05 June, 2023

Battery Metals Revert to Trend

Author - Ben McGregor

Gold edges up as 'risk-on' move continues

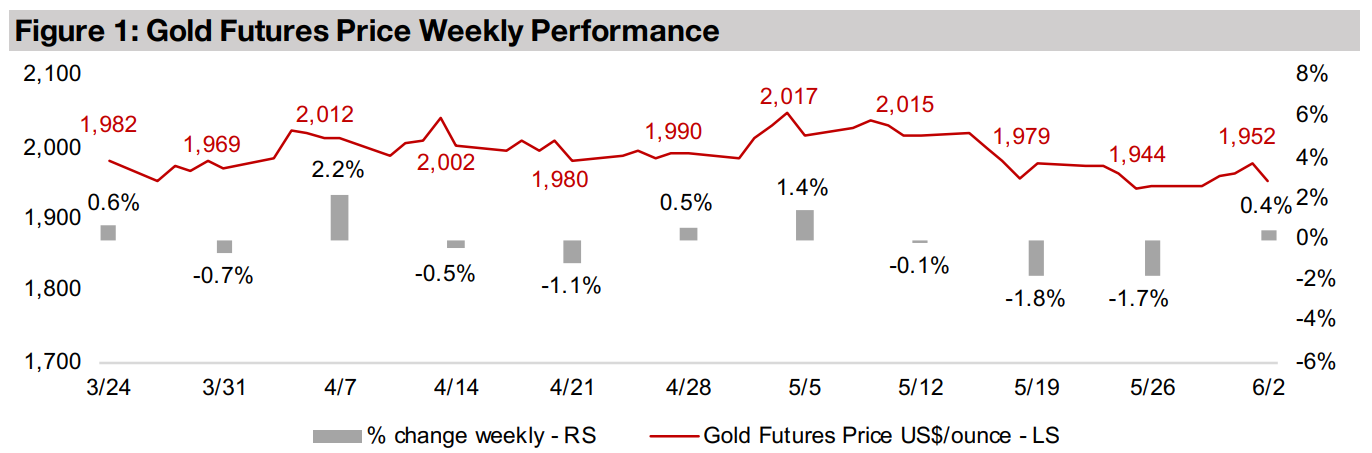

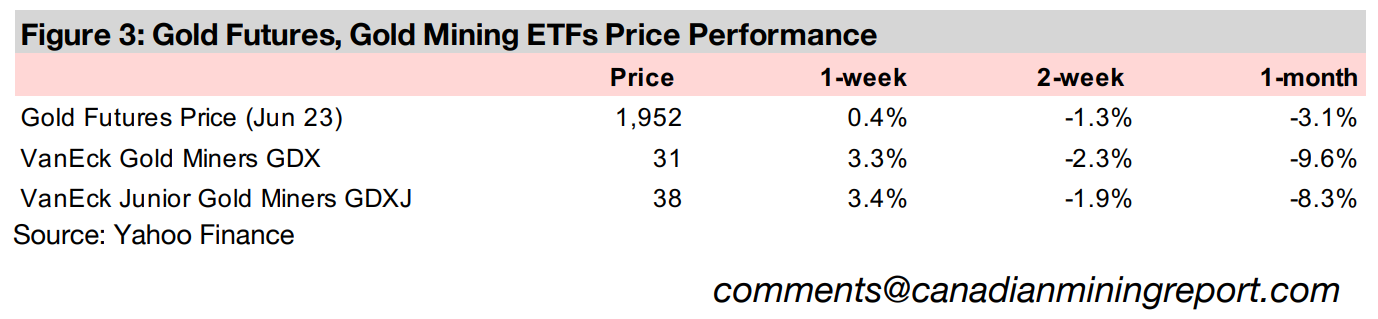

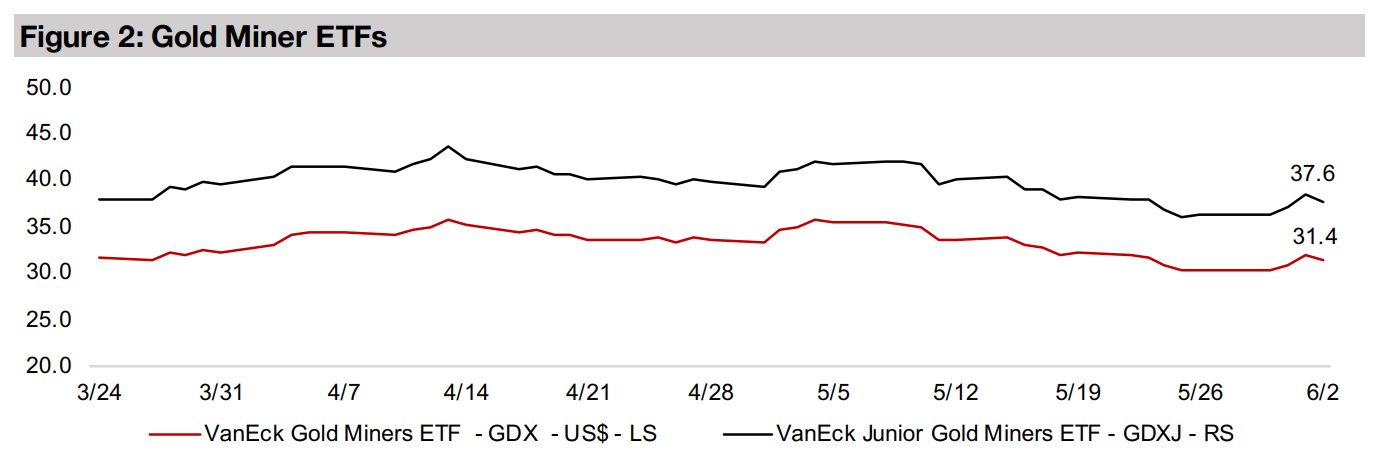

Gold rose 0.4% to US$1,952/oz as safe havens stagnated as the 'risk-on' move into equity markets continued, propelled by relief over a US debt ceiling deal, although gains in the S&P 500 have been concentrated mainly in just a handful mega-caps.

Battery metals pullback to pre-global health crisis trends

This week we look at battery metals, which have declined over the past year, reverting to pre-global health crisis trends, while the performance of the TSXV stocks in the sector are mixed, with several still being driven up by company specific factors.

