Copper price breakout point coming soon

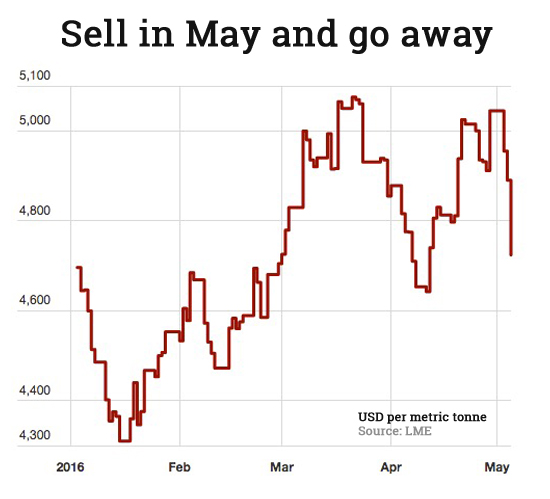

The price of copper in New York fell on Thursday for the fourth straight day with July futures trading on the Comex market giving up 2% to $2.1430 a pound after optimism about demand from top consumer China began to fade. After a few brutal days of trading copper is down 6.7% this week alone, wiping out year-to-date gains entirely.

Growing demand from China - responsible for 46% of the global trade in the metal - is crucial for the copper market which is set to experience another year of oversupply albeit smaller than 2015's 350,000+ tonnes surplus which was the largest in several years. Primary mine supply grew more than 3% last year to just over 19 million tonnes.

A new report by London-based CRU, an independent mining, metals and fertilizer researcher, paints a brighter picture of industry fundamentals and the copper price for the rest of the decade.

Investment funds appear reluctant to fill the gap in funding for projects, meaning that M&A activity will remain centred on piecemeal acquisitions of unwanted operating assetsCRU points out that major copper producers in an effort to strengthen balance sheets laden with debt are focusing on their operating mines and most-advanced projects and cutting capital expenditure for developing projects and exploration budgets.

At the same time "the investment community has lost its appetite for funding exploration and development work, forcing many mid-tier and junior mining companies to halt work on projects, with pre-development projects in the probable and possible categories especially affected."

Investment funds appear reluctant to fill the gap in funding for projects, meaning that M&A activity will remain centred on piecemeal acquisitions of unwanted operating assets says CRU.

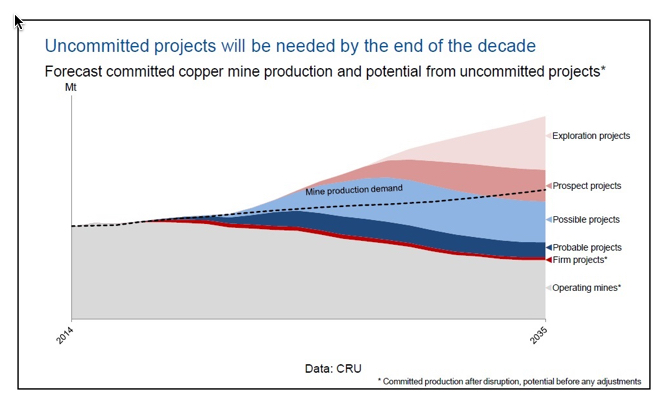

As a result, CRU's long term market outlook finds that committed mine supply (operating mines and firmly-committed projects) will be insufficient to meet primary demand by 2018 and new projects needed before the end of the decade:

As a result, CRU's long term market outlook finds that committed mine supply (operating mines and firmly-committed projects) will be insufficient to meet primary demand by 2018 and new projects needed before the end of the decade:

Even after allowing for additions to existing reserves, CRU expects that production from existing mines will peak in 2018 and decline thereafter due to falling ore grades and the exhaustion of reserves.

Increased output from firm projects will offset this decline until the end of this decade, but at that point, a marked downtrend in committed production will set in.

CRU tracks 238 projects that could come on stream within the next twenty year meaning there is no shortage of potential resources available to fill this gap.

However, CRU identifies several barriers, over and above low prices, that could see these plans collect dust. Those include increasing technical challenges associated with deeper resources, more complex ore bodies and difficulties with building mines in ever more remote regions. Other major factors are the potential for power and water shortages and continued opposition from local communities coupled with greater resource nationalism.

The challenge for exploration and development companies says the research house "is demonstrating that their assets are best-placed to come onto the market profitably."