December 10, 2020

Gold and the global money supply

Author - Ben McGregor

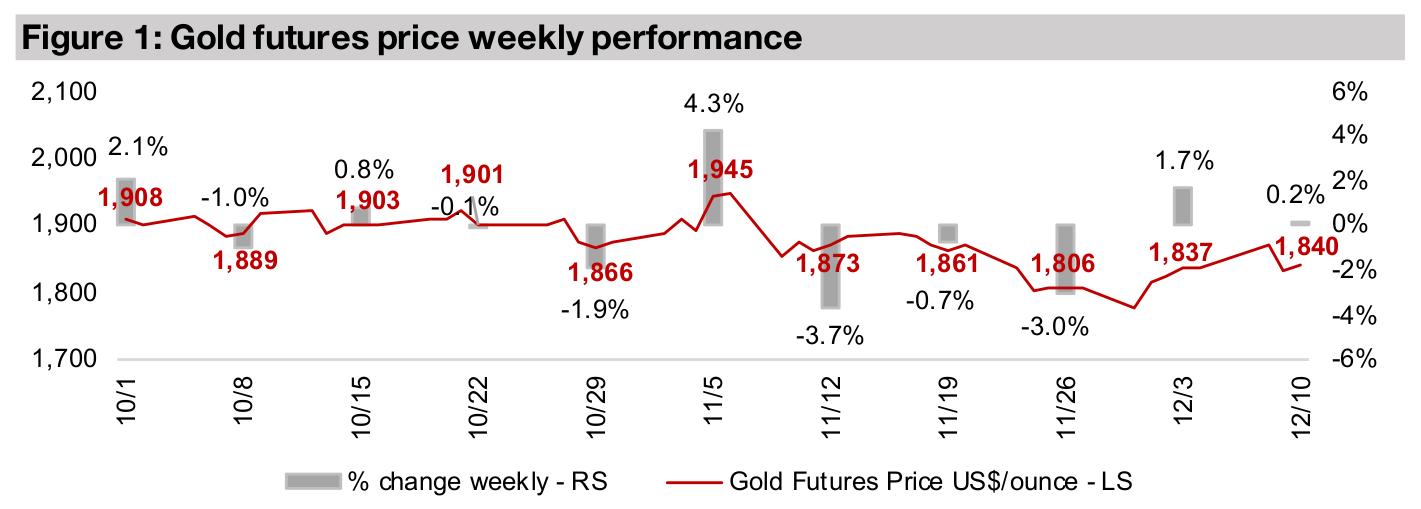

Gold flat this week

Gold ticked up 0.2% this week to US$1,840/oz, and has traded in a range between around US$1,800/oz-US$1,880/oz for the past months as its balances news of strong progress towards vaccines with ongoing global monetary expansion.

Looking at gold and the expansion in the global money supply

This week we look at one of gold's key fundamental drivers, a major ongoing expansion in the global money supply, which has continued to gain pace in recent months, and is occurring across all the world's largest economies.

The ramp up in the global money supply continues

For the past two weeks we outlined our ideas for a current trading range for gold in light of two opposing factors; to the downside for gold was abating health crisis fears, but to the upside, we cited the ongoing global monetary expansion. While this monetary expansion has been a major factor globally over the past decade since the financial crisis, it has seen a particularly strong resurgence since the start of the current health-related crisis around March 2020. We expect that the global economy will remain under pressure from the effects of the shutdowns for an extended period even if vaccines are made available relatively rapidly, and that expanding liquidity for markets will remain a key measure in combating this through 2021 and likely beyond. This week we look in detail at the numbers behind this ongoing global monetary expansion.