Battery Metals Revert to Trend

Gold edged up 0.4% to US$1,952/oz and has continued to have issues over the past

two months solidly holding the US$2,000/oz level. The downward pressure on gold

over the past few weeks has mainly been driven by a shift to 'risk-on' in markets as

a debt ceiling deal was reached in the US and there was a continued surge into AI

stocks. However, the big AI moves in the S&P 500 have been mainly concentrated in

a single stock, Nvidia, with more muted gains for the rest of the index outside of a

few mega-cap names, mainly tech, also including Apple and Google.

While a relief rally following the debt ceiling deal could have been expected, beyond

this short-term lift, it is unclear what will keep this rally going. While the price to

earnings ratio for the S&P 500 at 25x currently, is well off its December 2020 peak of

39x, it is still hardly inexpensive in historical terms, given an average since 1950 of

18x. Meanwhile market liquidity in the US, which had been rising over first half,

particularly boosted by measures following the banking crisis, is largely expected to

contract over second half 2023 and there are widespread fears of an imminent global

recession. Should all of these negative drivers converge at once, there could be a

rapid reversal to 'risk-off' and a return to safe havens like gold.

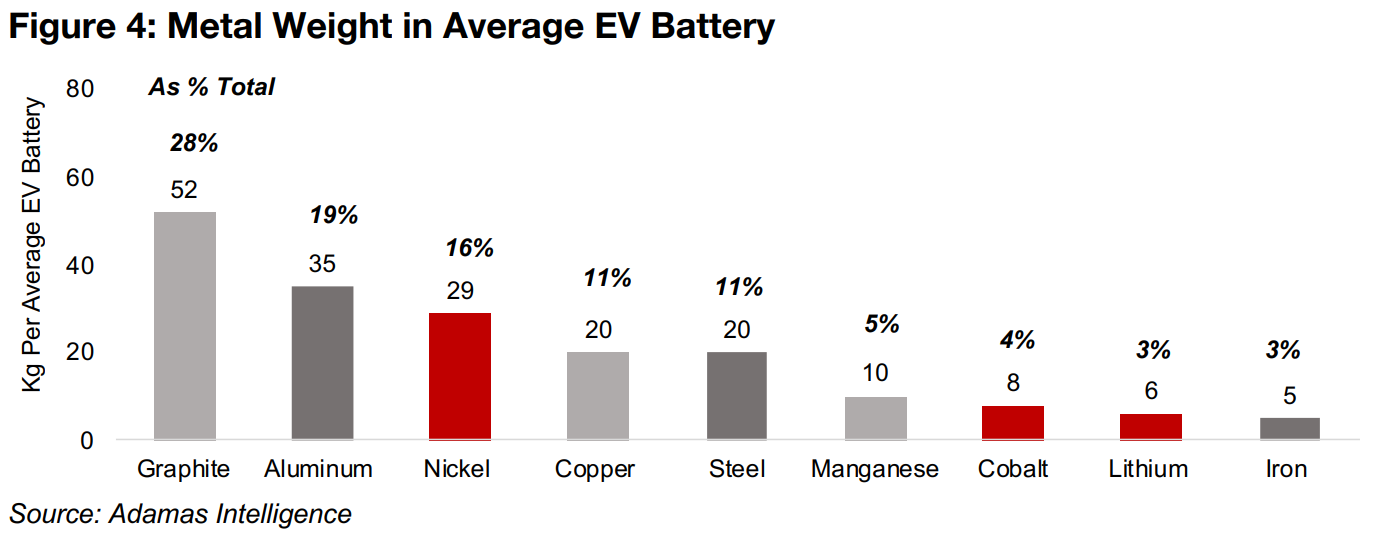

Nickel, cobalt and lithium have largest demand component from EV batteries

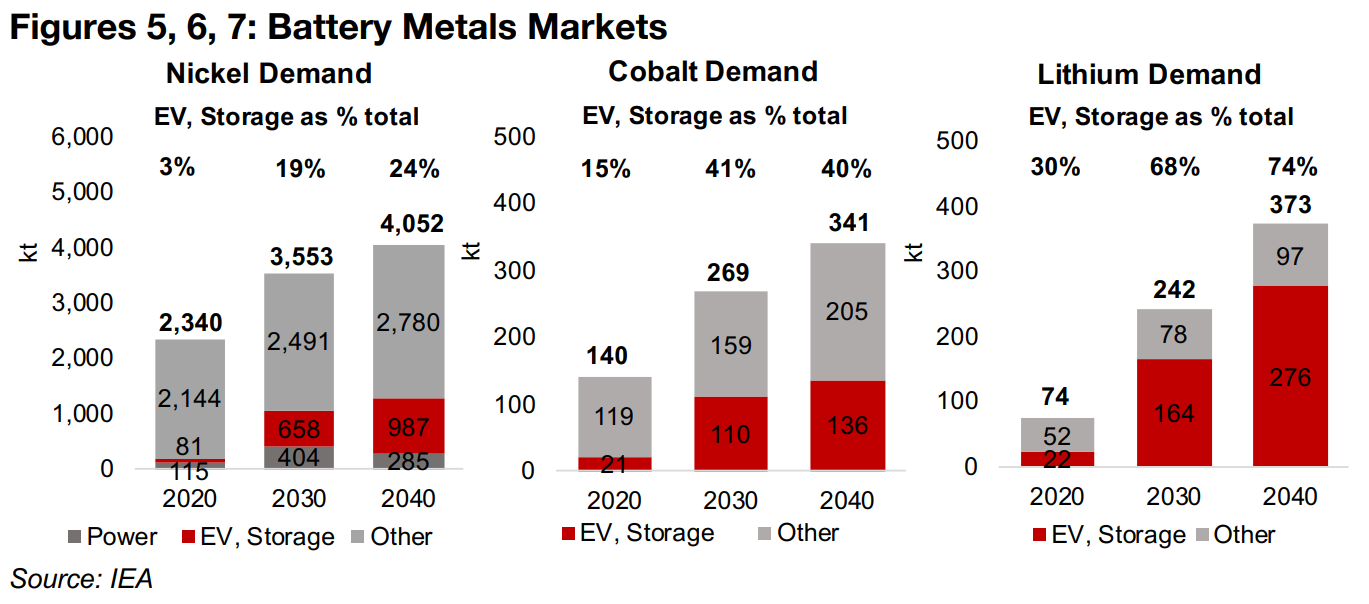

While gold and most other precious metals have been reasonably robust over the past year, some moderate recent pressure notwithstanding, battery metals have been less resilient, with all of them declining. While nine metals make up a large proportion of electric vehicle batteries, only three, nickel, cobalt and lithium are expected to have the largest component of their demand coming from EV batteries over the next two decades (Figure 4). While graphite is the largest metal component of EV batteries, at 28% of the weight, it is not widely publicly traded, so pricing data is scarce. Copper is also a critical component, but EVs and storage are only expected to be a small 2.8% of its total demand by 2030 and 3.5% by 2040.

