Trend Report: Covid-19 Driving Move to Digital

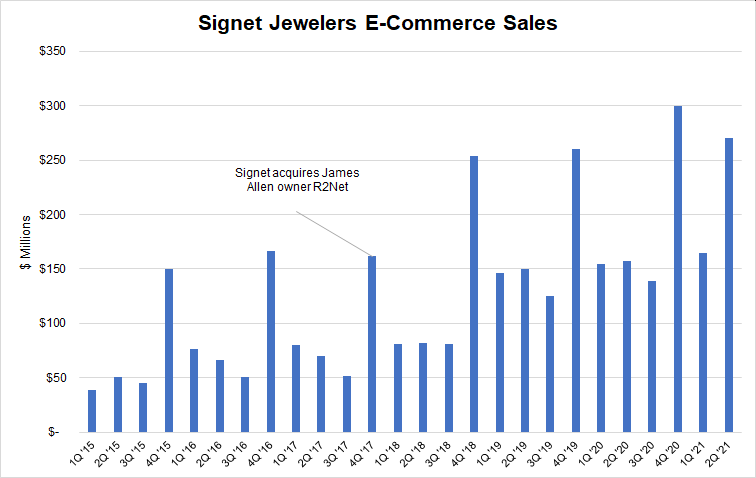

Las Vegas, September 24, 2020As the diamond industry begins its recovery from the initial impact of Covid-19, its once-lagging progress toward digital is being vastly accelerated. While this will not be a rapid transition for a trade that has traditionally thrived on face-to-face networking and handshakes, a growing number of companies are putting increased resources into focusing on their online capabilities. With COVID-19 unlikely to vanish any time soon and further outbreaks possible, businesses within the diamond and jewelry sector will face increasing pressure to develop and refine their digital strategies. Online marketing and sales will be a key element of these efforts and an important driver of growth, particularly during the upcoming holiday season. The key trends Rapaport has observed in this area since the emergence of the pandemic have been: Impressive Online Retail SalesDigital Auctions Breaking RecordsTrade Shows Forced to Reinvent ThemselvesRough Suppliers Seeking to Boost EfficiencyGrowth of Online Trading PlatformsImpressive Online Retail SalesWhile retail revenue plunged due to enforced closures during the pandemic, online sales became a silver lining for stores looking to generate alternative channels to compensate for the dramatic drop in business. Tiffany & Co.'s e-commerce sales rose 123% during the three months that ended July 31. The segment accounted for 15% of the company's total revenue in the first half of the year, compared to an average of about 6% annually in the past three years. Its overall group revenue, however, fell 29% to $747 million due to the lockdown of its retail stores.Signet Jewelers also saw overall in-store sales enter free fall, dropping 35% to $888 million for the quarter ending August 1. However, the retail giant's online sales grew 72% to $270 million (see graph), accounting for 30% of the group's total - up from an 11% share a year earlier.

Las Vegas, September 24, 2020As the diamond industry begins its recovery from the initial impact of Covid-19, its once-lagging progress toward digital is being vastly accelerated. While this will not be a rapid transition for a trade that has traditionally thrived on face-to-face networking and handshakes, a growing number of companies are putting increased resources into focusing on their online capabilities. With COVID-19 unlikely to vanish any time soon and further outbreaks possible, businesses within the diamond and jewelry sector will face increasing pressure to develop and refine their digital strategies. Online marketing and sales will be a key element of these efforts and an important driver of growth, particularly during the upcoming holiday season. The key trends Rapaport has observed in this area since the emergence of the pandemic have been: Impressive Online Retail SalesDigital Auctions Breaking RecordsTrade Shows Forced to Reinvent ThemselvesRough Suppliers Seeking to Boost EfficiencyGrowth of Online Trading PlatformsImpressive Online Retail SalesWhile retail revenue plunged due to enforced closures during the pandemic, online sales became a silver lining for stores looking to generate alternative channels to compensate for the dramatic drop in business. Tiffany & Co.'s e-commerce sales rose 123% during the three months that ended July 31. The segment accounted for 15% of the company's total revenue in the first half of the year, compared to an average of about 6% annually in the past three years. Its overall group revenue, however, fell 29% to $747 million due to the lockdown of its retail stores.Signet Jewelers also saw overall in-store sales enter free fall, dropping 35% to $888 million for the quarter ending August 1. However, the retail giant's online sales grew 72% to $270 million (see graph), accounting for 30% of the group's total - up from an 11% share a year earlier. Based on reports by Signet Jewelers.E-commerce may have jumped by more than usual during the quarter as the Covid-19 shutdowns forced consumers to shop online. But while online sales are expected to account for a lower percentage once the market returns to normal (Signet's figures for August, when stores were beginning to open again, showed the proportion of e-commerce sales at around 20%), companies are likely to continue investing in and marketing their online offerings to counteract any future Covid-19 outbreaks or enforced lockdowns as winter looms.Digital Auctions Breaking Records While some stores were able to offset at least some of their losses with improved online sales, auction houses appeared to fare better than retailers in pivoting to a digital-only presence. Christie's led the way on June 30, when it established a new record for a jewel sold in an online-only auction. The emerald-cut, 28.86-carat, D-color, VVS1-clarity, type IIa diamond ring garnered $2.1 million, beating its $2 million high estimate at the Jewels Online sale. After the auction, Christie's said the $4 million in total sales demonstrated greater client confidence in its digital ability and online sales platform.

Based on reports by Signet Jewelers.E-commerce may have jumped by more than usual during the quarter as the Covid-19 shutdowns forced consumers to shop online. But while online sales are expected to account for a lower percentage once the market returns to normal (Signet's figures for August, when stores were beginning to open again, showed the proportion of e-commerce sales at around 20%), companies are likely to continue investing in and marketing their online offerings to counteract any future Covid-19 outbreaks or enforced lockdowns as winter looms.Digital Auctions Breaking Records While some stores were able to offset at least some of their losses with improved online sales, auction houses appeared to fare better than retailers in pivoting to a digital-only presence. Christie's led the way on June 30, when it established a new record for a jewel sold in an online-only auction. The emerald-cut, 28.86-carat, D-color, VVS1-clarity, type IIa diamond ring garnered $2.1 million, beating its $2 million high estimate at the Jewels Online sale. After the auction, Christie's said the $4 million in total sales demonstrated greater client confidence in its digital ability and online sales platform.

The emerald-cut, 28.86-carat diamond ring that garnered $2.1 million at Christie's, marking a new record for the most expensive jewel sold in an online-only auction. (Image: Christie's)

Recent NewsUpgrades continue for 2024 gold price target...April 22, 2024 / www.canadianminingreport.com

Gold stocks edge up as weak equities offset metal riseApril 22, 2024 / www.canadianminingreport.com

Major investment banks make major gold price upgradesApril 15, 2024 / www.canadianminingreport.com

Gold stocks near flat as equities dipApril 15, 2024 / www.canadianminingreport.com

Revenue estimates for gold stocks have remained relatively flatApril 08, 2024 / www.canadianminingreport.com

|