Weekly Call Traders Pounce On Advanced Micro Devices Stock

AMD will report earnings in late July

AMD will report earnings in late July

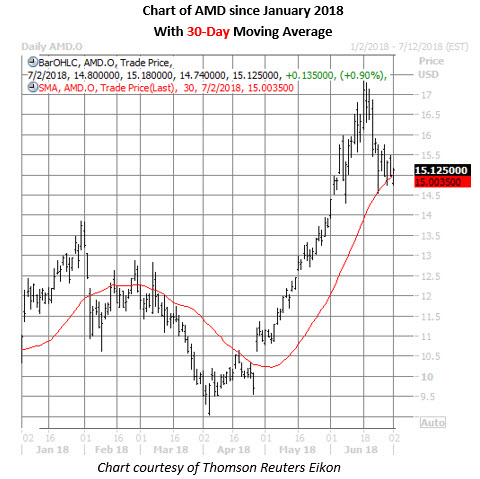

After skimming the $9 back in early April, Advanced Micro Devices, Inc. (NASDAQ:AMD) went on to hit an 11-year high of $17.34 on June 18. While the shares have since pulled back from this notable milestone, speculators on Friday targeted it for short-term trades using weekly AMD options.

Specifically, the weekly 7/13 and 7/27 17.50-strike calls were active in Friday's trading, and saw the biggest increases in open interest over the weekend. Data from the major options exchanges confirms the weekly 7/13 17.50-strike calls were bought to open. Based on the volume-weighted average price of $0.05, breakeven for the call buyers at next Friday's close is $17.55 (strike plus premium paid).

Meanwhile, data indicates the further-dated weekly 7/27 17.50-strike calls were sold to open. While this could suggest speculators think the $17.50 level will serve as resistance over the next few weeks, it's also likely they are hoping to profit from a post-earnings volatility crush, considering Advanced Micro Devices is slated to report earnings on Monday, July 23. At last check, the implied volatility term structure on weekly 7/27 AMD options is currently 63.6%, compared to 48.5% for the 7/13 series.

Historically speaking, the stock has been volatile after earnings. Looking at the last eight quarters, the shares have averaged a single-day post-earnings move of 12.2%, with five of those returns positive -- including a 13.7% pop following the chipmaker's April results.

At last check, AMD stock was trading up 0.8% at $15.12. Despite the security's recent pullback, it's found a foothold atop its rising 30-day moving average -- a former layer of resistance that is now serving as support -- and is maintaining a 47.3% year-to-date gain.

A round of short covering and/or analyst upgrades could help fuel an even bigger bounce for AMD shares, too. While more than one-fifth of the equity's float is dedicated to short interest, half the brokerages covering Advanced Micro Devices maintain a "hold" or worse rating. Echoing this, the average 12-month price target of $14.98 stands at a discount to the stock's current perch.