Will Global Growth Worries Boost Gold Demand?

Gold bulls are fighting for control, but currency weakness remains.

Gold's fear component shows signs of improving, however.

The end of the stock market correction should bode well for gold.

In recent reports, we've discussed the lack of safe-haven demand for gold. Indeed, this has been a serious concern for its short-term outlook since gold typically needs a certain amount of fear in order to rally. In today's report, I'll continue my argument that we'll likely witness a return of safety-related demand in the coming weeks, mainly due to global growth concerns. Before this happens, however, we'll need to see even more improvement in gold's currency component.

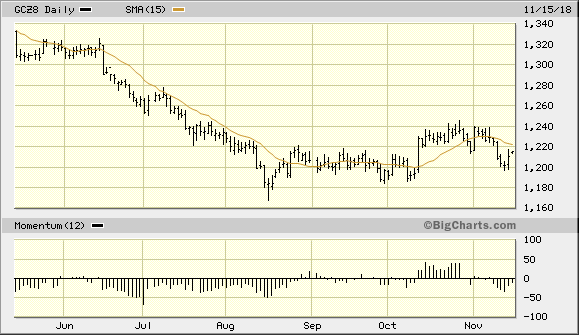

In recent weeks, the dollar's relentless show of strength has dented gold demand. The last two trading sessions, however, have seen the dollar dip, and this has given the yellow metal some much-needed breathing room. Gold prices rose on Wednesday as the dollar weakened and allowed gold to rally. Elsewhere, a mid-week slide in U.S. equity prices helped spark some safe-haven interest in gold among investors. The December gold futures price showed strength in the last two sessions, closing most recently at $1,215 while spot gold was last seen at $1,214. Although December gold remains below its 15-day moving average as of Thursday, the sharp reversal on Nov. 14 allowed it to keep intact a 3-month pattern of higher lows (below).

Source: BigCharts

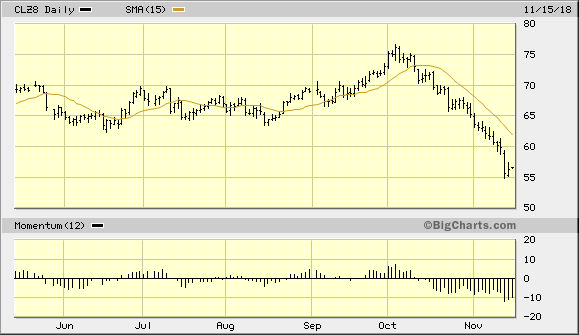

Many observers were inclined to attribute gold's latest rally to the market's concern over global economic growth. The fact that crude oil has entered a bear market is a major reason for these concerns, as the oil price has seen its biggest decline since 2015. Diminished demand from China and other industrial nations has been a contributor to the oil price slide, and many investors worry about potential spillover impacts to the U.S. economy. Shown here is the December crude oil graph, which helps explain the market's latest fear.

Source: BigCharts

The weak oil price hasn't exactly helped inspire strong demand for gold among institutional investors, however. As discussed in previous reports, a rising crude oil price is a prerequisite for gold price strength due to the fact that both are highly sensitive to dollar strength/weakness. The oil price is even more dollar sensitive than gold, which is why it tends to lead the gold price. So while the global growth fears which are behind oil's decline may ultimately help restore safe-haven demand for gold, until the oil price bottoms out, the gold price will remain vulnerable to dollar-related selling pressure.

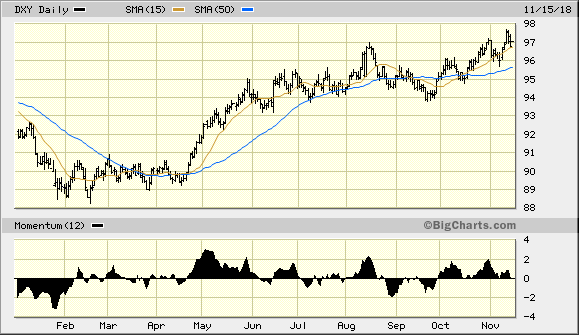

Speaking of the dollar, despite a 2-day pullback in the U.S. dollar index (DXY), it remains in a confirmed upward trend. As you can see here, DXY is still above its rising 15-day and 50-day moving averages, which confirms the rising trend. Investors shouldn't assume that the latest dollar pullback is the start of a meaningful pullback in the greenback until we at least see a weekly close under the 15-day MA. This hasn't happened since last month, which is what enabled the gold price to experience a sharp rally in October.

Source: BigCharts

Although the currency factor is the primary consideration for gold's near-term outlook, the financial market is another factor which pertains to gold's safety factor. I've made the case here that previous stock market corrections in recent years have tended to bode well for gold once the selling pressure for equities has completely diminished. The reason for this is that once the immediate need to raise cash from stock liquidations has ended, investors often turn to the traditional safe havens like gold. I maintain that the ongoing correction in the U.S. stock market - once it has completely bottomed out - should serve as a catalyst for safety-related gold purchases.

The latest gold price rally, occurring as it did on the heels of investors' concerns over the stock market and the global growth outlook, could be interpreted as a preliminary sign that safe-haven demand is finally returning to the gold market. While this could be the case, it's still too early to bank on this until we see a decisive downside reversal in the dollar index. I cannot emphasize enough that gold's primary directional driver is its currency component. It's therefore imperative that the dollar index shows greater weakness before gold can finally break out decisively from its August-November trading range.

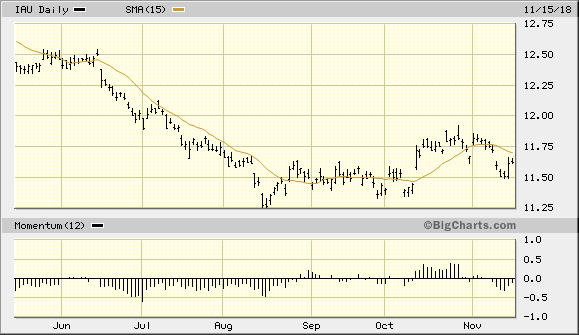

On the ETF front, after technically confirming an immediate-term speculative buy signal, the iShares Gold Trust (NYSEARCA:IAU) barely remains on a buy signal after slipping back under its 15-day moving average last week. As previously stated, an intraday violation of the $11.37 level (the Aug. 23 closing low) in IAU would trigger my stop-loss for this trading position. A violation of $11.37 would also put me back on the sidelines for the immediate term and put the bears back in control for now. IAU's 0.87% rally on Wednesday - and refusal to pull back on Thursday- was heartening. However, it didn't quite succeed in pushing the ETF's price back above the 15-day MA. If IAU manages to finish above the 15-day MA on Friday, however, we'll have a strong indication that the bulls have regained control of the immediate trend. Accordingly, today's trading session will be an important test of strength for the gold bulls.

Source: BigCharts

While short-term speculators are currently long the gold ETF, longer-term investors should remain in a cash position as gold's bear market hasn't ended yet. A weak close in the U.S. dollar index below the 50-day trend line would go a long way toward helping gold regain its footing. But as long as the dollar remains in a position of strength, gold's longer-term trend will remain under pressure.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts