Alligator Energy Appoints New CEO to Oversee Energy Projects

Having appointedGreg Hall as Acting CEO effective 1 April 2018, Alligator Energy (ASX:AGE) is now primed to push forward with its exploration work at itscobalt nickel play in Northern Italy, whilst maintaining its uranium projectsin the Alligator Rivers Uranium Province.

Hall iscurrently a non-executive director of Alligator Energy and has agreed to assumethe role as CEO on a part-time basis.

The formerMining Engineer has 35 years' experience in the resources sector, holding executiveroles in projects in uranium (Olympic Dam, Ranger, Toro Energy), nickel(Leinster and Kambalda Nickel Operations) and copper (Olympic Dam, HillgroveResources).

Hall wasalso Marketing Manager for Rio Tinto Uranium and Director Sales (Bauxite &Alumina) at Rio Tinto Aluminium.

"The Company is excited to be able to secure Greg's services in an executive capacity given his extensive knowledge and experience in both the uranium sector as well as energy minerals including nickel," AlligatorExecutive Chairman, John Main commented.

"Greg was actively involved in the investor presentations associated withthe Company's recent share placement and we look forward to him being able to build and extend the relationships formed with key shareholders andinvestors."

Get the latest articles straight to your inboxkeep me postedHall will betasked with early on-ground exploration and drilling at the Company's newlyacquired tenements in Piedmont, northern Italy and will oversee preparation fornear term work on AGE's two high quality and advanced uranium targets in theAlligator Rivers Uranium Province (ARUP) in the Northern Territory.

The Northern Italy deal

In February,AGE announced it had signed a binding Heads of Agreement with Chris Reindlerand Partners (CRP) to earn up to a 70% interest in the Piedmont cobalt nickelcopper project in Northern Italy.

Theacquisition plays into AGE's overall business plan to discover large, highgrade energy related metal deposits including uranium, nickel and cobalt withclear pathways for approval and development.

The company isin its early stages and investors should seek professional financial advice ifconsidering this stock for their portfolio.

The companysees the Piedmont acquisition as an outstanding opportunity that containswalk-up geophysical targets in close proximity to historical mines at a timewhen energy minerals are in high demand. Ford is spending US$11 billion onelectrified vehicles through to 2022, as Telsa continues to change public attitudestowards energy management.

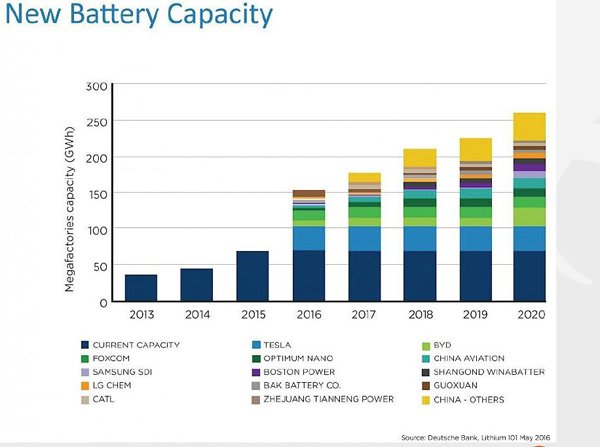

The followingDeutsche Bank table indicates market demand for cobalt:

Uranium also on the march

AGE'suranium project is also highly prospective, with drill ready uranium targets anda dominant land holding in a premier uranium exploration district.

Hall will betasked with preparing for near term work on AGE's two high quality, advanceduranium targets within ARUP, as well as consolidating and enhancing the highquality landholdings.

He will alsocontinue ongoing relationships with indigenous groups in Arnhem Land with whomAGE has had longstanding and beneficial relationships.

The ARUPis an under-explored, high grade uranium province which hosts several worldclass, high grade uranium deposits, including the RangerNo 1 and No 3 deposits which have to date produced over 300Mlb of U3O8 forexport and the Jabiluka deposit, which is one ofthe world's largest uranium deposits, having a resource in excess of 300MlbU3O8 at grades of 0.5% U3O8.

The Province has benefited from uranium miningfor over 30 years and has an established regulatoryframework which offers a high degree of certainty for business and stakeholders.

Get the latest articles straight to your inboxkeep me posted