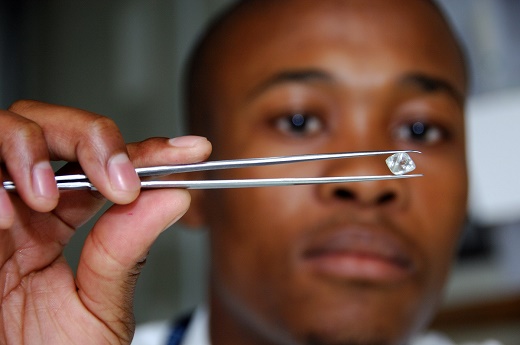

Rough Market Upbeat at $665M De Beers Sight

RAPAPORT... Rough-diamond demand was strong at De Beers' January sight, as manufacturers plan to increase their production in anticipation of post-holiday orders from retailers.The mining company reported proceeds of $665 million in its firstsales cycle of the year, which included last week's sight in Gaborone,Botswana, as well as its rough auctions. While that figure was 9% lower thanthe $729 million-worth of rough De Beers sold a year earlier, it represented a46% jump compared with the miner's previous sight in December. "Following positive early signs for diamond-jewelry salesover the holiday season in the US, the need for the industry to restock led toincreasing demand for our rough diamonds in the first sales cycle of 2018," DeBeers CEO Bruce Cleaver said Tuesday. "This seasonal restocking demand doesusually see a larger share of annual purchases being planned into the firstsales cycle of the year by our customers, resulting in an encouraging salesperformance." The drop versus last year was due to inflated demand in January 2017, as Indian manufacturers resumed activity after refraining from buying rough in late 2016 when the government's demonetizationpolicy sapped liquidity from the market. Other miners noted demand improved in the last few months.While the market was weak between July and October, it picked up before the endof the year, and strong retail sales during the holidays helped lift optimism,according to Petra Diamonds. "Initial results relating to Christmas sales are generallypositive, further to buoyant sales in the US and continued strong growth in theChinese and Hong Kong markets," the South Africa-focused producer said in anupdate this week. "Petra expects market conditions to remain stable in [Januaryto June]." Premiums - the markup at which sightholders resell DeBeers goods to other dealers on the secondary market - rose to 6.3% from 2.8%in January, reflecting the strong demand, according to rough broker Bluedax.Manufacturing in India has increased since Diwali in November due to demand forpolished, Bluedax's Dudu Harari said in a blog post. In addition, theseven-week gap since the December sight led to shortages in certain categories."There was a brisk trade in rough, and a lot of old goodssold," Harari noted. "It has been a good month for rough traders, who had arough ride last year."

RAPAPORT... Rough-diamond demand was strong at De Beers' January sight, as manufacturers plan to increase their production in anticipation of post-holiday orders from retailers.The mining company reported proceeds of $665 million in its firstsales cycle of the year, which included last week's sight in Gaborone,Botswana, as well as its rough auctions. While that figure was 9% lower thanthe $729 million-worth of rough De Beers sold a year earlier, it represented a46% jump compared with the miner's previous sight in December. "Following positive early signs for diamond-jewelry salesover the holiday season in the US, the need for the industry to restock led toincreasing demand for our rough diamonds in the first sales cycle of 2018," DeBeers CEO Bruce Cleaver said Tuesday. "This seasonal restocking demand doesusually see a larger share of annual purchases being planned into the firstsales cycle of the year by our customers, resulting in an encouraging salesperformance." The drop versus last year was due to inflated demand in January 2017, as Indian manufacturers resumed activity after refraining from buying rough in late 2016 when the government's demonetizationpolicy sapped liquidity from the market. Other miners noted demand improved in the last few months.While the market was weak between July and October, it picked up before the endof the year, and strong retail sales during the holidays helped lift optimism,according to Petra Diamonds. "Initial results relating to Christmas sales are generallypositive, further to buoyant sales in the US and continued strong growth in theChinese and Hong Kong markets," the South Africa-focused producer said in anupdate this week. "Petra expects market conditions to remain stable in [Januaryto June]." Premiums - the markup at which sightholders resell DeBeers goods to other dealers on the secondary market - rose to 6.3% from 2.8%in January, reflecting the strong demand, according to rough broker Bluedax.Manufacturing in India has increased since Diwali in November due to demand forpolished, Bluedax's Dudu Harari said in a blog post. In addition, theseven-week gap since the December sight led to shortages in certain categories."There was a brisk trade in rough, and a lot of old goodssold," Harari noted. "It has been a good month for rough traders, who had arough ride last year."