Central Banks Plan To Buy More Gold In 2022 / Commodities / Gold and Silver 2022

While gold and silver prices have fluctuated somewhat oflate, both assets were performing a little more solidly throughout US tradinglast week.

In fact, August gold futures were up by around $6.90 at$1,828.10 by Wednesday last week, while JulyComplex silver futures increased by $0.054 to $20.86 per ounceduring the same timeframe.

However, the market remained watchful head of a highlyanticipated central bankers’ forum in Portugal, which was set to featureinfluential speakers such as ECB President Christine Lagarde, Bank of Englandgovernor Andrew Bailey and Federal Reserve Chairman Jerome Powell.

This will also follow a recent central bank survey, whichrevealed some fascinating insights pertaining to gold and the precious metalmarket. We’ll explore these in a little more detail below:

What Did We Learn from the Central Bank Survey?

The annual central bank survey took place last week. Aseries of questions asked them how they plan to invest going forward. Someof the highlights included:

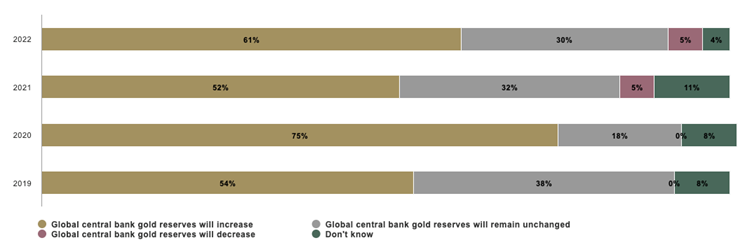

Gold continues to be viewed favourably bycentral banks as a reserve asset.25% of respondents say they have plans toincrease their gold reserves, up from 21% last year.Recent economic and geopolitical developmentsmay have contributed to a subtle but growing divide between central bankrespondents in advanced economies and those in Emerging Market and DevelopedEconomies (EDME).Gold seems to be viewed as a safe haven against inflation,global risks, and dependency on the dollar. Of course, this rule has remainedlargely unchanged through history, but there seems to be no sign of such atrend abating anytime soon.

The chart below shows how this has shifted over the last 4years:

Giles Maber from Gold sellers Sharps Pixley says:

'Due to financial uncertainty, it is no surprise that weare seeing central banks adding gold to their reserves. Coupled with the threatof international hostilities, central banks are seeing gold as a way ofreducing dependency on other nations. For retail investors, gold continues tobe a safe investment, but this central bank buying could cause alreadyhigh prices, to become unaffordable for many over the coming months. Theresult could be a much needed boost for silver.’

For investors this presents a difficult decision as towhether it’s worth purchasing gold in the current circumstances. If itcontinues its current meteoric rise, then it will be a great asset to protectthem from dips in the stock market over the coming months.

It may be a somewhat easier decision for investors whoalready own gold, as they will be looking for a peak in price where they cansell and potentially redistribute some of their portfolio in potential growthmarkets – such as tech stocks.

But all the signs are currently telling us that the worldwants more gold. And with such a finite resource and a move away fromalternative investments, the price is set to carry on rising.

By Travis Bard

© 2022 Copyright Travis Bard - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.