The total proportion of the demand for aluminum, steel and iron from EV batteries is also small. In contrast, EVs and storage are expected to jump from just 3% of nickel demand in 2020 to 19% in 2030 and 24% in 2040, even under conservative scenarios based on stated government policies (Figure 5). The IEA also releases sustainable development scenarios which would require significantly higher amounts of battery metals. For cobalt, EV and storage demand was 15% of the total in 2020, and is expected to increase to 41% by 2030 and then remain roughly flat at 40% by 2040 (Figure 6). EV and storage is expected to be by far the majority of lithium demand by 2030, at 68%, up from 30% in 2020, rising to 74% in 2040 (Figure 7).

Battery metals reverting to post global-health crisis trends

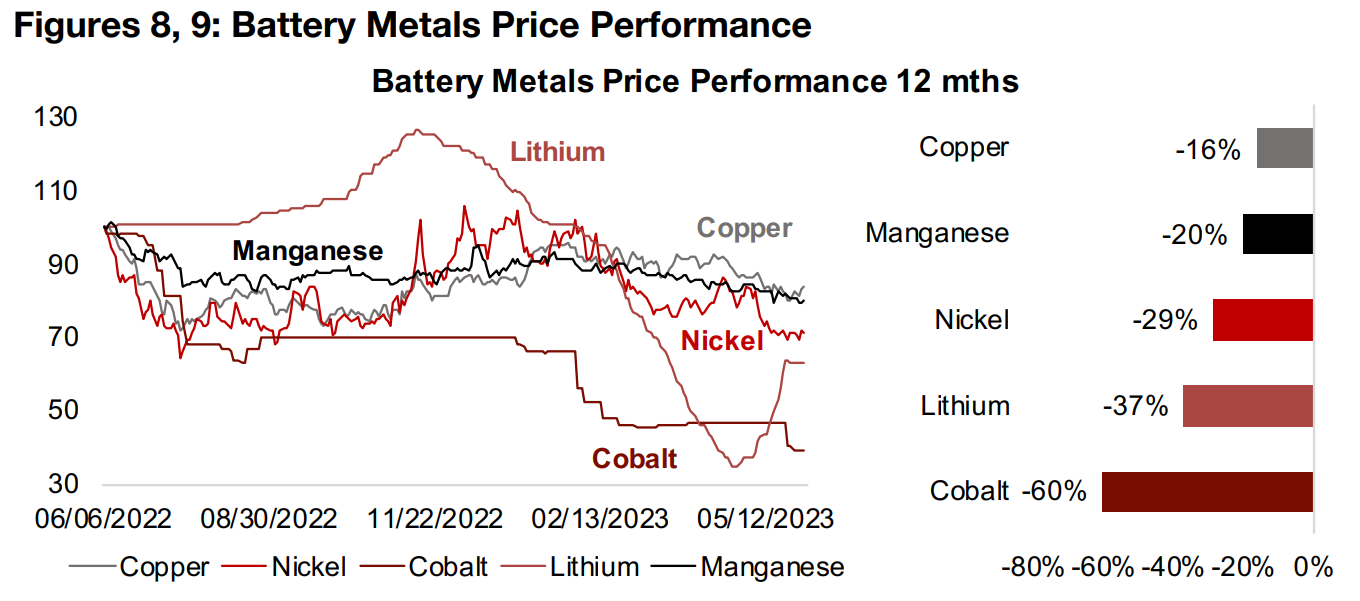

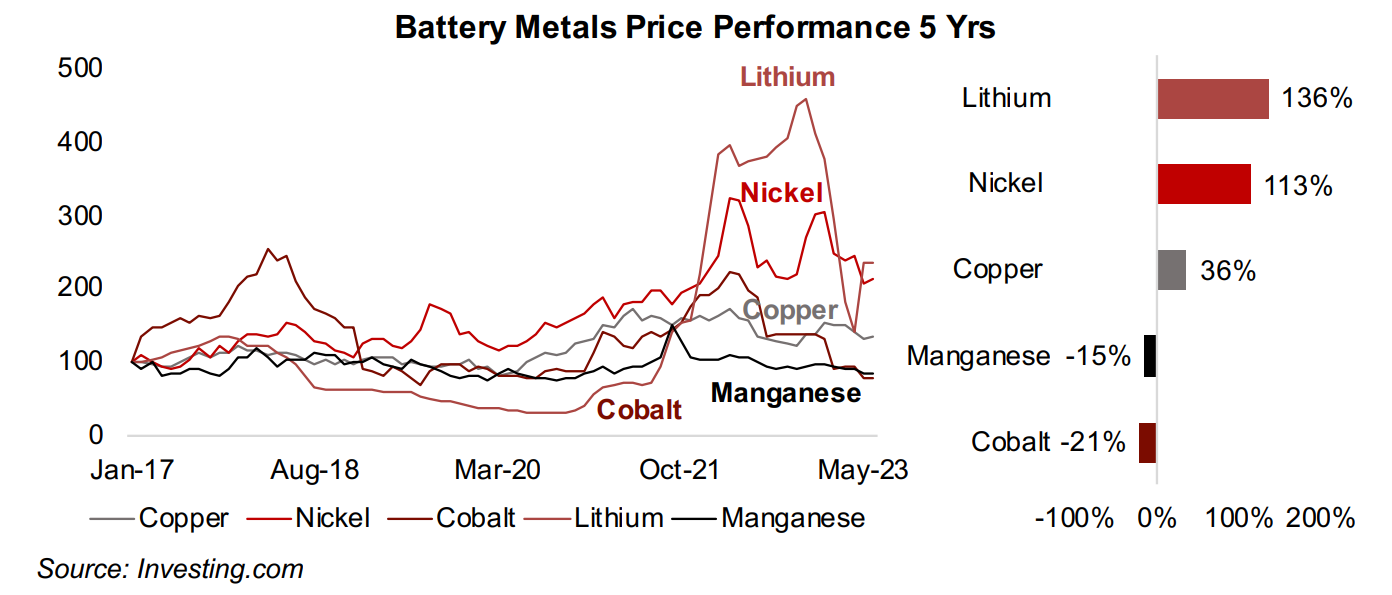

All of the major battery metals are down by over -15% in the past twelve months,

with copper declining -16%, manganese dropping -20%, nickel falling -29%, and

lithium and cobalt taking major hits, losing -37% and -60% (Figure 8). However, for

most of these metals, looking at their five-year performance since 2017, the declines

this year seem to be a reversion to medium terms after an unsustainable boom driven

by supply constraints during global health crisis (Figure 9).

