A Shareholders Perspective Of Doubleview Gold

The article posted below was written and sent to me from a reader of the website. The writer of the article is a shareholder of Doubleview Gold and wishes to share his views on the company and it's projects, namely the Hat project in the Golden Triangle area of BC.

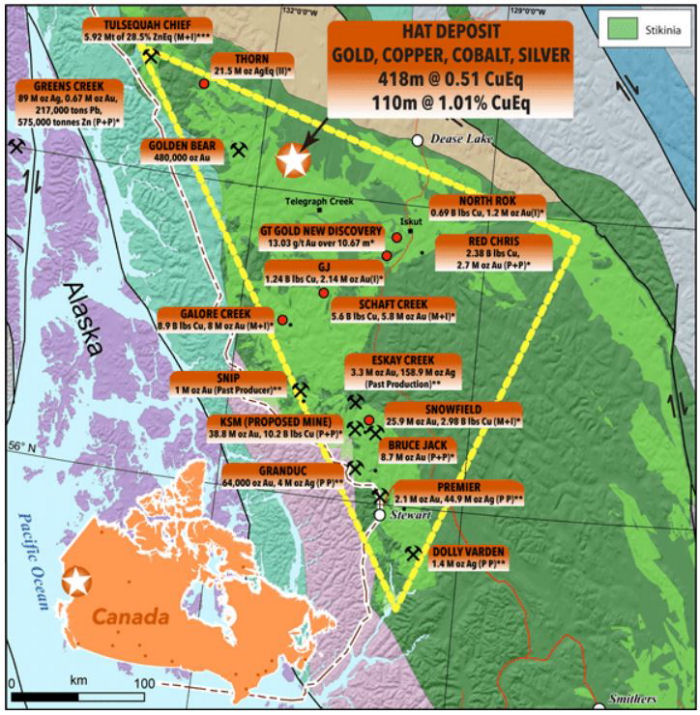

As shareholders of Doubleview Gold Corp we would like to share some info about a companythat we feel is a hidden gem and hasn't been discovered by the general market yet. DoubleviewGold Corp is a Canadian resource exploration and development company located in VancouverBritish Columbia. It has 3 properties which are all located in BC. BC is a safe mining jurisdictionand one that is in demand by Major Mining companies looking to replenish their depleting assets(last year Rio Tinto announced it is looking for porphyry deposits in BC).

Insider ownership. CEO/President (Farshad Shirvani) owns over 23 million shares(he said his spouse is the 2nd largestshareholder and the CEO has publicly said his close associates own approx 30% of the shares).The CEO has remortgaged his house multiple times (most recent one was for $500,000) to fundthe company. He truly believes in the company, has a lot of skin in the game and is extremelydedicated to the success of this company. We don't think you will find a more dedicated juniorexplorer CEO with more dedication and cares as much about the success of his company.

The new recently added director (Hugh Maddin) bought into the last private placement for$330,000 and it was priced at approx. 50% over the market price during the time period it wasannounced. He bought into it before becoming a director and since mid April he's been slowlyaccumulating on the open market.

Although they have 3 properties, lets just focus on their flagship asset called the HAT Gold Copperproperty. They've drilled 34 holes so far into this green field project (it had never been drilled beforeDoubleview acquired it).

