May 23, 2023

ALERT: A Multi-Billion Agricultural Technology Solution

Contents

- Greensand to Save the World's Soils

- This Proprietary Technology Has Just Changed the Game for Organic Fertilizers

- Florina: Fidelity Minerals' Flagship Project

- Fidelity's Team and Shareholders

- Here's What Investors Could Expect from Fidelity Minerals

Imagine dumping hundreds of billions of liters of bleach into the soil every year.

To be precise, 460 billion liters. Or 122 billion gallons.

Each year.

That's what traditional potash fertilizers do to some of the most productive and valuable soil in the world.

They release an insane amount of potassium chloride into the ground.

It poisons the soil, kills the organisms that live in it, and makes the soil less productive for crops in the long term.

The only solution to this problem is agricultural technology.

Yes, the world still needs potassium fertilizers... you can't avoid this fact.

You need them to grow enough food to match the world's rising food demand.

But without a new approach, we will have the opposite.

Growing demand and lower supply.

In other words, a full-blown food crisis.

And we're not talking about a small event... it could disrupt global food supply chains and directly impact the lives of millions of people.

Both developed and emerging countries will be hit...

Unless something changes.

And, we believe that the opportunity we will discuss below could change the way the world grows its food.

Fidelity Minerals Corp. (TSXV:FMN, OTC:SAIDF, FRA:S5G) has developed a way to produce next-generation fertilizers using natural materials and cutting-edge technology.

Greensand to Save the World's Soils

Greensand is a natural source of potash fertilizer.

Greensand contains the mineral glauconite, that is rich in potassium, the element contained in potash fertilizers.

Fidelity Minerals owns a greensand project that it aims to develop into a source of soil-friendly fertilizer.

Greensand occurs naturally. It's called "marine sediment." It means that you can find glauconite in areas that in the past were covered by seawater.

Unlike a gold or silver vein, which could be hard to trace, greensands usually occur as continuous layered units or rock and so are easy to follow.

It can potentially make it less costly and geologically challenging to mine it, as opposed to precious metals or copper, for example.

The best part about greensand is that it's almost ready to be used as a fertilizer right away.

It's a slow-release source of potassium. In other words, it breaks down in the soil over time and releases potassium atoms.

The fact that glauconite releases potassium relatively slowly is a benefit. Fast-acting fertilizers not only add chlorine to the soil, but the plants they are applied to also suffer from root injury if the fertilizer is released too fast.

Fidelity Minerals Corp. (TSXV:FMN, OTC:SAIDF, FRA:S5G) has access to a processing technology that finds a balance between the benefits of such slow release and the health of the plants.

(We will discuss this processing technology in a moment.)

What you should know, though, is that greensand could be the ultimate replacement for chloride-based commercial fertilizers popular today.

Past studies proved that greensand improves crop yields and plant height.

In fact, greensand has been used in agriculture for about 250 years.

One of the reasons why it has such a deep history is the relative ease with which it can be mined.

We said that it's a marine sedimentary mineral.

It means that it was deposited on sea floors. When those seas dried out, the minerals deposited on the seabed were pretty much available on the surface.

This is one of the benefits of greensand deposits. The mineral-rich material lies either on the surface or close to it. So the mining company developing a project like that doesn't need to deal with too much "overburden" or waste that needs to be removed to get to the economically significant material.

(We will provide you with more details on the company's greensand project shortly.)

In other words, there's no downside to using greensand in agriculture.

It's naturally derived, gentle, and effective.

And the processing technology that Fidelity has access to might have just made a breakthrough that will make it possible to replace the soil-eroding potassium chloride with organic and efficient greensand-based fertilizers.

This Proprietary Technology Has Just Changed the Game for Organic Fertilizers

This is called "activated greensand."

You probably never heard about it. A lot of investors haven't.

But it could potentially be one of the most exciting opportunities in agritech these days.

Fidelity Minerals may be on path to be able to "activate" greensand so that it releases potassium into the soil faster.

The company has already tested the solubility and, therefore, availability of potassium to plants of activated greensand.

The results were astonishing...

Whereas un-activated greensand can take years to release potassium in soil... the "activated" version does it within a year making it a more sustainable and environmentally friendly slow release fertilizer. And about 20% of the potassium in the material is available immediately.

Not only does the company's prior testing show that potassium can be released faster... this technology is an affordable option for the end users of potassium fertilizers.

The company is already seeing interest in activated greensand from fruit growers and other agricultural players.

But this is not all...

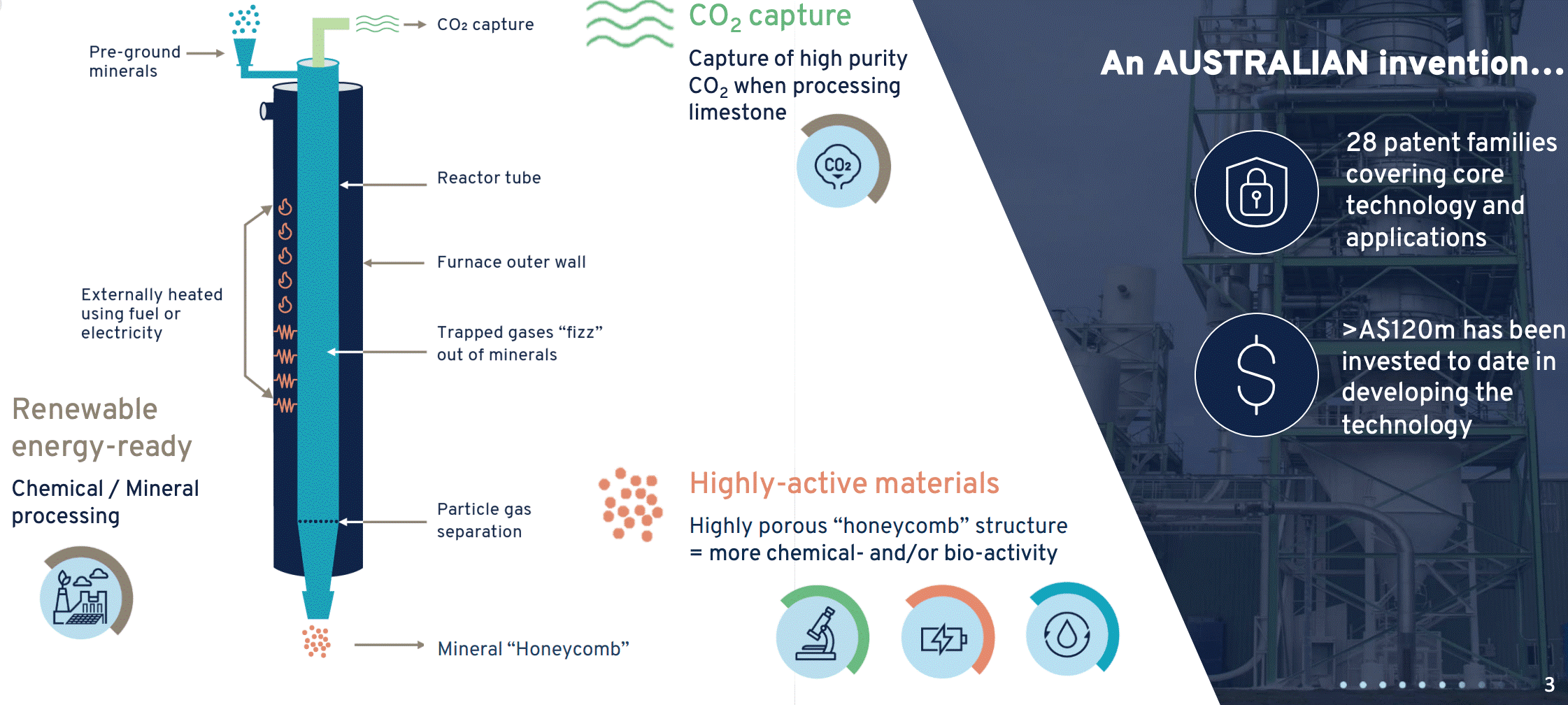

It aims to secure rights to a mineral processing technology that can capture carbon and can be coupled to green energy.

The material, which can then be used in high-technology applications such as biotechnology and advanced agritech applications.

