January 08, 2021

Gold and Monetary Mania

Author - Ben McGregor

Gold has a strong first week of 2020

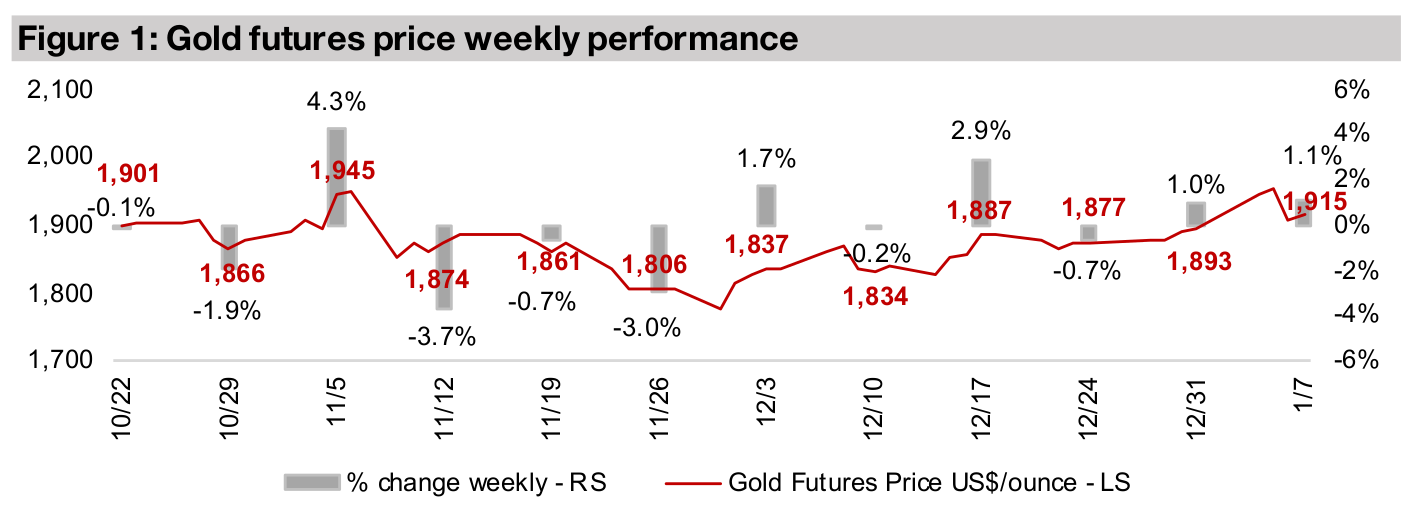

Gold had a strong first week to the year, rising 1.1% to US$1,915/oz, as concerns over a resurgence in global health crisis cases and a falling US$ offset a spike in US bond yields, with gold reaching its highest levels in nine weeks.

Continued 'Monetary Mania' the underlying driver

We believe that the US$ weakness and the general support for gold can be traced back mainly to the fundamental cause of an ongoing exorbitant money supply expansion, especially in the US, but also in other regions.

Monetary Mania, especially in the US, continues

Gold was up 1.1% this week on a combination of factors; bullish for gold was a

decline in the dollar, rising political risks, especially in the US, and rising global health

crisis risks, but bearish for gold was a spike in bond yields, making this alternative

more attractive. While we expect these issues will continue to drive short-term

movements in gold, we believe that the main underlying driver of gold will remain a

major expansion of the money supply globally that took off in 2020.

