Adriatic Metals lists on ASX, chases high-grade zinc discovery in mining-friendly Balkans

This stock is classified as 'very high risk' in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Adriatic Metals(ASX:ADT) makes its ASX debut today and is already drawing considerable attentionas a noteworthy zinc contender.

ADT is one of thefew independent near-term zinc development companies on the ASX and the first and only companyon the ASX with exposure to Bosnia and Herzegovina - a first-mover advantage that could give it a distinct edge as anemerging polymetallic play.

TheASX has seen very few zinc listings over the past few years, with Australiannewcomers mostly playing in the gold or battery metals space.

The bookbuild for ADT's $10 million listing, one of the biggest mining floats on the ASX so far this year next to JupiterMines which opened a $240 million offer in late April, provides ample evidencefor investor interest in this emerging Bosnian setting.

Although, ADT is an early stage play andinvestors should seek professional financial advice if considering this stockfor their portfolio.

Get the latest articles straight to your inboxkeep me postedImportantly, ADT has the $1.2 billion capped Sandfire Resources as acornerstone investor to help it mature its Bosnian assets. Sandfire spent $2million for a 7.6% stake in Adriatic.

Sandfire and Adriatic have entered into a strategic partnershipagreement which will enable Adriatic to access significant technical expertiseto develop its Veovaca and Rupice Projects as well as strategic support as thecompany moves to unlock the potential from its first mover status and regionalexploration portfolio.

"We welcome Sandfire as a strategic investor and partner of Adriatic aswe transition to a publicly listed Company," Adriatic's Chief ExecutiveOfficer, Geraint Harris said. "Securing a high-quality partner with worldleading expertise in the exploration and development of base metals projects isa strong endorsement to the quality and potential ofAdriatic's portfolio following an exhaustiveperiod of due diligence. This also validates the prospectivity of our licenceareas to host further discoveries as we commence our 2018 exploration program.

"Sandfire brings a tremendous depth of experience in these styles ofmineralisation which will enable us to further understand this under-exploredand emerging base metals province of central Europe."

Well-funded, with a $10 million cashinjection to fuel ongoing exploration and development of its key assets Rupiceand Veovaca, ADT's vitals are all very healthy.

The Sandfire investment would please Chairman, Peter Bilbe, who issomething of an industry veteran. Bilbe is a miningengineer with 40 years' Australian and international mining experience in gold,base metals and iron ore at operational, CEO and board levels.

Bilbe is alsocurrently chair of Independence Group NL. Since 2009, he's overseen IGO's growth from asingle mine to the $3 billion diversified gold and base metals mining companyit is today.

With Bilbe steeringthe ADT ship at it looks to ramp up its exploration game post-listing, there'severy chance that this newly listed polymetallic junior will have similarsuccess.

ADT is the second company to list on the ASX this year with a focuson the Balkans. The first was Raiden Resources (ASX:RDN), which is focused onSerbia, and recently penned a US$31.5 million (A$40 million)jointventure with mining powerhouse Rio Tinto - a deal that saw RDN's share price surge by some 62%...

The past performance of this product is notand should not be taken as an indication of future performance. Caution shouldbe exercised in assessing past performance. This product, like all otherfinancial products, is subject to market forces and unpredictable events thatmay adversely affect future performance.

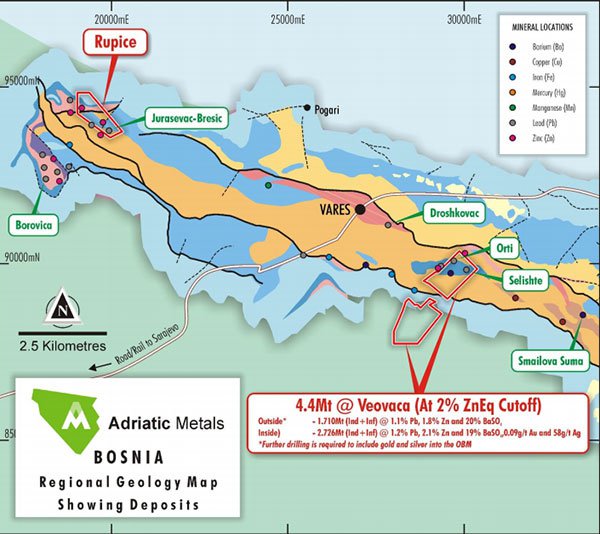

The map below shows you the locationof ADT's two key projects:

Rupice: one of the highest grade polymetallic deposits in the world

Rupice is an advanced explorationproject that displays exceptionally high grades of base and precious metals.This deposit has an ample regional footprint and multiple untested targets.

