May 11, 2023

Crisis Protection and Megatrend Upside: WATCH This Stock

Contents

- As the Banking Crisis Unfolded, This Asset Was Soaring

- A small Canada-based silver company soared by 48% over the same timeframe.

- Why Did Silver Do So Well During the Banking Crisis?

- Solar Energy Demand Meets Silver Supply Crunch

- All major silver demand categories reached record highs in 2022.

- How To Play This BULLISH Setup?

- AbraSilver's Gold-Silver Project Provides Exposure to Both "Safe Havens"

- A Well-Financed Company Backed by Industry's Biggest Names

The banking crisis isn't over.

In fact, it is just about to claim its next victim.

First Republic, a US-based bank, is on the brink of collapse.

Its shares are down 98% since February.

The Fed and major US banks are trying to bail it out... but the writing is on the wall.

First Republic is done.

Its equity is almost worthless.

It's anyone's guess which bank is going to go down next.

We will not be guessing here. Instead, we will focus on how you can protect your capital amid this crisis.

The answer may surprise you...

Read on.

As the Banking Crisis Unfolded, This Asset Was Soaring

First Republic wasn't the first bank to collapse. Before it, Silicon Valley Bank and Signature fell victim to the Fed's ruthless interest rate hikes.

The Fed is hell-bent on driving up interest rates. It doesn't care if it causes a recession... neither does it care if hundreds of thousands of people lose their jobs.

The Fed wants to slow down inflation, and it only knows how to do it through interest rate hikes.

So be prepared.

If you want to protect your portfolio, you need to know this.

As the banking crisis started unfolding in early March, a certain kind of asset started soaring...

Between March 3 and April 13, a US banking index has lost about 25% of its value.

Meanwhile, gold appreciated by 9.9%.

And silver went up 21%.

In other words, silver outperformed the KBWB Banking ETF by 46 percentage points... in a little over a month.

This tells us that silver has acted as a first-rate crisis protection investment.

And it confirms our view that silver could be one of the best investments for the remainder of 2023.

But there's more...

A small Canada-based silver company soared by 48% over the same timeframe.

(Be aware that past performance doesn't guarantee future results. See our full disclaimer)

We will discuss this company in detail soon...

For now, you might write down its name and symbol: AbraSilver Resource Corp. (TSXV:ABRA, OTC:ABBRF, FRA:1AH0).

Why Did Silver Do So Well During the Banking Crisis?

Silver is a crisis investment, just like gold.

When markets get volatile, gold tends to perform well, and silver follows.

But silver is also more volatile. So, it could outperform gold on the upside.

That, in fact, is why a lot of investors hold both gold and silver.

Morgan Stanley research says that silver could be up to three times more volatile than gold.

In other words, it could provide a 3x leverage to the price of gold, which is the ultimate safe haven.

So, when a crisis begins and gold goes up 10% in response, silver may outperform it by up to three times.

This is why thousands of investors buy silver when there is "blood in the streets."

They know about this "built-in leverage."

This is one of the reasons why silver has been performing so well during the banking crisis.

Another one is that the investing public has lost trust in the traditional banking system.

After investors saw Silicon Valley Bank collapse after a bank run, they started doubting if the financial system was as sound as everybody thought it was.

April data showed that banking customers pulled about $100 billion from US banks...

Without a doubt, some of that money went into safe haven investments such as gold and silver.

These "monetary metals" do not depend on the Fed or any other regulator. They have served as "investments of last resort" for thousands of years. There's no reason why they would stop providing this essential service now.

In other words, silver and gold outperformed because of public distrust in the financial system.

And that distrust is likely to continue as more banks stumble and some fail.

This tells us that right now is a good moment to give silver another look.

So far this year, gold and silver have shown that they still have their monetary features. They may provide capital protection amid a total market turmoil.

But silver has a special feature.

Unlike gold, it's also an industrial metal.

And it is a critical part of the clean energy revolution.

Let us explain...

Solar Energy Demand Meets Silver Supply Crunch

This could be one of the most bullish setups for silver in decades.

On the one hand, you have the banking crisis and rampant inflation.

Silver, as a monetary metal, provides the "safe haven" features to investors seeking to protect their capital.

