SWOT Analysis: Gold Demand Hit a Three-Year High, Says the WGC

Strengths

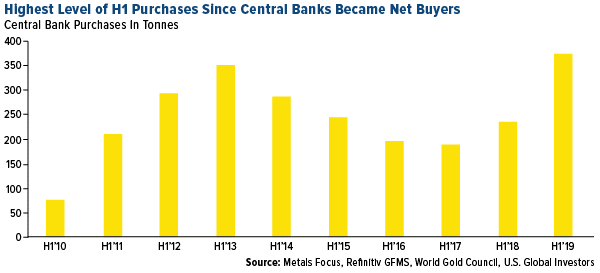

The best performing metal this week was gold, up 1.54 percent. Gold investors were stocking up for further gains in the yellow metal ahead of the Fed's rate cut decision. On Wednesday, holdings in bullion-backed ETFs rose 4.8 tons to the highest level since April 2013, according to Bloomberg data. Gold did fall that same day after the rate cut was announced, but rebounded sharply on Thursday thanks to President Trump's additional tariffs on Chinese imports.Gold saw its third-straight monthly gain in July, locked in by the above mentioned rate cut and U.S.-China trade tensions. U.S. Mint data shows that American Eagle gold coin sales rose 10 percent in July to 5,500 ounces for a second monthly increase.Demand for the yellow metal is at a three-year high largely driven by central banks. Globally, central banks added 374.1 tonnes to their reserves in the first six months of this year, according to the World Gold Council. Turkey's reserves rose $164 million last week from the prior week. Azerbaijan's sovereign wealth fund increased its gold holdings by a whopping 33 percent in the second quarter of this year.

Weaknesses

The worst performing metal this week was palladium, down 8.06 percent on the impact more tariffs may have on trade and automobile production. Gold fell sharply on Wednesday immediately following the Fed's decision to cut rates as traders viewed the comments as signaling the central bank likely won't be aggressive in lowering rates further. Consumer confidence in July rose sharply to 135.7 versus estimates of just 125.0. However, U.S. manufacturing activity fell in July to an almost three-year low due to slower production and shaky export markets, reports Bloomberg.De Beers, the world's largest diamond producer, saw its sales fall to the lowest since 2015 after it allowed its customers to defer more purchases to later this year, reports Bloomberg. The diamond industry is struggling to make profits as demand slumps due to a surplus in polished stones. Fresnillo, a Mexican gold and silver miner, reported a 69 percent drop in profit in the first half of the year and signaled that production may decline further. The company's shares sunk as much as 22 percent in London, according to Bloomberg.According to the World Gold Council, gold recycling in India is forecast to climb to the highest since 2012 due to a surge in local prices for the metal. Bloomberg's Swansy Afonso reports that higher scrap supply in the world's second largest consuming nation may reduce its dependence on overseas purchases. On a more positive note, India is exploring setting up bullion exchanges that could transform the nation's gold market and make it more liquid.

Opportunities

As the gold price continues to heat up, so too does M&A activity among gold miners. Resolute Mining Ltd. agreed to buy Toro Gold Ltd. for $274 million in cash and stock. Toro is private and operates its flagship asset in eastern Senegal. Citigroup is maintaining its third quarter average price forecast for the yellow metal at $1,425 per ounce.Silver continues to pull in speculation from investors. The combined volume of calls and puts for silver soared to 218,000 contracts in July - the highest since November 2010. Bloomberg's Justina Vasquez writes that silver is getting a boost, just like gold is, due to the prospect of central banks easing monetary policy. Investors are betting that silver will catch up to gold in terms of price gains.Signs of economies slowing around the globe and geopolitical uncertainty ever-rising are giving gold a boost on safe haven demand. The New York Fed gauge of the probability of a recession in the next 12 months is at the highest since 2008. China's PMI is still in contractionary territory and the uncertainty surrounding Brexit continues to weigh on markets. James Steel, chief precious metals analyst at HSBC Securities says "increasing your gold holdings is probably a judicious thing to do because it is one of the few things you can buy that is liquid and is on nobody else's credit."

Threats

? The Treasury Department is expected to hold its quarterly note and bond sales at record levels for the third straight time, writes Bloomberg, as Washington's latest budget deal shows that the U.S.'s debt binge will continue. Despite President Trump at one time promising to eliminate national debt, now he is set to approve a budget that will surely usher in "trillion-dollar annual deficits," the article continues. A different report from Bloomberg goes on to point out that borrowing is surging in the wake of Republican-backed tax cuts that have lifted economic growth and pushed unemployment lower.

? For years, De Beers has been selling its gems through 10 various sales each year in Botswana, writes Bloomberg, with "sightholders" - or buyers - having to accept both price and quantity being offered. This system is designed to benefit both miner and customer who is receiving the diamonds at a discounted rate. However, the discount has been shrinking and some sightholders are struggling to make money from a once lucrative business. The two problems here are: 1) high-end jewelry sales are stagnating, with other luxury offerings crowding the space, and 2) it's harder for diamond trading companies to find financing because banks are abandoning the sector due to fraud and bad loans, the article explains.

? The former Citigroup analyst who coined the term "plutonomy" in the mid-2000s, Ajay Kapur, is now saying it may be time to unwind that trade, reports Bloomberg. Plutonomy essentially boiled down to an investment thesis that said "buy the stuff rich people like." Now a political backlash is brewing, the article explains, after the wealth gap in the U.S. is widening. Democratic contenders for the 2020 presidential election support measures to narrow the gap, and even Trump's party has shown support for curbs on share buybacks and the power of tech firms. Kapur, who is now with Bank of America Merrill Lynch in Hong Kong, says things like oligopoly power and lower taxes are subject to change. "No one is ready for this new world," he said.