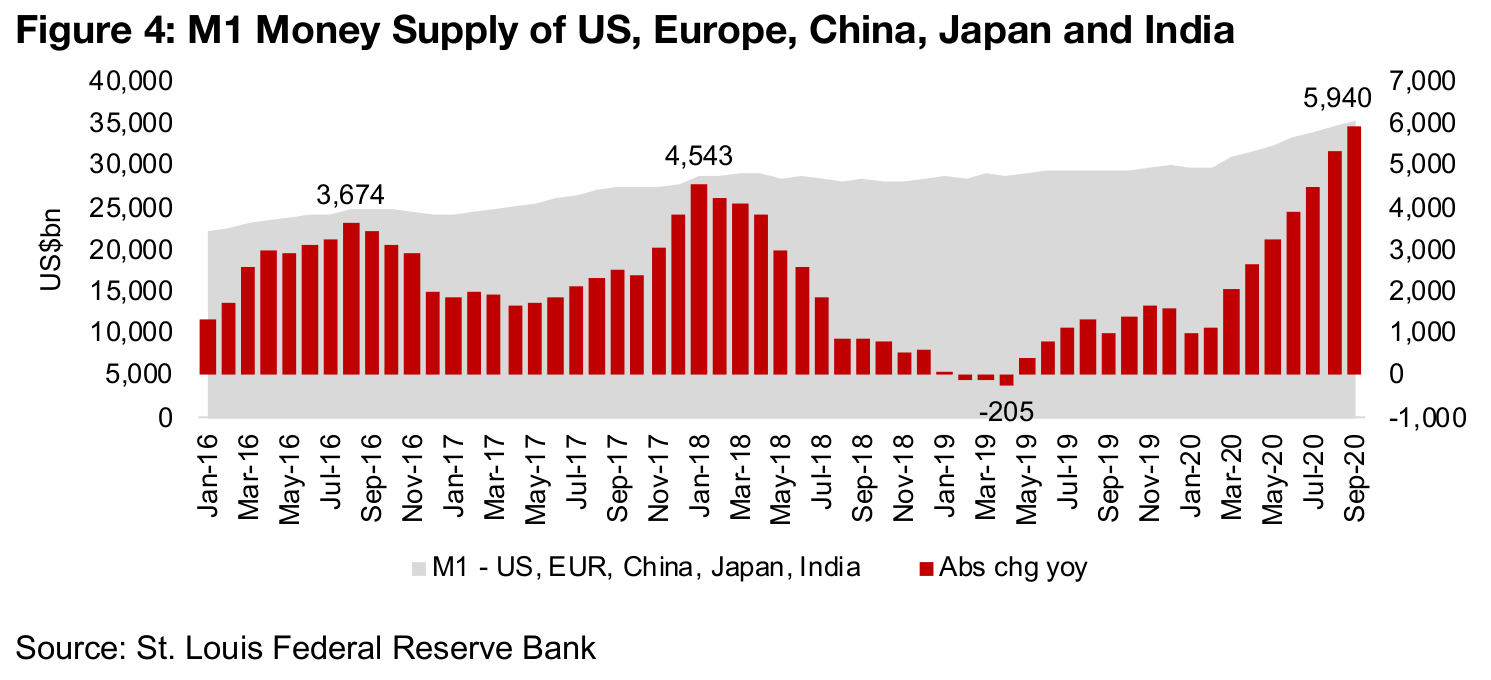

A look at global M1 Money Supply

Figure 4 shows global M1 Money Supply, which is the most basic definition of the broader money supply, which includes money in circulation plus checkable deposits (M2 is M1 plus savings deposits below US$100,000 and money market mutual funds, and M3 is M2 plus large time deposits). Using M1 is useful because it is reported monthly and available across all the major economies to recent periods, with data on M2 and M3 not as uniformly available. The majority of the global money supply comes from just five countries or regions, the US, Europe, China, Japan and India, so we use an aggregate of these five to show global money supply growth. We can see that the absolute change in the money supply was relatively high through 2016 to a peak in January 2018, but began to contract, especially as the US Federal Reserve began to hike interest rates, and the global money supply actually contracted for much of H1/19. Money supply growth remained low through to February 2020, but following the global health crisis, it has surged, and was still gaining pace as of the latest September 2020 numbers.

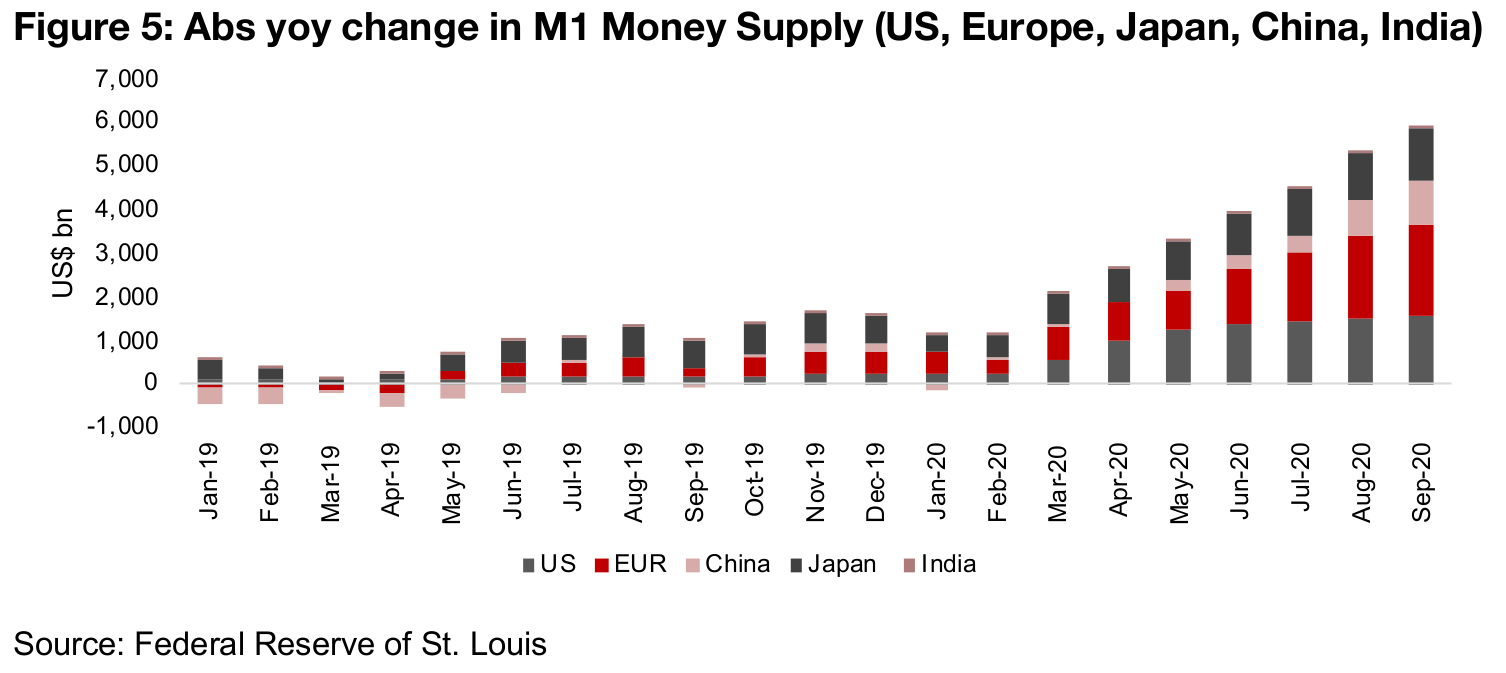

Money supply growth surged from March 2020 and has been broad based

Figure 5 shows the breakdown of the year-on-year absolute change in the money supply by these major countries and regions, and we see that the expansion was across the board in August 2020 and September 2020. The US, Europe and Japan all had major increases in yoy money supply starting from March 2020, and while China had held off on a major expansion prior to August 2020, it has also joined in over the past two months. There may be an argument that with peak health crisis fears occurring around August 2020, that we might see the global monetary authorities able to pull back a bit on liquidity expansion over the H2/20 and into 2021. However, major shutdowns across the world are still continuing, and the reverberation from the first wave of shutdowns still having negative effects. Given this, and the likelihood of deflationary effects, we expect that the authorities will continue to remain vigilant in its monetary expansion, and prefer to err to the upside and provide possibly too much liquidity, than to err to the downside, and not provide enough, given the very difficult situation.