The process that Fidelity Minerals' (TSXV:FMN, OTC:SAIDF, FRA:S5G) is working on is low carbon organic agritech.

The process that greensand goes through results in low-emissions fertilizer. Plus, the processing can be powered by renewable energy, which means that there are no emissions at the processing stage, either.

This off-the-shelf process has received several awards already, including Best Technology Product, according to the Australian Business Awards, as well as a Bioenergy Innovation Award.

The company's flagship project, Florina, is also located in Australia.

The country has become a Silicon Valley for agritech.

And Fidelity aims to deliver chloride-free potassium from Australia to both the country's local producers and the massive Asian agricultural market.

Florina: Fidelity Minerals' Flagship Project

This project is at the core of Fidelity Minerals' business strategy.

It is a greensand project located in the Northern Territory, Australia.

Florina is a large and continuous deposit located at the surface.

This makes it ideal for low-cost and large-scale production of activated greensand.

Fidelity points out that the project has a target resource of about 300 million tonnes of greensand. The fact that the mineralization appears to be located right at the surface will help the company control costs.

The project is also located close to roads, rail infrastructure, renewable energy sources, and is proximal to fast-growing Asian agricultural markets.

In the past, exploration holes drilled to the depth of 70m (~229 ft) confirmed the existence of near-surface greensand.

According to Fidelity, the material is easily dug and crushed.

This makes it perfect for the "grind and flash-heat" technology that we discussed before.

And the company has already tested the "activation" part, as we mentioned before. Now Fidelity wants to do further work to fine-tune and improve on the activation process.

The results of these studies will provide some near- and medium-term catalysts for the company.

As soon as the news about its activation studies starts coming out, the market could realize how much potential this clean agricultural technology has.

Fidelity also plans to launch market studies with a focus on Asia immediately following its process test work.

In 2021, the total Asia-Pacific fertilizer market was worth over $97 billion. By 2028, its total size could reach $116 billion.

As well as that, Fidelity plans to conduct more drilling at the Florina project.

The goal here is to have a NI 43-101-compliant resource estimate for the project by the end of this year.

This could be another potential catalyst for Fidelity.

But the company doesn't plan to stop there.

By the end of 2023, it aims to complete a scoping study for its Florina project.

Think of it as a rough draft of a business plan for the project.

It also plans to fine-tune its understanding of the project's economics next year.

In other words, the company has set several ambitious goals for itself that could potentially deliver multiple catalysts to its total value.

Companies like Fidelity rely on external financing to reach their milestones. And Fidelity used that tool in the past. It could do so in the future as well.

But it also has a potential source of funds that not every other company has.

A Portfolio of South American Projects

Fidelity is an agritech company, first and foremost.

It's focused on its Florina greensand property that it plans to advance and potentially bring to production.

But it also inherited a portfolio of projects located in Peru that could unlock extra value for the company.

Las Huaquillas project, for example, is one of the company's most important non-core properties.

It has been extensively drilled since the late 1980s. Drilling encountered five mineralized zones with significant results that included 14 meters of 8.4 g/t gold.

A historical resource estimate (which is not NI 43-101 compliant) outlined 446,000 ounces of gold and 5.3 million ounces of silver.

Las Huaquillas has one feature that could potentially mean that it's a world-class project. One of its zones (Los Socovanes) is interpreted as an epithermal gold-silver-tellurium zone superimposed on a porphyry system.

According to a historical study done in 1994-1995, this "superimposition" is an important criterion used in identifying world-class deposits.

Fidelity Minerals' (TSXV:FMN, OTC:SAIDF, FRA:S5G) plans to upgrade the historical resource to NI 43-101 standards. So far, the company spent $600,000 on drilling.

If the company is successful at establishing a compliant resource, it will put up this project for sale so it can continue focusing on Florina.

But a potential sale could bring in millions of dollars... that Fidelity will not need to raise by selling its shares.

The company says that one of its partners at Las Huaquillas is asking for $10 million for his share of the property.

For comparison, project establishment and scoping study costs at Florina are eight times less, at around US$900,000.

In our opinion, the company has a chance of unlocking this value by selling Las Huaquillas.