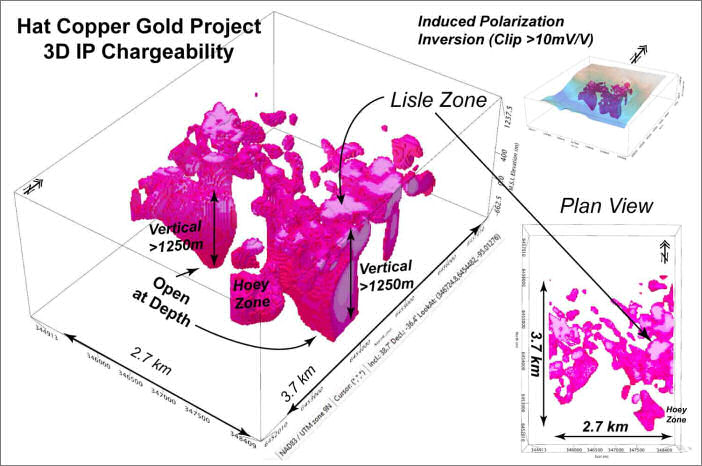

For those that like to do math and do thorough due diligence- current drilled dimensions of theLisle Zone according to the company is 650m x 920m x depth (unknown yet as it's open at depthand there are 2 anomalies that go beyond 1.25km). Using 400m which is ULTRA conservative thetonnage is calculated to be approx 600 million tones (used a specific gravity of 3.0). Using anexcel spreadsheet the weighted average grade was calculated for all holes drilled. Whencomparing Doubleview's current drilled tonnage and weighted average grade against some ofBC's porphyry deposits currently being mined (Gibralter, Mt Milligan, Red Chris, CopperMountain, Highland Valley, etc) Doubleview currently has more tonnage and better averagegrades than some deposits in operation! Keep in mind that this is comparing fully defineddeposits which include their best grades and Doubleview has only drilled a small fraction of thefoot print and hasn't even explored the remainder of the property yet! What is extremelypromising is their 1st drill campaign with the deep IP in hand (late 2019) they drilled theirstrongest mineralization so we're excited about the next drill campaign.

Looking at the deep IP footprint (below) look at what the drilled Lisle Zone of 650m x 920mrepresents (it's labelled on the IP pic below) on this enormous foot print (look at the dimensionsof the IP foot print 3.7km x 2.7km x depth of over 1.25km in 2 locations). The validity of an IPalways needs to be confirmed to ensure it's valid and Doubleview has tested that it's valid so thisshould all be mineralized. If Doubleview has more tonnage so far and higher grades that somedeposits currently being mined then this indicates the likely hood the deposit will be wanted byMajor mining companies. As they continue to drill the tonnage will increase thus the amount ofgold, copper, silver, cobalt and palladium will increase. They have 2 bodies of water immediateby the property (a stream that fills them) and it's not located in a rugged place so these shouldnot be show stoppers in building an open pit (unfortunately there are great deposits that willnever get mined because they're in bad locations and don't have the required necessities tooperate). Also note that prior to Hudbay Minerals signing a joint venture agreement withDoubleview they would have done extensive due diligence before committing time and moneyto the project.

Major mining companies are on the hunt for large porphyry deposits and they need to replenishtheir depleting assets. This IP foot print is said to be possibly the biggest in North America! Majormining companies look for large scale projects that have very long mine life to make it worththeir while. Unfortunately for these Majors there are not many projects that fit the largescale/long mine life criteria and luckily for Doubleview they have something that has one of thelargest IP footprints in North America so you can bet they're watching closely how this story unfolds. At what point will a Major make a move is anyone's guess but with every hole drilledwe think it's getting closer and closer.

What is also important to note is the Deep IP study which was done by Hudbay Minerals was onlyfor the main focus area of the property (Lisle Zone and its surrounds). Following the deep IP,word is they wanted to do the area north of the deep IP surveyed area because they suspectedthey would find more there too. The footprint they discovered is possibly the biggest in NorthAmerica so add the fact there might be more mineralization is mind boggling! If you look at theIP foot print the east and west show that there is more of it as it due to it being cut off and notincluded in the expensive area survey (it is said that this cost Hudbay approx. $1.2 million to do).

