Coeur Mining: Still Just A Call Option On Gold And Silver Prices

Coeur Mining reported a positive sustaining free cash flow in H1 using $16.50 per ounce silver and $1250 per ounce gold.

At the current spot prices, the free cash flow will be practically zero.

The Silvertip mine in British Columbia is up and running, and Coeur is pursuing its next acquisition to add to its Nevada production platform.

Introduction

Coeur Mining (CDE) used to be one of the 'go-to' names in the silver space in the first decade of this millennium, but the company has lost a lot of its allure after in excess of half a decade of mediocre performances. The operating results are so-so, but the company isn't making any cash flow at the current silver prices. Granted, most silver (and gold) producers aren't doing great these days, but it's painful to see Coeur's share price continue to slide.

The first half of the year showed good production results, but virtually no free cash flow

Coeur Mining remains one of the largest precious metals producers out there, and this was confirmed in the company's H1 performance. Coeur produced 6.4 million ounces of silver as well as approximately 180,000 ounces of gold for a total silver-equivalent production of 17.1 million ounces. If we would use the current spot price of $1195 per ounce for gold and $14.15 per ounce of silver, the silver-equivalent production based on these spot prices would be approximately 21.5 million ounces. That's substantially higher than Coeur's own silver-equivalent calculation of 17.1 million ounces, which is based on a 60:1 gold-silver ratio whereas the current ratio is closer to 85.

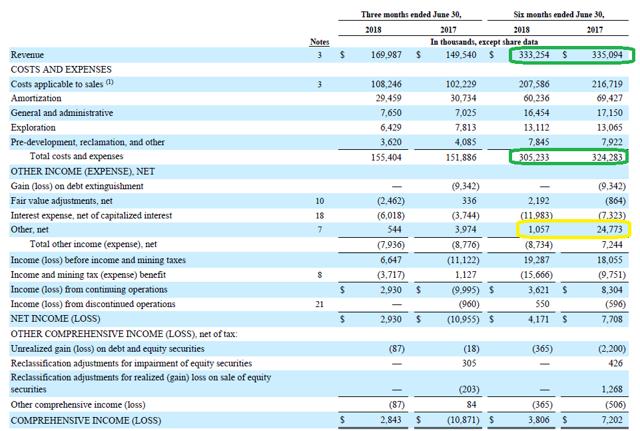

Source: SEC filings

Coeur Mining received just over $16.50 per ounce of silver and in excess of $1250 per ounce of gold in the first half of the year, and this allowed the company to report a total revenue of $333.3M, which is roughly in line with the revenue of the first half of 2017. However, Coeur Mining reported lower operating expenses compared to the previous year, and this resulted in a pre-tax income of $19.3M, up from $18.1M in H1 2017, although the first half of 2017 included a non-recurring 'other' income of almost $25M from the sale of the Joaquin project.

The net income of $3.8M or 2 cents per share is nice for the stats, but doesn't really mean much for a mining company as the cash flow overviews are traditionally more important for commodity companies.

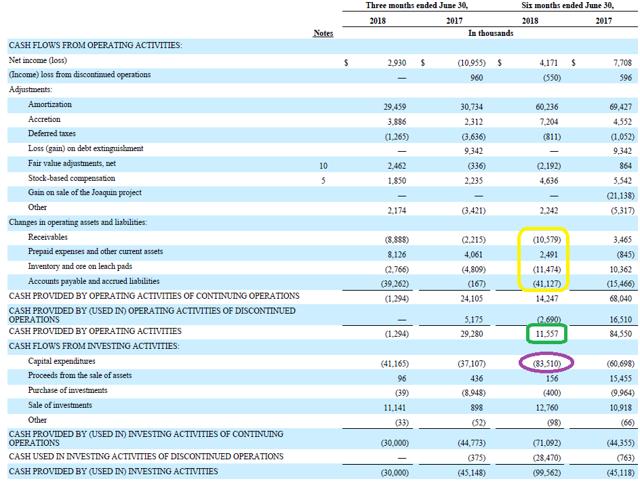

Source: SEC filings

In the first half of the year, Coeur reported an operating cash flow of $11.6M from continuing activities, but this included a relatively high investment in its working capital position (it reduced its accrued liabilities by in excess of $30M). Taking these working capital changes into consideration, the adjusted operating cash flow increases to $72.6M. That's not sufficient to cover the $83.5M in capital expenditures, but it's important to realize a substantial part of this capex was spent on the Silvertip mine, which hadn't reached commercial production by June 30.

