Continental Gold's Buritica Project Keeps Getting Better And Better

The Buritica mine construction is underway. After it's completed, it should produce 253,000 toz gold per year at an AISC below $500.

The trial mining provided excellent results. The gold and silver production from the stopes was much higher than expected.

An extensive drill program is underway; multiple drill targets will be tested in 2018.

The Buritica project looks very good, and there are various indications that it will get even better.

Continental Gold (OTCQX:CGOOF) develops its world-class Buritica gold project in Colombia. Buritica is one of the biggest undeveloped high-grade gold projects. The reserves contain 3.7 million toz gold at a gold grade of 8.4 g/t. The mine is expected to produce 253,000 toz gold per year at an AISC of $492/toz. It is fully funded, fully permitted, and under construction. Besides the construction activities, Continental Gold also undertakes an extensive exploration program that is aimed not only at expanding the currently outlined deposit and converting more resources into reserves but also on drilling some other high-priority targets on the its large land package.

Despite the positive developments, Continental Gold's share price moved sideways in a $2.25-3 range for a better part of 2017. The Buritica mine development is in a boring, two-year long construction phase. First gold production is expected only in 1H 2020, which means that a lot of investors will try to find some bigger, near-term gains elsewhere. However, this strategy may turn out to be wrong, as the exploration potential of the Buritica property that covers an area of 706.78 km2 and the extensive 2018 drill program may lead to a discovery of a new, big, high-grade gold deposit and a subsequent quick share price growth. Not to talk about the fact that the vein systems included in the current mining plan are still open in several directions and the initial long-hole trial mining tests indicate that the Buritica resource estimate is probably too conservative.

The Buritica Project

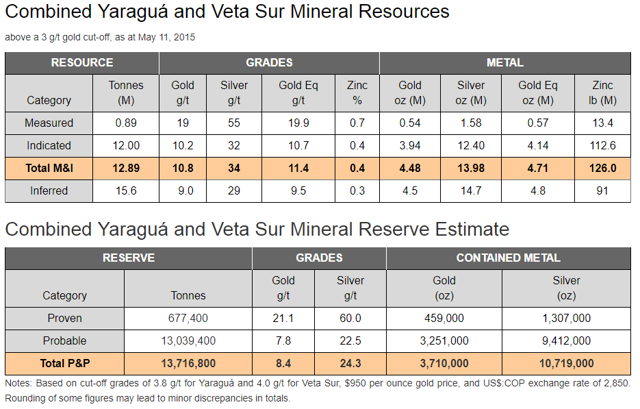

The Buritica Project is located in northern Colombia in the Medellin region. The mining operation will initially focus on the Yaragua and Veta Sur vein systems. The combined Yaragua and Veta Sur reserves contain 3.71 million toz gold at a gold grade of 8.4 g/t and 10.72 million toz silver at a silver grade of 24.3 g/t. The measured, indicated and inferred resources contain 8.98 million toz gold and 28.68 million toz silver (including reserves).

Source: Continental Gold

Although the reserves and resources are high-grade and extensive and the Buritica Project belongs to the biggest undeveloped high-grade gold deposits, it turns out that the resource model may be way too conservative. Continental Gold undertook two long-hole trial mining stope tests, and both of them provided significantly better results than expected.

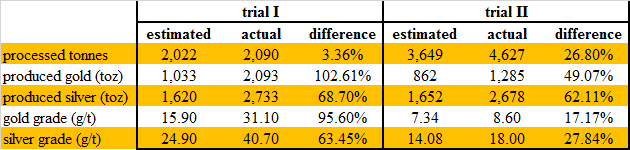

The first trial was completed in May, and the stope provided 3.36% more ore than originally expected. The gold grade was 95.6% higher and the silver grade was 63.45% higher than estimated. As a result, the silver production was 68.7% higher and the gold production was 102.61% higher than expected.

Results of the second trial were reported in December, and they were very positive as well. The volume of processed ore was 26.8% above the estimates, the gold grade was 17.17% higher and the silver grade was 27.84% higher than expected. It means that the gold and silver production exceeded the estimates by 49.07% and 62.11% respectively.

Source: Continental Gold

According to the 2016 feasibility study, the Buritica mine should be able to produce 253,000 toz gold and 466,000 toz silver at an AISC of $492/toz gold. The initial CAPEX is estimated at $389.2 million, which is a relatively low number given the production profile of the project. At an USD/COP exchange rate of 2,850 (the current value is 2,857) and a gold price of $1,300/toz, which is slightly below the current market price of $1,320/toz, the after-tax NPV(5%) of the project is $1.01 billion and the after-tax IRR is 34.6%.