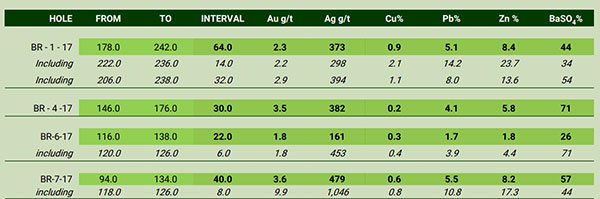

What we'relooking at here are near-surface sedimentary-style base metal deposits withvery high grades of zinc, lead, silver, gold, barite and cobalt. In fact, 64mat 8.4% zinc, 5.1% lead, 373g/t silver, 2.3g/t gold, 1% cobalt and 44% barite - making Rupice oneof the highest grade polymetallic deposits in the world.

An example of the high-grade oreencountered here:

The deposit sits some 17 kilometresnorth-west of the Veovaca pit and the historic processing facility.

Historic small-scale mining of theoutcrop produced some 20,000 tonnes, containing 88.9% barite and sent to USA.49 historic holes were drilled for 5696 metres, but only 35% of the holes weresampled for gold and silver.

Exploration adits were used to mine15,000 tonnes of high grade zinc/lead material that was processed at Veovaca.

Intriguingly, 2017 diamond drilling byADT (8 holes for 1458 metres) offered up outstanding results and demonstratedhigh-grade gold, silver and barite, with high-grade base metals.

Selected 2017 intercepts showingthickness and consistency of a high-grade nature:

Recent drilling by ADT shows a clearrelationship between base and precious metal grades, suggesting at potential toadd gold and silver to a future JORC Resource.

Moreover, numerous IP anomaliesindicate that these two projects form part of a broader polymetallic district,with immediate targets in the Rupice (which we'll look at shortly) and Borovicacorridor. These IP anomalies correlate with historical work, includingtrenching, exploration adits and limited drilling.

ADT has begun geophysics andgeochemistry work to further define exploration drill targets. ADT's plan in the short-term is to complete an infilldrilling program at Rupice, which kicks off this week, so there's bound to beplenty of news flow in the near future here. ADT will also be targeting aResource for Rupice.

On top of these two key holdings, ADTalso has in its grasp numerous regional prospects with exploration targetsindicating attractive tonnages and grades - these aresupported by historic geophysics, exploration and drilling.

These promising targets offerexploration upside -and for the Orti and Selishte targets, possible inclusion in a developmentscenario at Veovaca. Discussions are currently underway to expand existingconcession boundaries.

Veovaca: World-class exploration potential

ADT also has on its hands significantbrownfields assets with world-class exploration potential, and is now gearingup to launch itself head-first into a series of proactive exploration works.

Veovaca is an historic open-cutzinc/lead/silver/barite mine with a 25-year mining concession. The project wasmined between 1983 and 1987, and produced saleable zinc, lead and bariteconcentrate, delivered into European smelters. Notably, this project alreadyhas a JORC-complaint Resource of 4.4Mt with 80% classified as Indicated.

Backtracking for a moment, a quickword on barite... Barite is the naturally occurring mineral of barium sulphate - it is non-toxic, has a high specific gravity and low solubility.Notably, the barite found at Rupice and Veovaca is high-quality drilling fluidgrade (4.2SG), which fetches a premium price. Here's barite found at Veovaca:

Bearing that in mind, a recent hole atVeovaca 76 metres from surface delivered 4.0% zinc, 2.5% lead, 118 grams pertonne silver, 0.23 grams per tonne gold and 36% barite.

Below, you can see the Veovaca pitlooking south-east, with the ore exposed at surface:

51 historic holes were drilled for8,022 metres with zinc, lead, gold, silver, cobalt and barite mineralisationfrom surface, open down-plunge to the east-north-east and for potential repeatlenses.

