Copper price won't lag spiking oil for much longer

The price of copper in New York was drifting lower on Tuesday with July futures exchanging hands for $2.0870 a pound in late afternoon trade.

Last week large scale investors in copper futures like hedge funds made a 138% about turn from bullish positioning, returning to a net short position on the Comex market indicating expectations of lower prices further out.

After a brutal couple of weeks of trading copper is down more than 10% in May, wiping out year-to-date gains entirely.

State spending on infrastructure is being front-loaded and should translate into significantly higher copper demand later in the yearThe story on oil markets is totally different with US benchmark crude futures prices settling at seven-month highs on Tuesday within shouting distance of $50 a barrel. The oil price has been boosted by supply outages in Canada and Nigeria and a report by the EIA forecasting a further 800,000 bpd drop in US output in 2017.

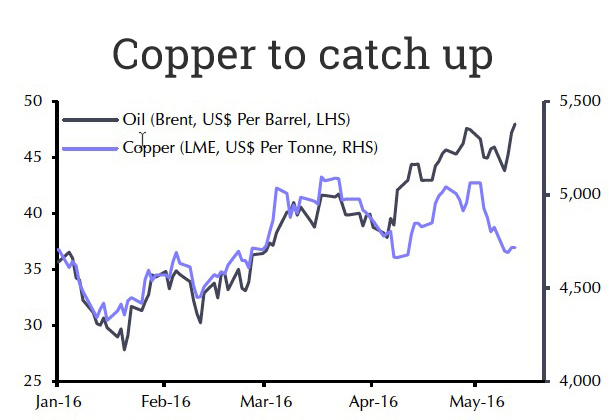

A new report by Capital Economics points out that until the beginning of April, oil and copper had been trading in lockstep with the prices of both commodities "being driven by improvements in sentiment towards risky assets in general, a weaker US dollar and reduced concern about the state of China's economy."

The London-based independent research house believes the gap that opened up about a month ago will close as oil retreats slightly as supply comes back on line and the copper price resumes an upward trend thanks to "encouraging fundamental data":

China's refined copper imports were up by 23% y/y in January-April and state spending on infrastructure is being front-loaded and should translate into significantly higher copper demand later in the year. Indeed, spending on the copper-intensive State Grid rose by just under 40% y/y in Q1.

Moreover, copper scrap is in relatively short supply now - after years of falling prices have acted as a disincentive - which should support demand for newly refined copper.

Capital Economics' house view of the copper price by end-2016 is $5,500 per tonne or $2.50 a pound and closer to $6,000 next year. The firm sees oil prices at $45 a barrel by the end of the year, advancing to $60 a barrel by the end of next year.

Source: Capital Economics