Sizing Up Sandstorm's Latest Gold Stream Deal

In a somewhat surprising move, Sandstorm has announced a new gold stream/royalty acquisition.

The company says it will invest a total of $42.5 million in Americas Silver Corporation for a stream/royalties, debt, and equity.

Sandstorm is making a bet on this junior's exploration upside, but the deal carries some risk that shouldn't be ignored, as I explain below.

Sandstorm Gold's Latest Deal with Americas Silver

Sandstorm Gold (SAND) surprised me a bit recently when it announced a new streaming acquisition with Americas Silver Corporation (USAS), which just merged with Pershing Gold, a Nevada-based gold junior. This is Sandstorm's first major deal since its Fruta del Norte royalty deal in January.

Americas will use the funds to advance its Relief Canyon project (formerly owned by Pershing Gold) to production by year-end.

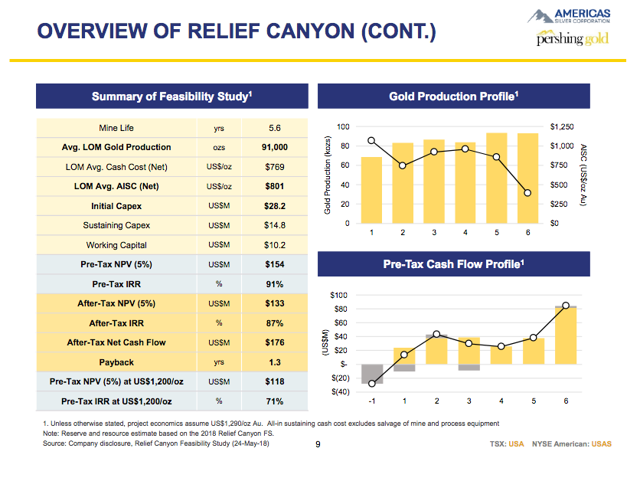

Relief Canyon is a small, past producing, open-pit gold mine in Nevada that is coming back to production and is expected to produce 91,000 ounces of gold annually at $801/AISC over an initial 5.6-year mine life. The after-tax NPV of $133 million (based on a feasibility study) isn't much to get excited about. However, this mine requires very minimal capital to get to production ($28.2 million), with a very short construction period and rapid payback of just 1.3 years, with some exploration upside.

Americas Silver has received permits to start construction and resume mining, and Relief Canyon is expected to pour gold by the end of 2019; according to Sandstorm, infrastructure on site includes access to power and water as well as a 21,500 ton per day heap-leach processing facility that is fully permitted and constructed.

Americas Silver shares have reacted positively to the news so far and have outperformed silver mining peers (SIL) and gold miners (GDX) over the past month or so.  (Credit: Americas Silver Corp.)

(Credit: Americas Silver Corp.)

So, is this a good deal for Sandstorm? Why is it investing $42.5 million on such a small gold mine and an unproven gold junior?

Before getting into the risks of the deal, it's first important to understand that the $42.5 million deal has several components to it, as it's not just a gold stream.

