May 12, 2025

Another Big Quarter for Big Gold

Author - Ben McGregor

Gold up on Fed decision as trade and geopolitical risk declines

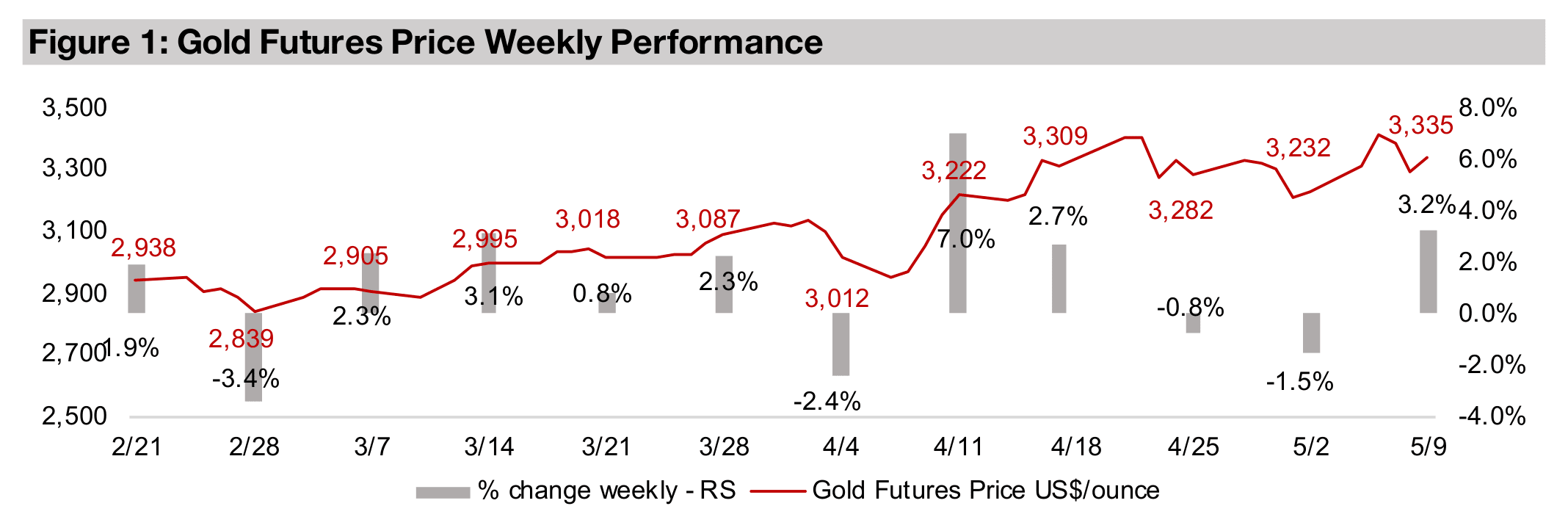

Gold rose 3.2% to US$3,335/oz and briefly reached above US$3,400/oz for the second time in a month, as the Fed’s decision to keep rates on holds seems to have offset progress on US global trade agreements and a decline in geopolitical risk.

Another strong quarter for Big Gold but some signs of cooling

Big Gold had its fourth consecutive quarter of strong growth in Q1/25 mainly on the rising gold price as there were other signs of operations cooling, including a yoy and qoq decline in production and a significant rise in core operating costs.

Another Big Quarter for Big Gold

Gold rose 3.2% to US$3,335/oz and briefly reached above US$3,400/oz for the

second time in a month, before settling back down just above the US$3,305/oz

average that has held for the past four weeks. This came as the month long risk on

rebound from the early April 2025 crash slowed, with the S&P 500 up just 0.1%, the

Nasdaq rising 0.6% and the Russell 2000 gaining 1.0%. The main driver for this

appears to have been the US Fed’s decision to hold rates steady at its meeting this

