Stock Buyers May Need to Be Patient In 2018

As surprising and uncharacteristic as a Donald Trump presidency is, it might not make sense to compare this year to past presidential cycles, but I have decided to do it anyway. It's well known that historically, stocks have been outstanding in the third year of the cycle. The theory is, that before the election year politicians focus their energy on campaigning, they tend to pass legislation that's market friendly because a bullish stock market favors the incumbents. By that logic, the most market-damaging legislation might get passed early in the cycle, in year one or two. This week I break down how stocks have performed during each year of the presidential cycle.

Stocks Per Presidential Cycle Year

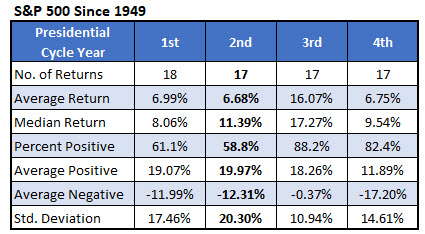

The table below summarizes the S&P 500 Index (SPX) returns for each year in the presidential cycle. I went back to 1949 since that was the year Inauguration Day was moved to January 20th. Since then, there have been 17 full presidential cycles. Looking at the average return, the third year is the obvious outlier, just as I discussed above. The other years all look similar as measured by average return, but looking at the other stats you can notice some glaring differences.

Supporting my theory from earlier, the first two years have been the most inconsistent with close to just 60% of the returns positive. Compare that to the third and fourth year returns, which have a percentage positive above 80%. The second year has been the most volatile year of the cycle as measured by the standard deviation of the returns.

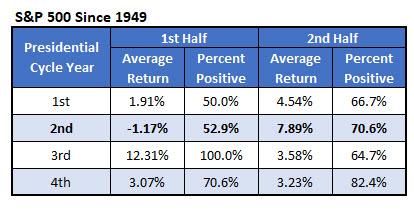

Something to keep in mind as we begin the second year of Trump's presidency is that previously, the first half of the second year has been dreadful. Barely half of the returns have been positive in the first half of the year, and the S&P 500 averages a loss of more than 1%. Based on this, a stock buyer may want to wait until mid-way through the year. The second half of the second year has been excellent. In the second half, the index has gained an average of 7.89% with over 70% of the returns positive.

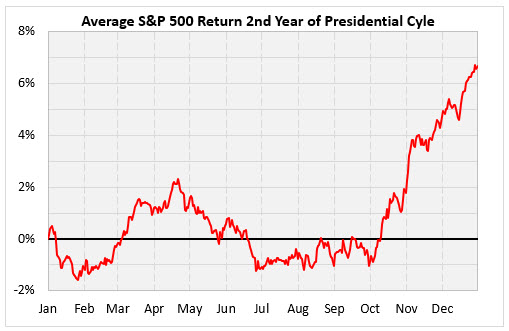

Here is a chart showing the typical path the SPX has taken during the second year of a presidential cycle. After looking at the table above, I stated it might make sense to wait until the second half of the year. Now that I charted the typical path, you might wait even longer. In the second year of the cycle, stocks have tended to struggle right up until the fourth quarter, at which point they surge to an adequate return between 6% and 7%.