in short order.

Then Trump's win bolstered US speculative interest in copper just as Chinese investors were also getting on board the speculative copper train.

The result has been a phenomenal 25% price gain in a month.

Is it sustainable? Hard to say. My gut says no, based on the how sharply the price shot up, but then remember that copper is a 19-million tonne annual market that most years has less than 300,000 tonnes of excess or deficit. Such a tight balance for such an important commodity means sudden prices moves can take hold.

It is too soon to know if all of this move will sustain but the crumbling of the oversupply narrative is significant and means, I think, that copper will hold on to at least some of these gains going forward.

Zinc

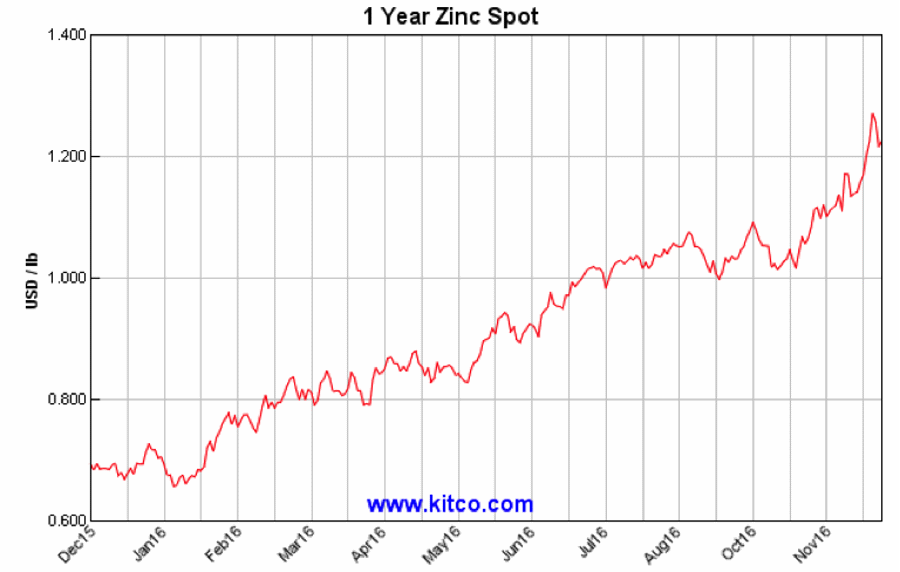

Zinc prices also surged in November, though for the galvanizer the move continued a yearlong ascent aligned with clearly bullish fundamentals.

Nevertheless, some of the factors behind zinc's November surge were the same as those that drove copper: a surge in speculative trading in China, huge amounts of programmed short and long position trading in London spurred by price moves, and options market positioning have all played a role. In other words, a move that started in fundamentals is being carried, at least in part, by algorithm and spec trades.

Volumes in Shanghai are a good example. On Monday alone the most active zinc contract in Shanghai traded 1.17 million lots, which equates to almost 3 million tonnes, making it the heaviest trading day in a year. The surge of trading is due at least in part to regulators raising margin calls and trading fees for several other overheated commodity contracts, including coking coal and iron ore. Speculators, it seemed, left those markets and turned to zinc.

The resulting price surges pushed zinc up through important levels, like $2,500 per tonne. In London, there were 6,160 lots or 154,000 tonnes of open call interest at $2,500. As the price rises, those who sold those options rush to cover their exposure (by selling the option they are obliged to sell zinc to the option holder at $2,500, so they buy futures contracts to cover their exposure). These spec games pour fuel on a rising price fire.

However, all of this spec mayhem is happening against a fundamentally bullish narrative. The zinc story is one of tightening supply and rising demand - and evidence of those fundamentals is starting to mount.

Zinc treatment charges dropped 40% over the past month to sit at $40 to $50 a tonne. They averaged $200 a tonne a year ago. Treatment charges are what smelters charge to treat zinc feed and lower charges mean smelters are competing for feed. A very similar scenario - insufficient zinc feed to satisfy smelter capacity - fueled zinc's move in 2006, when prices shot from $0.50 per lb. to $2 per lb. in 18 months.

Right now zinc is gaining based on two key factors: higher treatment charges, which signal supply tightness, and falling mine output, which will in time force smelters to shut down. For the price to move up sharply from here likely requires a third factor: visible inventory declines. In 2006 zinc really took off when inventories in London plummeted from 600,000 tonnes to 50,000 tonnes.

This is starting to play out. Reported inventories are down about 9% this year, but unreported inventories are down something like 80%. Once those off-exchange stocks are gone, reported inventories will start declining more rapidly. That could spike prices up.

Strength in copper and zinc is welcome while precious metals struggle. When gold and silver were rising earlier this year I said many times that it takes more than just precious metals to create a really good mining upcycle. Copper and zinc joining the ascent is very good from the big picture perspective. When gold gets going again, it will rejoin a much stronger sector.