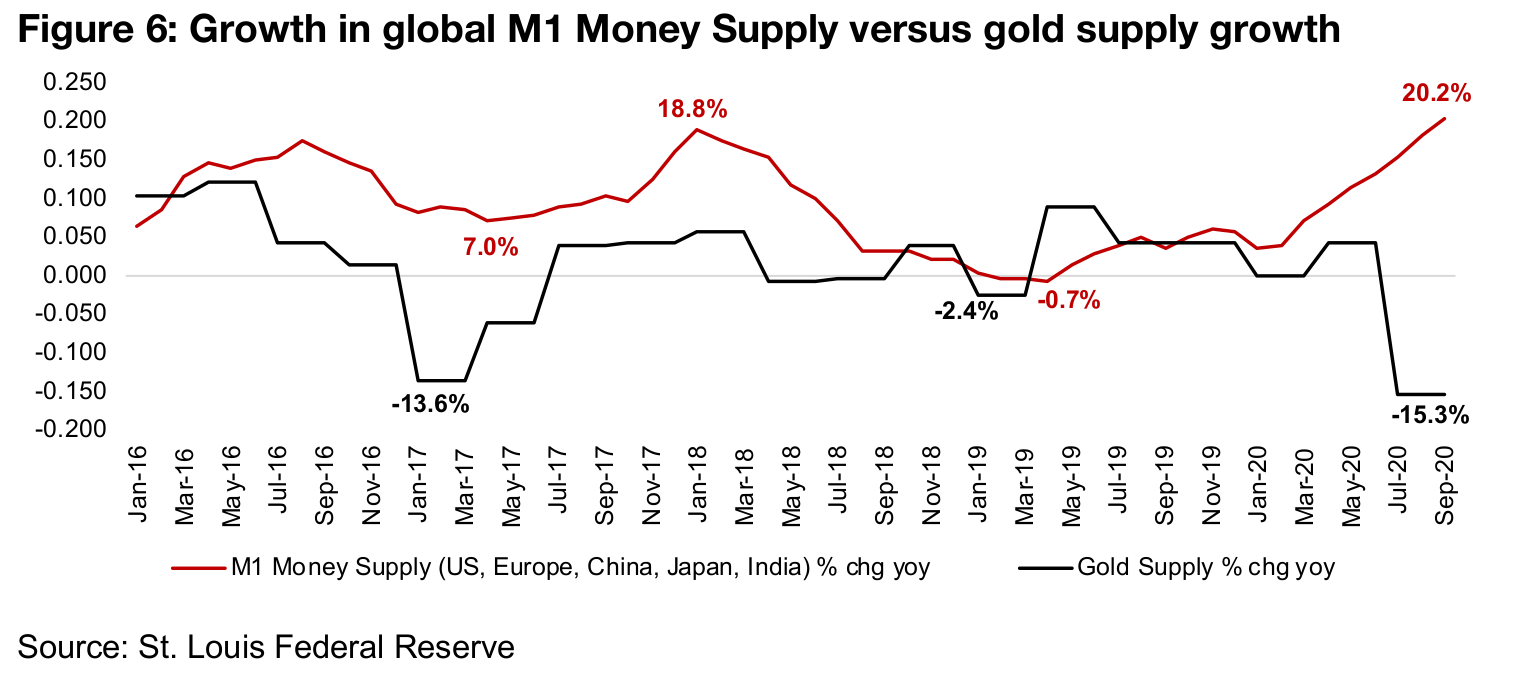

Money supply growth has far outpaced gold supply growth

If we consider gold as a substitute currency, we would want to put this money supply growth in the context of the growth in the gold supply. If the growth of money is rapidly outpacing that of the gold supply, all else equal, we would expect the relative value of the gold to be rising and money to be declining. Certainly in recent years the money supply has been substantially outpacing the supply of gold, for which we have quarterly growth data. While year-on-year gold supply growth has averaged just 1.5% since 2016, money supply growth has been 9.0% (Figure 6). In the most recently released data for gold to Q2/20, there is a particularly strong divergence, as gold supply growth dipped to -15.3% on global-health-crisis related shutdowns even as money supply growth headed towards 20.2% growth as of September 2020. Even as mines come back into operation in Q3/20, we would expect supply growth to move back to the average, and still remain well below that of money supply growth.

