March 26, 2021

Big in Base Metals

Author - Ben McGregor

Gold consolidates above US$1,700/oz

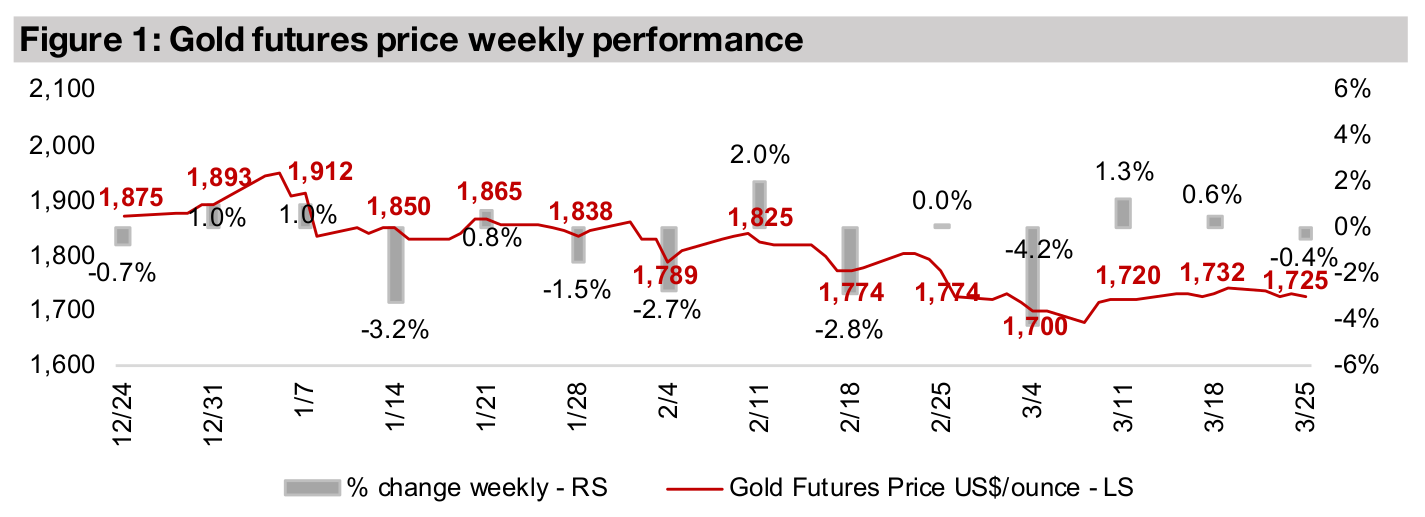

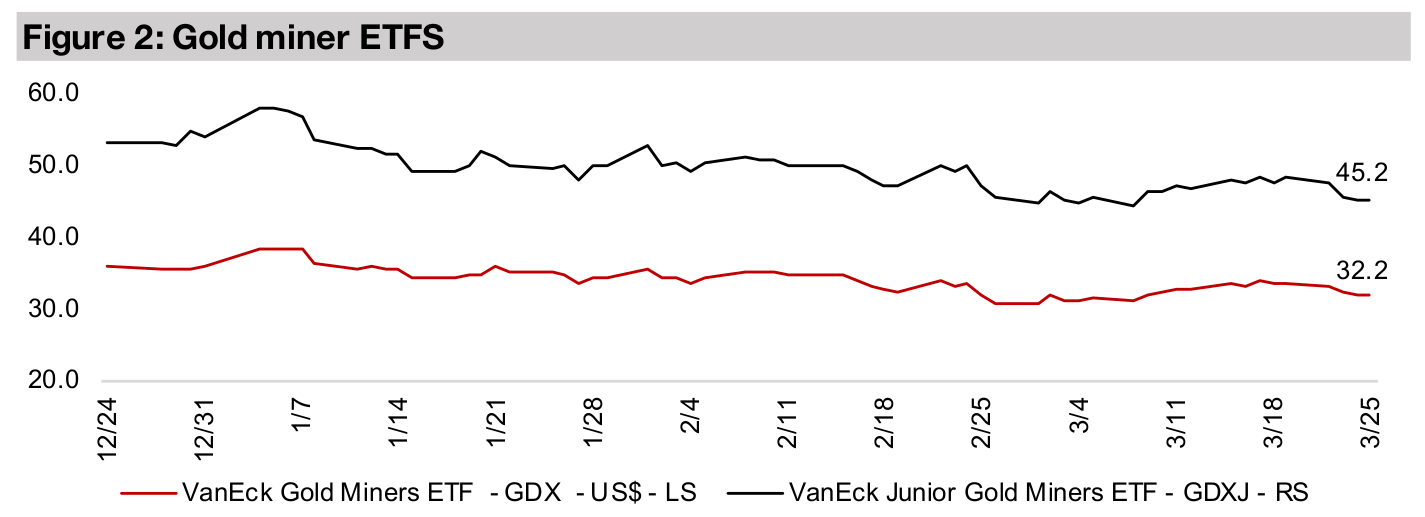

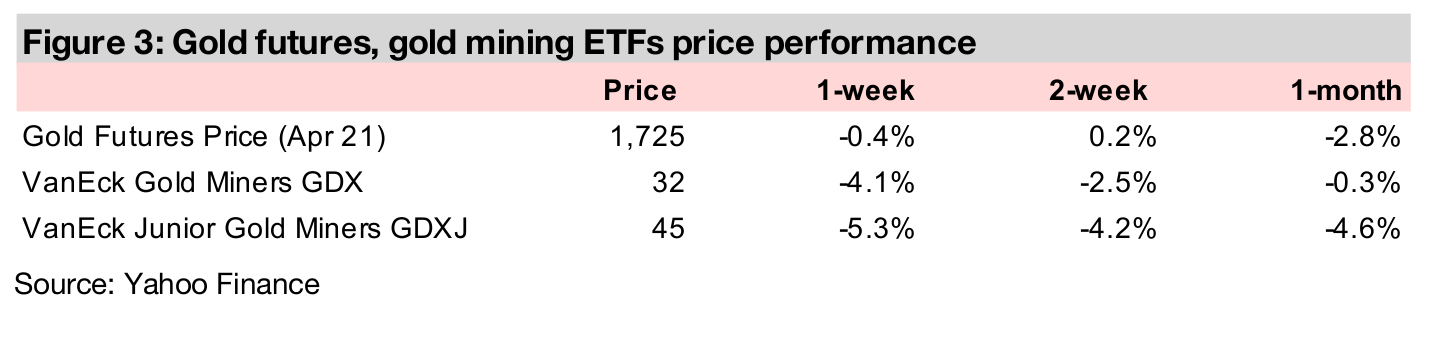

Gold fell -0.4% this week to US$1,725/oz, as it consolidates above US$1,700/oz for the third week in a row, as a rise bond yields, which had been a major driver of gold’s slowdown over the past few months, eased.