week. This led to a rise in the US$ index and US bond yields, which tend to move

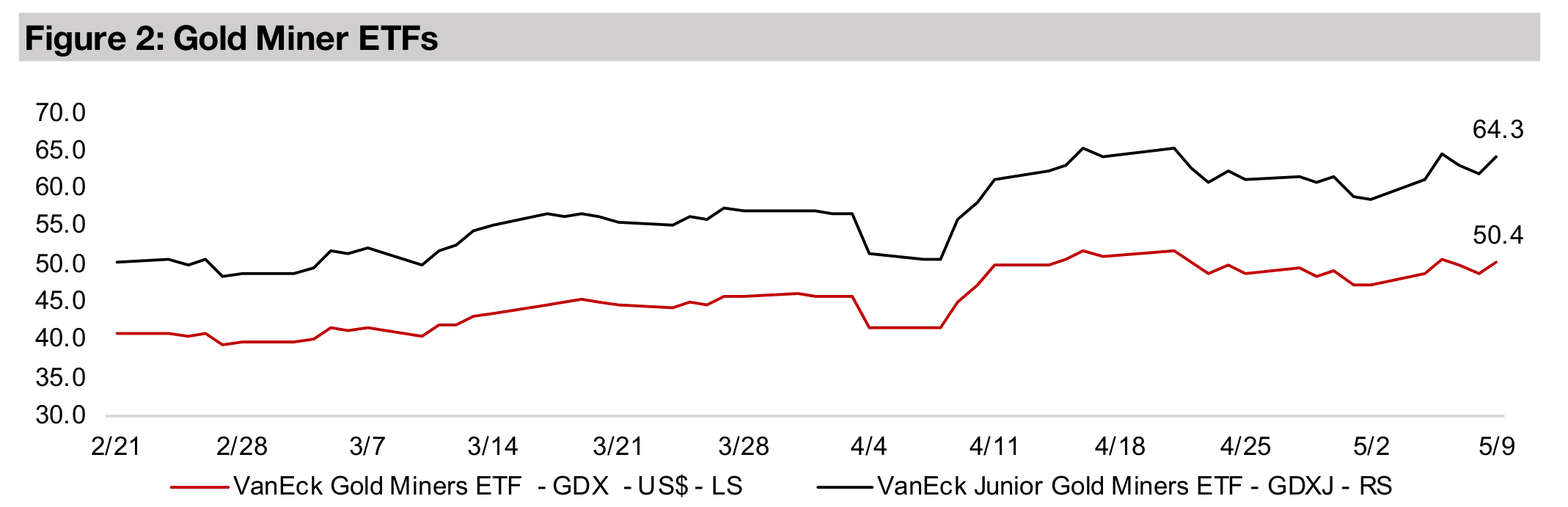

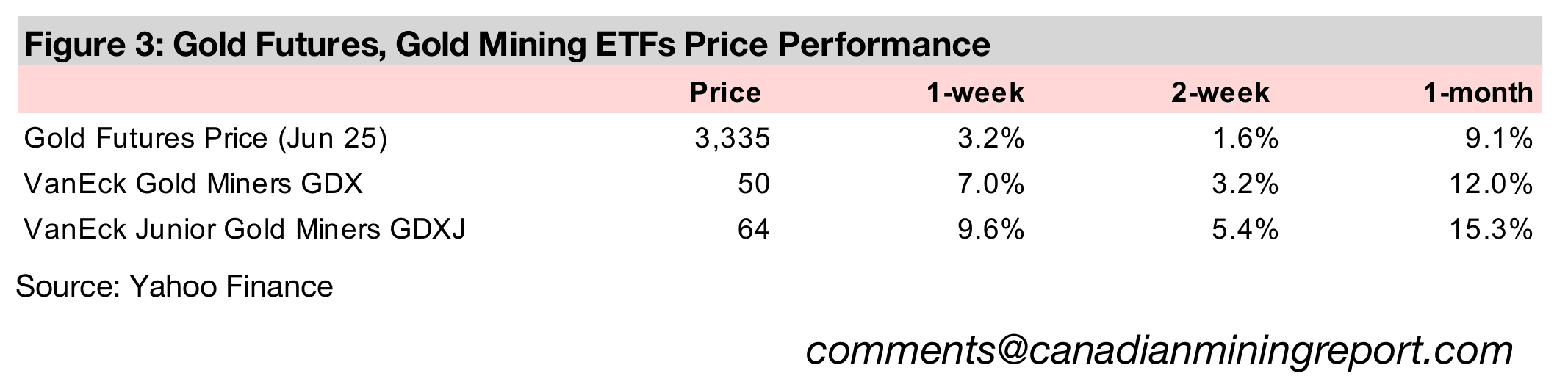

inversely to gold, while gold stocks jumped with the GDX up 7.0% and GDXJ 9.6%,

mainly on the metal’s rise, given a limited boost from large or small cap equities.

However, this alone seems unlikely to have been the sole reason behind gold’s

strength, as the Fed’s decision was not a major surprise to markets, and there were

offsetting factors of substantial progress on both trade and geopolitical issues

announced this week. These reduced overall global risk and therefore might have

been expected to be negative for the gold price. This included progress on US trade

negotiations, with talks with China apparently underway and a major deal announced

with the UK. Geopolitical risk also declined as there have been some signs of de-

escalation in the Middle East, the Russia-Ukraine war and the recently erupting India-

Pakistan conflict.

There are several other broader underlying factors that have likely been supported

gold. Even though a full-blown global trade war has been averted, tariffs will still be

rising to some degree, which could curb global economic activity. Also, even given

recent progress, these major geopolitical conflicts are clearly far from entirely

resolved. Equities have also now returned to pre-crash levels, which may be

prompting markets to question whether the economic outlook has really returned to

where it was a month ago, and if they have fully priced in potentially higher risks.

There is also a prevailing trend since mid-2024 of the markets looking to hedge risk

more with defensive sectors, including gold and gold stocks. Adding to this is that

the gold trade has become much more popular among the wider retail market this

year, as shown by sector ETF inflows surging to all-time highs in March 2025. All

these factors combined, catalyzed by the Fed holding rates, could explain the rise in

gold this week even in the face of the upbeat trade and geopolitical news flow.

Big Gold has another strong quarter, but some signs growth cooling

The continued rise in the gold price so far in Q2/25 could be setting up the gold sector for another stand out quarter to follow the strong Q1/25 results that have recently been reported by Newmont, Barrick and Agnico Eagle. However, there were some warning signs the sector’s peak growth for this cycle may already be behind it, with the gains nearly all driven by the rocketing gold price, but production declining and core operating costs rising considerably both year on year and quarter on quarter.