That sale could be another medium-term catalyst for Fidelity Minerals (TSXV:FMN, OTC:SAIDF, FRA:S5G).

This strategy was put together by its management team and Lions Bay, Fidelity's largest shareholder.

Fidelity's Team and Shareholders

We had the pleasure of talking to Mr. John Byrne, the company's Chairman.

Canadian Mining Report was impressed by Mr. Byrne's knowledge, experience, and strategy.

Mr. Byrne has over 40 years of experience in the resource industry. He also has an impressive track record of executing mining mergers and acquisitions.

In 2002, Mr. Byrne formed Cambrian Mining plc, which was acquired in 2008 at 106x times the company's original assets.

Another company that Mr. Byrne was involved with was formed with less than CAD1 million and later sold for CAD3.3 billion.

Mr. Byrne is also the founder of Fidelity's largest shareholder, Lions Bay Capital.

Fidelity's CEO is Mr. Dean Pekeski. He has over 25 years of international experience in mineral exploration and development.

He was involved in multiple exploration projects in the past, including Bunder Diamonds in India, Milestone Potash in Canada, and Sevier Playa Potash in the United States.

The management and Mr. Byrne's Lions Bay Capital together hold over 57% of the company. In other words, Fidelity features a strong insider position.

The company has 86 million shares outstanding, which is a conservative number for an Australian company. In addition, there are 31 million share purchase options and warrants.

At the current price, Fidelity has a market capitalization of about $6 million. This is a microcap that could potentially transform the global potash market.

However, given the scope of the company's project and potential milestones, we recommend that you take a closer look at Fidelity Minerals (TSXV:FMN, OTC:SAIDF, FRA:S5G).

Here's What Investors Could Expect from Fidelity Minerals

The company has a lot going on... and it has set ambitious goals for itself.

However, we have confidence that Fidelity's management team can rise to the challenge.

If it reaches its milestones successfully, the company will deliver plenty of positive news to its early investors.

First, the company is working towards upgrading its historical resource estimate at Las Huaquillas. As a reminder, that historical resource includes over 446,000 ounces of gold and 5.3 million ounces of silver.

An upgrade to NI 43-101, if successful, will provide Fidelity with a chance to sell the project and speed up the development of its main asset, the Florina Greensand project in Australia.

Meanwhile, Fidelity plans to continue drilling at Florina with the goal of producing a NI 43-101 compliant resource estimate in 2023.

So far, there are indications that the project could be large in size and have a low-cost production profile.

The business model of Fidelity relies on Florina and the cutting-edge mineral processing technology that makes it possible to produce organic and safe fertilizer.

As a result, the company also plans to focus on process test work at Florina. The goal here is to ascertain the exact details and parameters of processing for maximum efficiency and economy.

At the same time, the company plans to engage in a market study that could outline the best export opportunities in the Asian region, which is a multi-billion-dollar fertilizer market.

When it is equipped with an understanding of the project's resource size and the details of the processing technique it uses... it will prepare an initial scoping study, which is an economic outline of the project's potential revenue, expenses, and capital costs.

The company plans to release this scoping study in 2023 as well.

Any progress that the company makes at improving its understanding of Florina's economics could provide a boost to the company's total value.

And in 2024, Fidelity plans to complete bulk sampling, mining, and processing.

This would further de-risk this project... which by that time may potentially be worth more than Fidelity's current market capitalization of just $6 million.

In fact, the sale of the company's non-core projects might potentially deliver more value than its total valuation.

This is where we (and the company's directors) see an IMMEDIATE upside.

From there, Fidelity Minerals (TSXV:FMN, OTC:SAIDF, FRA:S5G) aims to advance its Florina property as soon as possible and deliver a potentially life-changing technology to fertilizer markets around the world.

This is why we call Fidelity an agritech opportunity. It has the assets, the expertise, and the market understanding to become an agricultural technology leader.

SEE DISCLAIMER & DISCLOSURE BELOW

Sign up to receive our future articles and updates.

Disclosure

The Canadian Mining Report has been retained by Fidelity Minerals to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Fidelity Minerals and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Fidelity Minerals and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More