A look at larger Canadian juniors in base metals

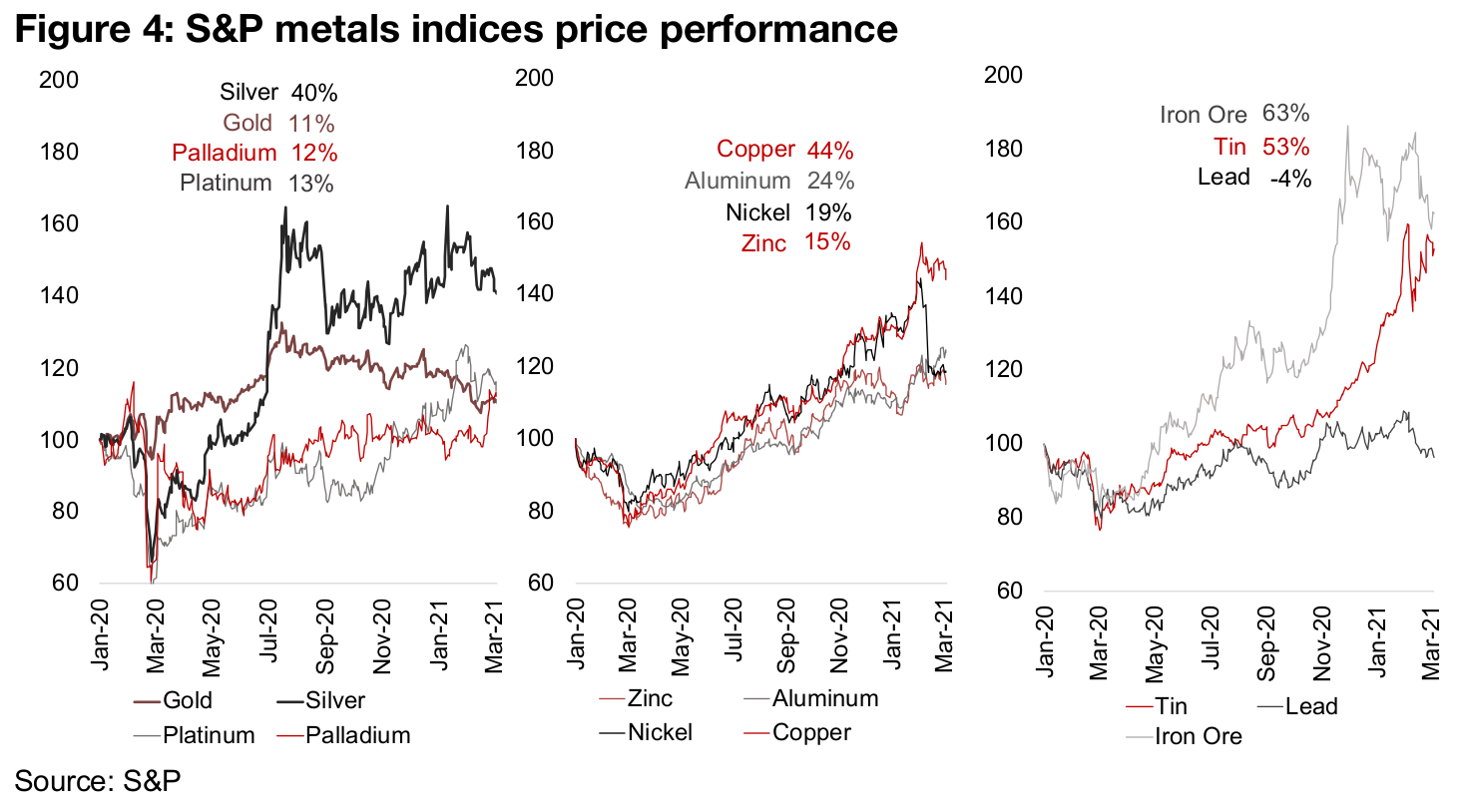

While monetary-factor-driven gold is taking a bit of a pause for now, industrial-factor- driven base metals have performed strongly recently, and this week we outline the larger Canadian juniors in this space, including nickel, zinc, tin and iron companies.

Gold price continues to consolidate above US$1,700/oz

The gold price dipped -0.4% to US$1,725/oz, and has continued to consolidate in a range of US$1,700/oz-US$1,750/oz over the past three weeks. This has partly been driven by a pullback in bond yields recently, after a rise in yields in recent months had pressured gold. However, with the rise in bond yields believed to be driven by inflation expectations, we would expect an inflation hedge like gold to be rising, not declining. The rise in yields and inflation is also not driven by a fundamental organic improvement in the economy, but rather radical levels of monetary expansion and bond issuance, leading to an oversupply of bonds and driving down prices, therefore boosting yields. This is hardly a bullish situation, but rather one where caution, and a move into assets that cannot be easily devalued, like gold, is prudent. Nonetheless with this 'recovery' steaming ahead, and many investors shifting to risk-on, gold may continue to see some pressure short-term. If inflation expectations alone, or monetary factors, continue to be the driver of yields, instead of an organic cyclical and structural improvement in the economy, or real factors, we believe that the gold price is likely to see some significant gains over the medium to long-term.

A look at the larger Canadian juniors in base metals

While gold is taking a bit of a pause, we turn our focus this week to some big winners from the recent economic recovery (however artificially supported it may be), the base metals. Figure 4 shows that these metals, driven by industrial uses, in contrast to gold, driven by monetary factors, have done well in recent months. Silver, which has a both a monetary and industrial component, is up 40%, and copper, which has very limited monetary use, but is crucial in industry, is up 44%. But the biggest gainers since 2020, have been iron ore, up 63%, and tin, up 53%, with aluminum, nickel and zinc, all seeing decent gains of 24%, 19% and 15%, respectively.