Lithium, nickel and copper were already in several year uptrends prior to the financial

crisis, and remain up 136%, 113% and 36%, respectively, since 2017. In contrast,

manganese was relatively flat and cobalt trending from since 2017, and are now down

-15% and -21%, respectively, over the past five and half years. For the rest of the

year and into 2024, the broader macro picture looks set to weaken, which could drag

down the battery metals overall, especially if EV demand weakens. However, sector

specific factors will continue to drive spreads in the relative performance between

these metals, which we highlight below for nickel, cobalt, and lithium.

Electric vehicle sales growth strong in absolute terms, but well off peak

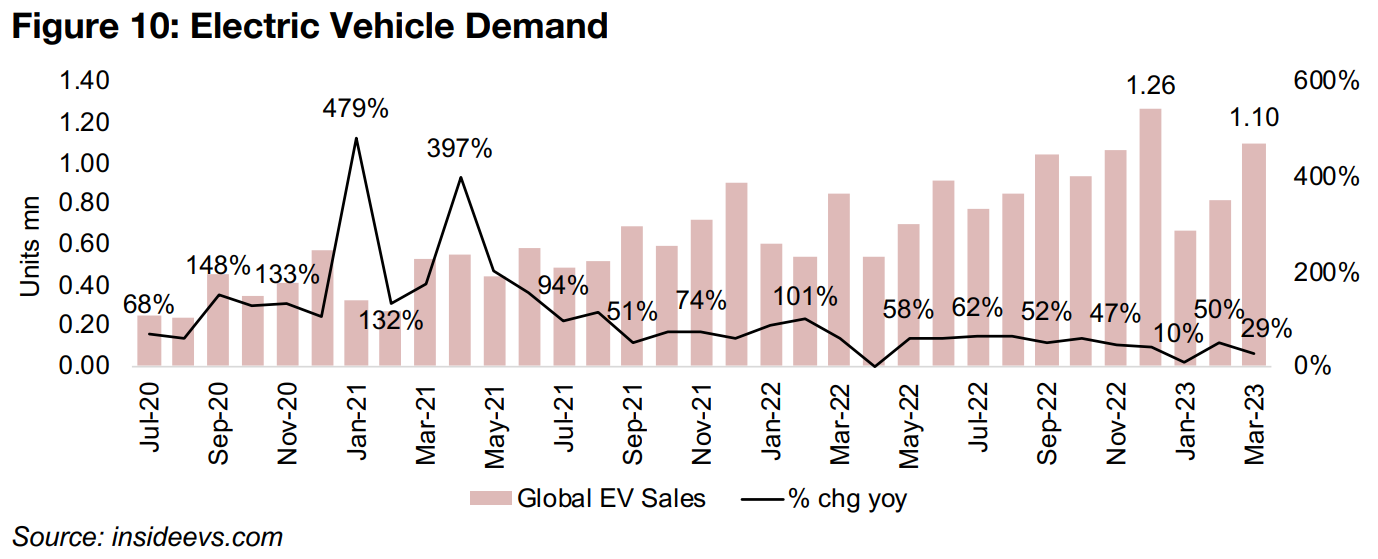

While global electric vehicle sales are still growing rapidly in absolute terms, in relative

terms there has been a clear cooling compared to the 2021-2022 boom. There were

1.10mn units sold globally in March 2023, up 29% yoy, and a 50% rise in February

2023 (Figure 10). However, the rise in January 2023 at 10% yoy was one of the

weakest in recent years, and there was a -1.0% contraction in April 2022. The average

growth from 2022 to March 2023 at 52% is less than a third the average 167% in

2022.

There are concerns that the EV sales growth rate could continue to decline, especially

as inflation has boosts the price of these vehicles, which are already expensive versus

alternatives. Also, China is the number one global market for electric vehicles, and

major subsidies offered by the government there towards electric vehicle purchases

have ended, which is also expected to hit demand.