Confirmation drilling by ADT in 2017(16 diamond holes for 1,381 metres), meanwhile, yielded outstanding results,showing verifiable mineralisation from surface down to depths up to 125 metres.

Encouragingly, Veovaca iswell-serviced by sealed roads, rail and infrastructure, and low-cost powerwhich bodes well in terms of a future mining operation, should ADT managed todig up something substantial.

A metallurgical test work program is currently underway withUK-based Wardell Armstrong. Now that ADT's IPO is done and dusted, the companyis looking to take things to the next level here. ADT is looking to kick off ascoping study in the coming months, as well as a Resource update in the secondhalf of the year.

All in all, this is a promising startfor ADT in its Bosnian setting.

Bosnia: an establishing shot

When thinking aboutappealing investment destinations, Bosnia might not be the first location thatsprings to mind. However, the previously war-torn country is now looking toattract greater foreign investment and become part of the EU.

Since the end of the civilwar in the early 1990s and the signing of the Dayton peace agreement in 1995,Bosnia has experienced a stable and peaceful democracy. Bosnia is a stable democracy, andcomprises harmonious tri-religious communities, making for relatively lowsovereign risk.

Bosnia is rapidly attractingattention as a pro-mining, business-friendly country with world-class geologyyet limited modern exploration. The country saw limitedforeign investment and modern exploration over the last 20 years, leaving adoor open for major discoveries. Here's a snapshot of Sarajevo today:

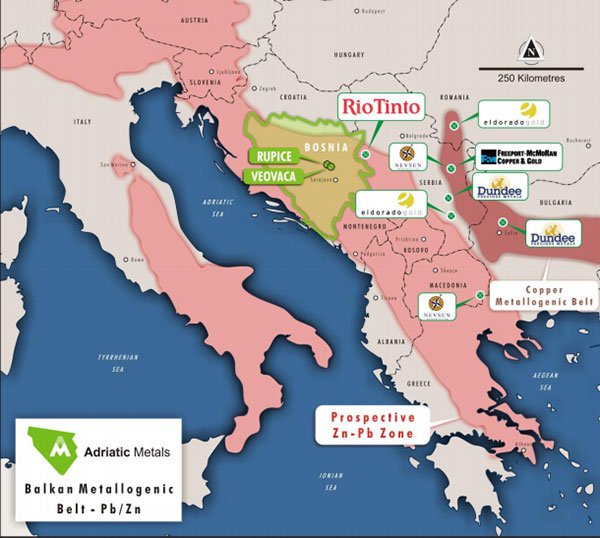

Bosnia displays similar prospectivity to Serbia, which is also openingup to foreign investment and has some of the world's largest cobalt and silverdeposits.

Bosnia is alsoeminently miner-friendly, with favourable regulatory terms, including lowcorporate tax rates of 10% - among the lowestin Europe - withforeign investors having the same rights as locals. There's no government participationright or free carry, and the local currency (BAM) is pegged to the Euro.

Furthermore, ADT has at its disposalaccess to a highly skilled workforce, and low labour, transport and electricitycosts. Promisingly, there is an extensive rail network linking Europeansmelters and seaborne markets through the port in Montenegro (Bar) and Croatia(Ploc?OEe), as you can see below:

As we've mentioned, the Balkans israpidly attracting a host of attention from a cluster of mining heavyweights,including the likes of Rio Tinto, Nevsun, Dundee, First Quantum, Eldorado Goldand Freeport-McMoRan. You can see these major players plotted out in the mapbelow alongside ADT's Veovaca and Rupice projects, spanning the highly covetedBalkan Metallogenic Belt:

A peer comparison

Below, you can see how ADT is trackingagainst its ASX peers in terms of market cap and contained zinc:

As you can see, the average market caphere is $72 million.

Bearingin mind the fact that ADT has in its hands some of the world's highest grade polymetallicdeposits, this ASX newcomer has apost-listing market cap of $26.2 million - making it significantly under-valued whentaking into account these peers.

Although it does remain a speculative stockand investors should seek professional financial advice if considering thisstock for their portfolio.