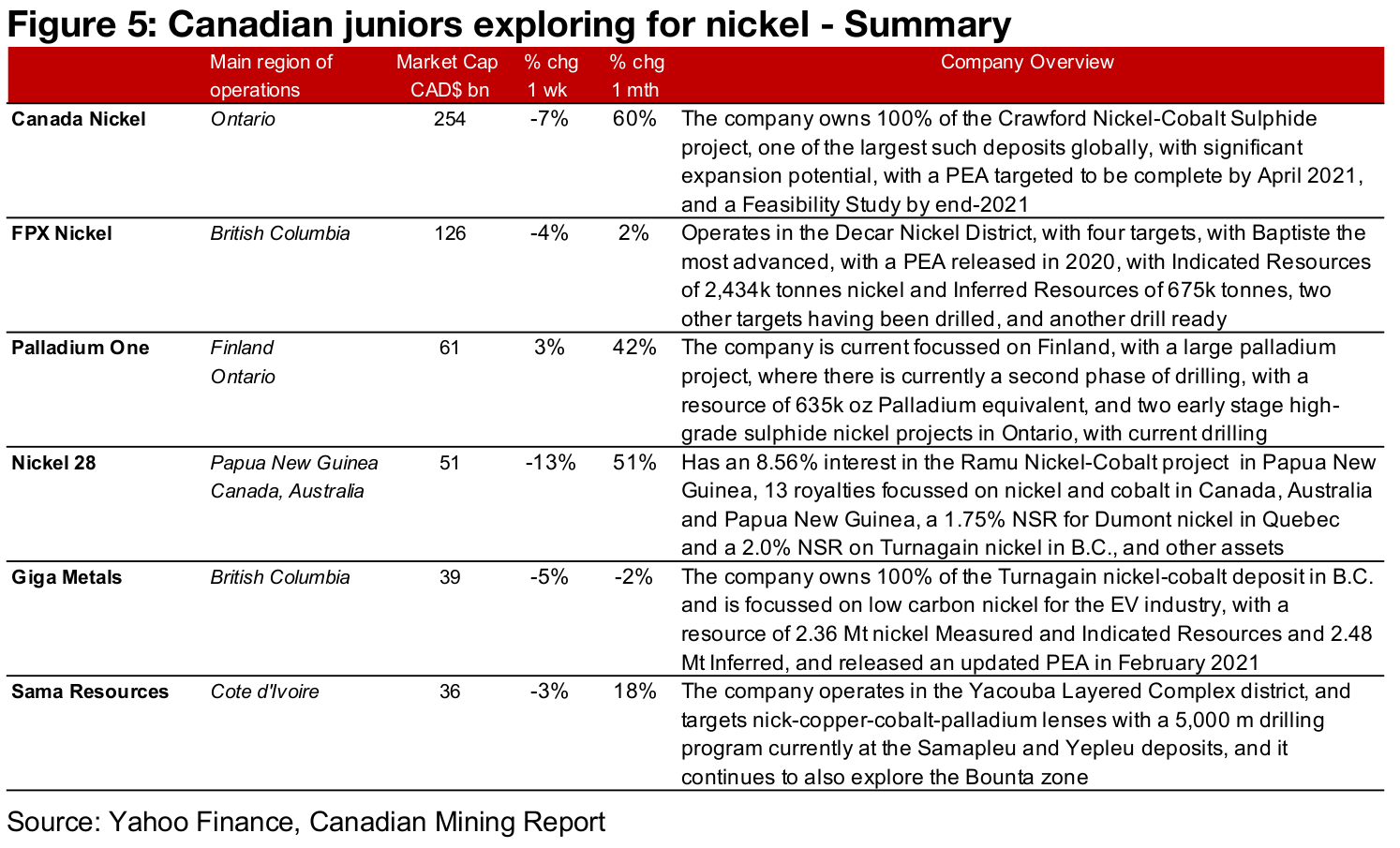

Several reasonably large nickel-focussed juniors

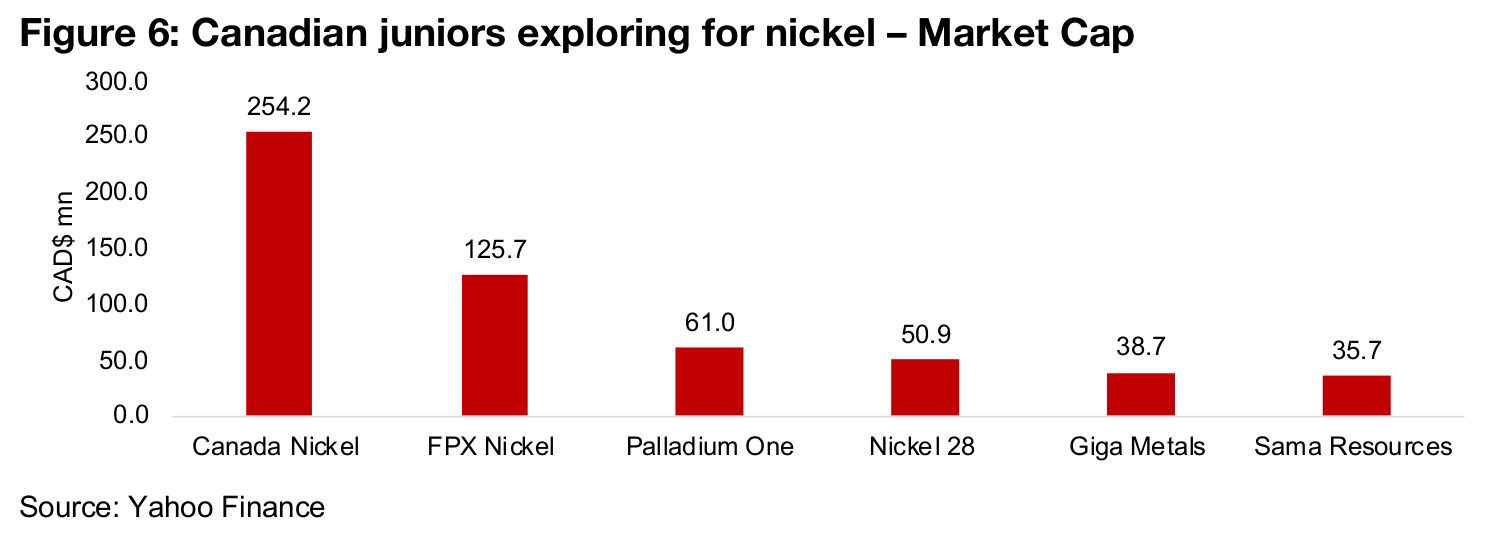

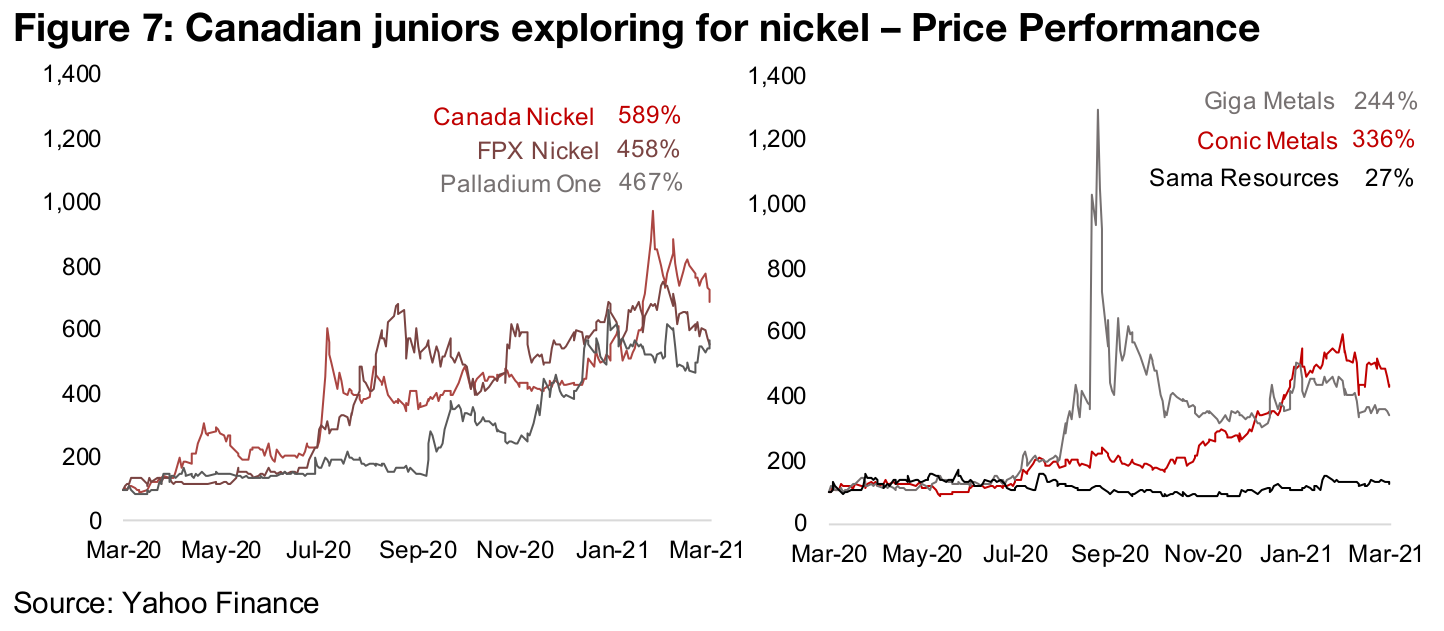

There are several reasonably large nickel-focussed Canadian juniors (Figure 5), with the two largest by market cap being Canada Nickel and FPX Nickel (Figure 6), and they have had the strongest performance of the group since 2020, up 589% and 458%, respectively (Figure 7). Both have seen substantial operation improvement over the past year, with Canada Nickel expecting to advance its Crawford project to a PEA in 2021, and FPX having released a PEA for its Baptiste project already in 2020. Palladium One is drilling a large Palladium project, but also has earlier stage nickel projects, Nickel 28 is a nickel royalty company, Giga Metals released an updated PEA for its Turnagain project in February 2021, and Sama resources is currently undertaking a drilling program at its Samapleu and Yepleu projects.