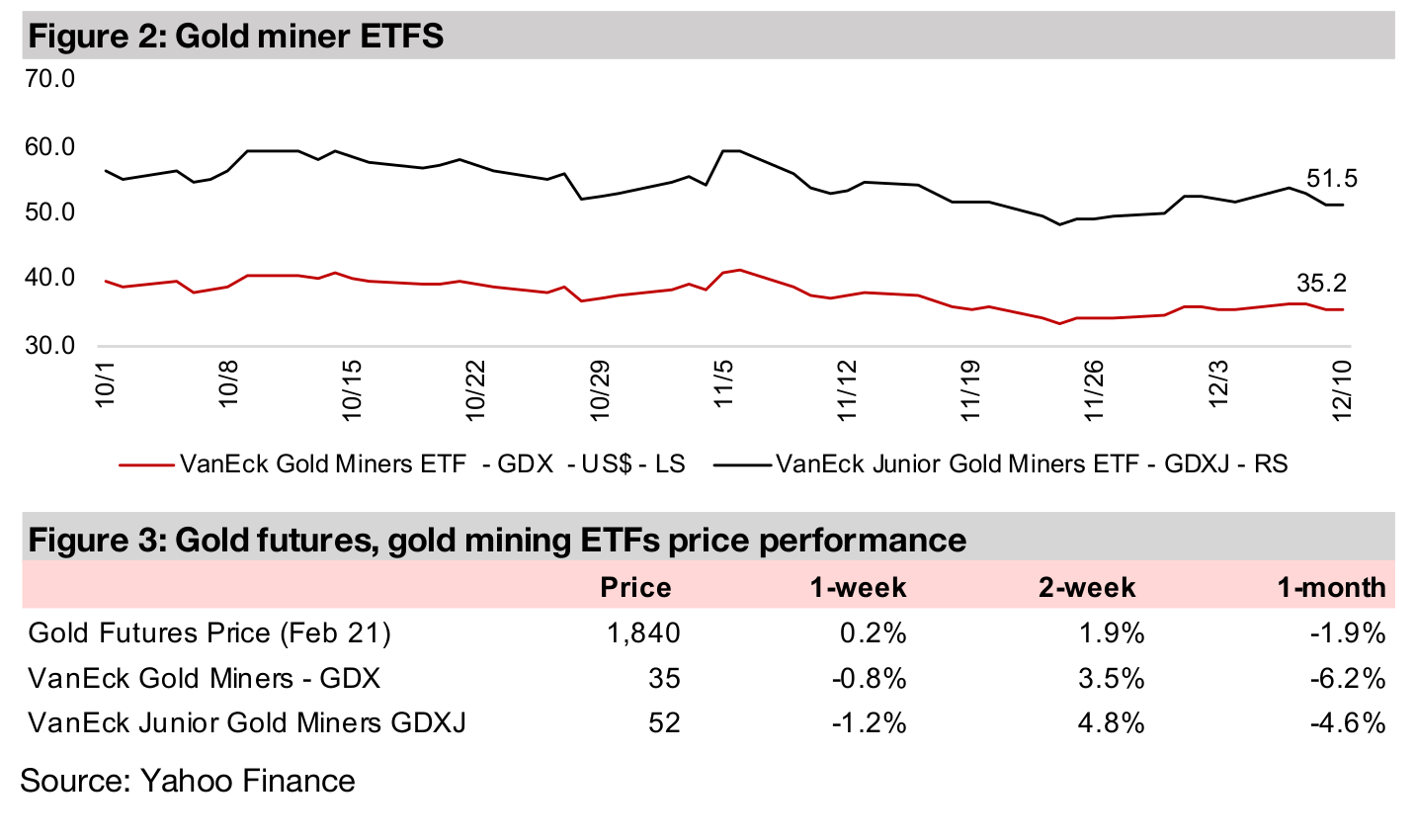

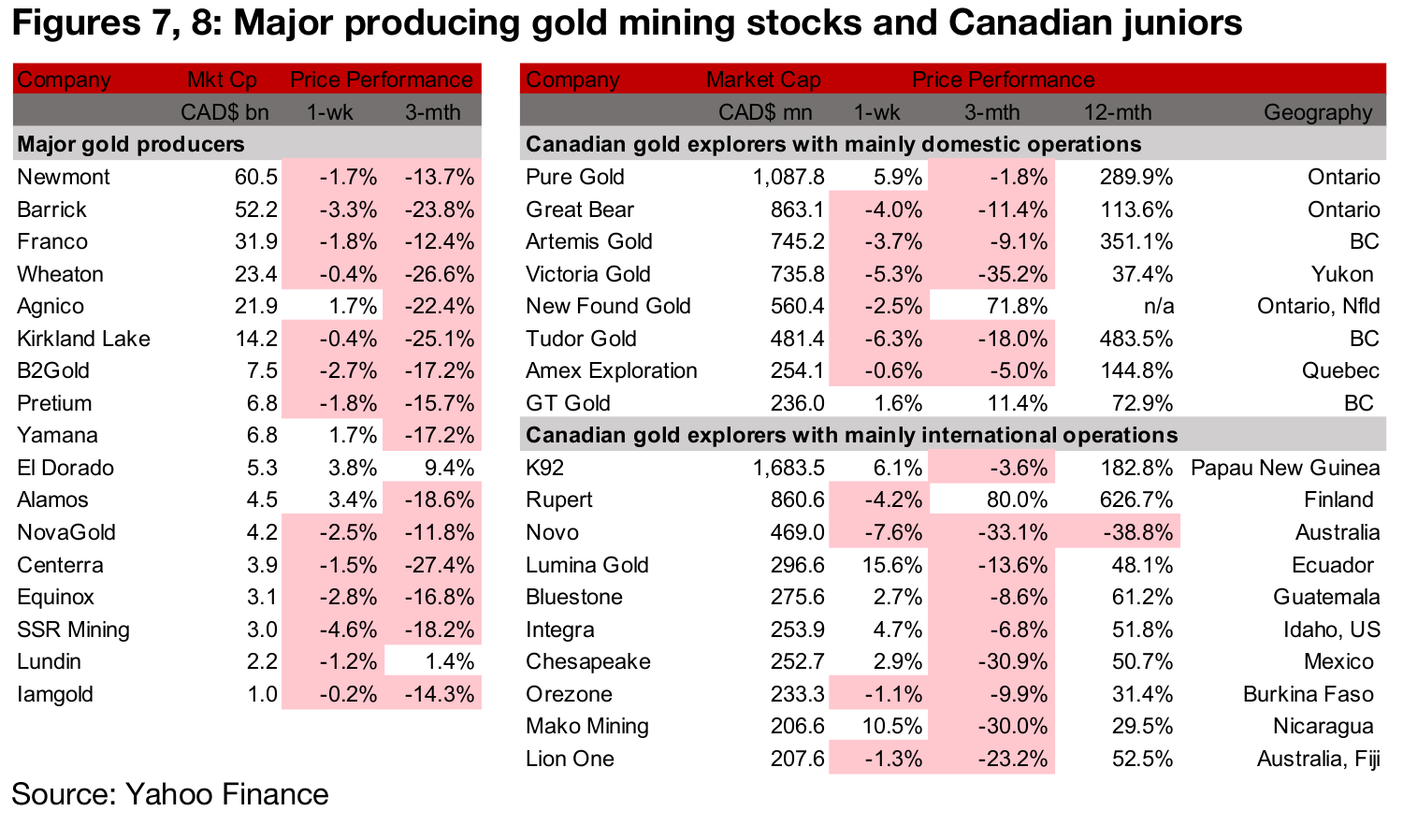

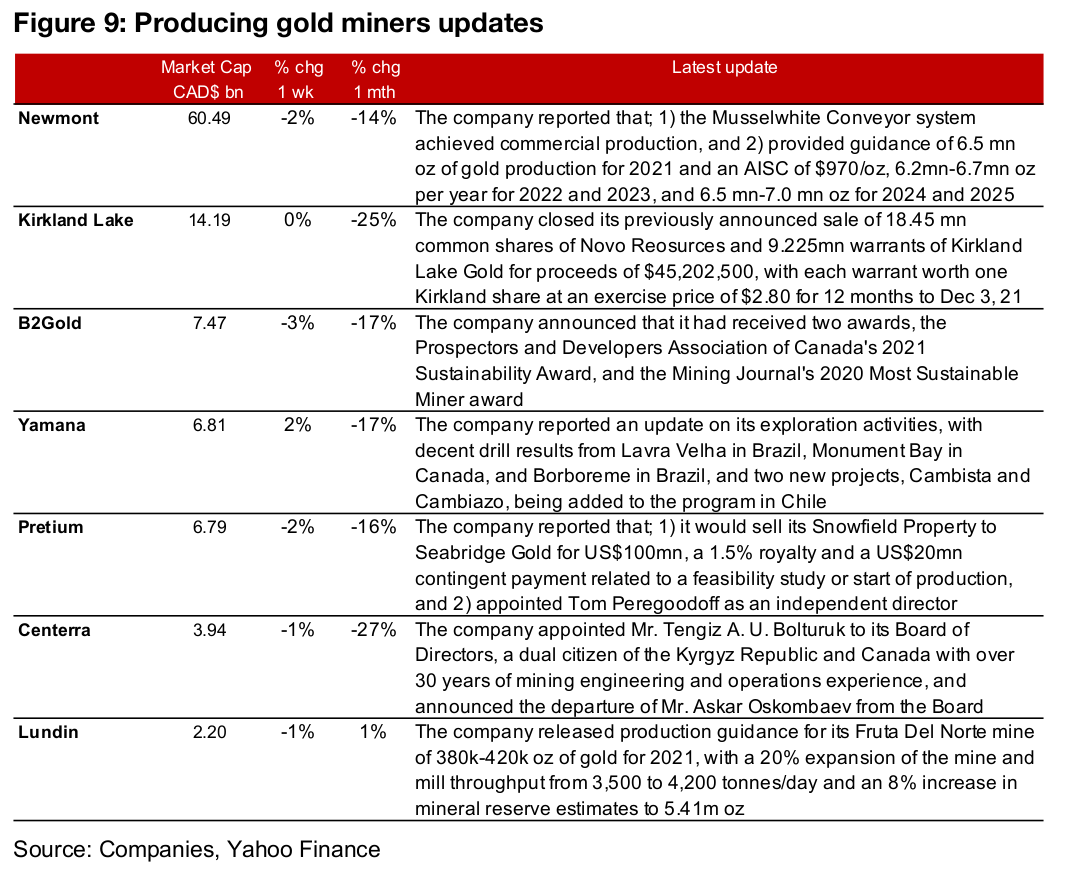

Producers mostly down as gold only edges up

The producing miners were most down this week as the gold price was near flat (Figure 7). Newmont reported that its Musselwhite Conveyor system had achieved commercial production, and production guidance for 2021-2025 (Figure 9). Kirkland announced the sale of a stake in Novo Resources, B2Gold received two mining awards, and Yamana reported an update on its exploration activities. Pretium announced the sale of the Snowfield Property to Seabridge, and the appointment of an independent director, Centerra announced changes in its Board of Directors, and Lundin reported 2021 guidance for its Fruta Del Norte project.