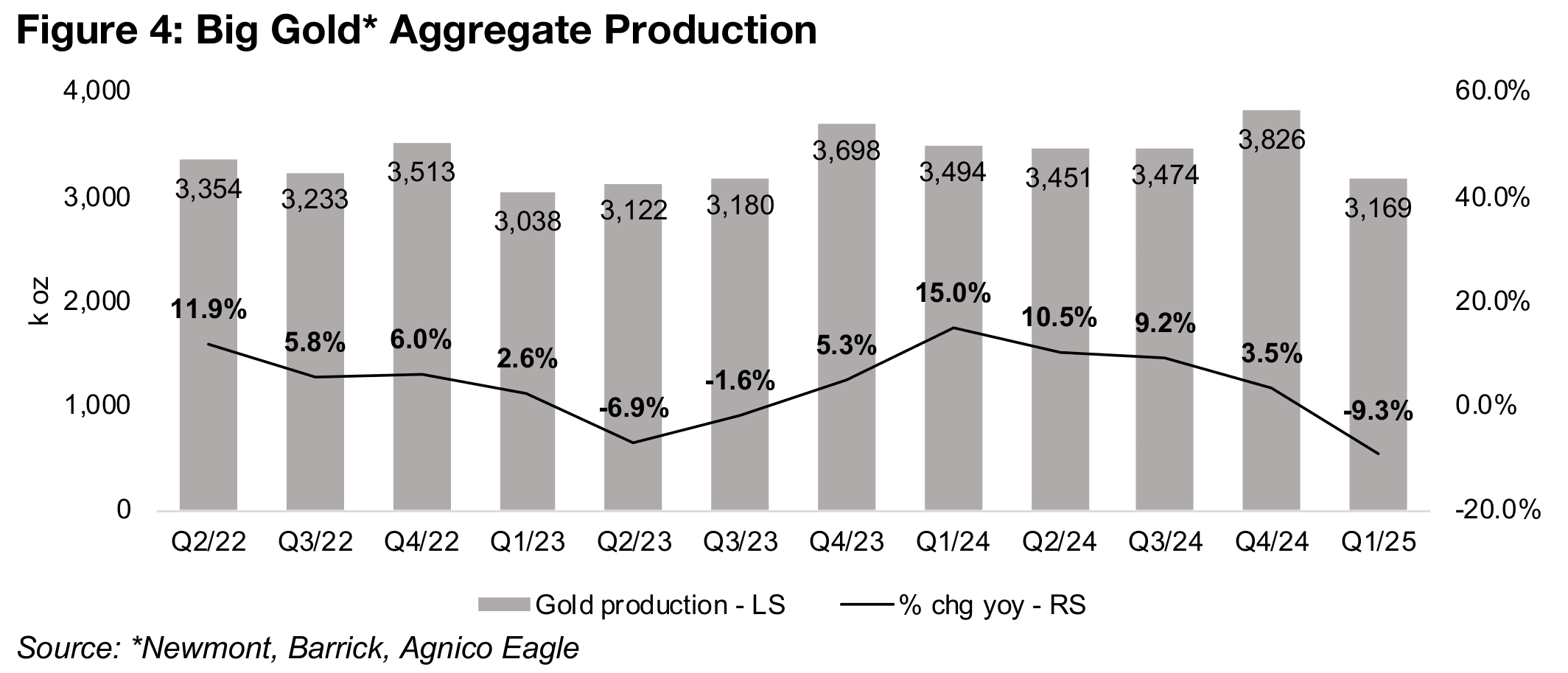

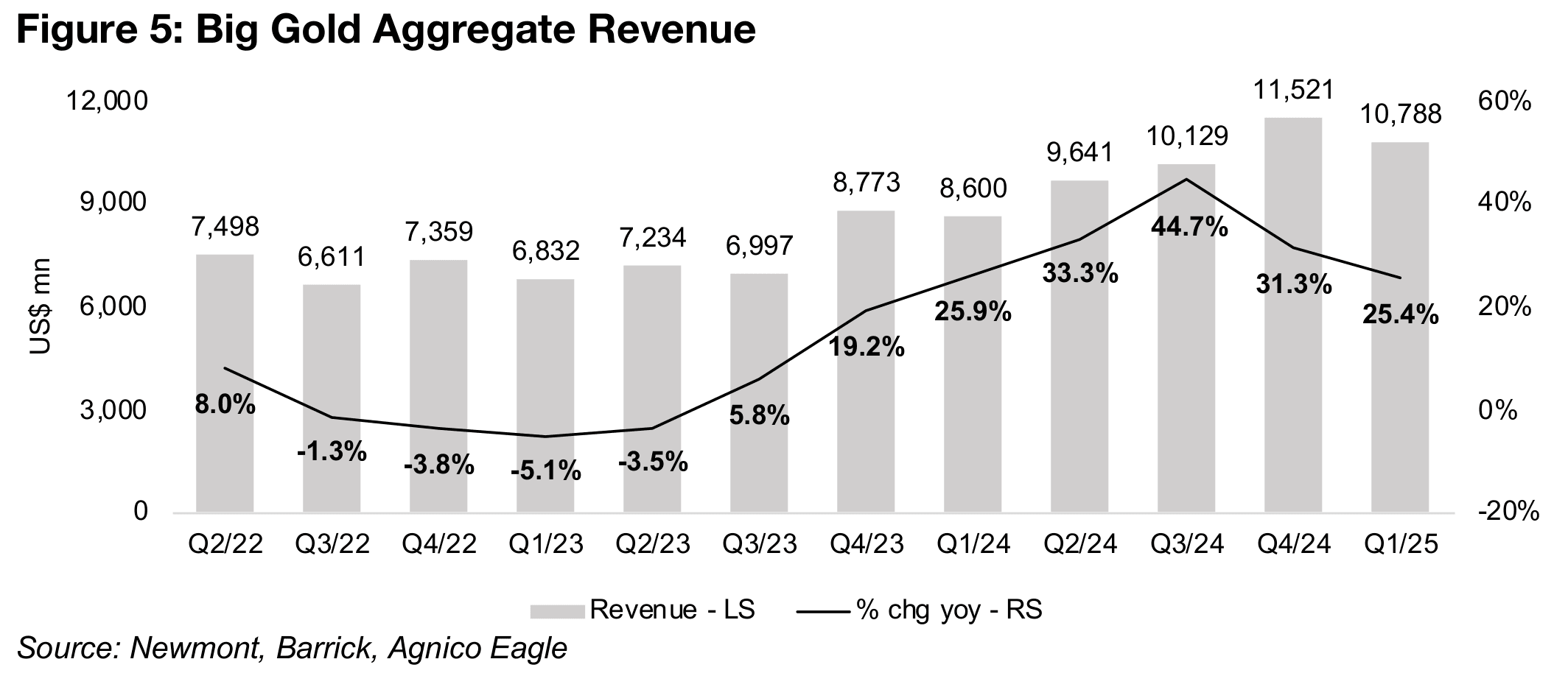

Aggregate production declined -9.3% yoy, turning negative for the first time since Q3/23, and continuing to trend down from a peak growth of 15.0% in Q4/24 (Figure 4). However, this was far offset by the continued surge in the gold price, and revenue rose 25.4%, although this has trended down from the highs of 44.7% in Q3/24, after rising consistently off lows of -5.1% in Q1/23 (Figure 5). The level of revenue also declined for the first time in a year, to US$10.8bn in Q1/25 from US$11.5bn Q4/24.

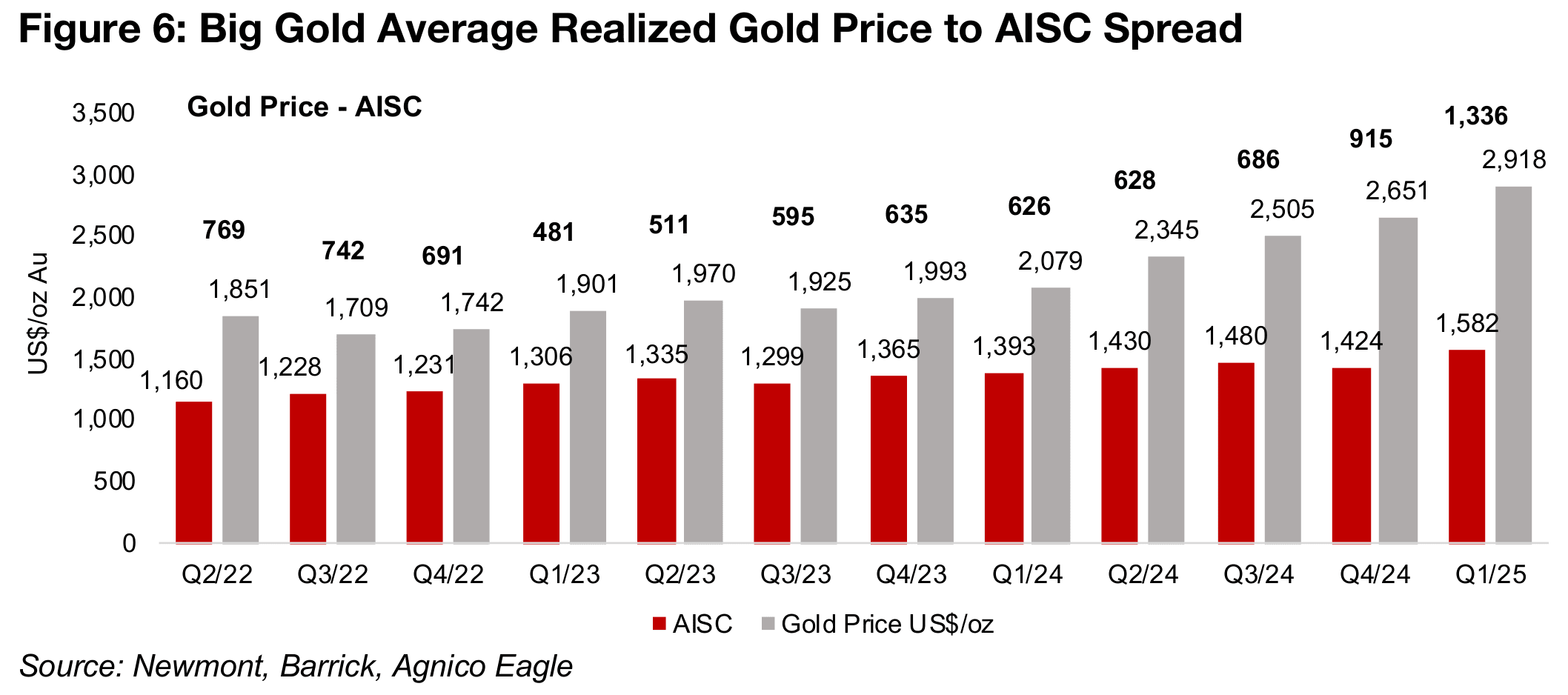

The revenue gain was driven by a 40% rise in the realized gold price yoy to US$2,918/oz in Q1/25 from US$2,079/oz in Q1/24. While there was a considerable rise in the all in sustaining cost (AISC) per oz by 13.5% yoy to US$1,582/oz, this was far outpaced by gold’s rise, with the spread doubling to US$1,336/oz from US$626/oz in Q1/24 (Figure 6). Rising costs had been more of concern to markets in H2/24 in the absence of a rocketing gold price to offset them and had pressured share prices. However, Q1/25 still shows that inflation continues to hit the industry, and markets could put a greater focus on this issue if gold eventually pulls back.