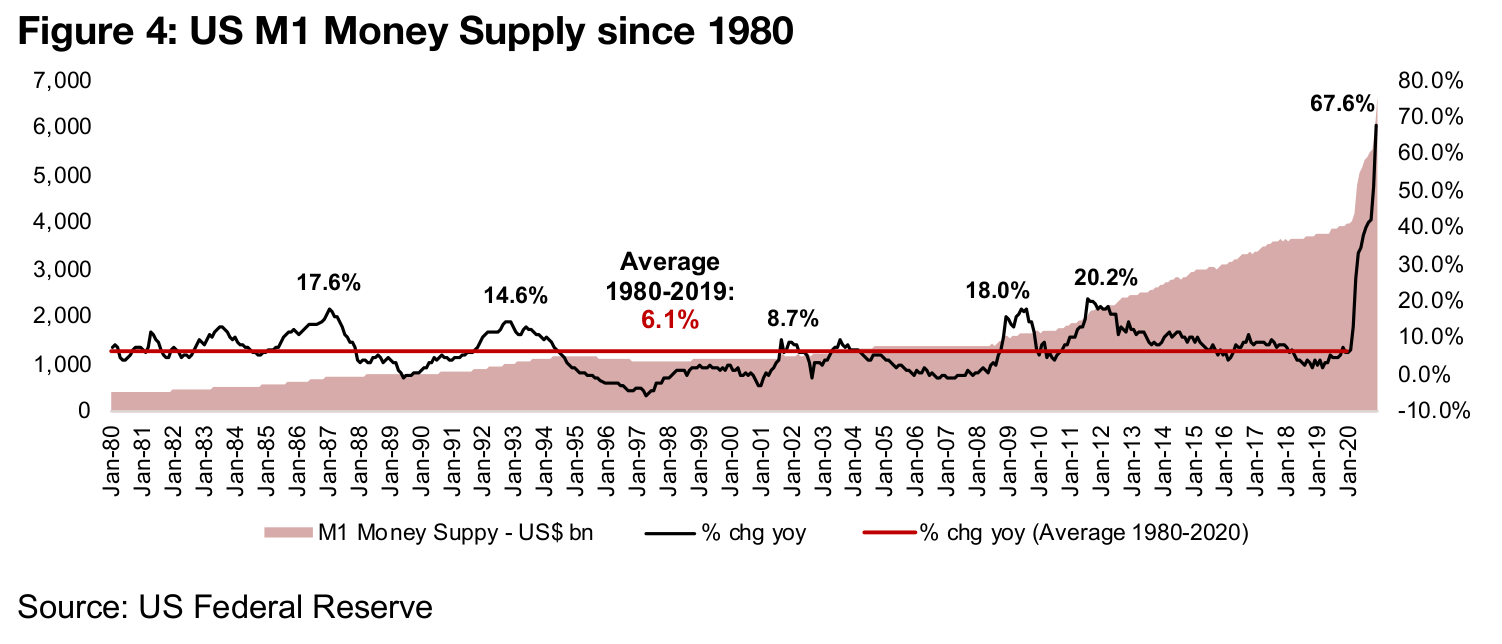

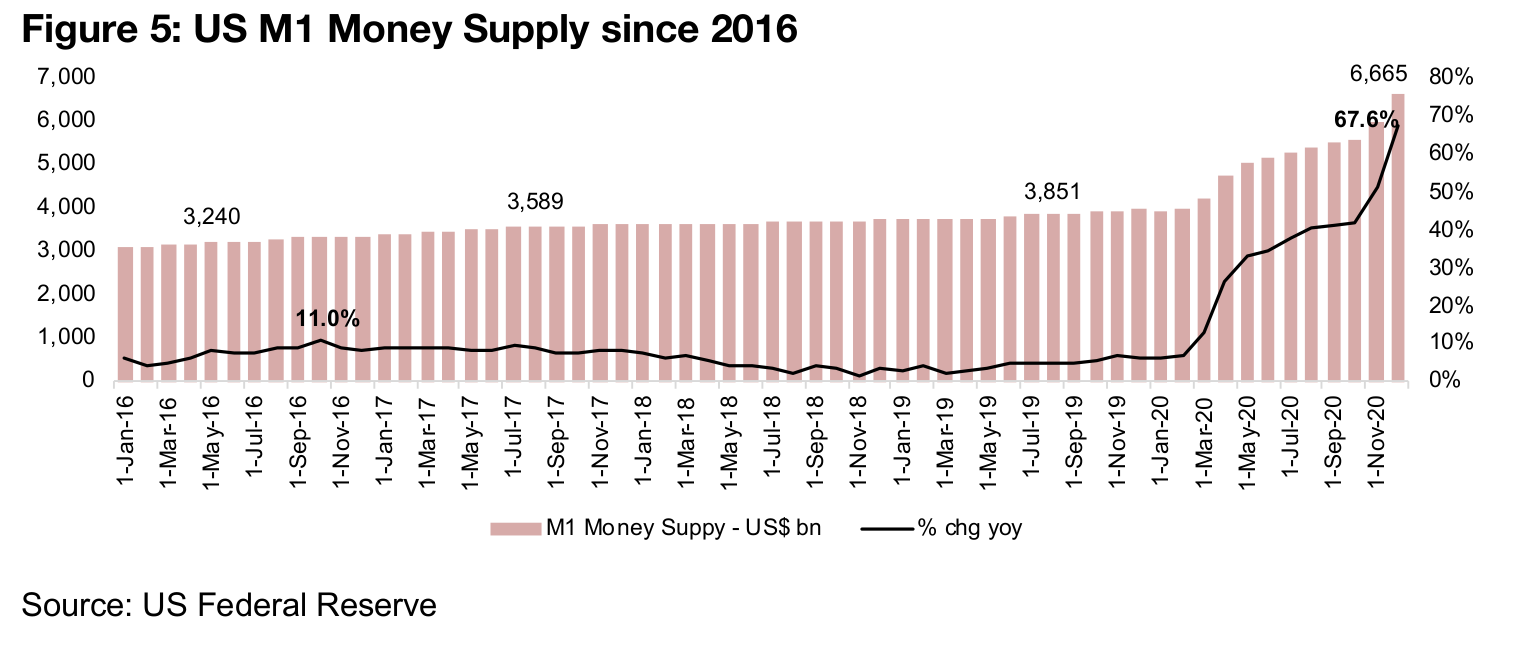

It has been especially exorbitant so far in the US, as shown by the US M1 money

supply data available to December 2020, in Figures 4 and 5, with an unprecedented,

extreme spike to 67.6%. The average growth from 1980 to 2019 was just 6.1%, and

even during highs in the wake of the 2008-2009 crisis, reached only 18.0% in 2009

and 20.2% in 2011. Prior to that, the historic peak was way back in 1987 at 17.6%.

With the current growth over triple the level of previous highs, it is starting to look

more and more like what view as 'Monetary Mania'.