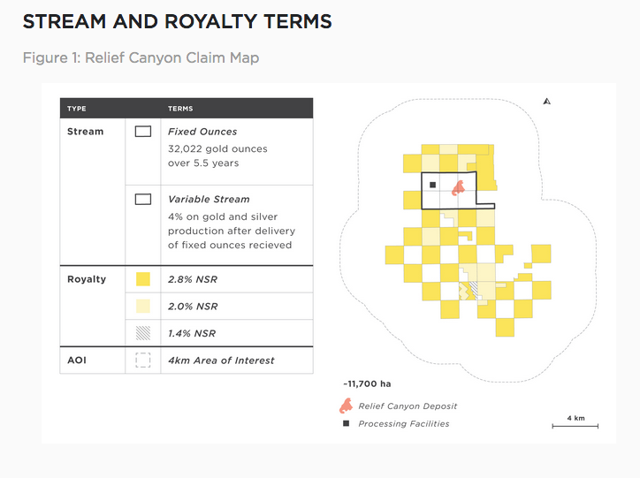

Sandstorm will pay $25 million for the gold stream component of the deal; it will receive 32,022 ounces of gold over 5.5 years (apparently at no ongoing cost per ounce), followed by a 4% precious metals stream thereafter (which will carry an ongoing cost of 30% to 65% of the spot price of gold). The company expects this to increase its attributable production by 7% in 2020 and 9% in 2021. Its fixed gold deliveries will start on April 3, 2020, and during the first five years of production, Sandstorm will get 492 ounces of gold per month. Sandstorm will net approximately 5,800 ounces of gold per year; at $1,300 gold, I am estimating this will result in $7.5 million in annual cash flow to Sandstorm, and at least $40 million cash flow total for the life of the stream (the initial period of 5.5 years), based on $1,300 gold. By 2022, Sandstorm's estimated gold production should be over 145,000 ounces (up from 140,000 previously). Sandstorm's after-tax cash flow is likely to top $120 million in 2022 and $135 million in 2023, based on previous estimates. Also, Sandstorm will receive a 1.4-2.8% net smelter returns royalty on the area surrounding the Relief Canyon mine, plus a four-kilometer area of interest, at no additional cost (image below). Relief Canyon is situated at the southern edge of the Pershing Gold and Silver trend along the Humboldt Range; its landholdings cover approximately 25,000 acres. This royalty component is a good aspect of the deal (in my opinion) as it's a massive land package with various 2.8% NSRs.The deposit contains 635,000 ounces of gold reserves, plus 789,000 ounces of measured and indicated resource and 45,000 ounces inferred. However, only 20% of the property has been explored to date, according to Americas Silver.

After the 60th month (fifth year), Sandstorm will receive 4% of the gold and silver produced at Relief Canyon for the life of the mine and will then pay between 30% and 65% of the spot price of gold and silver for each ounce delivered. The payment varies based on the location of the gold ("concession") and is calculated with pre-existing royalties in mind. Americas Silver has the option to reduce the 4% stream and NSRs in half by delivering 4,000 ounces of gold (worth approx. $5-6 million) to Sandstorm. I am guessing that, assuming successful production and cash cost targets are achieved, Americas plans on exercising this option.The gold stream and royalty component of this deal are very favorable for Sandstorm, in my opinion. It could potentially make its full $25 million investment back in just three years based on a $1,300 gold price, and then it would continue earning $4-5 million cash flow annually (not counting any revenue from royalties).

However, the company has also agreed to supply Americas with $10 million in debt financing via a convertible debenture; it bears an interest rate of 6% annually with a term of four years and is convertible into shares of Americas Silver, at any time prior to maturity, at a conversion price of US$2.14 per share (shares trade at US$1.63 currently).

This looks like it is more favorable for Americas as a 6% interest rate and $2.14/share conversion price are pretty good terms; I have seen convertible debentures carry interest rates around 8-10% for junior gold miners (Gran Colombia is one example).

Finally, Sandstorm has agreed to subscribe for 4.78 million shares of Americas at a price of C$2.09 per share (current price of C$2.25).

How Will Sandstorm Fund This Deal?

Sandstorm will be funding most of the deal with its revolving credit facility, which was recently increased to $225 million and was fully undrawn.

Sandstorm recently received notice that Erdene (OTCPK:ERDCF), a small gold explorer in Mongolia, will repurchase half of its royalty for C$1.2 million, so that cash infusion certainly helps. According to its most recent corporate presentation, Sandstorm also has $65 million worth of debt and equity investments in various companies, which it could monetize if needed.

Sandstorm's liquidity position is not a concern to me at the moment, but it will be interesting to see if the company scales back its share buyback program in favor of completing new deals like this one.

What Are The Risks To This Deal?

Junior gold miners like Americas Silver Corp. are riskier than mid-tier and senior gold producers as they typically only have one or two producing assets (less cash flow diversification) and have less liquidity and access to capital markets. Americas is a promising gold junior, but it's a small, unproven company. If Americas Silver runs into some trouble during construction (there are many things that could affect its ability to commence mining), there's no guarantee it will be able to raise more funds. I don't expect this to be the case, but it is a risk that should be considered.

There is some risk that Sandstorm won't be able to monetize its convertible debenture or equity investment in Americas. The share price needs to hit US$2.14 per share to be convertible into Americas equity (US$1.67 current share price). Otherwise, Sandstorm receives 6% interest annually on its investment.

Also, Americas Silver's AISC estimate of $801/oz is based on it receiving all of the gold from the mine and doesn't factor in the new stream/royalties, which will impact its cash costs/profitability. If gold prices fall a bit from here, the gold stream could end up hurting the miner a bit.

Finally, I think Pershing has nice exploration upside, given its massive land position and promising past drill results, but exploration costs money, and there's no guarantee it will be able to carry out such exploration in the future. It will likely need to produce gold profitably to conduct future exploration on its massive land package.

These are just a few risks related to the investment by Sandstorm.

Final Thoughts

Overall, I like this deal by Sandstorm. While it's not one that is likely to move the stock in the short term, I do think the risk vs. reward is somewhat favorable. I think it's a bit riskier than its Fruta del Norte deal and other similar royalty deals, but the upside is greater.

What do you think of Sandstorm's latest deal? Please comment below.

This article was first made available to subscribers of The Gold Bull Portfolio; subscribers also receive frequent updates on Sandstorm Gold and its peers. To get access to all of my top gold stock picks, as well as access to my real-life gold portfolio holdings, weekly updates and 24/7 live chat, please subscribe! A 2-week free trial is available for a limited time only.

Disclosure: I am/we are long SAND. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Gold Mining Bull and get email alerts