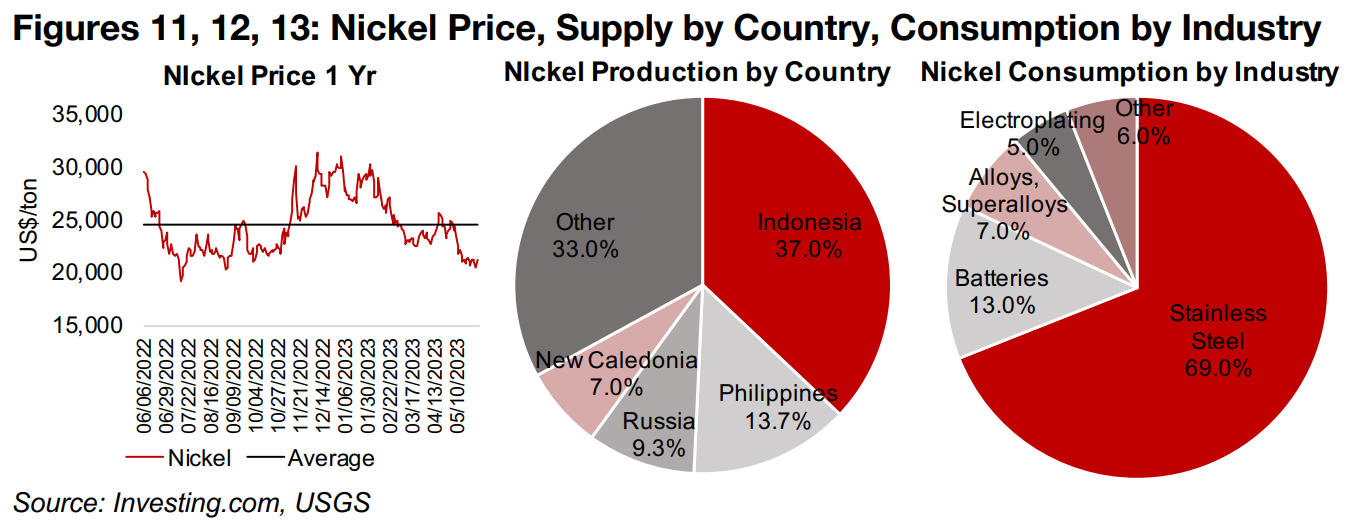

Nickel price declining on production ramp up and demand concerns

After a price spike in March 2023 driven by Russia's invasion of Ukraine (Figure 11), which raised supply concerns given the former's 9.3% contribution to global nickel supply, the nickel price eased through mid-2022. However, it spiked again from November 2022, on fears of potential supply constraints from Indonesia, the largest global nickel producer, at 37.0% of the total, and New Caledonia, the fourth largest, at 7.0% (Figure 12). However, nickel has declined in 2023 as production from Indonesia and China is expected to increase and global recession fears have driven concerns of lighter demand from the stainless steel and battery sectors, which represent 69.0% and 13.0% of nickel demand, respectively (Figure 13).

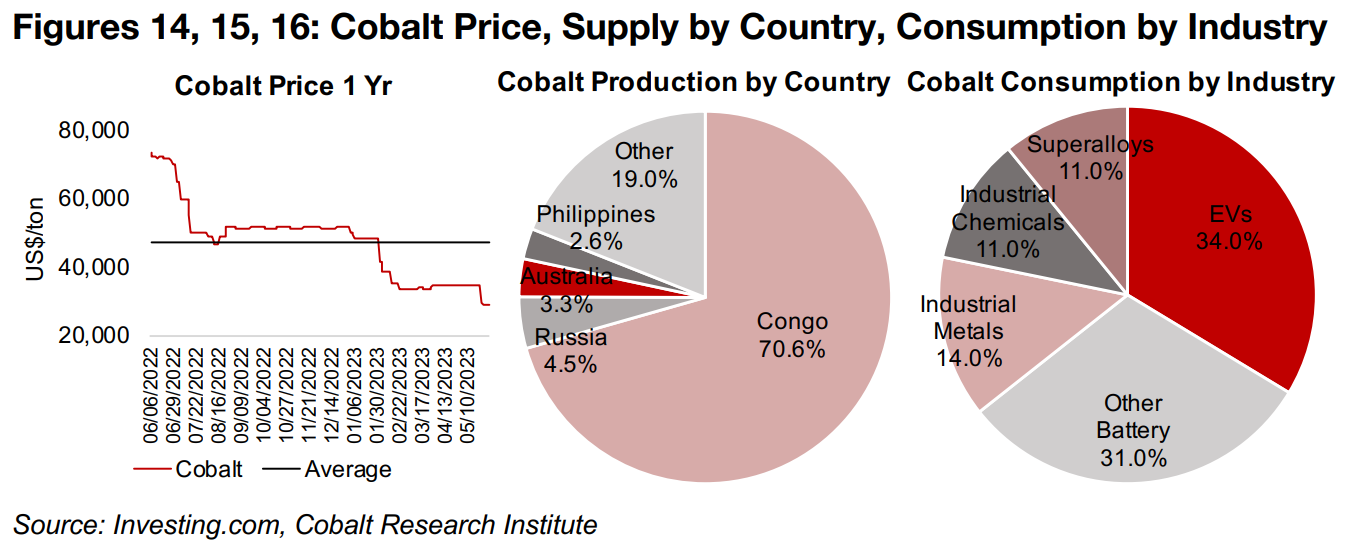

Cobalt price continues to trend down on surging supply

After reaching historical highs in early 2022, cobalt plunged nearly 40% by mid-2022, and then flattened before another 35% decline from December 2022 to January 2023 (Figure 14). While the earlier price boom had been driven by a rising demand from the EV sector, which is 34% of cobalt demand, there had been a decline in supply because of the global health crisis (Figure 16). The fall in the cobalt price has especially been driven by the supply side, with refined cobalt output expected to rise 24% in 2023, versus an only 8% demand increase. Meanwhile cobalt mining capacity surged by 42% just from 2020 to 2022, driven mainly by the Democratic Republic of Congo, at 70.6% of supply, but also from an expansion in Indonesia (Figure 15).