Money supply growth also picking up in other regions

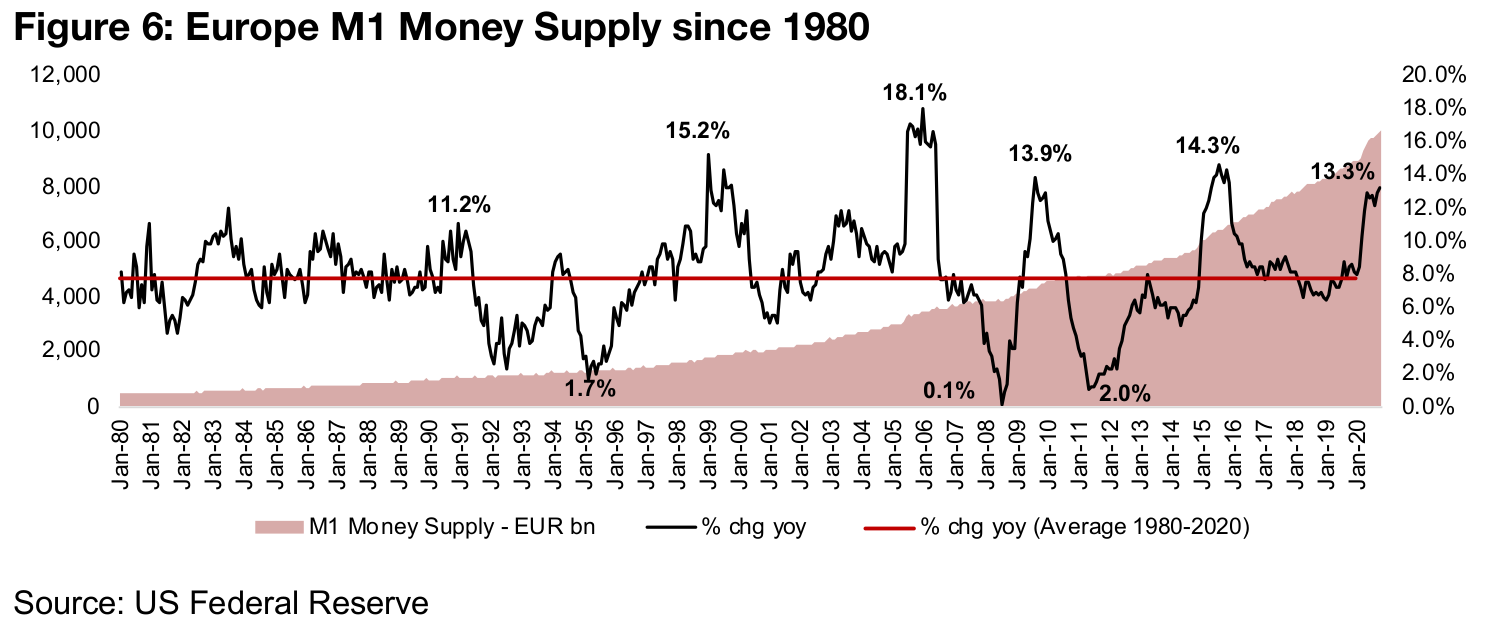

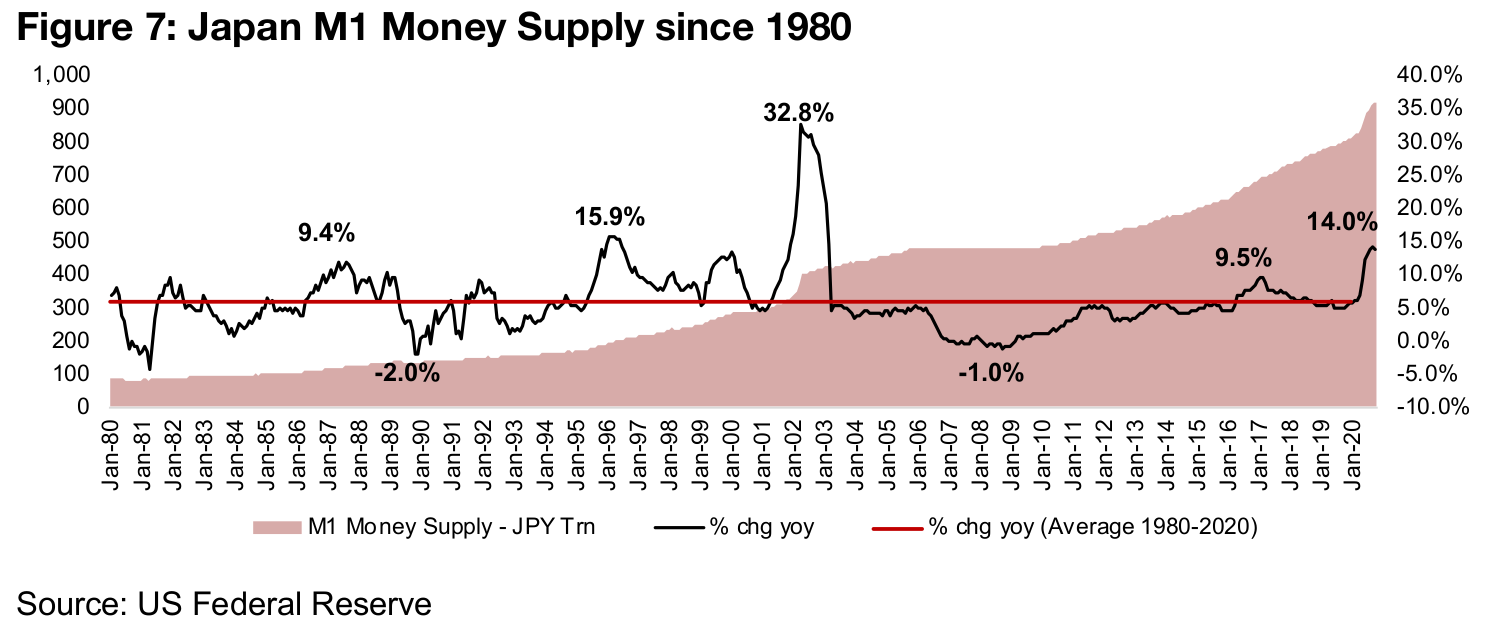

If we are to consider gold's relative value versus the paper currencies, it is not enough to just look at the US, as Europe, Japan and China also comprise very large proportions of the global money supply. If there is an expansion in the US money supply, but a major contraction in other regions, the global money supply could feasibly stay flat, and may not be such a strong driver of gold. However, there has also been major expansions of the money supply in other major regions (although not as strong as in the US), with data available from Europe (Figure 6) and Japan (Figure 7) to October 2020 (as China money supply data is available only to August 2020, we do not include it here). With this data two months behind the US, it is possible monetary expansion growth rates in these regions have also risen in November and December, as the monetary authorities in these regions respond to rising risks.

For Europe, M1 Money Supply Growth has certainly picked up, to its highest level in

five years, at 13.3% as of October 2020. However, this growth is not actually above

historic highs, with previous peaks in 1999, 2005, 2009 and 2015. For Japan, the

growth over the past year looks more severe in a historical context, and at 14.0%, is

at the highest level since the 32.8% of 2002 nearly 20 years ago, and was only

surpassed one other time since 1980, in 1996, at 15.9%.