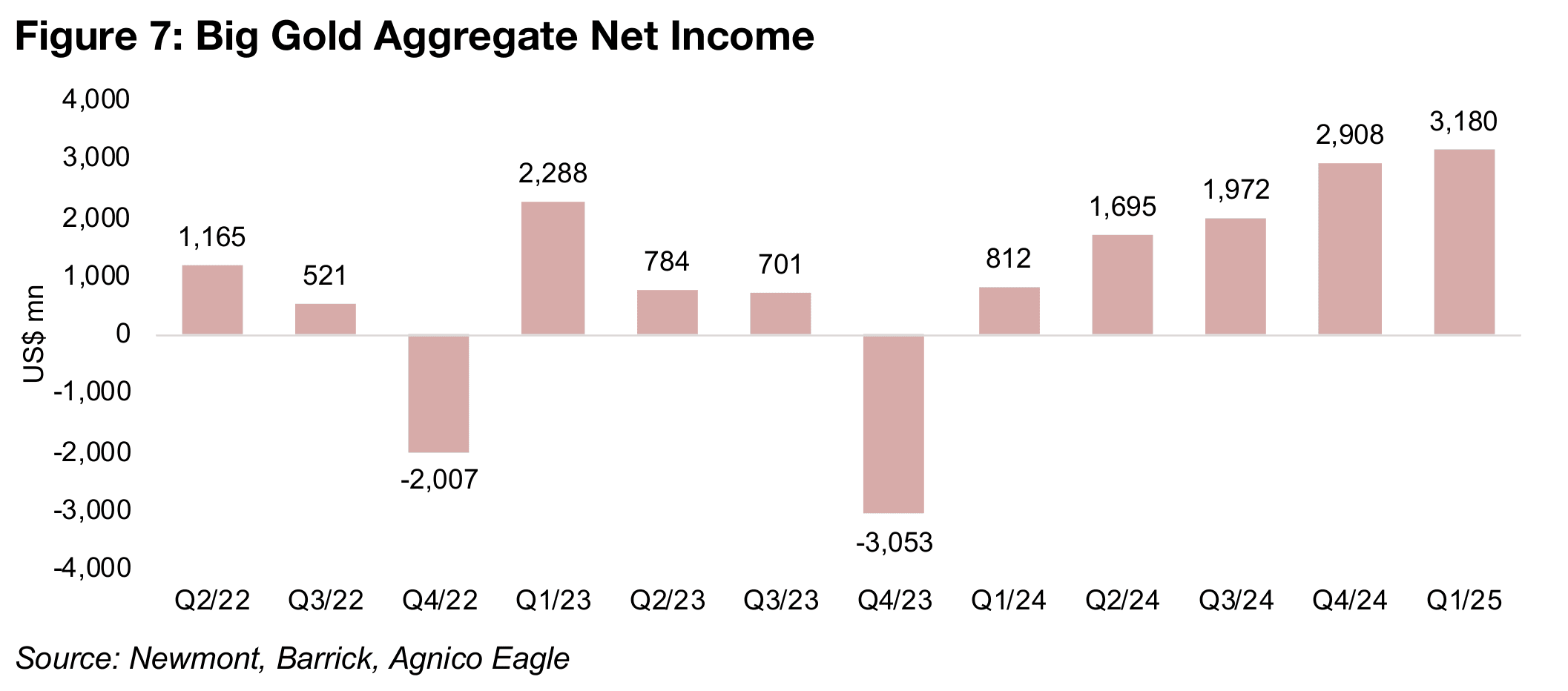

The rising gold price drove the fourth consecutive quarter of strong net income growth, to US$3,180mn, up 291% yoy (Figure 7). Major exceptional items, including write offs, dragged down net profit in several quarters in 2022 and 2023, most notably Q4/22 and in Q4/23. However, accounting for these issues in 2022 and 2023 cleared the way for the strong growth in net income of the past several quarters.

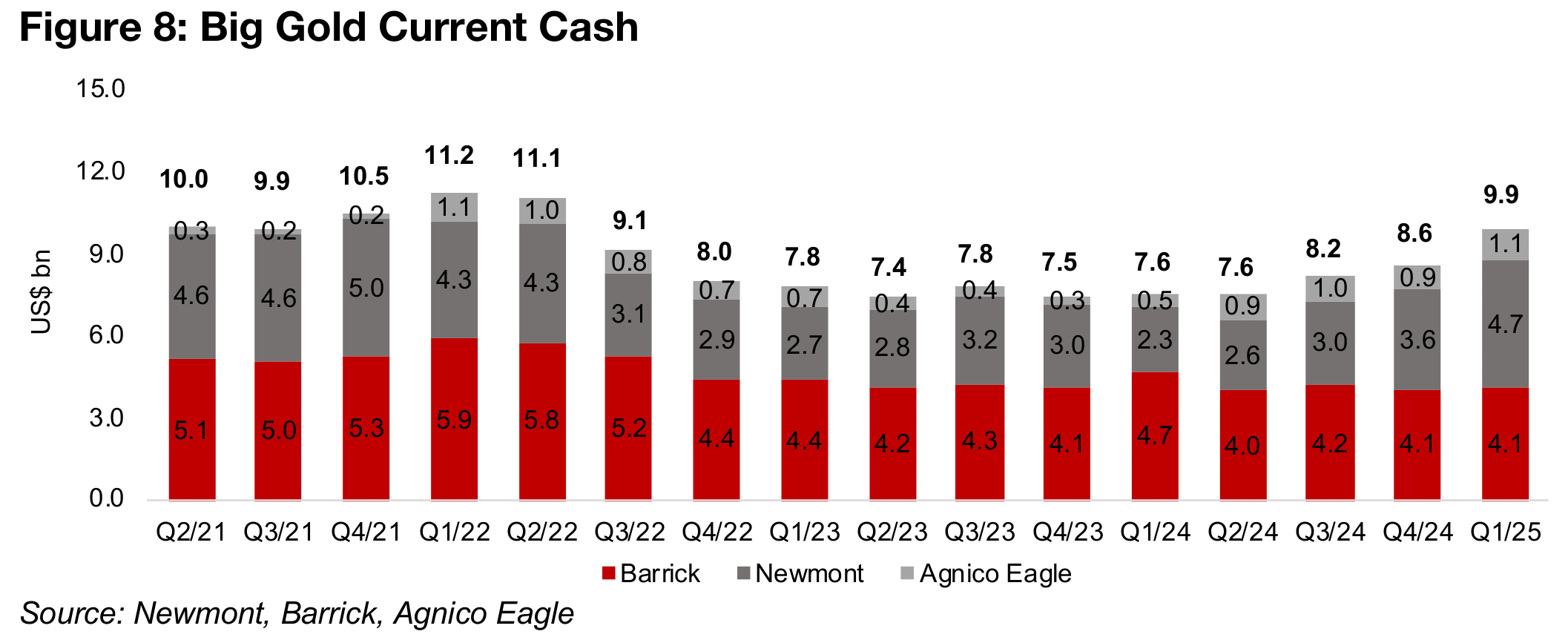

The sector continued to pile up cash, which reached US$9.9bn, with the last time it was above this level in Q2/22 (Figure 8). The rise was mainly driven by a qoq rise for Newmont to US$4.7bn in Q1/25 from US$3.6bn in Q4/24, while Barrick’s cash balance remained flat at US$4.1bn, and Agnico Eagle’s edged up to US$1.1bn from $0.9bn. Newmont has now overtaken Barrick for the highest cash balance of Big Gold for the first time since early 2019, with Newmont at an average 41% of the total cash of the three from 2019 with a low of 34% reached in Q1/23.

