Weak Prices Dent Petra Revenue

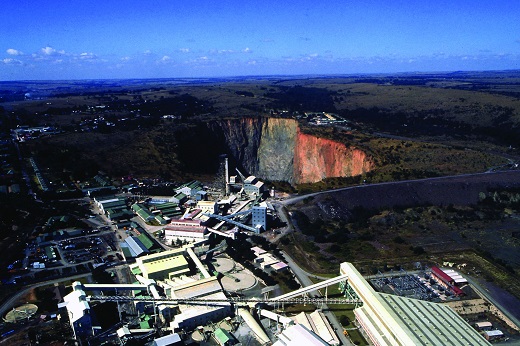

RAPAPORT... Petra Diamonds' revenue fell in the first fiscal quarteramid a drop in the average price and a weaker product mix at three of itsmines. Revenue dropped 23% year on year to $61.6 million for thethree months ending September 30, the miner reported Monday. Sales volumeslipped 4% to 603,626 carats, with the average selling price down 20% to $102per carat. The sales product mix was weaker than analysts' expectations, withthe absence of large stones impacting prices, investment bank Berenberg noted. The average prices at the Finsch and Cullinan deposits were also lowerthan the bank had predicted. "Management believes that [the] mix will improve and pointsto special-diamond recovery as an upside, but how long this takes is a keyquestion," Berenberg added. Petra's diamond prices were down 4% on a like-for-like basisversus the previous quarter, it said. "The rough-diamond market remains quietahead of the start of the seasonally busier retail period," Petra explained."There was a slight increase in activity in the Indian manufacturing centersahead of the Diwali holiday, however polished prices and exports remain underpressure, with softer demand and lower prices for rough diamonds." Petra is counting on the sale of a 20.08-carat blue diamond,which it will offer at tender in November, to help boost revenues, said Richard Duffy, the miner's CEO.. Berenberg believes the stone will fetch about $13 million attender, or $650,000 per carat, while Shore Capital has valued it between $13million and $15 million. Production for the period grew 1% to 1.1 million carats. Theincrease in output in September, combined with the drop in sales, led to a risein the company's inventory, which grew to 1.1 million carats from 970,620carats during the same period last year. Meanwhile, the company's debt increased to $592.8 million as of September 30, from $564.8 million on June 30, which it attributes to holding only one tenderduring the quarter. To pay off the debt, Petra has launched Project 2022, athree-year plan to save $150 million to $200 million by implementing operationalefficiencies, it explained. However, the lower diamond prices may make thisdifficult, Berenberg noted. "Should prices take longer to improve, we believe it willbecome more of a challenge for management to meet [the] free-cash-flow-generationtargets," the bank observed. Petra is on track to deliver its production guidance of 3.8 millioncarats for the full fiscal year ending June 30, the miner added. Petra operates the Cullinan, Finsch and Koffiefonteinunderground mines in South Africa, and the Williamson open-pit facility inTanzania. Image: An aerial view of the Cullinan mine. (Petra Diamonds)

RAPAPORT... Petra Diamonds' revenue fell in the first fiscal quarteramid a drop in the average price and a weaker product mix at three of itsmines. Revenue dropped 23% year on year to $61.6 million for thethree months ending September 30, the miner reported Monday. Sales volumeslipped 4% to 603,626 carats, with the average selling price down 20% to $102per carat. The sales product mix was weaker than analysts' expectations, withthe absence of large stones impacting prices, investment bank Berenberg noted. The average prices at the Finsch and Cullinan deposits were also lowerthan the bank had predicted. "Management believes that [the] mix will improve and pointsto special-diamond recovery as an upside, but how long this takes is a keyquestion," Berenberg added. Petra's diamond prices were down 4% on a like-for-like basisversus the previous quarter, it said. "The rough-diamond market remains quietahead of the start of the seasonally busier retail period," Petra explained."There was a slight increase in activity in the Indian manufacturing centersahead of the Diwali holiday, however polished prices and exports remain underpressure, with softer demand and lower prices for rough diamonds." Petra is counting on the sale of a 20.08-carat blue diamond,which it will offer at tender in November, to help boost revenues, said Richard Duffy, the miner's CEO.. Berenberg believes the stone will fetch about $13 million attender, or $650,000 per carat, while Shore Capital has valued it between $13million and $15 million. Production for the period grew 1% to 1.1 million carats. Theincrease in output in September, combined with the drop in sales, led to a risein the company's inventory, which grew to 1.1 million carats from 970,620carats during the same period last year. Meanwhile, the company's debt increased to $592.8 million as of September 30, from $564.8 million on June 30, which it attributes to holding only one tenderduring the quarter. To pay off the debt, Petra has launched Project 2022, athree-year plan to save $150 million to $200 million by implementing operationalefficiencies, it explained. However, the lower diamond prices may make thisdifficult, Berenberg noted. "Should prices take longer to improve, we believe it willbecome more of a challenge for management to meet [the] free-cash-flow-generationtargets," the bank observed. Petra is on track to deliver its production guidance of 3.8 millioncarats for the full fiscal year ending June 30, the miner added. Petra operates the Cullinan, Finsch and Koffiefonteinunderground mines in South Africa, and the Williamson open-pit facility inTanzania. Image: An aerial view of the Cullinan mine. (Petra Diamonds)