So while the monetary expansion in Europe and Japan is still not anywhere near the

'Monetary Mania' that is occurring in the US, the expansion in these two regions is

still clearly at the higher-end of historical growth rates. We will need to see the data

for November and December 2020 to see if these regions, along with the US, are also

entering a real 'Monetary Mania', or just an aggressive monetary expansion to the

higher end of historical ranges. Regardless, we believe that the current expansions

will be more than enough to support the gold price through 2021 if they continue at

anywhere near these rates.

Gold supply growth versus currencies, inflation and risk perception

We believe that these monetary issues are likely to be supportive of gold through a

combination of factors. First, given that gold is a currency substitute, and considering

that gold mining supply growth has been flat for many years, and actually contracted

substantially in 2020 because of the mine shutdowns, we would certainly expect that

gold should be increasing in relative value versus these major currencies based on

this factor alone. The second issue is inflation. While a common definition of inflation

is based on the consumer prices, using the CPI Index, and growth in this measure

has remained low, some would define inflation instead as an expansion of the money

supply. If we use this second definition, the US could be considered to already be

entering into hyperinflationary territory, which should certainly be supportive of gold.

Whether or not this money supply inflation does work its way through to consumer

prices is another issue, as for the past decade, major monetary expansions have not.

However, the inflation has shown up in asset markets, with equity, bonds, real estate,

and other alternative assets all surging from 2013-2018, and investors virtually

ignoring the safe haven asset gold. In contrast, currently we believe that the

perception of risk is much higher than in the mid-2010s, and that investors will be

much interested in gold this time around, even if equity and other alternative assets

see substantial gains because of this liquidity explosion.