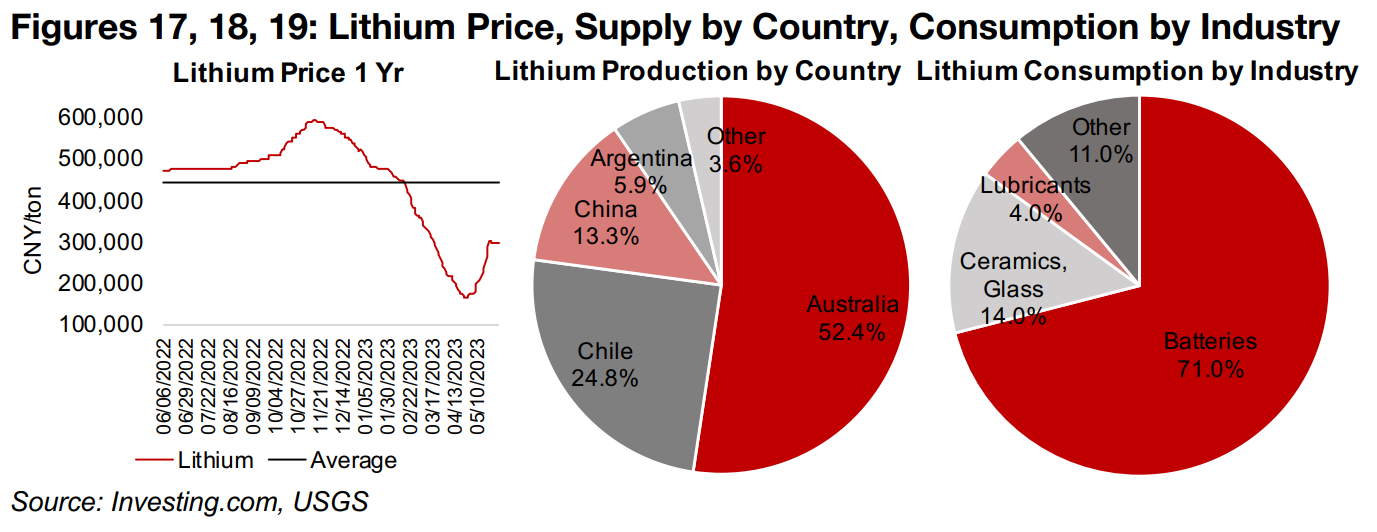

Lithium price plunges by 69% followed by 68% rebound

Lithium has been volatile over the past year, surging to a historical peak in November 2022, plunging 69% through to April 2023, and recovering 68% to June 2023 (Figure 17). Batteries are already the majority of lithium demand, at 71.0% of the total, and concerns over easing demand for electric vehicles by late 2022 had affected the price negatively (Figure 19). However, supply factors were possibly even a greater issue, with a large increase in lithium capacity expected to come online in 2023 in China, with the country producing over 70% of the processed global lithium supply.