Both Newmont and Barrick production pulls back substantially

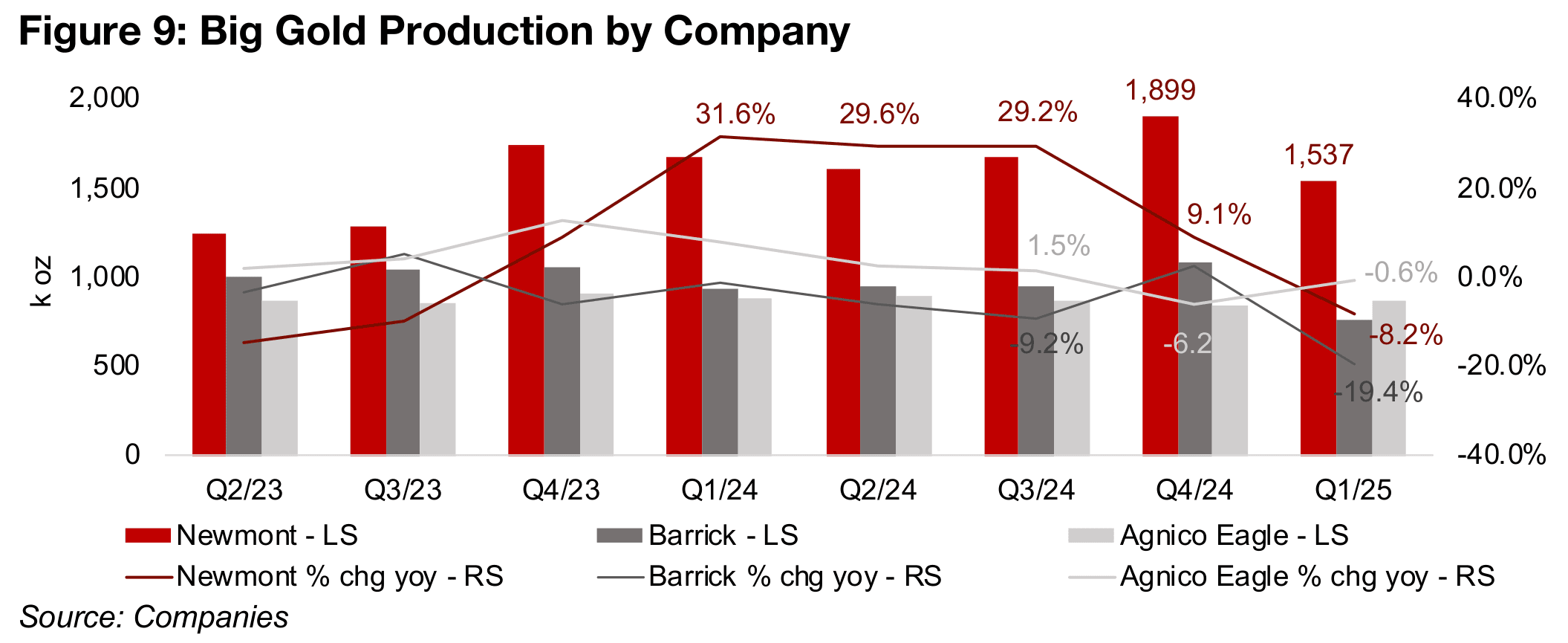

The decline in production was driven especially by the -8.2% decline year on year for Newmont, down by 362k oz from 1.89 mn oz Au to 1.54 mn oz Au (Figure 9). While Barrick’s percentage decline of -19.4% was more severe, it was similar in absolute terms at 322k oz Au, with its production much lower, at 758k oz Au in Q1/25. While Agnico Eagle’s production was down, it was only by -0.6% yoy to 874k oz Au, and actually rose qoq from 847k oz Au. Agnico Eagle also rose to the number two producer in Q1/25 of the three Big Gold companies after the major decline for Barrick.

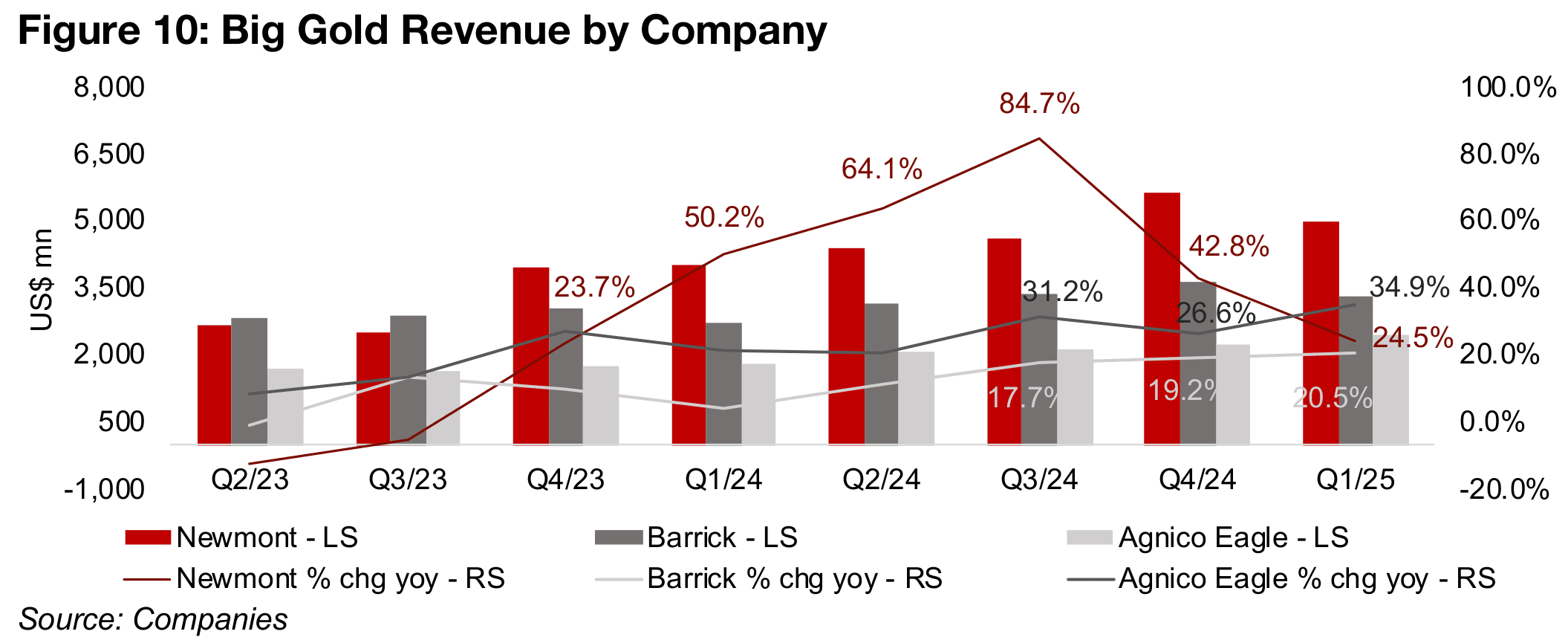

The rise in the gold far surpassed the decline in production and revenue for all three

grew substantially in Q1/25 (Figure 10). Newmont’s revenue growth declined qoq to

24.5% from 42.8% and is well off its 84.7% peak in Q3/24, which has been driven by

a production increase and surging gold price, while in Q1/25 it had only the backing

of the strong metal price. However, revenue growth for both Barrick and Agnico Eagle

rose qoq to 34.9% and 20.5%, respectively, from 26.6% and 19.2% in Q4/24.