Canadian gold juniors mixed

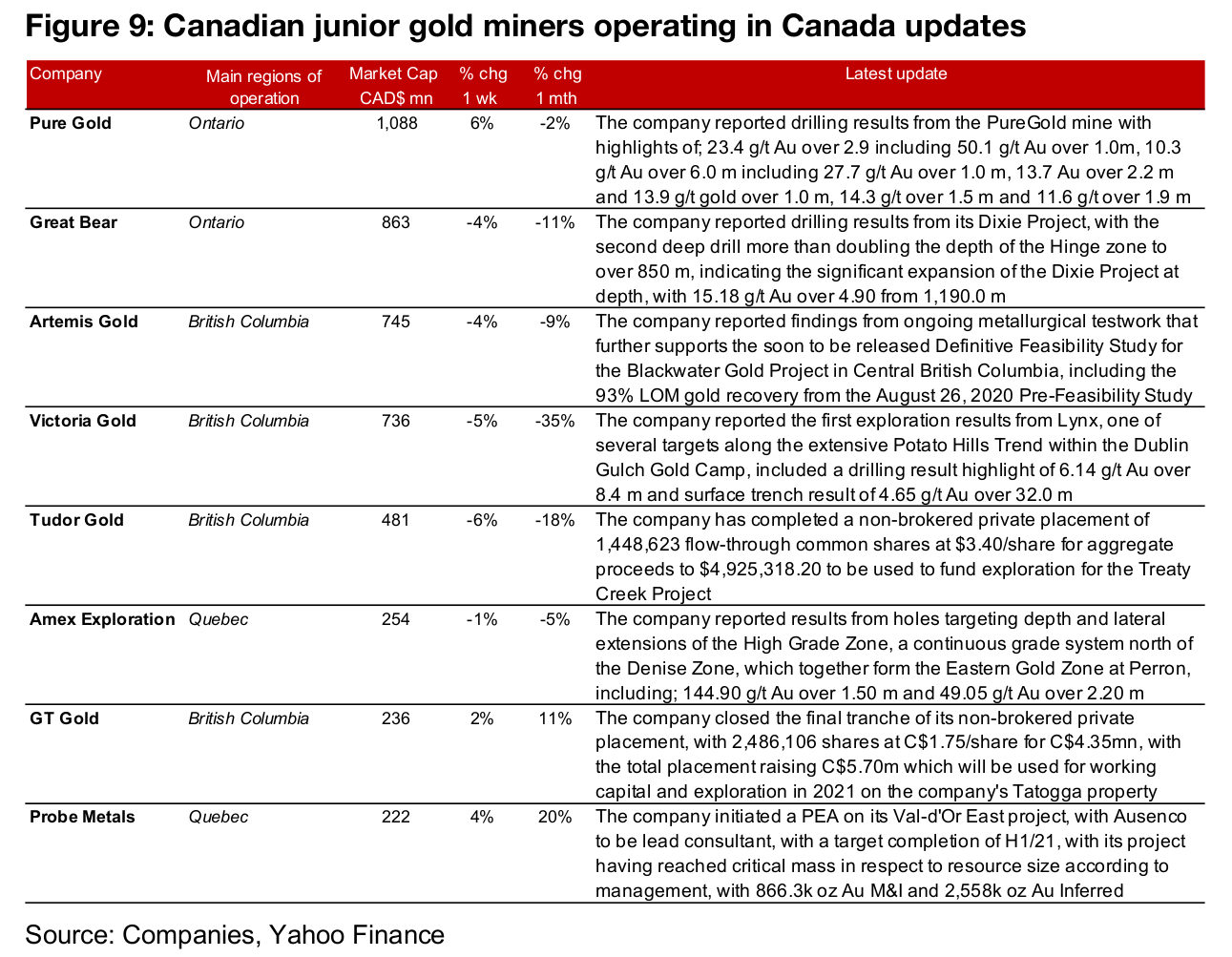

The Canadian juniors were mixed this week, with companies operating domestically

mostly declining and firms operating internationally mostly seeing gains. (Figure 8).

For the domestically focussed companies, Pure Gold reported drilling results from its

PureGold Mine and Great Bear drilling results it Dixie Project, and Artemis reported

finds from ongoing metallurgical testwork to support its FS for Blackwater (Figure 9).

Victoria Gold reported the first exploration results from Lynx, a new target at Dublin

Gulch and Tudor completed a $4.9mn private placement, Amex Exploration reported

drilling results from the Eastern Gold Zone at Perron, GT Gold closed a $5.7mn

private placement and Probe initiated its PEA on its Val d-Or East Project.

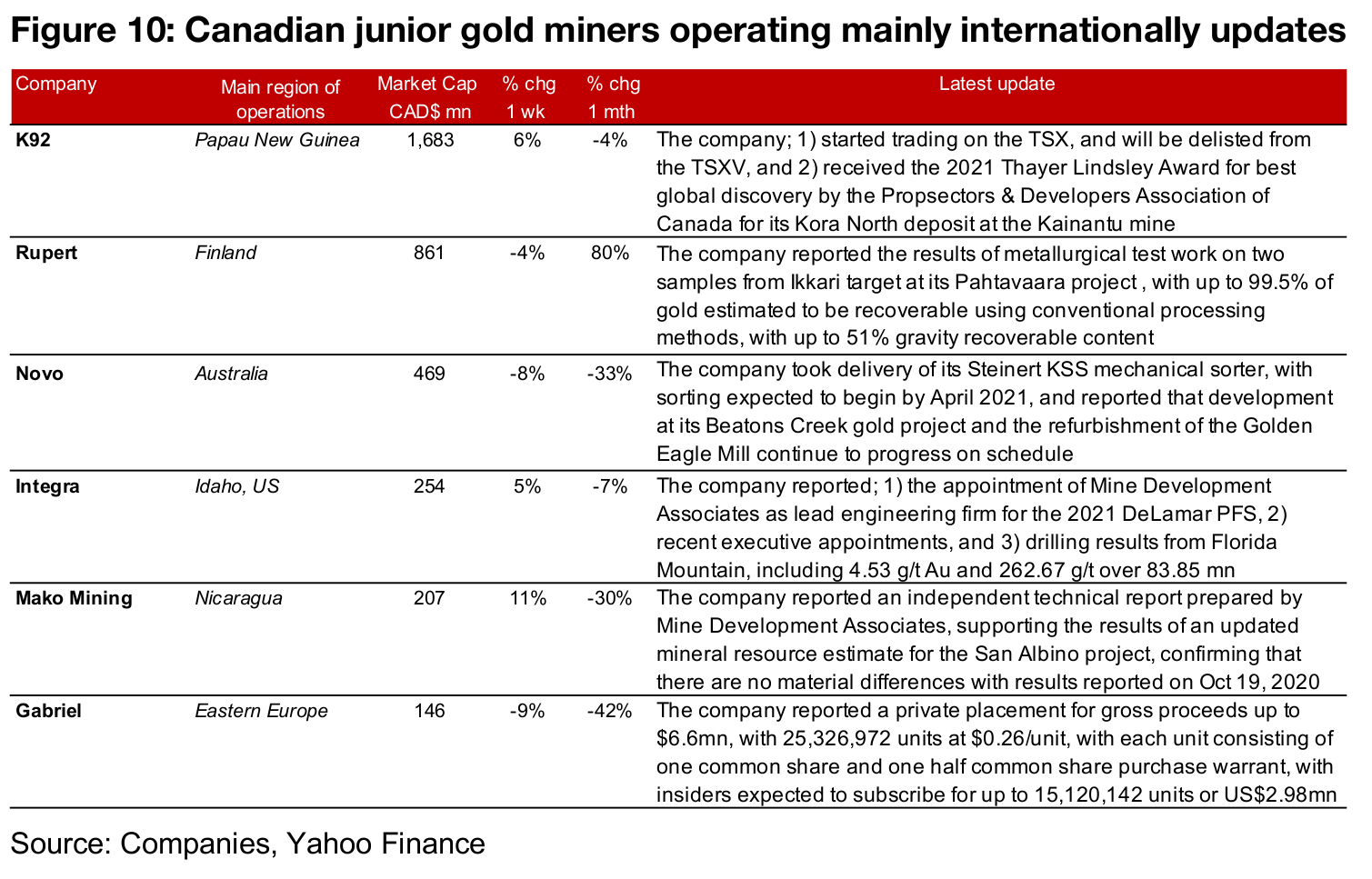

For the internationally focussed operators, K92 started trading on the TSX and

received a mining award, Rupert reported testwork on samples from Ikkari, and Novo

received its Steinert KSS mechanical sorter, and provided an update on progress at

Beaton's Creek (Figure 10). Integra announced its lead engineering firm for the 2021

Delamar PFS and drilling results from Florida Mountain, Mako outlined detail of a

technical report on San Albino, and Gabriel announced a $6.6mn private placement.