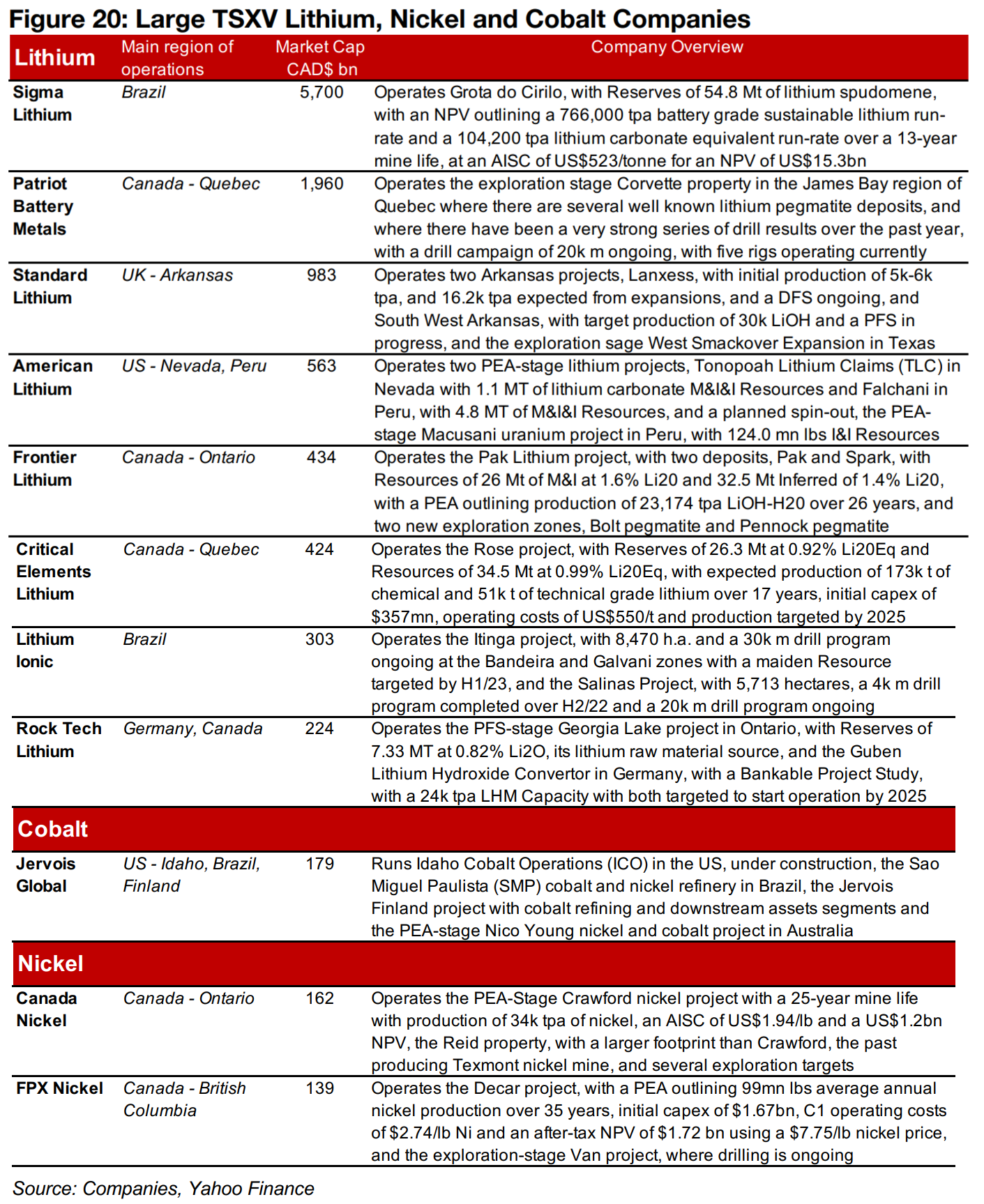

TSXV larger battery metals companies dominated by lithium

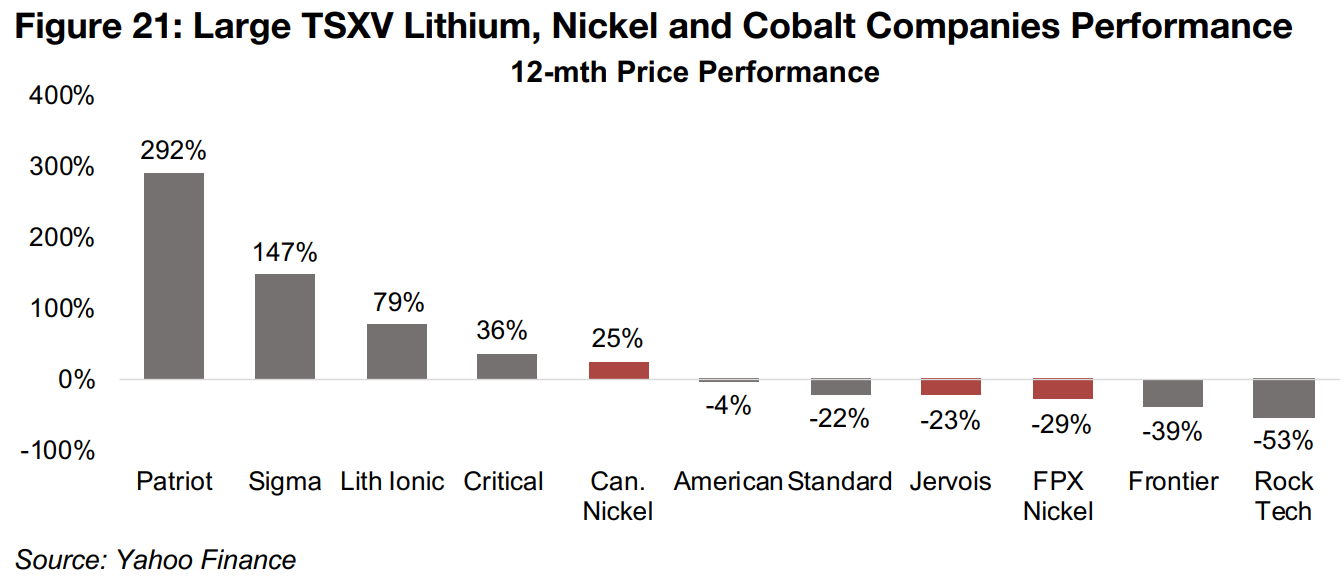

The battery metals companies listed on the TSXV are mainly lithium companies,

which comprise 26% of the aggregate market cap of TSXV metals and mining sector,

significantly above gold, the next largest sector, at 14% (Figure 20). Just two

companies, Sigma Lithium, with a market cap of CAD$5.70bn, and Patriot Battery

Metals, with a market cap of US$1.96, account for the majority of this, and have seen

by far the largest gains over the past year, up 292% and 147%, respectively (Figure

21). The other strong TSXV battery metals performers have been Lithium Ionic, and

Critical Elements Lithium, up 79% and 36%, respectively.

While these companies have been driven by particularly outstanding company

specific drivers, other TSXV lithium companies have seen the downtrend in the lithium

price offset continued operational progress, with American Lithium, Standard Lithium,

Frontier Lithium and Rock Tech Lithium down -4%, -22%, -39% and -53%,

respectively. There are relatively few larger TSXV listings for the other battery metals

sectors, with only a single stock with major cobalt exposure, Jervois Global, with a

market cap of $179mn, declining -23% over the past year, driven by the slide in the

cobalt price. There are two larger nickel stocks, Canada Nickel, with a market cap of

$162mn and gain of 25% over the past year, and FPX Nickel, with a market cap of

$139mn and -29% decline in its share price.