Revenue growth for Big Gold could decline further if production continues to remain

weak, which would see any increase relying on further gains in the gold price. While

the gold price continues to make strong gains in absolute terms, the percentage

increase has declined from 31% in 2024 to 17% this year. To match last year’s gain,

gold would need to average US$3,300/oz in 2025. With an average to April 2025 of

US$2,980/oz, it would need to hit an average US$3,400/oz for the rest of 2025 to

match the 2024 growth rate. While this is possible given that gold has recently already

breached the US$3,400/oz level, there are warning signs it is getting ahead of

fundamentals, with many of its ratios versus comparable assets at long-term highs.

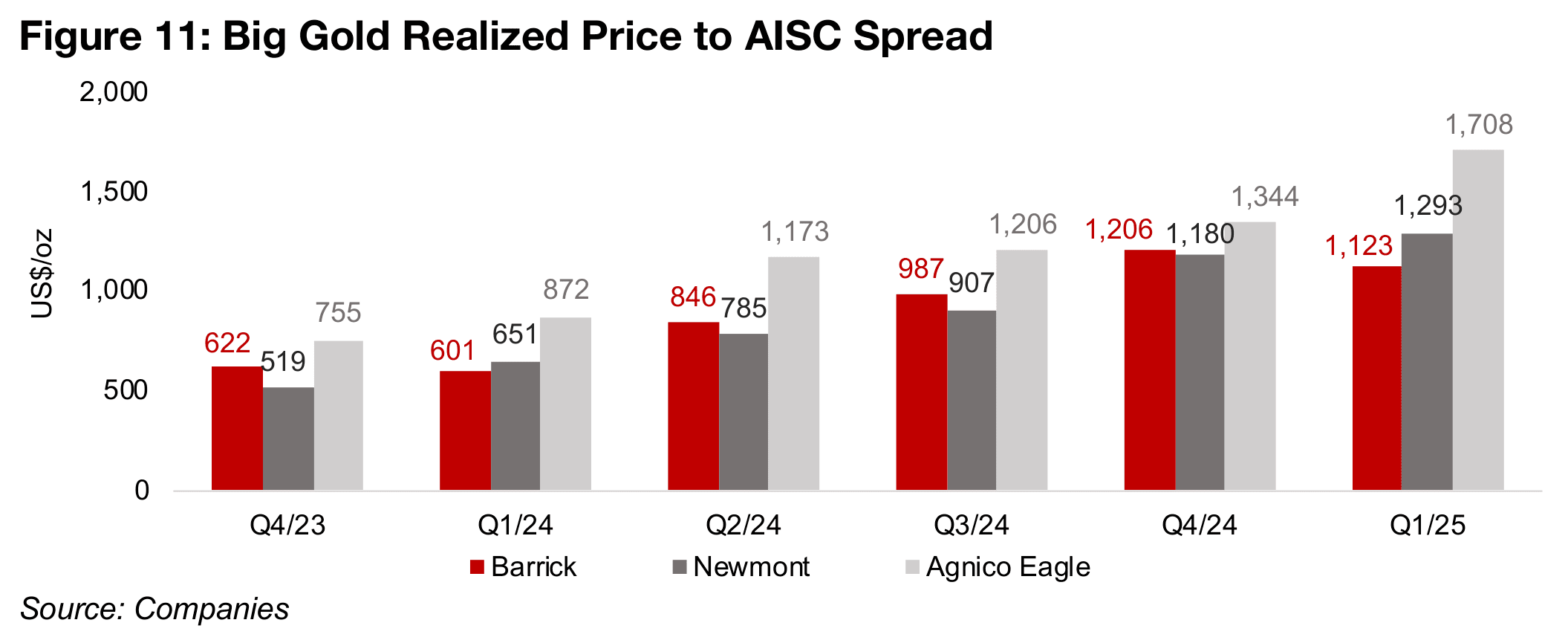

The rise in the realized gold price to AISC spread qoq for Big Gold was especially driven by Agnico Eagle, which saw an increase to US$1,708/oz in Q1/25 from US$1,344/oz in Q4/24, with Newmont also up, to US$1,293/oz from US$1,180/oz (Figure 11). However, Barrick’s spread actually declined to US$1,123/oz in Q1/25 from US$1,206/oz in Q4/24, showing that the rising costs are starting to affect profitability in the industry.

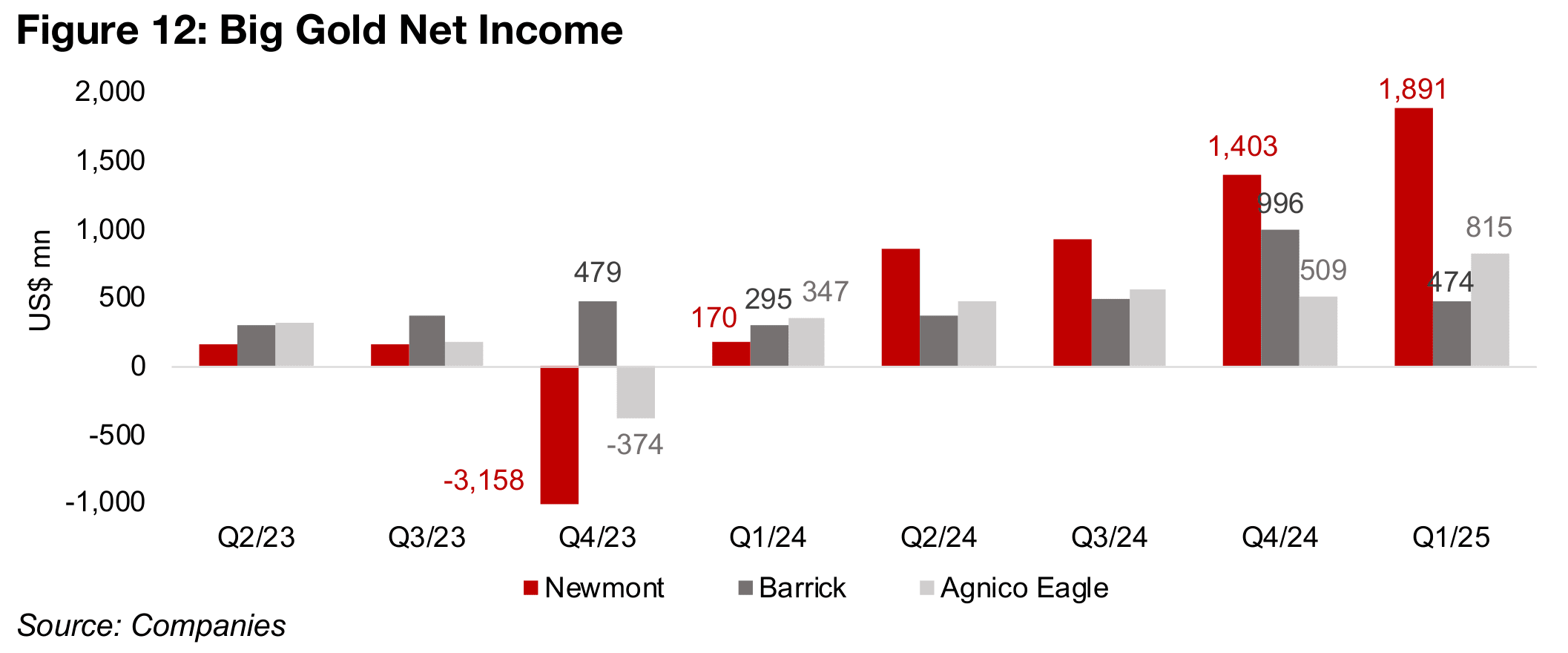

Newmont has seen the largest rise in net income for Big Gold, to US$1,891mn in Q1/25, up 35% qoq from US$1,403mn in Q4/24 and increasing eleven times yoy from US$170mn in Q1/24 (Figure 12). Agnico Eagle has also seen a significant rise to US$815mn in Q1/25, up 60% qoq from US$509mn in Q4/24 and more than doubling yoy from US$346 in Q1/24. Barrick’s performance has been more muted, with net income of US$474mn, increasing just 60% yoy from US$295 in Q1/24. While Barrick’s income declined by nearly half qoq from US$996mn in Q4/24, the prior quarter was boosted by a large US$457mn reversal of an impairment gain.