In Focus: Tudor Gold (TUV.V)

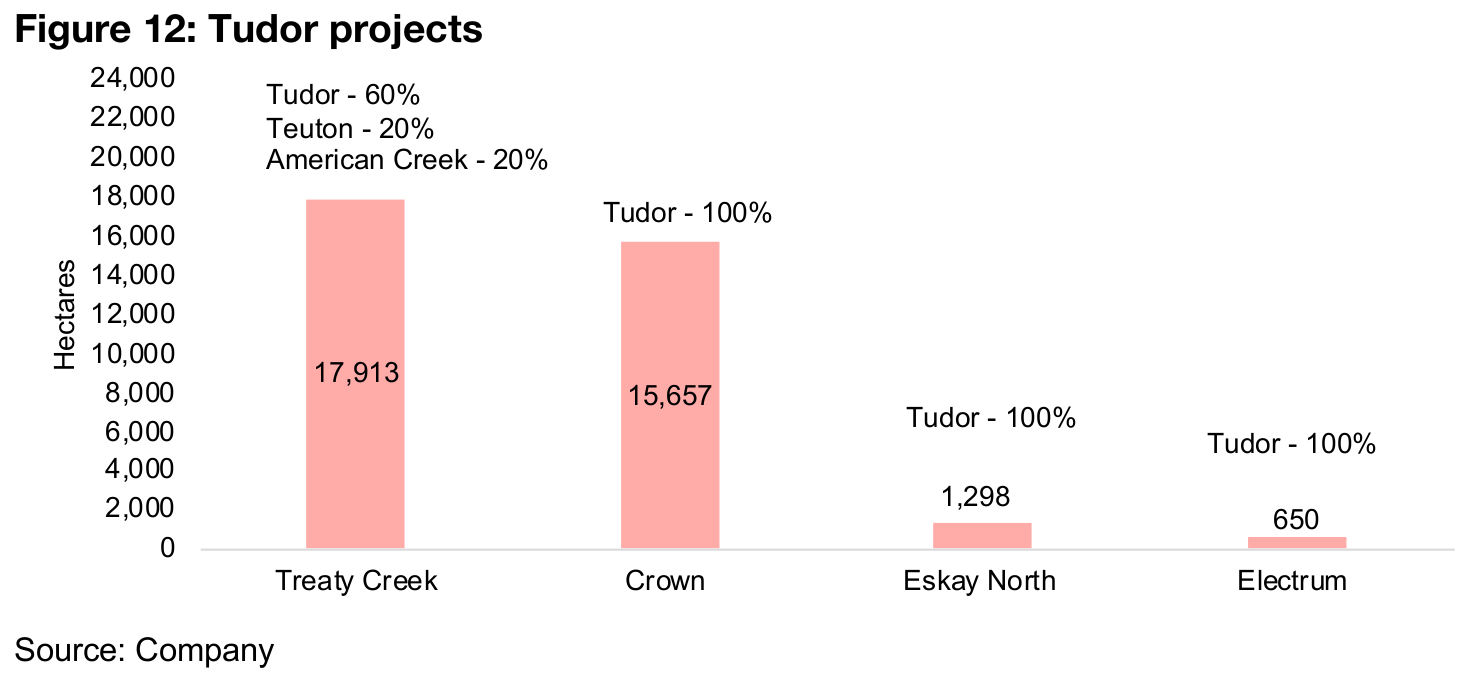

Tudor has four properties, one 60% JV, three 100% owned

Tudor holds 35,518 h.a. over four properties in the Golden Triangle, Treaty Creek, a 17,913 h.a. 60%-owned joint venture with Teuton (holding 20%) and American Creek (20%), Crown, a 100%-owned 15,657 h.a. project, Electrum, a 650 h.a. 100%-owned project, and Eskay North, a 100%-owned 1,298 h.a. project (Figure 12). The properties are close to two major discoveries, Seabridge's KSM project and Pretium’s Valley of the Kings projects, which contain resources totalling over 72mn ounces Au and 13bn lbs Cu. They are also close to strong road, air and port infrastructure. The company has also signed engagement, communication and opportunity sharing agreements with the local Tahltan First Nation.