But unlike gold, silver has a lot of industrial applications. This is due to the fact that silver is one of the best conductors of electricity.

These days, solar energy is the biggest driving force behind the demand for silver.

World Silver Survey says that the surging demand for the metal is going to continue as solar energy maintains its momentum.

The photovoltaic (or PV) technology is critical for solar energy.

And PV remains the top source of green electricity.

But this technology has a lot of room to grow.

In 2022, total installed PV capacity contributed just 4% of worldwide electricity demand.

This number is growing. As well as the share of the total silver supply that goes into green energy.

In 2019, 11% of the world's silver supply was used for green energy needs.

In 2020, this number rose to 13%.

Between 2024 and 2030, silver demand for solar installations will fluctuate between 70 and 80 million ounces, according to Silver Institute.

It means that each year the world will need tens of millions of ounces of silver... This demand is consistent, and it won't go anywhere.

The question is... will there be enough supply?

It doesn't look like it.

Experts from MKS PAMP, a trading services company, say that over the next five years, the global silver shortage could reach 100 million ounces.

The most recent numbers published by the Silver Institute back up this claim.

All major silver demand categories reached record highs in 2022.

This is a unique and bullish setup.

Total silver demand reached a record peak of 1.2 billion ounces.

Industrial demand rose by 5% compared to 2021, physical investment demand increased by 22%, and jewelry and silverware demand rose by 29% and 80%, respectively.

Since before the pandemic, total silver demand has grown by 38%.

Meanwhile, silver production slowed down.

You need to understand that a lot of silver comes as a by-product. It means that silver isn't what a lot of mining companies focus on.

They could have, let's say, a zinc mine with a little bit of silver in the mix. They are focused on zinc, and silver just "tags along."

In 2022, silver by-product output from the mines located in China and Peru fell. Primary silver mines also exist... but their production was mostly flat compared to 2021.

Peru's silver output fell by the most, driven by mine suspensions, falling silver grades, and social unrest.

Because of lower production and soaring demand, the silver market ended 2022 in a state of deficit. To be precise, the market deficit totaled 238 million ounces last year.

The Silver Institute points out that the total shortfall of 2022 and 2021 erased the combined surplus of the last 11 years.

And silver demand is growing... so you can only imagine what could happen if the industrial and investment demand continues soaring while silver supply doesn't catch up.

As we said earlier, this is one of the most bullish setups for silver in years.

How To Play This BULLISH Setup?

Investors have several ways to play this setup.

They could get exposure to silver through an exchange-traded fund.

It's probably the easiest way of adding silver exposure to a portfolio.

ETFs track the price of silver quite closely, and they are easy to buy and sell.

Physical silver is another option. Some investors prefer to invest in silver coins and bars.

But there is another way to profit from silver's "safe haven" status and the crazy (and positive) market imbalance created by the metal's role in the green transition.

Earlier, we mentioned that a silver junior, AbraSilver Resource Corp. (TSXV:ABRA, OTC:ABBRF, FRA:1AH0), has delivered what we call "leverage" to the price of silver.

In other words, it outperformed the metal itself.

Some mining companies have this feature.

When the price of the underlying commodity changes by, let's say, 1%, the price of the company changes more-in either direction.

This is why, in our opinion, silver mining companies and resource juniors could have a place in a portfolio as a "turbocharged" way of getting exposure to the price of a commodity.

But not all of them deliver this leverage.

AbraSilver has some fundamental advantages over the vast majority of its peers.

Let's see what they are.

AbraSilver's Gold-Silver Project Provides Exposure to Both

Both gold and silver are monetary metals. They are well-known for their "crisis upside" features.

When things go bad in the global economy, investors buy these, along with other safe havens such as the US dollar and Treasuries.

Abra owns the Diablillos project, which is located in the mining-friendly Salta province of Argentina.

According to the Fraser Institute, Salta was ranked #2 for investment attractiveness in the country in 2021.

Diablillos is the company's main asset. It is also an advanced-stage property.

You need to understand this... AbraSilver has done a lot of work already to explore and de-risk its Diablillos project.

It has an established resource estimate of 109 million ounces of silver and 1.3 million ounces of gold.

