WTI Crude Tops $85 For The First Time Since 2014 As Banks See Oil Surge Accelerating

It's remarkable that just last April, West Texas Intermediate crude was trading at a negative $40. Well, fast forward to today when moments ago, the US black gold grade just topped $85 for the first time since 2014, the landmark in a global energy crunch that has seen prices soar. Brent traded about 150 cents higher as the spread between the two grades has narrowed sharply in recent weeks.

Oil has jumped in recent weeks as natural gas prices hit records; as a result of rising gas-to-oil switching overnight Goldman forecast that the surge in gas prices could add at least 1 million barrels a day to oil demand "with current gas forwards incentivizing this through winter." In the note from Goldman commodity analyst Callum Bruce, the bank also estimated that global oil demand has surpassed 99 mb/d and will shortly hit its pre-COVID level of 100 mb/d as Asia rebounds post the Delta wave.

Goldman also cautioned that such persistence would pose upside risk to our $90/bbl year-end Brent price forecast (full note available to pro subs). Some more highlights from the Goldman note:

The latest surge in the price of oil comes as OPEC+ are adding back output only gradually into a market where stockpiles are steadily declining and where JPMorgan warned on Friday, Cushing could be effectively empty in just a few weeks.

The advance in oil prices is the latest leg higher in a surge in broader energy costs that is adding inflationary pressure to the global economy as policymakers begin to taper stimulus.

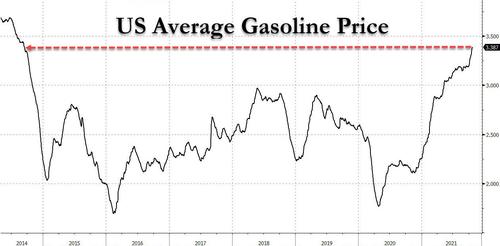

Meanwhile, keep an eye on gasoline prices. At a $3.387 nationwide average (with most metroareas seeing prices far higher) this is already the highest gasoline price since 2014. At the current rate of ascent, and should winter see an aggressive spike in gas usage as switching accelerates, it would not be surprising if gasoline takes out its all time highs of $4.11 set back in July 2008.

Needless to say, this will be an increasingly political issue for the Biden administration.