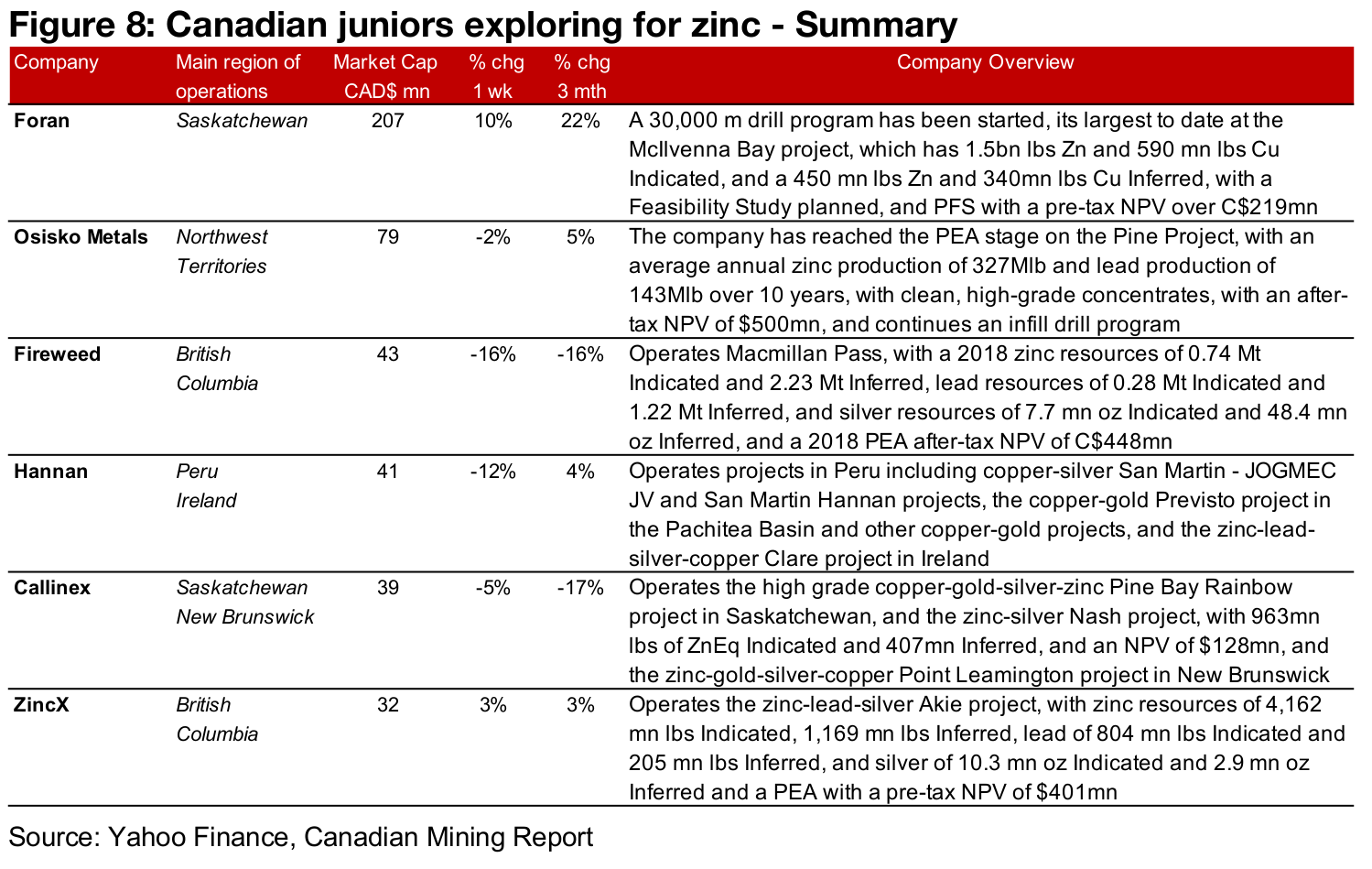

Zinc exploring juniors seeing strong performance

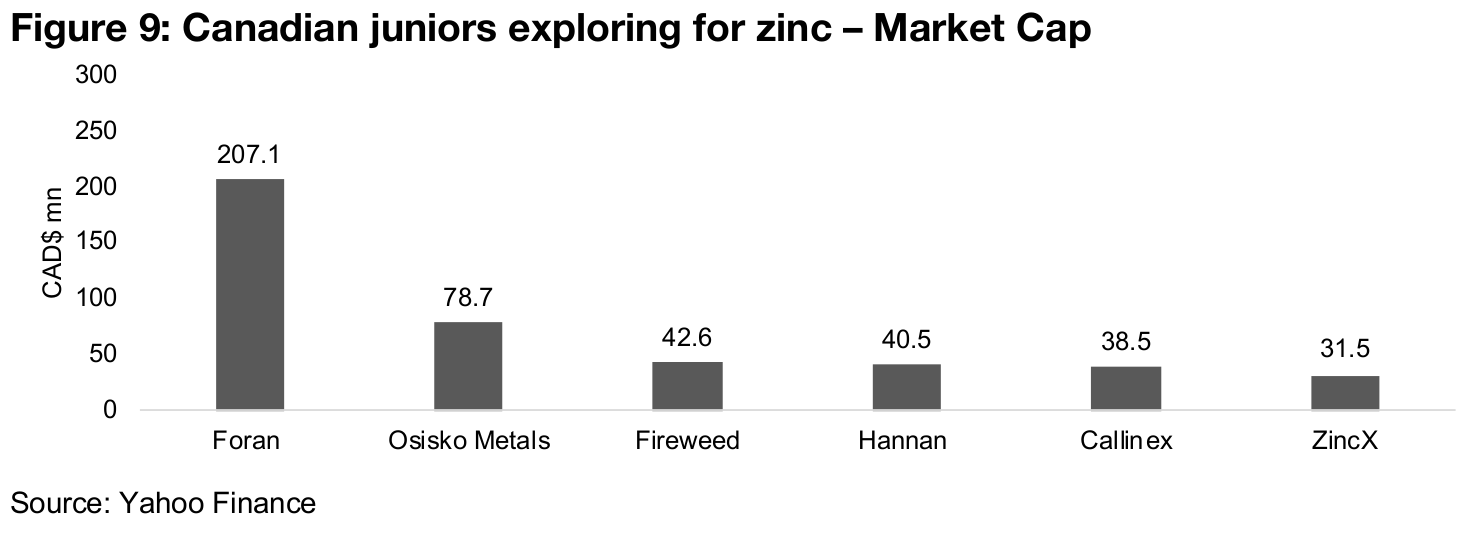

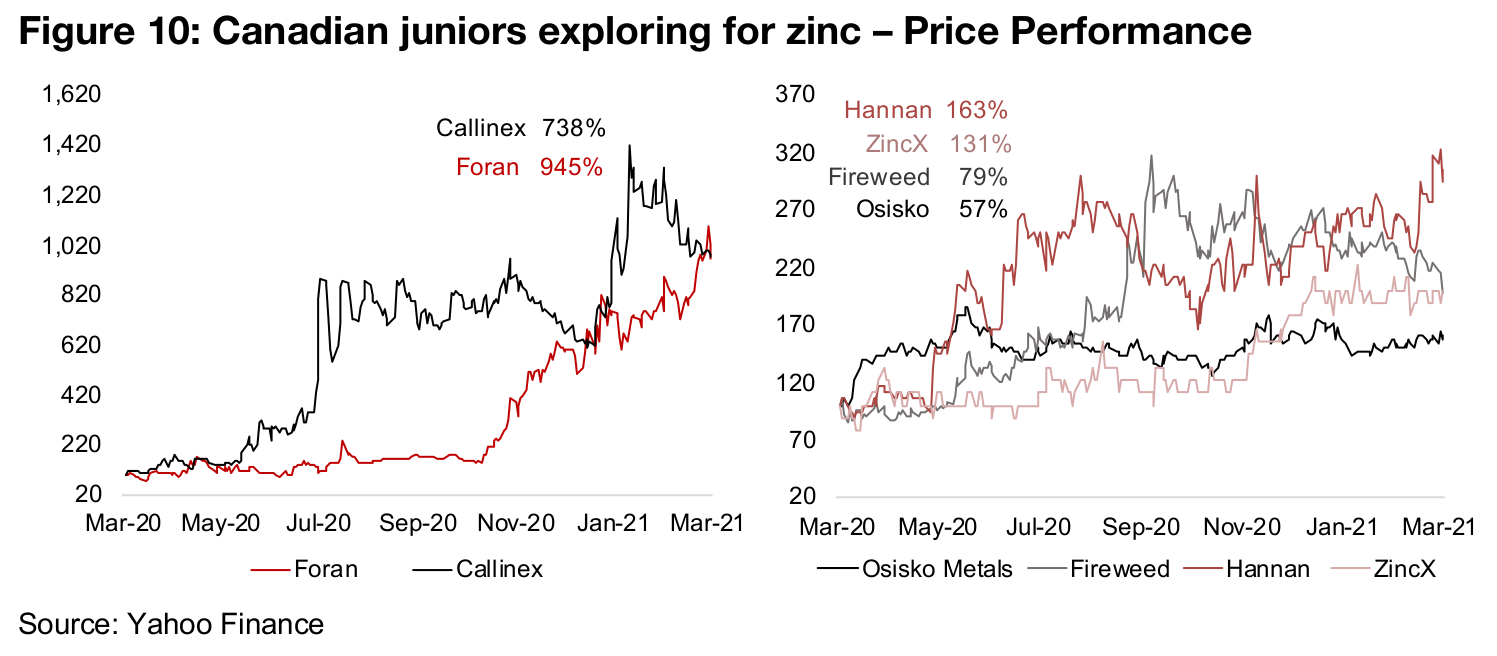

The Canadian juniors focussing on zinc have all seen good gains since 2020 (Figure 8), with the largest, Foran and the second smallest of the group, Callinex (Figure 9), outstanding, surging 945% and 738%, respectively (Figure 10). Foran has started a major 30,000 m drill program at its zinc-copper McIlvenna Bay project, with a pre- feasibility study already issued and a feasibility study targeted, while Callenix has released a PEA on zinc-silver Nash project, and operates two other polymetallic projects with a contribution from zinc. Fireweed is a pure play on zinc, and ZincX is also mainly zinc, and Hannan is more focussed on copper, with one zinc project.