The project is also a relatively high-grade one. The average silver grade is 66 grams per tonne (or g/t), and the gold grade is about 0.79 g/t.

The company is advancing the project toward a pre-feasibility study.

As a reminder, a pre-feasibility study is basically a "business plan" for the project. The study outlines the project's logistics, capital cost requirements, and some technical information, such as whether the project should be mined as an open pit or as an underground operation.

Abra is advancing its project toward this stage right now.

And this is one of the biggest catalysts for the company.

When early investors see the signs that a project could potentially be economically viable, they revise their estimate of the company's value.

This is the most important catalyst for AbraSilver Resource Corp. (TSXV:ABRA, OTC:ABBRF, FRA:1AH0).

There are others...

Not only does the company work toward de-risking the existing resource... it has also made a new high-grade silver discovery outside the known resource area.

It made the discovery at the JAC zone, located about 500 meters (~1,640 feet) away from the existing resource.

Abra is actively exploring the new area. As of now, it is working on a 22,000-meter (~72,000-feet) drilling program.

The company is well-financed, so the budget for the program is there. The company won't likely need to raise funds to finish its planned 2023 drilling.

Potential exploration results would deliver intermediate-term catalysts as well, provided they are positive.

So far, Diablillos has delivered some great exploration results.

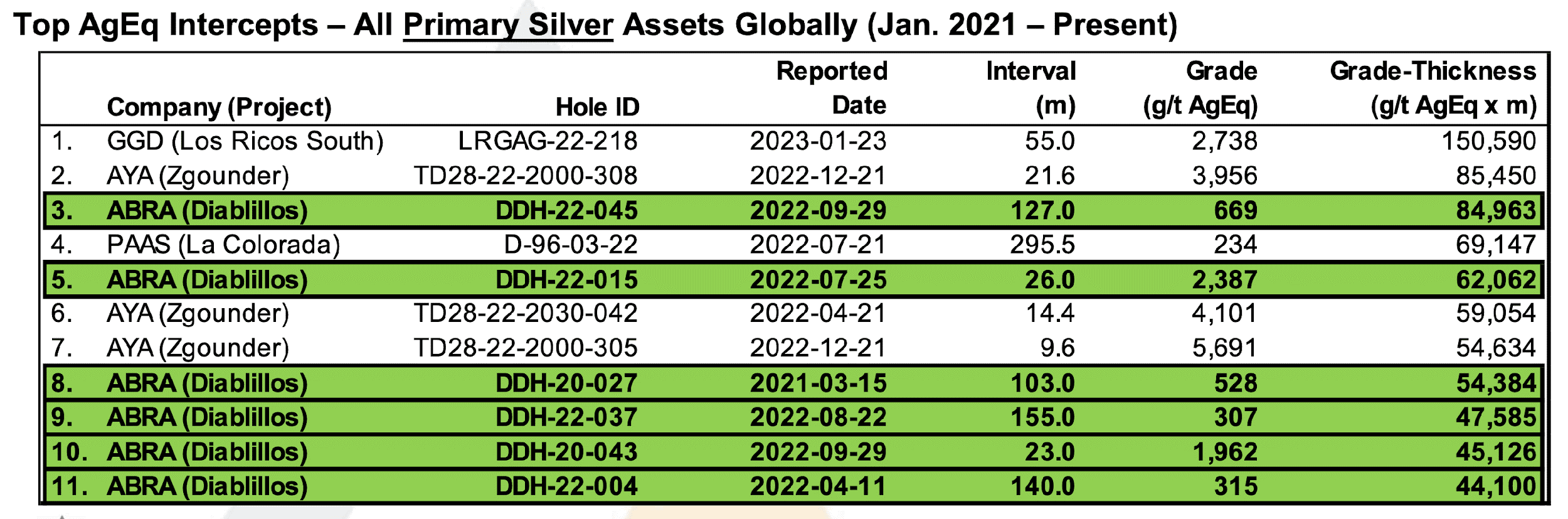

In fact, they were world-class. Estimated by a combination of grade and interval thickness, Diablillos delivered six out of 11 best silver drill results in the world between January 2021 and now.

The company's discovery hole at the JAC target also delivered an excellent interval of 87m grading 346 g/t silver and 0.15 g/t gold.