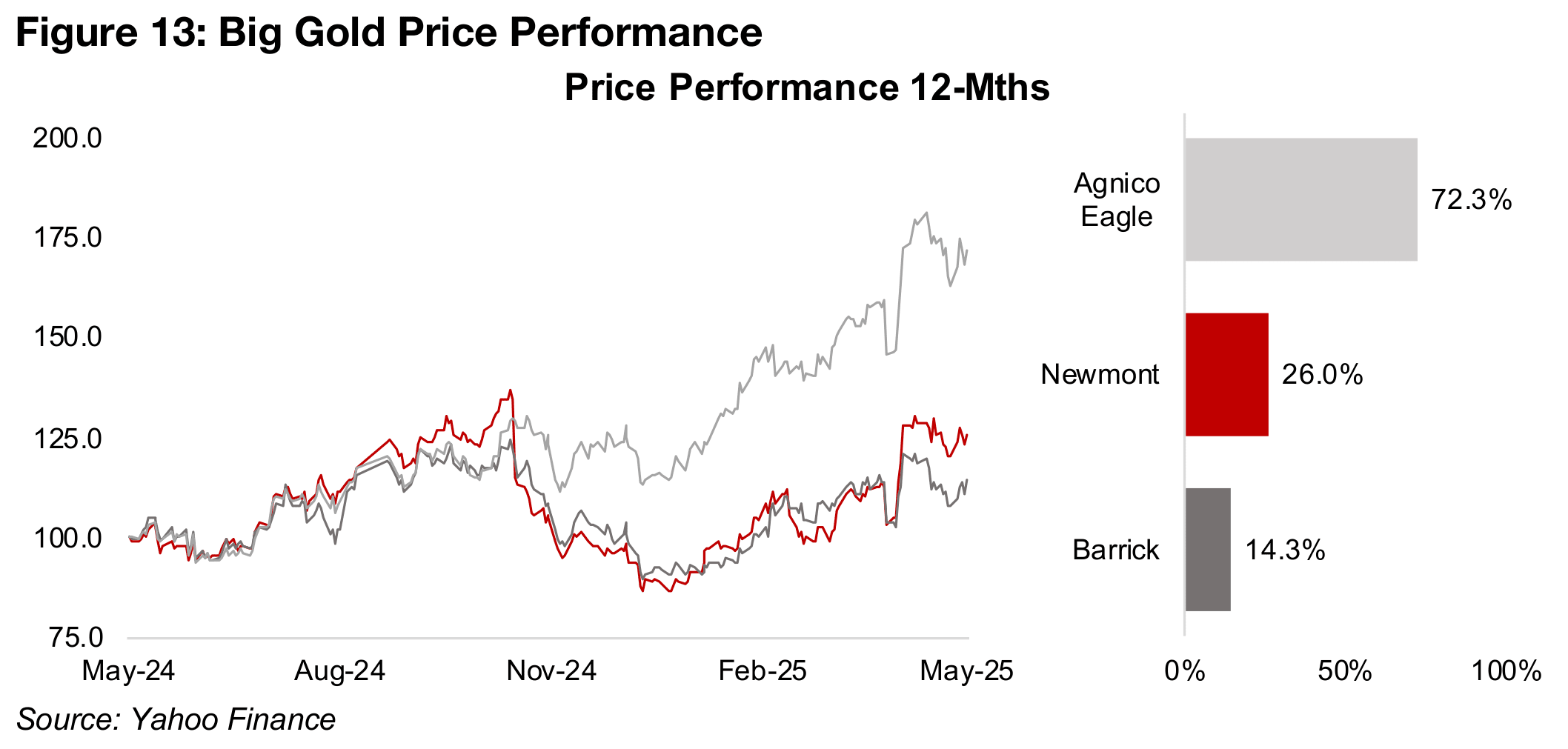

The share prices of the Big Gold stocks have all gained over the past year, as would be expected given the surge in the gold price, but only the Agnico Eagle stands out for substantial gains, up 72.3%, given the strong rise in core operating profitability. Newmont is up just 26.0% over the past year, and Barrick has lagged, with only a 14.3% rise, given a weaker net income growth than the sector.

