Short Sellers Continue to Hammer This Amazon Victim

The good news continue to pour in for Amazon.com (AMZN) following the company's Whole Foods purchase, with Bloomberg reporting another strong increase in foot traffic for the grocer. While Wal-Mart (WMT) is often seen as the main Amazon rival, the recent foot traffic data suggests Sprouts Farmers Market Inc (NASDAQ:SFM) could be the big loser, and the shares are sliding as a result. The stock was last seen 0.6% lower at $18.51, and short sellers have been betting on even more downside for SFM.

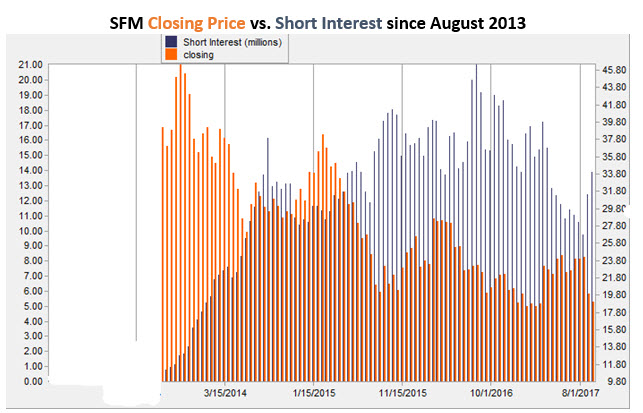

First of all, the equity's poor historical technical performance should not be overlooked. In fact, SFM has essentially been in a downtrend since the company went public back in mid-2013. The security reached a record low of $17.38 on March 7, and more recently have closed in positive territory in just two of the past seven weeks.

Not helping matters are ever-increasing short-interest levels. Since Aug. 1, short interest has jumped almost 31%. Short interest now accounts for almost 12% of the stock's float, or 3.2 times its average daily trading volume. More losses could be in store for SFM if these bears continue piling on.

As for options trading, volume has been light on an absolute basis. But those buying options have preferred calls by a wide margin, evidenced by a 10-day call/put volume ratio of 15.68 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). However, part of this activity is likely short sellers using options to hedge.

What's also troubling, from a contrarian perspective, is that a large majority of analysts are still bullish on Sprouts Farmers Market -- setting up a potential wave of bearish attention from this group. Of the 15 brokerage firms tracking the equity, nine say it's a "buy" or "strong buy," and zero have "sell" ratings. Moreover, its average 12-month price target of $25.65 represents a 38.1% premium to current levels. It's also worth nothing that SFM shares were quickly rejected from this area back in mid-June.