Abra has published assay results for about 40 holes drilled at JAC. And every single one of them encountered silver mineralization.

This is very impressive.

But, as we said, the biggest catalyst will be the prefeasibility study.

And the company has an ambitious goal.

Not only does it plan to prepare a "business plan"-like study on the whole Diablillos property... Abra also aims to prepare an initial resource estimate on the newly discovered JAC zone by the end of the fourth quarter of 2023.

There's yet more...

Abra has another property, La Coipita. It's a copper-gold project located in the San Juan province. San Juan, by the way, is Argentina's #1 province by investment attractiveness, according to the 2021 Fraser Institute Survey of Mining Companies.

And La Coipita is located in one of the world's most prolific copper-gold belts in Argentina.

Abra has the option to acquire 100% of La Coipita, which is a large 70,000-hectare (~173,000-acre) project.

As of writing, the company outlined a 2,000-meter by 1,500-meter (~6,500-ft by ~4,900-ft) porphyry system at the project.

And it has delivered some great exploration results.

For example, hole DDHC 22-002 delivered a continuous zone of 226m (~741 feet) of 0.34% copper, 0.07 g/t gold and 66 parts per million molybdenum. Abra says that the mineralization that the hole intersected remains open at depth.

The company plans to do follow-up drilling at La Coipita. So we will expect press releases and drill results from that project as well.

Abra has multiple catalysts. We will not be surprised to see it appear on a lot of investors' radars as it continues delivering progress at its Diablillos and La Coipita projects.

Some high-profile investors have already taken note.

A Well-Financed Company Backed by Industry's Biggest Names

Abra has about C$15 million (or ~USD11 million) in cash. This will be enough to do everything it plans this year.

This massive treasury didn't come from nothing.

Some of the titans of the mining industry, such as the mining guru Eric Sprott, were early investors.

In fact, Mr. Sprott owns about 12% of the company.

Institutions own about 30% of Abra. These are traditionally long-term investors known as "steady hands."

In 2022, the company had an average trading volume well in excess of one million shares daily.

In other words, this company has plenty of liquidity for individual and even institutional investors.

They have noticed the company's winning team and outstanding exploration results early on.

But it's not too late to put AbraSilver Resource Corp. (TSXV:ABRA, OTC:ABBRF, FRA:1AH0) on your watchlist.

The company's team consistently delivered great results... and we expect it to continue to do so.

Its CEO, John Miniotis, has almost two decades of experience in the mining industry. Before Abra, he was involved with such big names as Lundin Mining, AuRico Metals, and Barrick.

Mr. Miniotis has extensive experience in mergers and acquisitions, equity capital raising, and investor relations.

In other words, the areas that are critical for the success of an exploration-stage company that needs to raise funds to advance its projects toward their exploration and development milestones.

The company's Chief Geologies is Mr. David O'Connor, who has over 40 years of experience in the exploration, development, and acquisition of mineral projects in South America.

The rest of the company's team has extensive experience in Latin America as well.

The management owns about 4% of the compan's total shares outstanding. And this number is growing...

We view it as a vote of confidence.

AbraSilver Resource Corp. (TSXV:ABRA, OTC:ABBRF, FRA:1AH0) is one of the strongest resource juniors out there.

It has exposure to silver, gold, and copper. The monetary metals (gold and silver) have become immensely popular this year as the banking crisis unfolded.

This trend continues, and we expect gold and silver to provide investors with capital preservation and crisis protection.

Silver is also a clean energy metal. Above, we told you why the investment setup for silver is perfect right now. The metal faces soaring demand and limited supply.

Silver could be in for a massive and long-term bull market.

Not every investor has realized it yet.

But industry heavyweights such as Mr. Eric Sprott did. And he built a stake in Abra because he saw the company's potential.

This is not too late to join Mr. Sprott and other "smart money" investors to get exposure to AbraSilver Resource Corp. (TSXV:ABRA, OTC:ABBRF, FRA:1AH0).

SEE DISCLAIMER & DISCLOSURE BELOW

Sign up to receive our future articles and updates.

Disclosure

The Canadian Mining Report has been retained by AbraSilver Resource Corp. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by AbraSilver Resource Corp. and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in AbraSilver Resource Corp. and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More