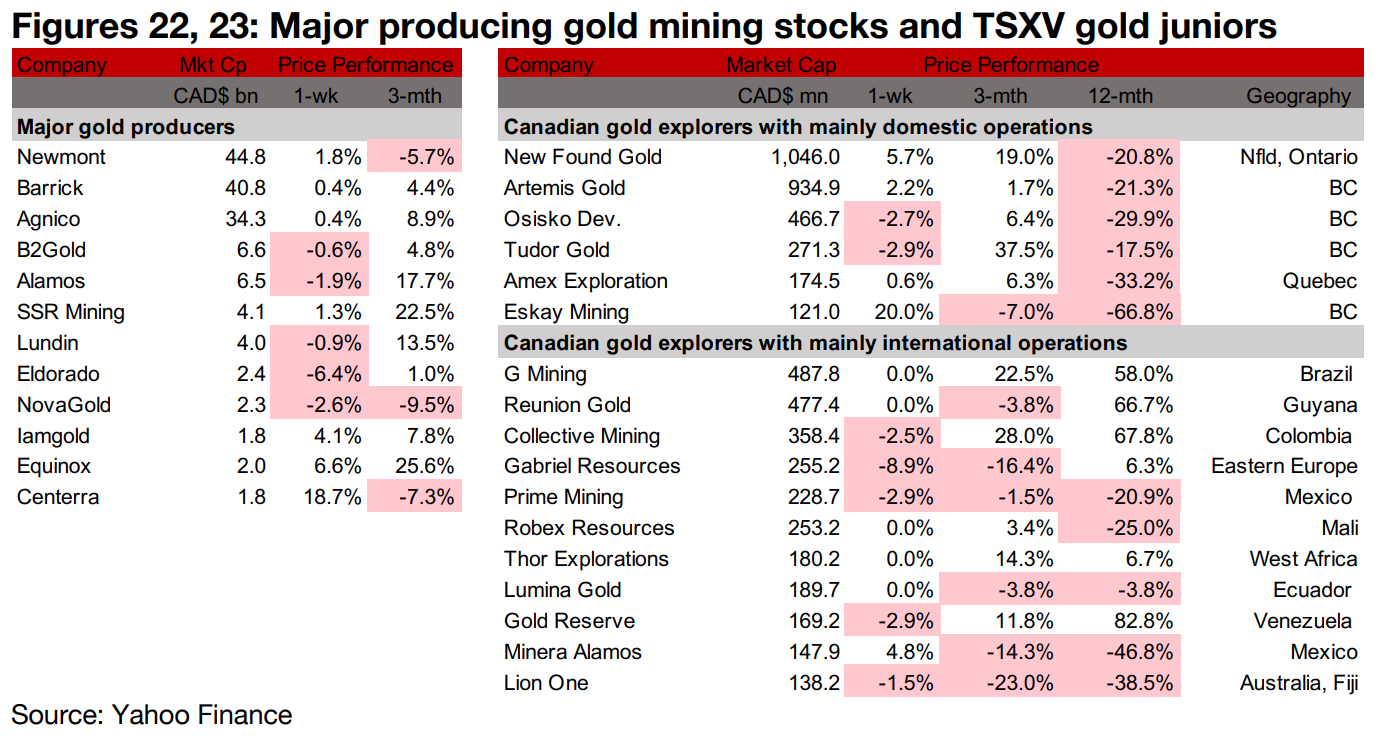

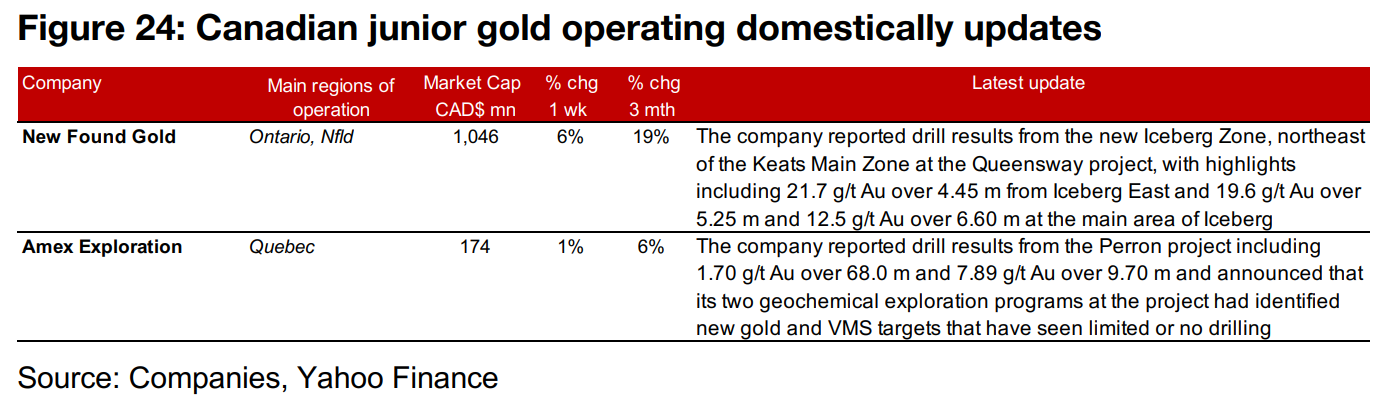

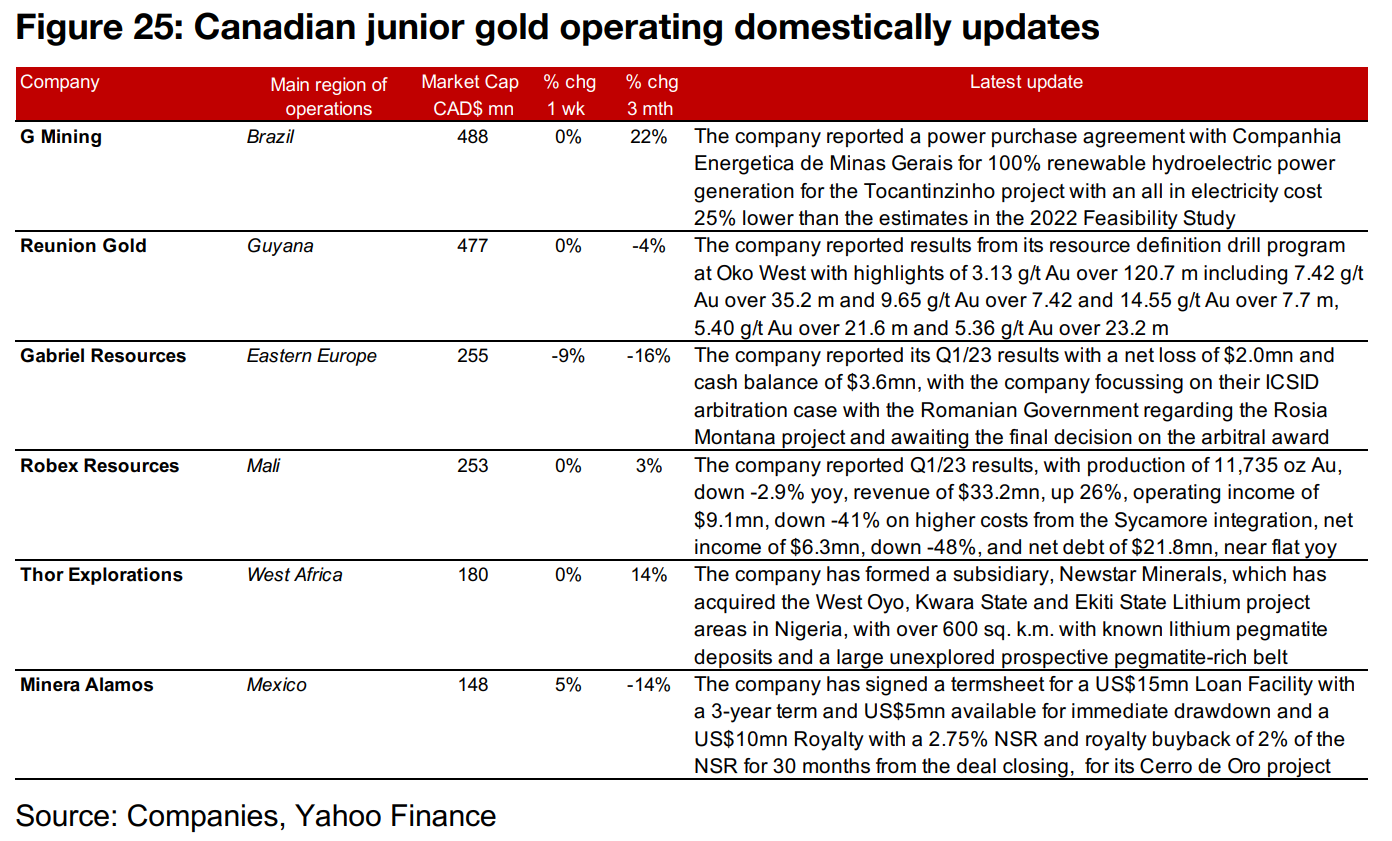

Producers and large TSXV gold mixed

The gold producers all declined and large TSXV gold were mixed as the gold price edged up and equity markets rose (Figures 22, 23). For the TSXV gold companies operating domestically, New Found Gold reported drill results from the new Iceberg Zone of Queensway and Amex Exploration released drill results from Perron and announced that two geochemical exploration programs had identified new gold and VMS targets at the project (Figure 24). For the TSXV gold companies operating internationally, G Mining Ventures reported a hydroelectric power purchase agreement for Tocantinzinho and Reunion Gold announced drill results from Oko West. Gabriel Resources and Robex Resources reported Q1/23 results, Thor Explorations formed a new subsidiary focussed on lithium in Nigeria and Minera Alamos signed a termsheet for a US$15mn Loan Facility and US$10mn Royalty (Figure 25).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.