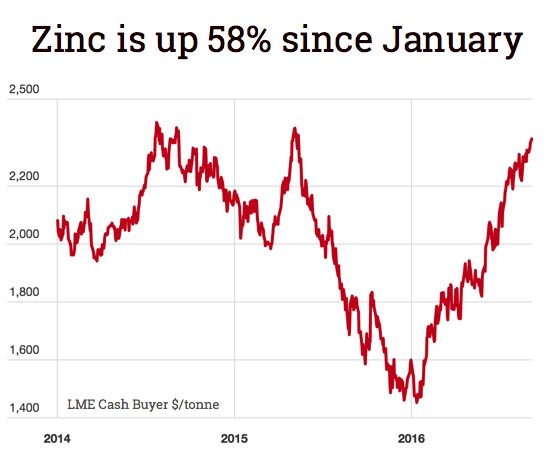

Zinc price rally may have gone too far

Zinc is the best performing base metal so far this year and measured from its six-year low struck mid-January today's $2,336 a tonne zinc prize is up 58%.

Zinc's prospects brightened considerably after the shutdown of two major mines last year - Australia's Century and the Lisheen mine in Ireland. The two mines had a combined output of more than 630,000.

The shuttering of top zinc producer Glencore's depleted Brunswick and Perseverance mines in Canada in 2012 brings total tonnes going offline since 2013 to more than one million tonnes.

MMG has recently secured additional funding for its Dugald River zinc mine, which is expected to start production in 2018, the same year that Vedanta's Gamsberg mine in South Africa should also come onlineGlencore has been out in front when it comes to curtailing production to shore up prices and the Swiss giants' announcement of cutbacks inspired another leg up in the price.

Glencore's first half production numbers showed a 31% output decline to 506,000 tonnes after the company idled mines in Peru and downscaled its Australia operations. Mining and metals processing company Nyrstar's zinc mine output fell 39% over the same period and the Swiss company has cut capex by nearly two-thirds as it seeks to offload mining operations.

Glencore's first half production numbers showed a 31% output decline to 506,000 tonnes after the company idled mines in Peru and downscaled its Australia operations. Mining and metals processing company Nyrstar's zinc mine output fell 39% over the same period and the Swiss company has cut capex by nearly two-thirds as it seeks to offload mining operations.

China, top consumer and producer of the metal mainly used to galvanize steel, recently added fuel to the fire after Beijing ordered the shutdown of all lead and zinc mines in parts of Hunan province, the centre of Chinese production.

China is now forecast to have a mined zinc deficit of 390,000 tonnes in 2016, widening from a deficit of 9,000 tonnes a year ago.

A new report by Capital Economics argues that the constrained supply-induced rally may have proven too effective and that today's price may convince the likes of Glencore to bring production back online and encourage investment in new projects.

Indeed, MMG has recently secured additional funding for its Dugald River zinc mine, which is expected to start production in 2018, the same year that Vedanta's Gamsberg mine in South Africa should also come online. Meanwhile, plans are underway for Glencore to expand production at its McArthur River mine in Australia, although environmental concerns might make government approval more difficult.

The strength of Chinese demand is also clouding the outlook and Capital Economics says prices "have gone too far and there is a risk that the large deficit next year might not actually materialise." The house view of end-2016 and end-2017 prices are $2,100 and $2,300 per tonne respectively.

Cowboy Creative Common image by JbarC ranch