The mine construction is underway. The activities are focused mainly on the infrastructure now. In late 2017, the major earthworks started, and first concrete should be poured in early 2018. The mine should be completed in early 2020, and the commercial production should be reached in summer 2020.

The exploration potential

What is important is both of the main vein systems remain open along strike and at depth (picture below). There is a very high probability that the volume of gold and silver reserves will be significantly expanded in the future which may lead not only to a major mine life expansion but also to a growth of the throughput rate and production volumes.

Source: Continental Gold

In late 2017, Continental Gold drilled several targets (Arados, Guarco/Pajarito, Pinguro, Obispo); the results are pending. The 2018 drill program will target another nine exploration targets: Laurel, Perseus, Orion, Yaragua East Deep, Adonis, Electra, Medusa, Yaragua North, and Poseidon. Some of them are close to Yaragua, Veta Sur, and the future mine site (map below), which means that if some economic deposits are discovered, it should be relatively easy to process the ore from them at the facilities that are currently under construction.

Source: Continental Gold

During 2017, some infill drilling also took place. The results were very promising as they provided gold grades significantly higher compared to the resource model. Some of the more interesting drill results include BUUY331 (17.67 g/t gold and 16 g/t silver over 45.6 meters), BUUY336 (17.7 g/t gold and 25.6 g/t silver over 33.9 meters), BUUY320 (67.69 g/t gold and 136.8 g/t silver over 6.10 meters), BUUY324 (51.76 g/t gold and 95.3 g/t silver over 3.25 meters) and BUUY326 (39.13 g/t gold and 44.2 g/t silver over 7.85 meters).

Although the infill drilling was successful, it hasn't impacted the share price too much, as positive results were expected. However, if Continental Gold manages to intersect similar grades and intervals also at some of the new exploration targets, the impact on the share price should be much more visible.

Risks

The initial CAPEX of the Buritica mine is estimated at $389 million. Continental Gold secured a $250 million debt facility from Red Kite and allocated $153 million of cash to cover the rest of the CAPEX needs. Although the CAPEX is fully covered now, the construction should be completed only in 2020. It means that there is still relatively lot of time for some construction delays and cost overruns to arise. The company will also need to finance its common operations and extensive exploration activities. Although the recent corporate presentation lists several options, including equipment lease financing and conversion of the outstanding warrants, an equity financing and share dilution can't be ruled out completely. However, at the current share price, if Continental Gold wanted to raise $50-100 million via an equity financing, the resulting share dilution would be only around 10-20%, which is not a disaster.

Another potential risk is related to the security situation in Colombia. Although the Buritica Project is located in a less dangerous part of the country, the security issues can't be ruled out completely. Continental Gold shouldn't have problems with the Colombian drug cartels, but it may have some issues with the local illegal miners. There are some issues with illegal mining operations in the region. Although the Colombian government tries to deal with this problem, it has been unable to eliminate the illegal operations completely yet. Only in July, Continental Gold reported the death of six of its security contractors, who died during an inspection of an illegal mine closed by the government.

It is important to realize the risks; however, it would be a mistake to overblow them too much. The fact that the risks related to Continental Gold are reasonable was confirmed also by Newmont Mining (NEM), that purchased 37.38 million shares of Continental Gold for $109 million back in May. Thanks to the purchase, Newmont became a major shareholder, holding almost 20% of Continental Gold's outstanding shares.

Conclusion

Although it is possible to expect some share dilution and there are also several other risks, mostly related to the construction activities and the political and security situation in Colombia, they are outweighed by the upside potential. The after-tax NPV(5%) of the Buritica mine is over $1 billion at the current gold price, which compares favorably to Continental Gold's current market capitalization of $522 million. The mine should be able to produce over 250,000 toz gold per year at an AISC under $500/toz. At the current gold price, the Buritica mine should be able to generate cash flow around $200 million per year. However, if the actual mining operations confirm the results of the two trial mining tests, the annual production and the cash flow may be much higher. Moreover, there is a lot of potential to further expand the vein systems included in the mining plan and also to discover new ones. For investors who are willing to wait for the next 2-3 years, investment in Continental Gold may pay off handsomely.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CGOOF over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.