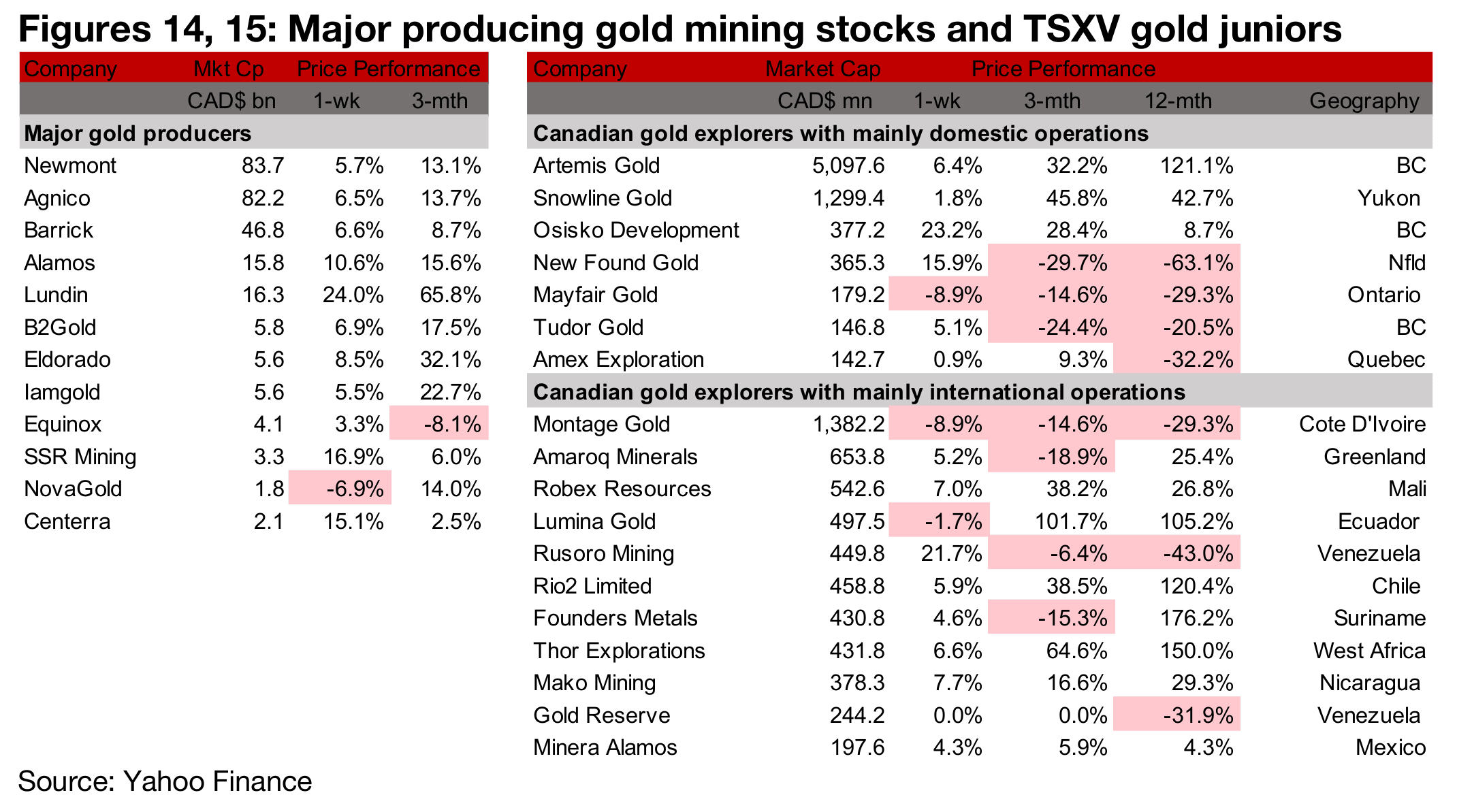

Major producers and TSXV gold nearly all rise

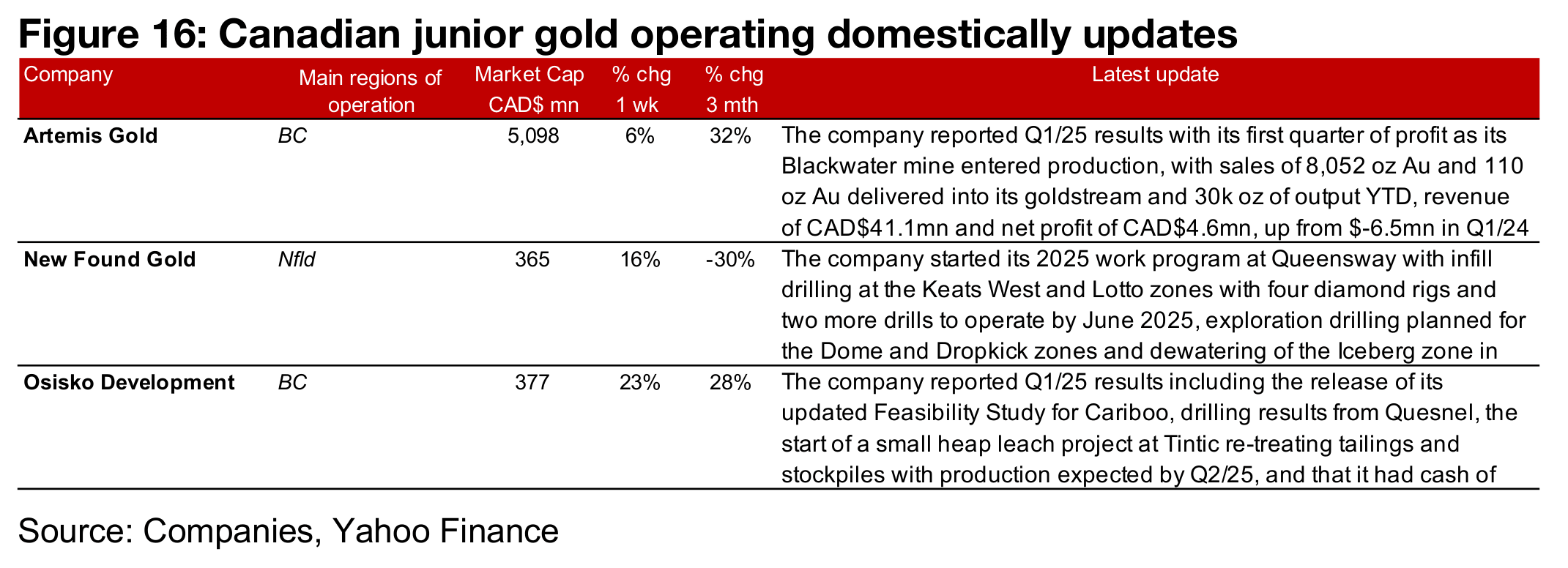

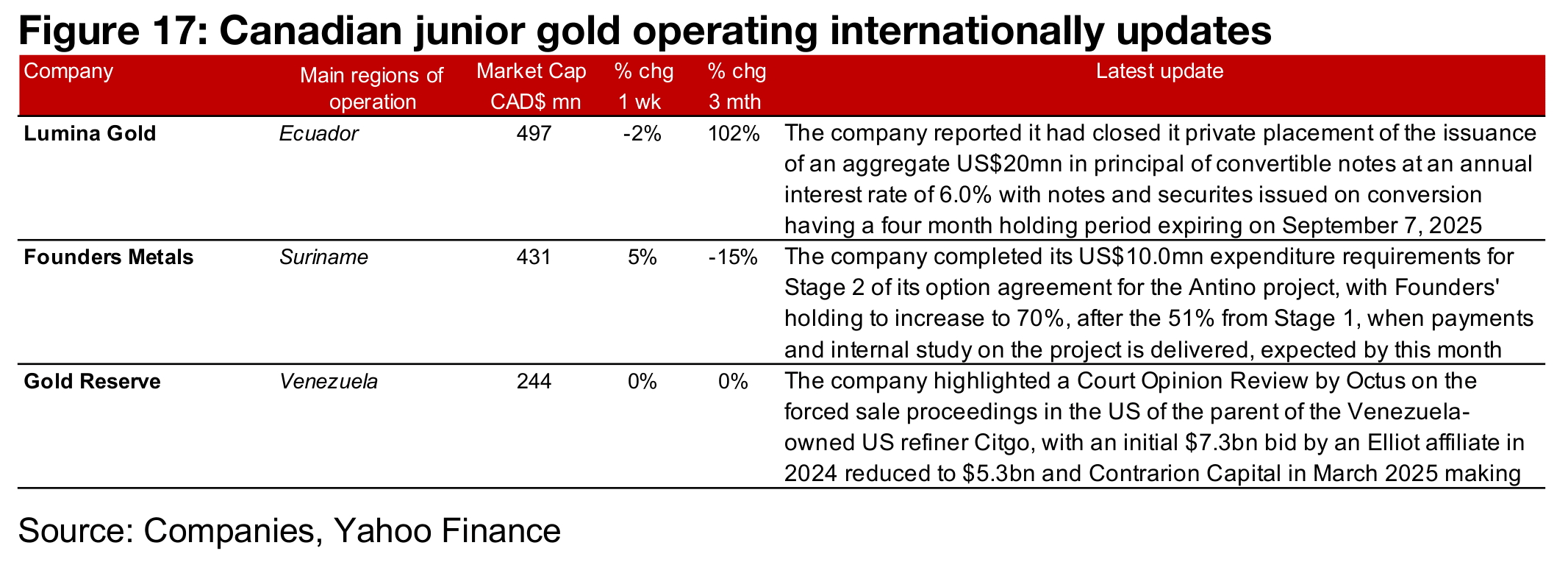

The major producers and TSXV almost all rose on the gain in the metal price (Figures 14, 15). For the TSXV gold companies operating mainly domestically, Artemis reported Q1/25 results, New Found Gold started its 2025 work program at Queensway and Osisko Development also announced its first quarter results (Figure 16). For the TSXV gold companies operating mainly internationally, Lumina closed its US$20mn private placement of convertible debentures, Founders completed its Stage 2 capital expenditure requirement for Antino, increasing its stake to 70% from 51%, and Gold Reserve highlighted a Court Opinion Review by Oculus covering the ongoing Citgo sale proceedings (Figure 17).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.