Given its highlyprospective holdings, this modest sized stock could be a judicious entry pointinto a rapidly expanding investment corridor - theemerging Balkans region.

The zinc story

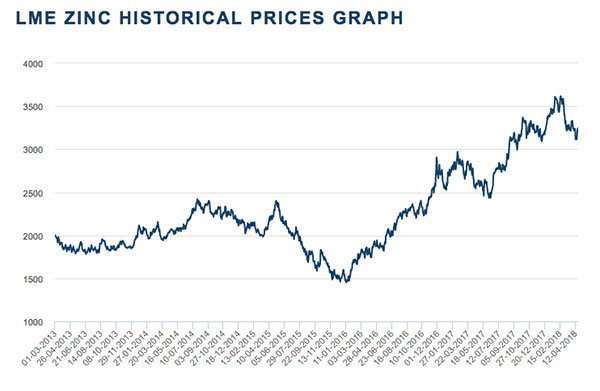

In 2017, zinc prices jumped almost 30% on the back of supply concerns,scheduled mine closures, strategic supply cuts by major supplier Glencore,declining warehouse stocks, a weakened US dollar, and a positive Chinese demandoutlook.

Into 2018, these supply issues continue to grow. Worldwide stockpiles of zinc are sitting at near-decade lows,translating to the near-decade high price of US$3400/t:

The London MetalsExchange's (LME) zincprice has more than doubled since falling below $1500/t in late 2015:

Thepast performance of this product is not and should not be taken as anindication of future performance. Caution should be exercised in assessing pastperformance. This product, like all other financial products, is subject tomarket forces and unpredictable events that may adversely affect futureperformance.

Global zincdemand continues to grow at 2-4% per year.

Pundits don't see this high-powered zinc story changing any timesoon, looking to a significantly tightening zinc market over the coming years.

Zinc is most commonly used in steel galvanisation, which accountsfor some 60% of global usage. The end-use zinc market is dominated byconstruction companies, followed closely by the transport industry. On top ofthis, however, zinc is also emerging as a compelling commodity in the energystorage story.

Despite the fact that it's the largest zinc producer in the world,China has become a netimporter of zinc.

Also contributing to this supply/demand imbalance has been thedwindling output of some of the world's major zinc mines, with leadingproducers having closed down historic zinc mines in Australia and Ireland inrecent times.

Given these kinds of dynamics, it seems like ADT has impeccable timing,and is looking for this high-performing commodity in a low-cost Balkans region that'srapidly emerging as a key investmentdestination.

Moving forward

Freshly listed and in a solid cash position, ADT is looking to move fastas it ramps up its game in Bosnia. In the weeks and months to come, ADT will aggressivelydrill Rupice and Veovaca, with a 15,000 metre program currently being tendered.

Development workat both Veovaca and Rupice will continue with metallurgical work, flowsheet andpreliminary mine design.

Regionalexploration on surrounding prospects will also further define drill targets forthe remaining months of 2018. ADT is also looking to evaluate new projectopportunities with a view to build its already impressive portfolio.

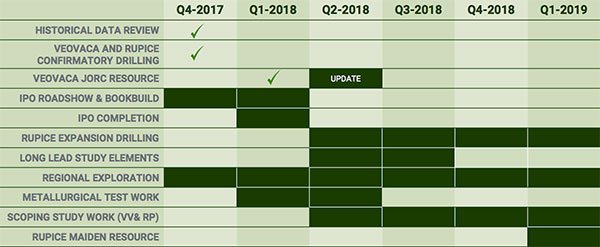

As you can see inthe timeline below, ADT has plenty to keep it busy in the days ahead:

ADT is one of the few independent near-term zincdevelopment companies on the ASX, and it's capitalising on one of the world'smost prolific and underexplored regions.

It does still have a lot of work to do so investors should still take acautious approach to their investment decision when considering this stock fortheir portfolio.

With high-grade targets and potential for new discoveries,ADT has assembled a team with proven experience in a low-cost operating environmentclose to existing markets. All of this makes for a rather tasty recipe forsuccess, and we have no doubt we'll be tracking this ASX newcomer closely inthe months to come.

Get the latest articles straight to your inboxkeep me posted