The price of lab-created diamonds continues to fall

By Paul Zimnisky

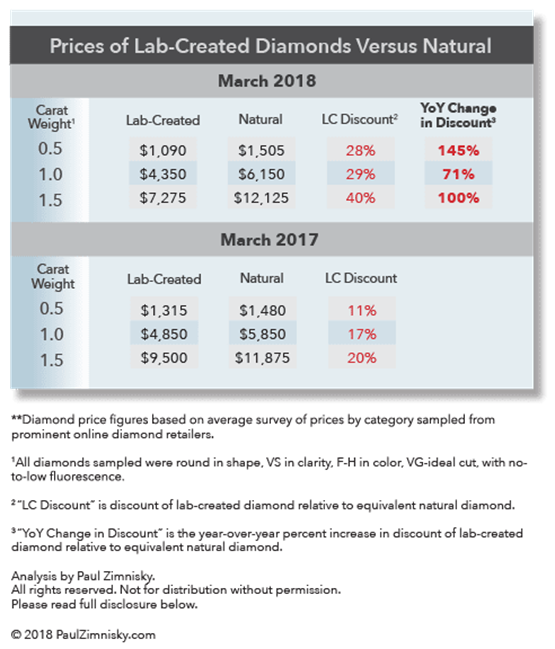

The discount of gem-quality lab-created diamonds, manufactured for use in jewelry, relative to natural diamonds has doubled from 11-20% a year ago to 28-40% today, according to a survey of prices.

For example, a white, 1-carat round diamond that is VS (very-slightly included) in clarity, F-H (near-colorless to colorless) in color, VG-ideal cut, with no-to-low florescence was selling for approximately $4,850 in March 2017 but is now $4,350 in March 2018, a 10% decline.

However, over the same period of time the price of an equivalent natural diamond went from $5,850 to $6,150, representing about a 5% increase. Thus, the discount of the lab-created diamond relative to the natural equivalent was approximately a 17% in March 2017, but is now about 29%, a 71% year-over-year increase.

See table below for more examples:

Lab-created diamonds are becoming less expensive relative to natural equivalents as investment in lab-diamond production technology has rapidly improved production economics in just the last few years. This has led to rapid relative supply growth and an environment that is more price competitive for lab-diamond manufactures.

However, actually gauging lab-diamond supply growth is difficult. The global proliferation of lab-diamond production facilities in recent years, from China to Russia to the U.S., has made tracking production figures challenging, especially given that the companies involved are private and proprietary in nature. Further complicating the process is the range in quality and scale at which lab-diamonds are being produced.

Natural diamond production quality can be segmented as approximately 40% gem-quality, 20% near-gem-quality, and 40% industrial-grade. Gem-diamonds are used in jewelry, industrial-grade diamonds are used for abrasive and other industrial application, and near-gem diamonds are used for both jewelry and more-specialized industrial application, with the split of use dependent on market prices and demand.

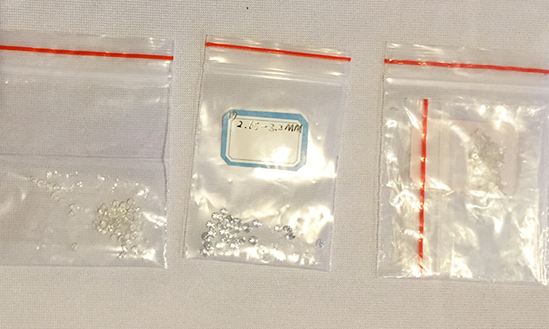

Small parcels of near-gem-quality lab-created diamonds manufactured in China. Image source: Paul Zimnisky

It is important to note that natural industrial-grade diamonds are simply seen as a by-product, as the presence of gem-quality diamonds in a deposit are what drive the economics behind natural diamond production decisions.

In the case of lab-diamonds, the ability to create higher-quality gem-diamond product economically is a relatively recent development -within the last decade. Even with the recent developments in technology, current lab-created production of true gem-diamonds only represents