Caldas stock sinks on $33m special warrant financing

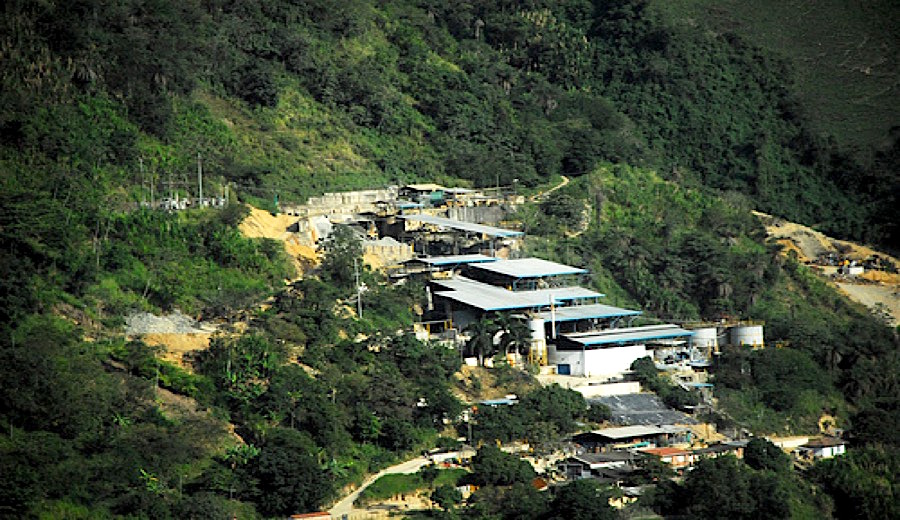

The Marmato project is located in the Caldas department in the heart of the Middle Cauca gold district, a region that has been exploited since pre-Colonial times by the Quimbaya people.(Image courtesy of Gran Colombia)

The Marmato project is located in the Caldas department in the heart of the Middle Cauca gold district, a region that has been exploited since pre-Colonial times by the Quimbaya people.(Image courtesy of Gran Colombia)

Caldas Gold (TSXV: CGC) is raising aggregate gross proceeds of C$45 million (about $33m) after coming into agreement with a syndicate of underwriters led by Scotiabank and Canaccord Genuity to purchase, on a bought deal private placement basis, 20 million special warrants of the company at a price of C$2.25 each.

The issue price represents an approximate 16.6% discount to Caldas Gold's share price of C$2.70 at Friday's market close.

Each special warrant entitles the holder to receive one unit of Caldas Gold, with each unit comprising one Caldas Gold common share and one common share purchase warrant. The common share purchase warrants are exercisable for five years following the closing date at a price of C$2.75 per common share.

This offering is another step in securing the financing required for the expansion of Caldas Gold's mining operations at the new Deeps Zone operation

Caldas Gold has also granted the underwriters an option, exercisable at any time up to 48 hours prior to the closing date, to purchase up to an additional 2.22 million special warrants at the issue price for additional proceeds of C$5 million.

This offering is another step in securing the financing required for the expansion of Caldas Gold's mining operations at the new Deeps Zone operation of Marmato project in Colombia, chairman and CEO Serafino Iacono says.

Iacono adds that marketing of the previously announced gold-linked notes by Gran Colombia Gold (TSX: GCM), which owns 74% of the company, is continuing with positive feedback to date and expects to finalize terms shortly, with an announcement on the expected closing to follow soon thereafter.

Meanwhile, Wheaton Precious Metals (NYSE: WPM) has indicated to Caldas Gold that it plans to subscribe for up to C$5 million pursuant to the special warrants offering. The companies recently signed a non-binding term sheet for a precious metals streaming arrangement on the Marmato mine, which has been in operation since 1991.

Located within a historical mining district, the Marmato project contains approximately two million ounces of gold in the measured and indicated resource categories and 3.3 million ounces in the Inferred category.

A prefeasibility study (PFS) is currently in progress and expected to be completed mid-year, focusing on the development of the Deeps Zone mineralization, construction of a new 4,000 tpd plant and new dry stack tailings storage facilities. Mechanized mining is expected to begin in 2023 with an additional estimated 1.6 million ounces of gold recovered over a 16-year mine life.

Shares of Caldas Gold plunged 13.2% midday Tuesday on the latest financing announcement. The Vancouver-based gold miner has a market capitalization of approximately C$118.6 million.