If you're asking about Hudbay and the reason it no longer has a joint venture on the propertywith such scale and potential it has nothing to do with them not being impressed and walkingaway. It was assumed that they unwilling had to cater to something else because they reallywere impressed and excited about the project and was setting it up for years to come (upgradedthe camp, worked closely with locale First Nation tribe, was looking to hire people, etc). Theirprized deposit in Arizona is going into a big legal battle and all capital and efforts are focused onthis: See link azcentral.com

Recent assays released 12 May 2020:Doubleview Drills Strongest Mineralization Discovered so far at Hat Property including 258meters of 0.31 g/t Gold and 0.47% Copper (1% Cu Eq) in an interval of 450 meters of 0.23 g/tGold and 0.35% Copper (0.7% Cu Eq). See News Release

If anyone is interested in Doubleview Gold there is an excellent telegram group for shareholdersand we have the CEO in the group. He readily answers shareholder's questions if he can talkabout it so one doesn't have to all individually call the company to ask questions and we allbenefit from the answered questions others ask if he can legally answer it. If interested in joiningthe group please let your point of contact know and we will give you the link to the privatechat. We share due diligence on Doubleview and discuss things related to it. We also have a exFreeport geologist/geotechnical engineer that worked at the Grasberg Mine that posts in thegroup. He is a shareholder and has provided us with his comments about the potential of theproject and about IP foot print. He is extremely excited about the potential of the property andits future. Grassberg is the largest gold mine and 2nd largest copper mine in the world.

The company has stated they want to resume drilling ASAP. After the last assays on 12 May theyreceived a lot of interest from Major mining companies. The float (what's most likely going to be traded) is relatively low and most of the shares are instrong hands that are all believers of a buyout so they're holding for it to happen. The CEO holdsalmost 24 million shares, our telegram group hold collectively approx 15 million shares (notincluding the CEO), Latimer (see below) has been accumulating since summer of 2017 and isconstantly on the bid and has been almost buying daily owns approx 10.7 million shares and theCEO's spouse is the 2nd biggest shareholder (no idea how many shares). The CEO said that withjust a few phone calls he can account for over 50% of the shares so if a low ball offer occurs it caneasily be rejected if the major shareholders that are close to the CEO vote against the offer.

To compare Doubleview's tonnage (approx. 600 million tons based on the drilled Lisle dimensionwhich is just a small fraction of the foot print and using just 400m depth which is way tooconservative but it's better to underestimate than overestimate).

Based on the current tonnage (drilled Lisle Zone), the grades being similar to other BC porphyrydeposits in operation, the foot print being one of the biggest in North America (3.7 km x 2.7 km),the potential of the property (the IP footprint was only done on a part of the property and therecould be more mineralization elsewhere), the low tradable float, the company's goal ofaggressively drilling it to take it to a buyout, the location (BC) and the increased interest by Majormining companies we feel this is an extremely undervalued company (stock price as of 20 May is.11) that holds multiple dollars of upside if it gets bought out. Please do your own due diligence.

Disclosure- This information was not sponsored in any way by Doubleview Gold Corp. This reportcontains opinions of shareholders and as shareholders they're biased. This was createdanonymously by a shareholder to spread the untold story of Doubleview Gold Corp to theirinvestment contacts and was specifically made for the current shareholders in the DoubleviewTelegram chat group (created by shareholders) to use to send to their contacts to get themacquainted with the company because they feel it's a great investment opportunity. Asshareholders we are biased and have done extensive due diligence. We believe Doubleview is a rare opportunity right now and the timing of this couldn't be better due to the resource bullmarket!

If interested please take a look at Doubleview and do your due diligence. If not interested in itright now it's recommended you keep it on your watch list in case you change you mind after theright news. Also, if interested in the Doubleview private telegram group just ask your point ofcontact for the link. This is not investment advice and although a lot of facts were taken fromreliable sources nobody is responsible for any errors, typos or mistakes in this article. Invest atyour own risk and there are no guarantees that Doubleview Gold Corp will succeed. Pleaseconsult investment advice through a certified financial planner.

Additional Information

Tahltan Industry Review / Hudbay Minerals Information Here

Nice write up about the last assays in Resource World Magazine. Article Here

Link to the company presentation: Latest Presentation

Drill results: View Drill Results Here

Lawrence Roulston research report on Doubleview from 2017 (20 page report) Report Link Here

Link to join the Doubleview Gold shareholder Telegram chat group (CEO is part of the group) Joinchat

If you enjoyed this article, please feel free to share. When seeking out mining stocks always use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.