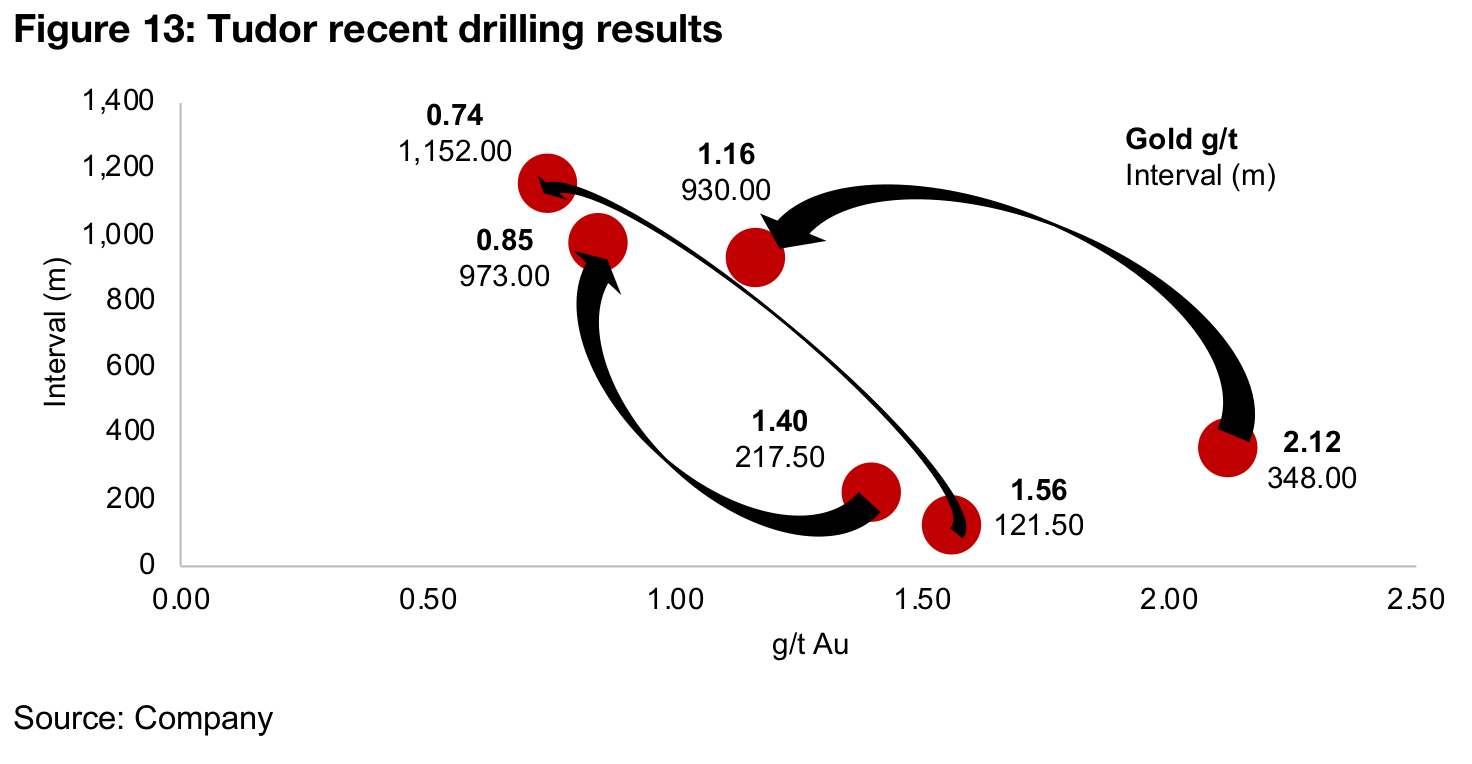

Treaty Creek is the flagship project

Treaty Creek is the company's flagship project, and there has been significant

progress on it this year. The company announced the initial metallurgical test study

from Treaty Creek in April 2020 to consider its viability as a bulk tonnage mine using

conventional processing techniques, with the test work done on drilling results from

the exploration program in 2019. In May the company began its 2020 drilling program

at Treaty Creek with two rigs, and in June added a third. In July 2020 Tudor doubled

the drilling with another three rigs for a total six, for 40,000 m of drilling, and a step-

out hole extended the Goldstorm system at Treaty Creek 150 m to the northeast. In

September the company discovered a significant new gold-silver-copper mineralized

system at the Perfectstorm zone of Treaty Creek. As of end-October, the company

had reported the results from 24,434 m drilled over 29 holes, and was still awaiting

the results of 12,443 m over 6 more holes at Goldstorm. The highlights of the 2020

drilling are shown in Figure 13, with 1.400 g/t Au Eq over 217.5 m within 0.845 g/t Au

Eq over 973 m, 2.120 g/t Au Eq over 348 m within 1.161 g/t Au Eq over 930 m, and

1.561 g/t Au Eq over 121.5 m within 0.741 g/t Au Eq over 1,152.0 m.

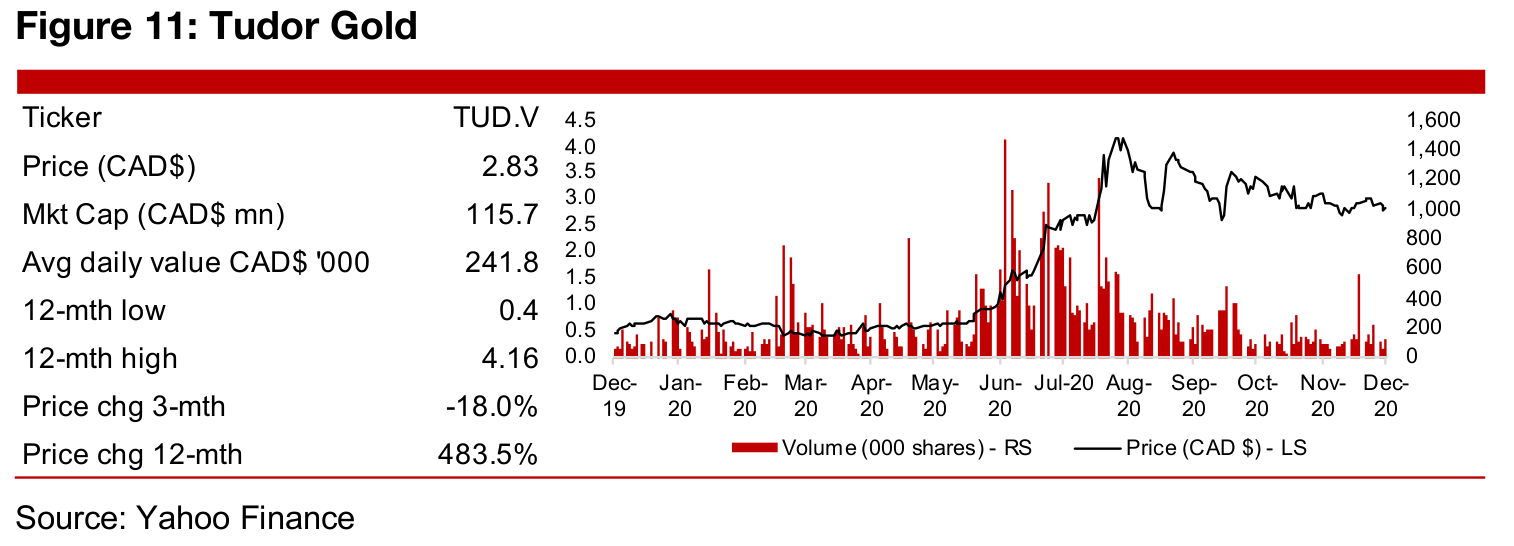

The company's share price is up 483.5% this year, driven by the progress of its

flagship project Treaty Creek combined with the strong gold price, management with

a strong track record, with President and CEO Walter Storm having been the founder

of Osisko Mining, and major shareholder backing, including Eric Sprott holding 19.9%.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.