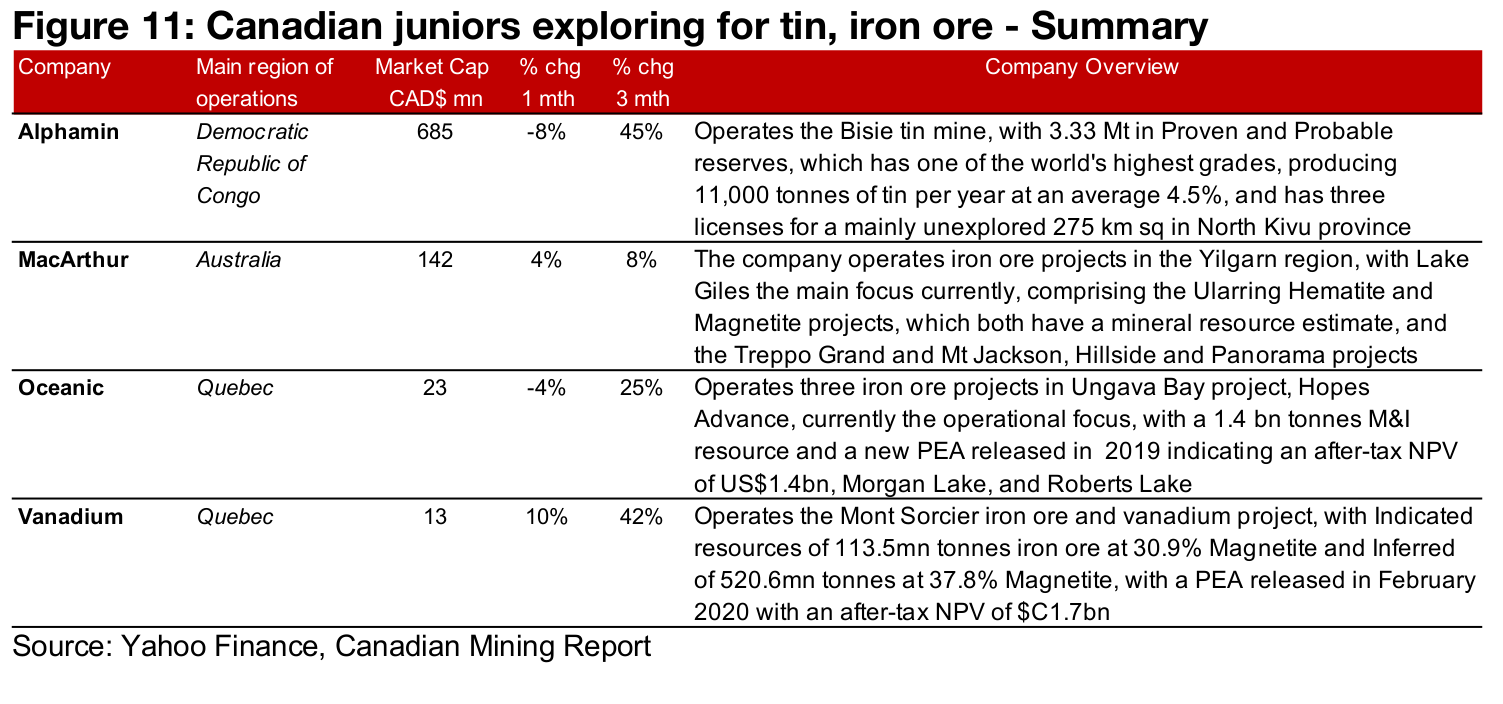

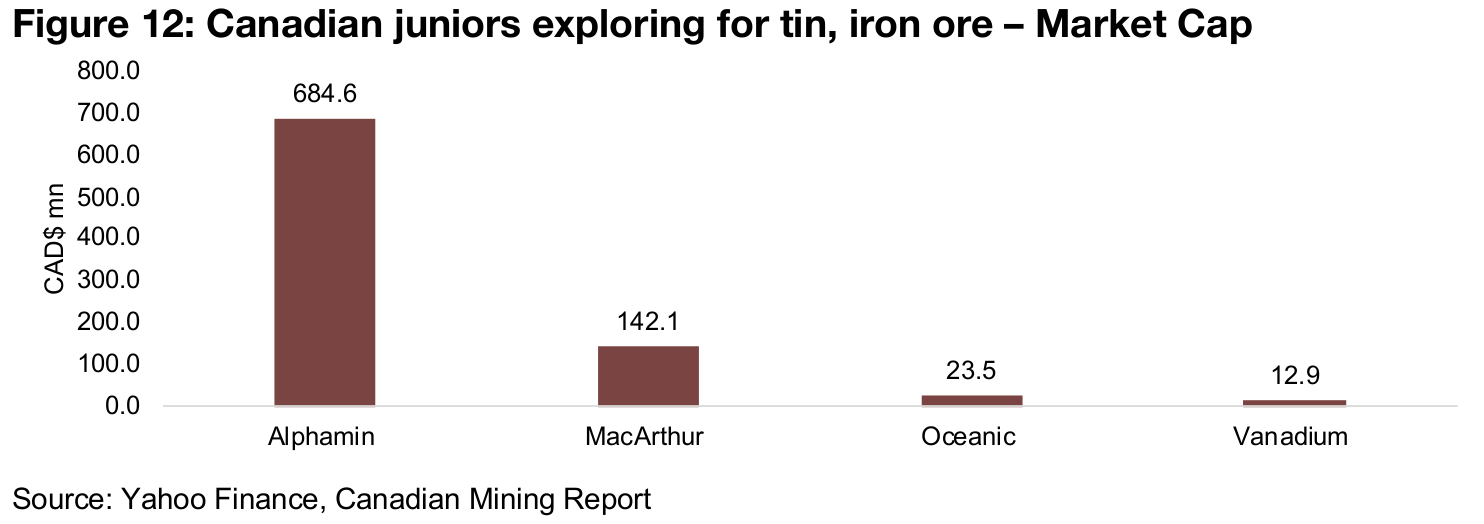

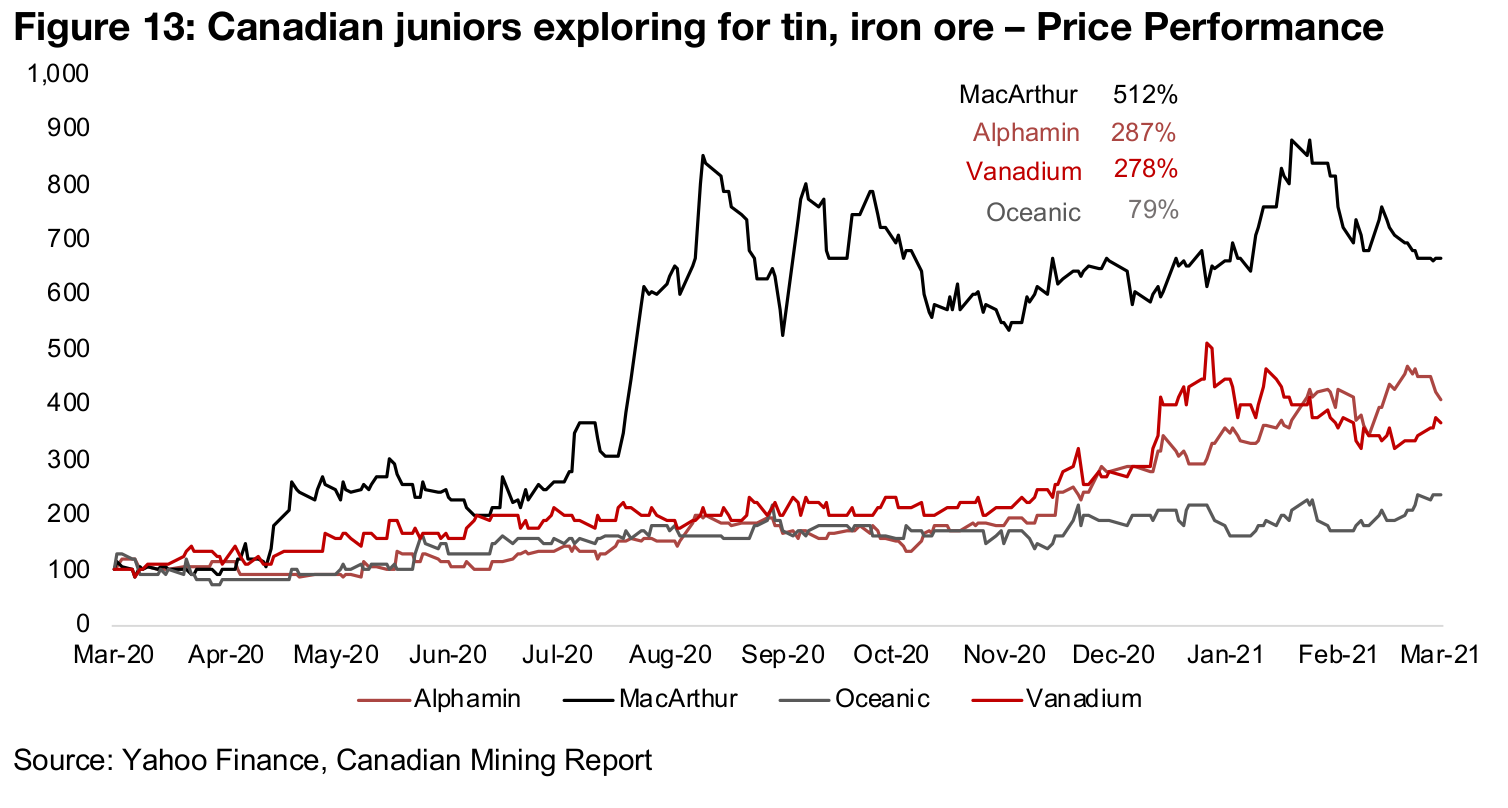

Alphamin the main play on tin, three iron-ore stocks

For tin and iron-ore there are only a handful of Canadian juniors. There is really only one large tin pure play, Alphamin (Figure 11), which is a major global tin producer, but also continues exploration activities, and has the largest market cap of all the base metals companies we have looked at here, at CAD$684.6mn (Figure 12), and is up 287% since 2020 (Figure 13). For Canadian iron-ore focussed juniors, MacArthur is the only reasonably large option, with a market cap of CAD$141.1mn, and is up 512%, the most of this group. The other iron-ore plays are small, with Oceanic and Vanadium having market caps of CAD$23.5mn and CAD$12.9mn, and having risen 79% and 278%, respectively, since 2020.