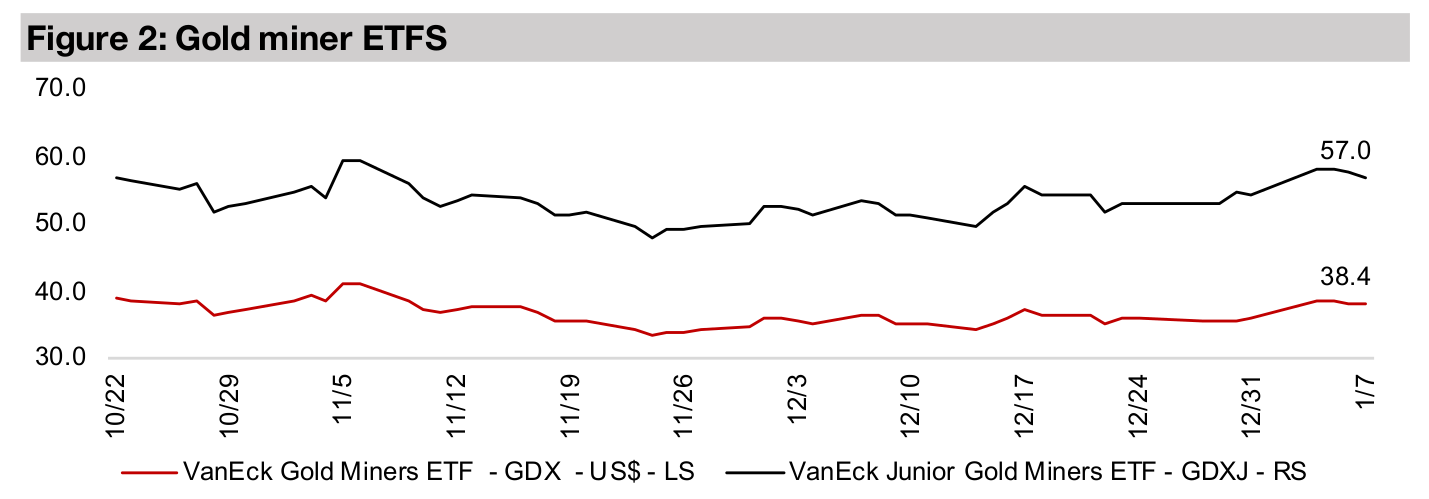

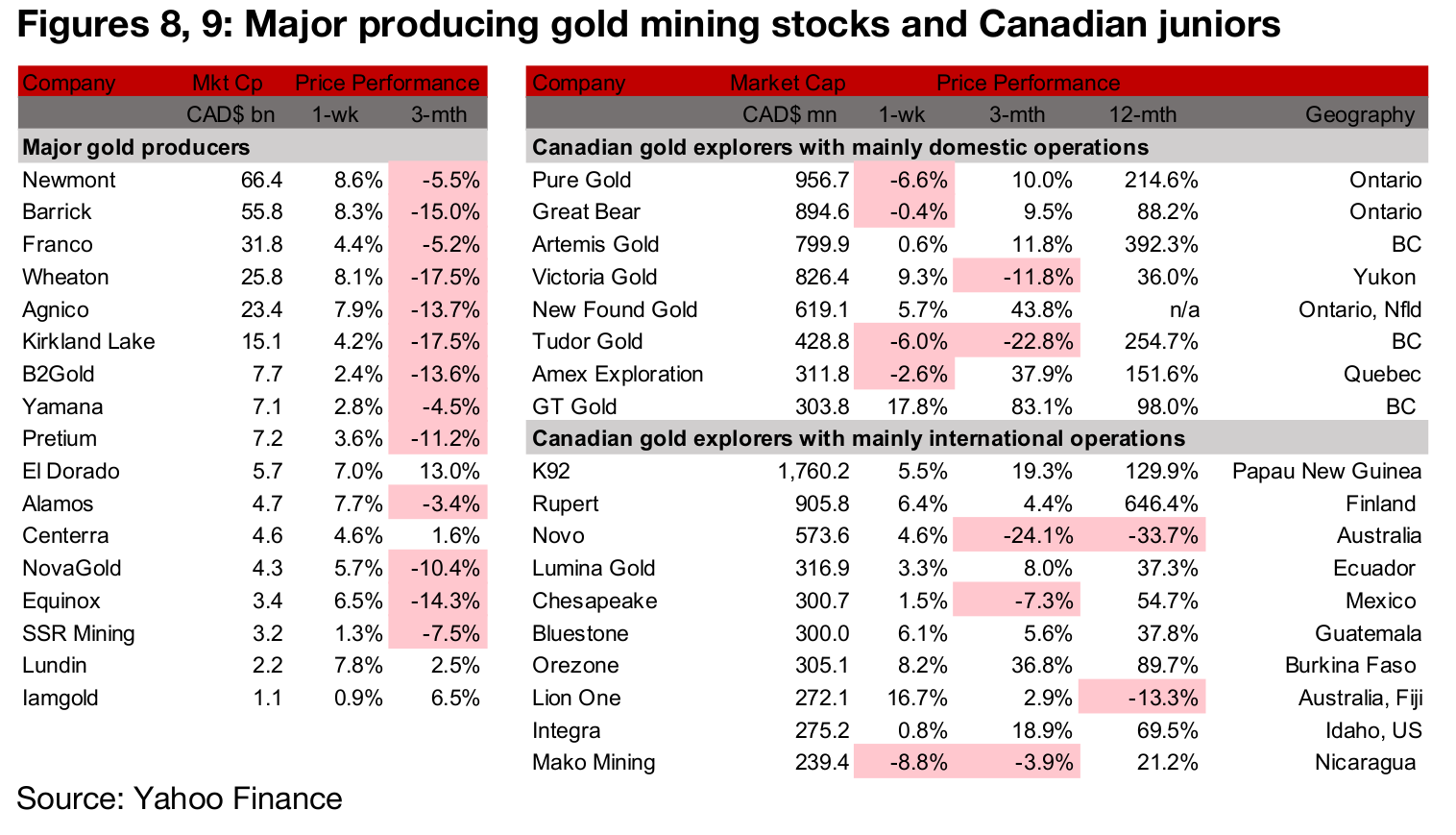

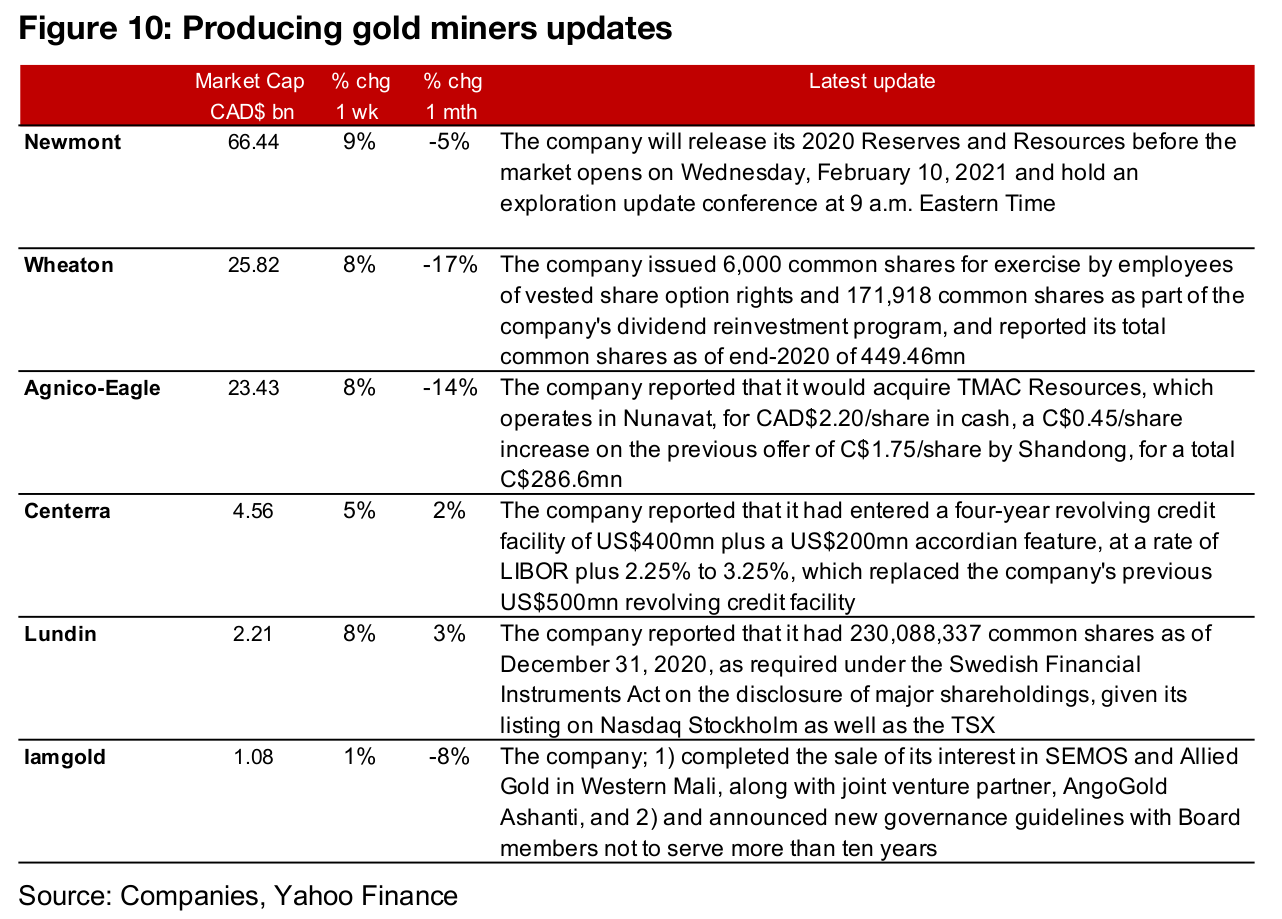

Producing miners up on gold

The producing miners were all up this week on the rise in gold (Figure 8). Newmont reported the February 10 release date for its 2020 Reserves and Resources, Wheaton released details on its employee stock options and its number of shares, and Agnico- Eagle reported that it would acquire TMAC Resources, beating out Shandong's previous offer. Centerra reported that it had entered a four-year revolving credit facility of US$400mn plus a $200mn accordian feature, Lundin reported its number of shares, in compliance with regulations related to its Nasdaq Stockholm listing, and Iamgold reported the completion of the sale of its stake in SEMOS and Allied Gold in Western Mali, along with its joint venture partner, AngloGold Ashanti, and announced new governance guidelines with board members not to serve more than ten years (Figure 10).