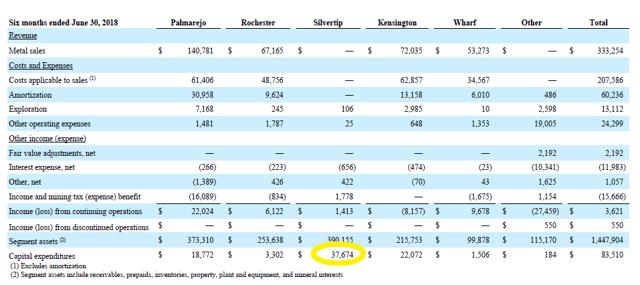

Source: SEC filings

According to the notes to the financial statements, Coeur spent approximately $38M on Silvertip and considering this is a completely new mine, the entire $37.7M should be logged as 'expansion capex.' This obviously has a positive impact on the adjusted free cash flows which would be approximately $26M. This still assumes that none of the other capital expenditures were spent on growth. According to Coeur, approximately 50% of the total capex was spent on sustaining capex (46% of the Q1 capex and 57% of the Q2 capex). This results in an additional $4M being added to the sustaining free cash flow, which would have been $30M in the first half of the year.

Silvertip is up and running, and Northern Empire could be the next stepping stone in Coeur's growth strategy

A free cash flow performance of $30M is obviously very nice, but keep in mind this was based on a silver price of $16.50 per ounce and a gold price of $1250 per ounce and Coeur Mining would be free-cash-flow-negative using the current spot prices on the precious metals market.

Coeur has now declared commercial production at Silvertip as the processing rates had increased up to 800 tonnes per day by the end of August. Coeur expects Silvertip to reach an average production rate of 750 tonnes per day by the end of the year, which will be the stepping stone to reach 1,000 tonnes per day in 2019. Keep in mind, Coeur is still awaiting the final approvals to boost the production rate to 1,000 tpd, and it anticipates to have all permits in hand by the end of this year.

Source: company presentation

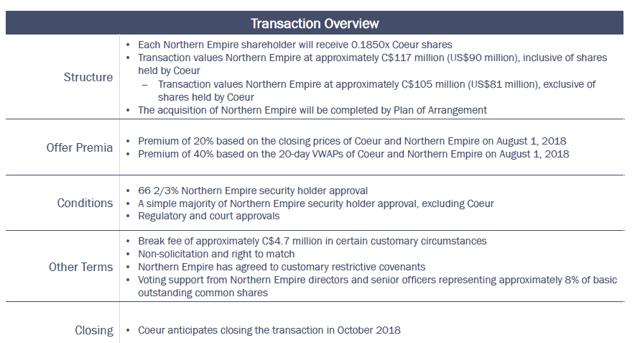

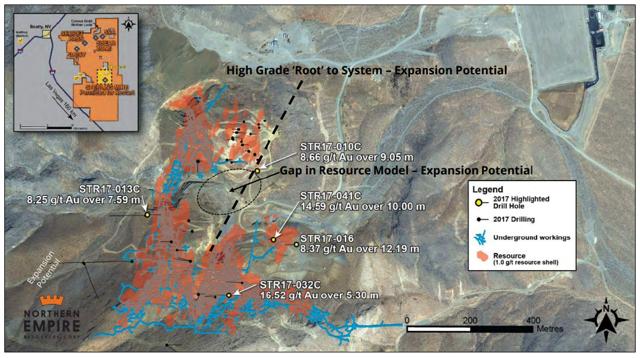

Coeur is already anticipating its next step after Silvertip, and in August it made an offer to acquire Northern Empire Resources (OTCPK:PSPGF), a Canadian junior exploration company owning an exploration-stage gold project in Nevada. Considering there's an existing resource estimate of in excess of 700,000 ounces and the fact the production facility is permitted, it's understandable why Coeur Mining was so interested in this asset. Coeur valued Northern Empire at US$90M in an all-share swap wherein it's offering 0.185 of its own shares per share of Northern Empire it didn't own yet.

Source: company presentation

I only have one fear now, and that's to see Coeur overpaying to acquire adjoining Corvus Gold (OTCQX:CORVF) as well. Its US$250M market capitalization appears to be very rich and the market seems to be anticipating a sale to Coeur which could then combine the high-grade 'Mother Lode' on the Corvus land with its permitted production facility and own resources at Sterling.

Investment thesis

Coeur's performance in the first half of the year wasn't as bad as I feared once you strip out the non-sustaining capital expenditures. However, the current precious metal prices won't allow Coeur to be free-cash-flow-positive; so I'm not expecting the company to publish great results for Q3. Declaring commercial production at the new Silvertip mine is a positive milestone, and now that has been completed, I would expect Coeur to aggressively advance the Sterling project in 2019.

At $20 per ounce silver and $1300 per ounce gold, Coeur would be generating in excess of $110M/year in free cash flow, so its current market capitalization of approximately $1B (before issuing shares to acquire Northern Empire Resources) and enterprise value of $1.3B aren't outrageous for a company that's essentially a call option on gold and silver prices.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow The Investment Doctor and get email alerts