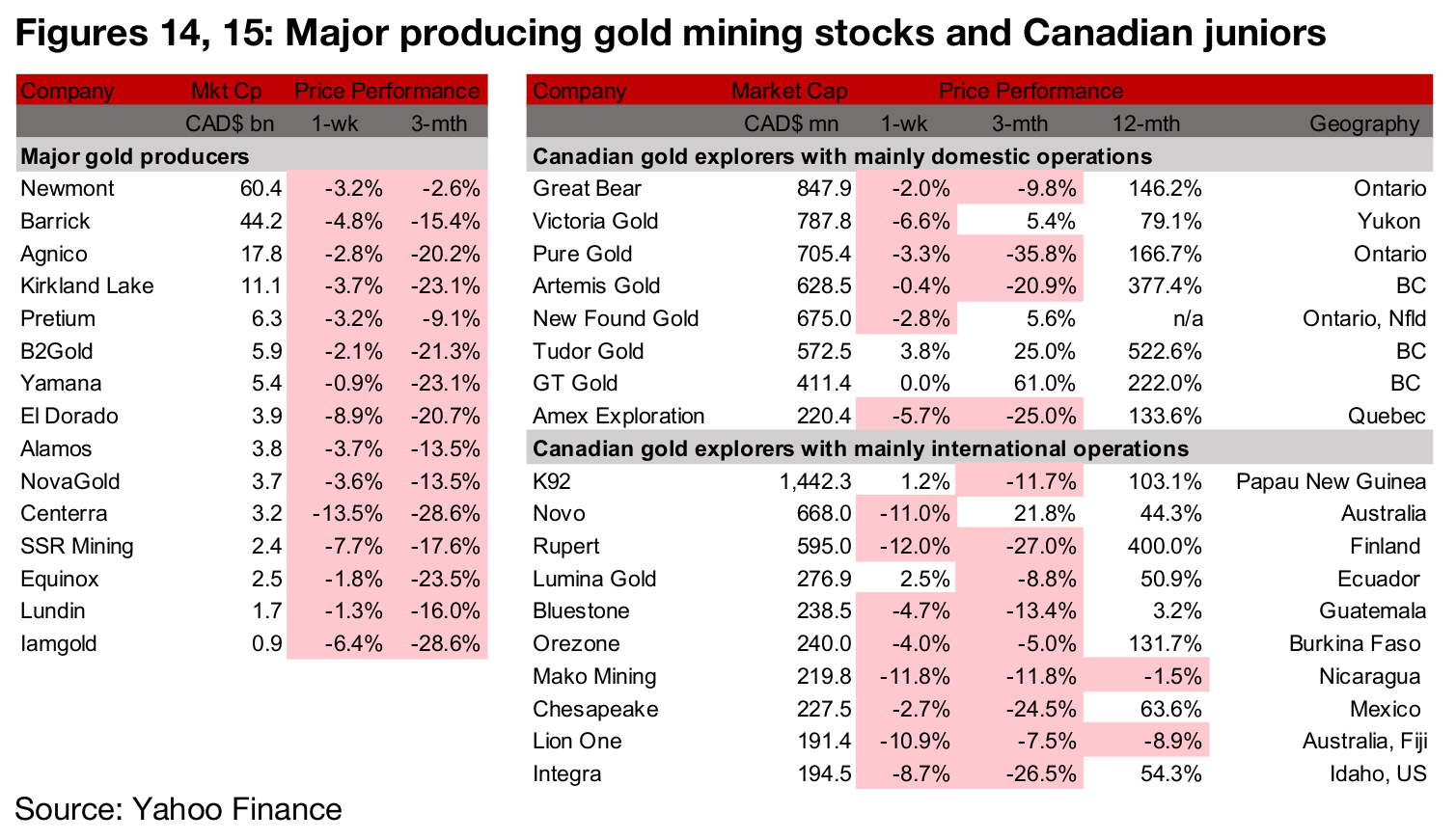

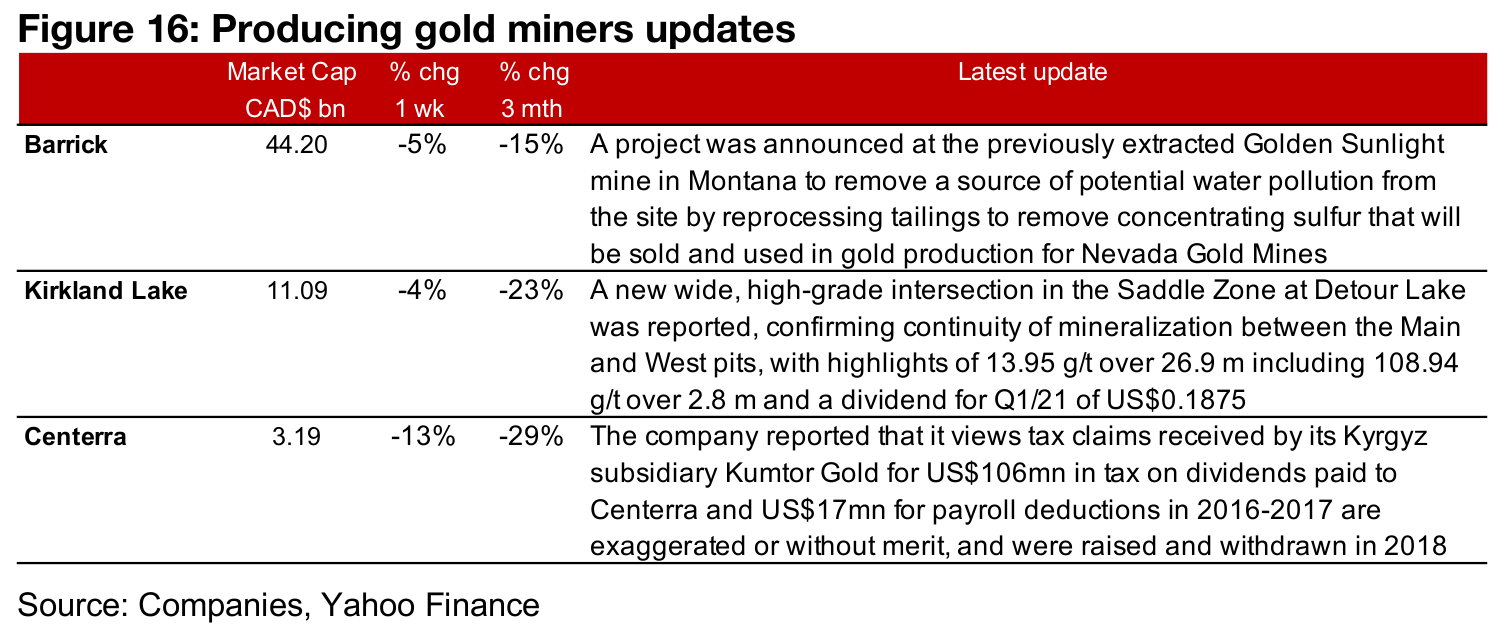

Producing miners all down on gold consolidation

All of the large gold producers were down this week as the gold price continued to consolidate for the third consecutive week (Figure 14). Barrick announced a new program at the closed Golden Sunlight mine to remove a source of potential water pollution by reprocessing tailings, Kirkland Lake reported a new wide, high-grade intersection at the Saddle Zone at Detour Lake, confirming continuity between the Main and West Pits, and Centerra reported on some tax claims against its Krygyz subsidiary that it is currently addressing (Figure 16).

Canadian juniors mostly down

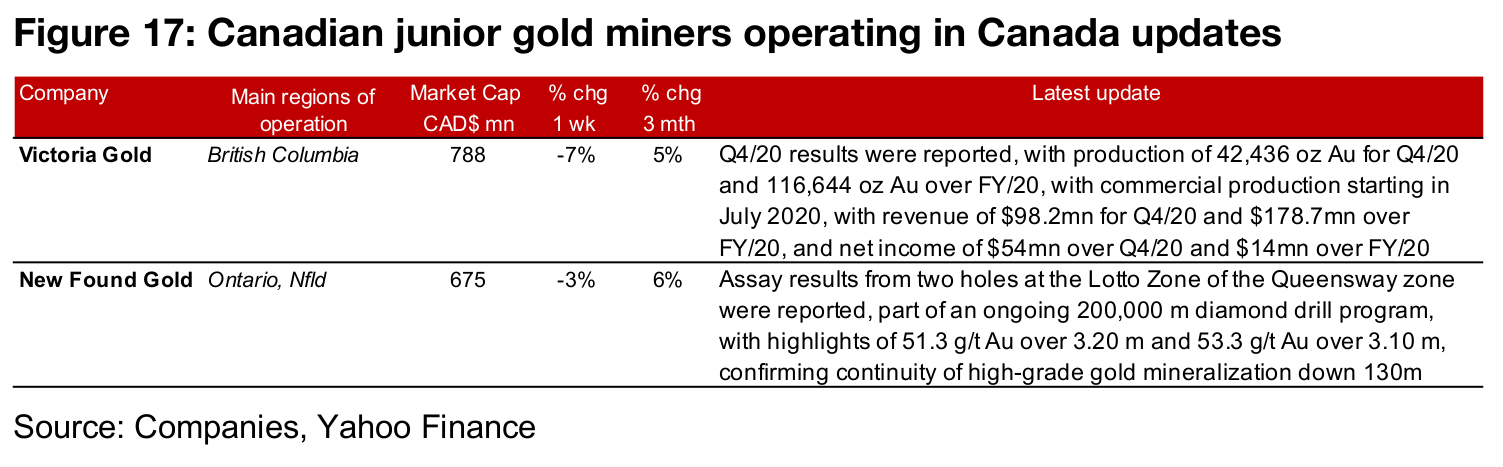

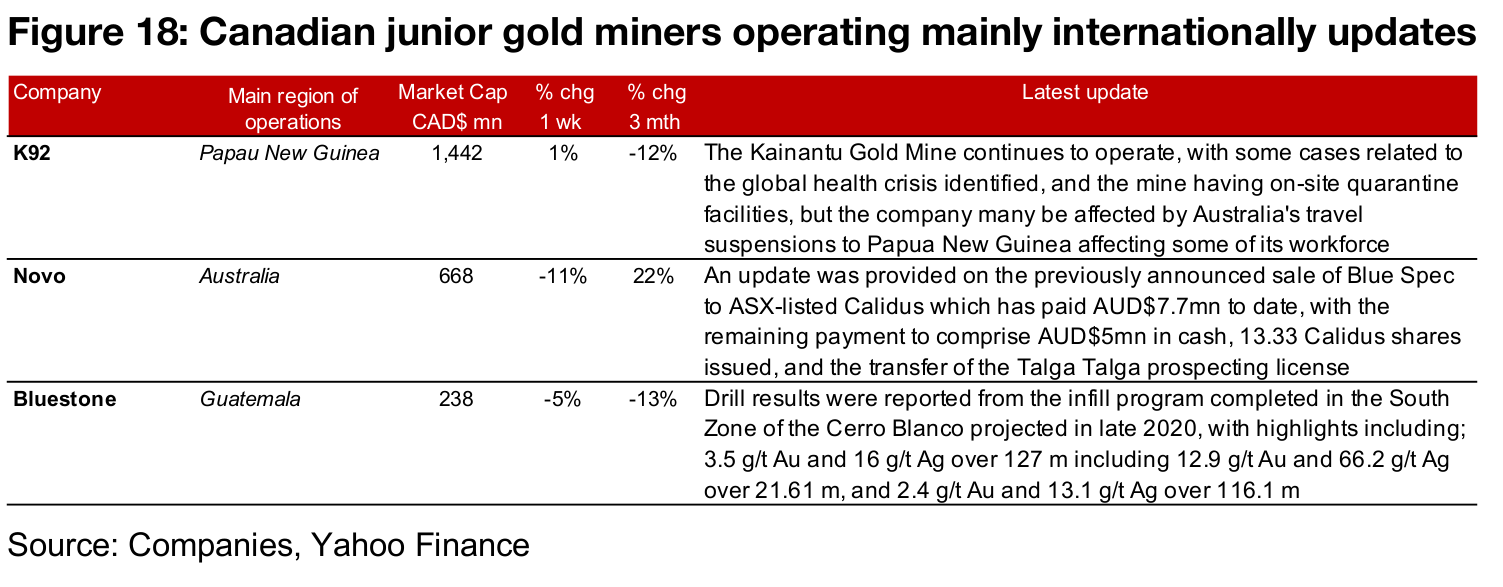

The Canadian juniors were mostly down as the gold price has not been able to drive a substantial advance for about three weeks (Figure 15). For the Canadian juniors operating mainly domestically, Victoria Gold reported its Q4/20 results, with commercial production having begun in July 2020, and New Found Gold reported assay results from two holes at the Lotto Zone of its Queensway project (Figure 17). For the Canadian juniors operating mainly internationally, K92 provided an update on the Kainantu mine after some issues related to the global health crisis, including some onsite cases and workforce issues as Australia has temporarily suspended travel to Papua New Guinea. Novo reported an update on the specifics on the terms of its previously announced sale of Blue Spec to ASX-listed Calidus, and Bluestone reported drill results from the infill program completed in the South Zone of Cerro Blanco in late 2020 (Figure 18).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.