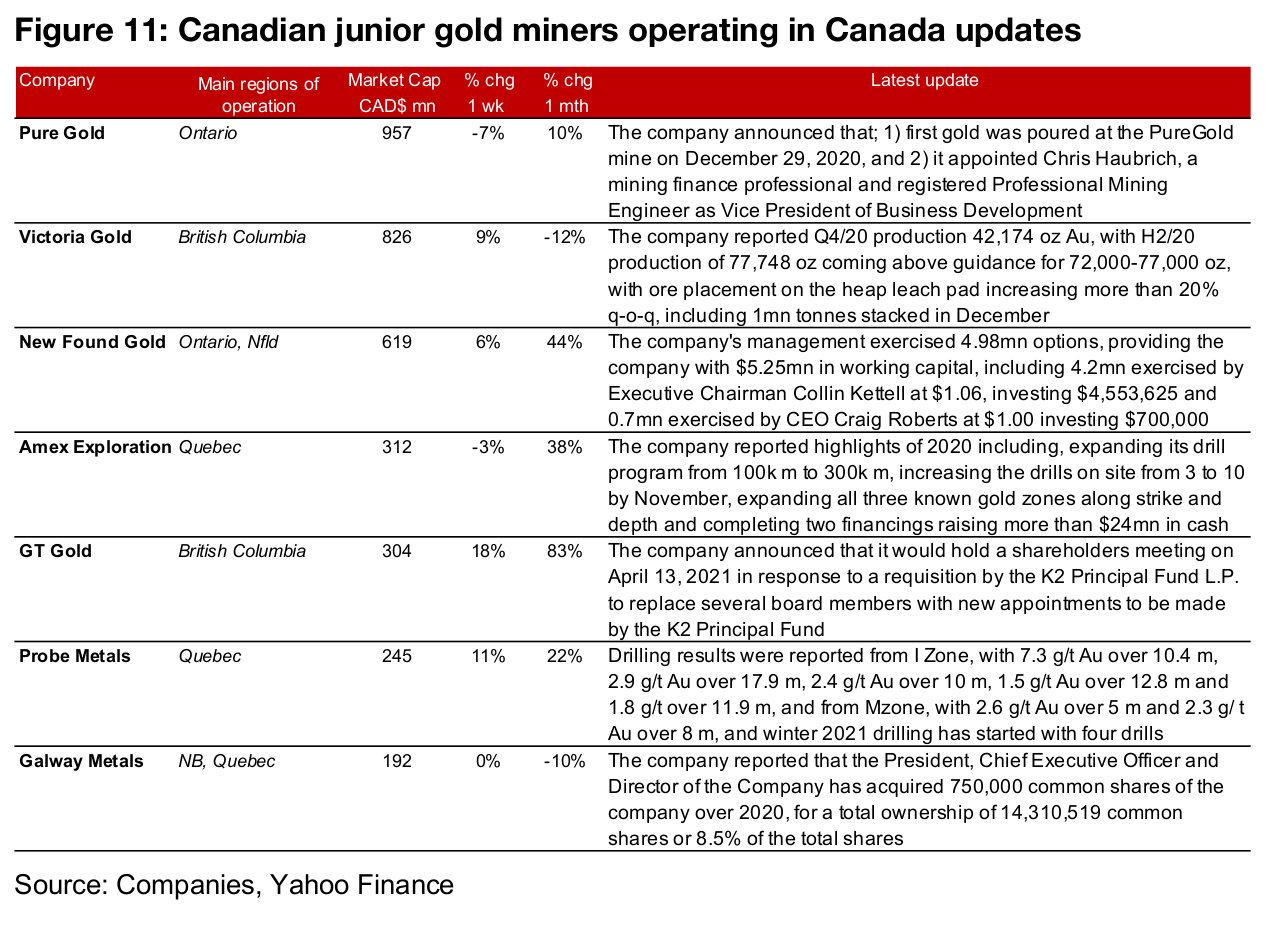

Canadian gold juniors operating domestically mostly rise

The Canadian juniors operating domestically were mainly up this week (Figure 9). The most major milestone was reached by Pure Gold, which had its first gold pour on December 30, meeting their target for year-end, and also appointed a new Vice President of Business Development. Victoria Gold reported its Q4/20 production, New Found Gold announced a large investment by its senior management via the exercise of options, and Amex reported the highlights of its 2020 operations. GT Gold announced that it would hold a shareholders meeting on April 13 in response to a requisition by the K2 Principal Fund for the replacement of some board members. Probe Metals reported a series of drilling results, and that its winter 2021 drilling program had started, and Galway Metals reported the acquisition of a large stake of common shares in the company by its President (Figure 11).

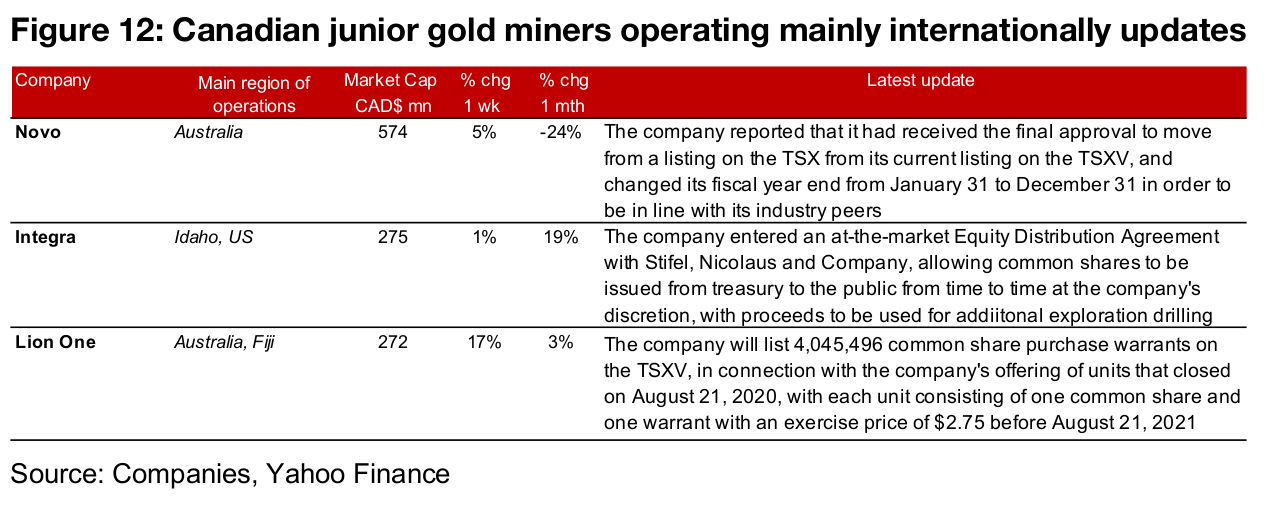

Canadian gold juniors operating internationally mainly up

The Canadian juniors operating domestically were mixed this week (Figure 9). Novo reported that it had received final approval to move its listing to the TSX from the TSXV, and changed its fiscal year end from January 31 to December 31, in line with peers in the industry. Integra entered an at-the-market Equity Distribution Agreement, allowing for common shares to be issued from time to time, and Lion One announced the listing of common share purchase warrants on the TSXV (Figure 12).

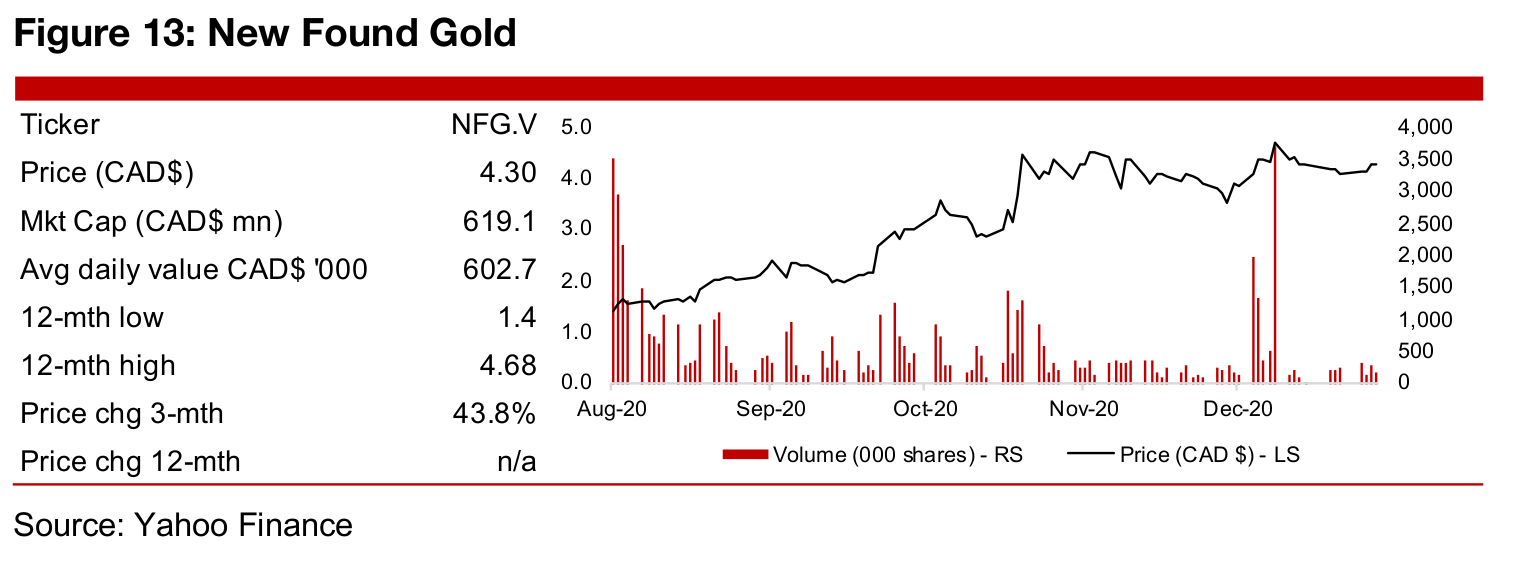

In Focus: New Found Gold (NFG.V)

Operates the 1,500 sq. km Queensway project

New Found Gold operates the 1,500 sq. km Queensway project in Newfoundland, comprising 105 km of untested strike length along two deep crustal gold mineralization structures, with more than ten drill ready high-grade targets along 8 k.m. The company was formed in 2016-2017 when it completed nine property transactions to form Queensway, and in November 2016 a till sampling program covering the JBP Fault Zone was completed. A VTEM magnetic and EM survey over 821 sq. k.m was completed in July 2017 and a regional scale till survey to sample over 750 locations completed by February 2018. A 1,950 m diamond drilling program at the JBP and Appleton Fault Zones was completed in November 2019.

New Found Gold listed in August 2020

In March 2020 the company completed an airborne gravity test of Queensway Project North, and expanded it by 74% through staking to 1,500 sq. k.m. in April 2020. In May 2020 the company had expanded to a phase two regional till program to cover an additional 750 sites, with systematic surface mapping and sampling. In August 2020, the company completed its initial public offering, raising $31.3mn at $1.30/share, and increasing its working capital to $75.2mn. With this funding the company could initiate its Phase I diamond drilling program at the JBP and Appleton Fault Zones in August 2020, with the drilling results from this program outlined below.

Major expansion in drill program for 2021 from 100k to 200k m

The company had completed 13,400 m of drilling as of December 2020, and in

January 2021, announced it would expand the Queensway drill program from

100,000 metres to 200,000 metres, and increase the rig count from four to eight drills.

This was after an analysis of the multiple high-grade gold intercepts reported over

H2/20 and a review of the multiple drill-ready targets that had been defined along 5

km of strike of the Appleton Fault Zone and 3 km of strike of the JPB Fault Zone.

The company also reported that there is a significant backlog of samples from the

2020 drilling at the assay lab, and additional results are expected by next week. The

expansion would require a budget for the drilling program starting in January 2021 of

approximately US$35mn, or about half the company's current total $67mn in working

capital. The news drove a 5.7% gain over the past week to CAD$4.30/share, and the

stock has gained 207% since its August 2020 listing.

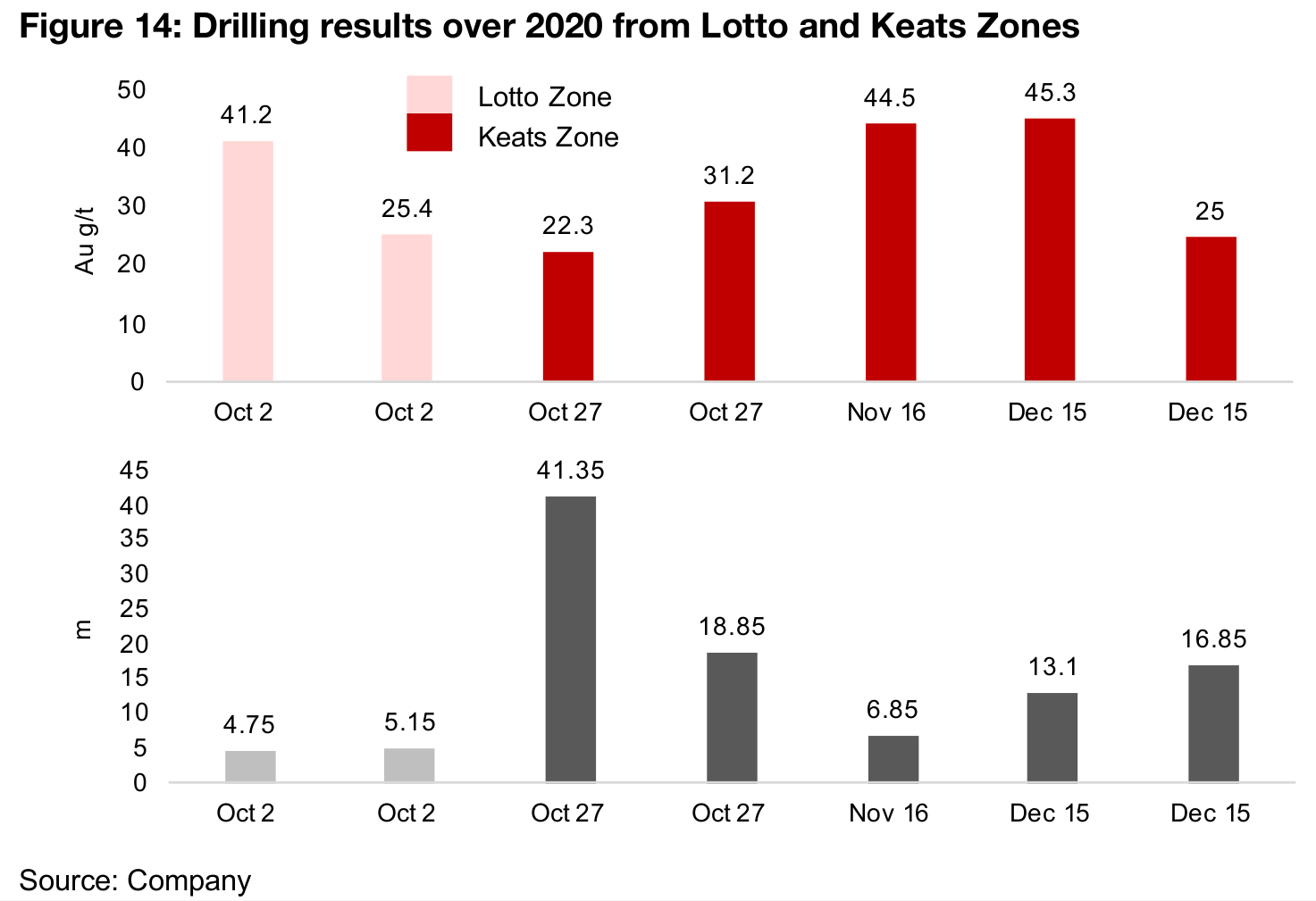

Drilling results focussed on Keats and Lotto in 2020

The company released drilling results from its 2020 program over Q4/20, which focussed on the both the Lotto and Keats Zone. The company's strongest drilling results had actually come near the end of 2019, with 92.9 g/t Au over 19.0 m. The stand out result from the Lotto Zone in 2020 was earlier in Q4/20, on Oct 2, 2021, with 41.2 g/t over 4.75 m, with the rest of results in 2020 from the Keats Zone, with stand-outs including 44.5 g/t Au over 6.85 m on November 16 and 45.3 g/t over 13.1 m on December 15 (Figure 14).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.