July 10, 2020

Gold makes solid break through US$1,800/oz

Author - Ben McGregor

Gold futures holds above US$1,800 for three consecutive days

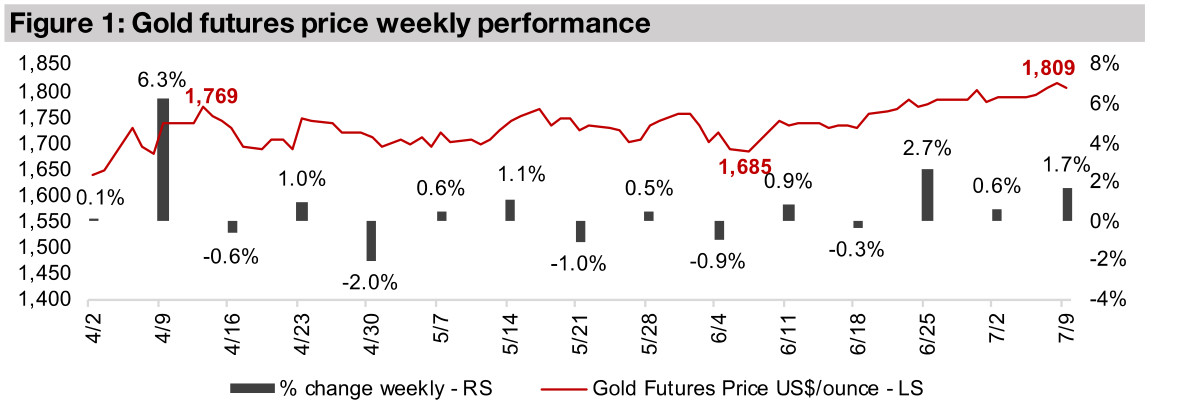

The gold futures price solidly broke through US$1,800/oz this week, and after briefly breaching the level last week, held above it for three days, peaking at US$1,818/oz on Wednesday and closing at US$1,809/oz on Thursday.

Producing miners up on rising gold price

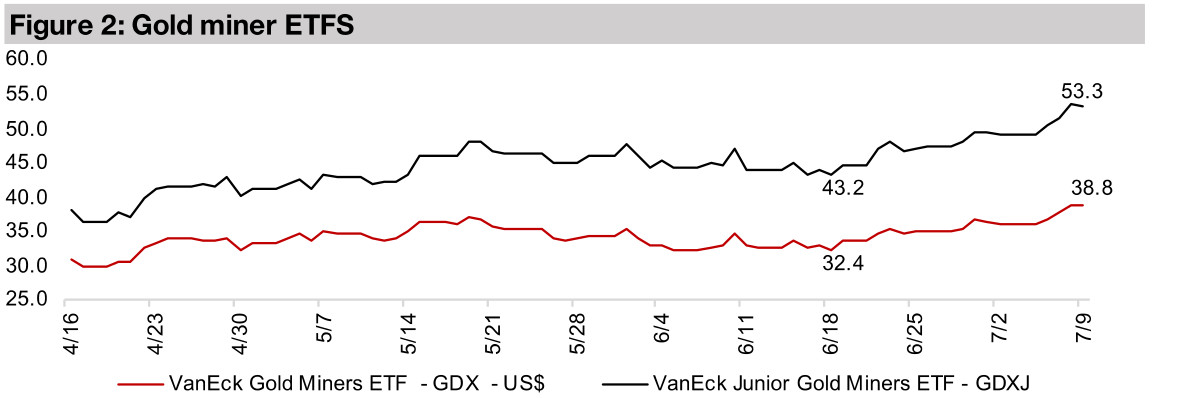

The jump in gold drove the producing miners up, with the GDX rising 7.2% for the week, and most major producing miners seeing gains, with many firms also seeing news flow over the past week.

Gold solidly breaks through US$1,800/oz

Gold solidly broke the US$1,800/oz level last week, after briefly breaching the level last week, with the gold futures price spiking to US$1,818/oz on Wednesday, and closing on Thursday at US$1,809/oz. This marked a solid move out of a range around between US$1,685 and US$1,769 that had held from April 2020 to June 2020. The immediate driver was comments by one of US Fed MPC committee members that implied that the outlook for the global economy remained weak, in spite of some better than expected economic data recently. However, we view the underlying drivers of the gold rise to be more persistent and pervasive than just this MPC member's comments, including; 1) a major monetary expansion by the US Fed which is expected to continue indefinitely, and could be followed by other global central banks if global economic weakness persists, 2) continued risks from the global health crisis, and 3) the likelihood that alternative assets to gold are likely to have to lower yields over the next few years than over the past few years, making holding gold more appealing.

How lower yields on alternative assets could drive gold

The key assets that are widely available alternatives to holding gold are; 1) cash, 2) bonds, 3) equity, and 4) real estate. We believe that while a few years ago, there was a strong case for these assets versus gold, in the current period, their yield relative to gold may not be as good, therefore in part driving the shift out of these assets and toward gold

Cash devalued via monetary expansion: The Fed's response in both the 2008 and current crisis has been clear; increase liquidity via aggressive monetary expansion. This type of expansion, all else equal, lowers the value of each currency unit versus gold, and naturally drives up the gold price. The Fed, of course, is not the only major central bank, and over these early months since the crisis started, we have not seen particularly aggressive monetary expansion by Europe, Japan or China's central banks. However, should the global crisis persist and economies slow further, we would expect to see these Central banks follow suit, reducing the value of cash further. Add to this the already near zero interest on cash holdings, and shifting to gold as an instrument to maintain monetary value looks appealing.

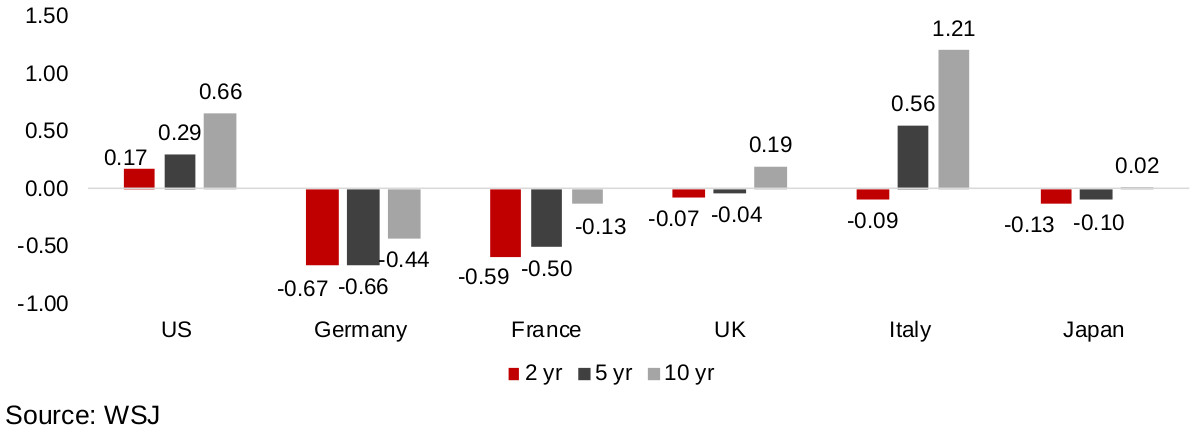

Negative yields on many global government bonds: Similar to cash, the extremely low yield on bonds in compensation for the risk taken is an issue currently, with many countries seeing government bonds at low maturities with negative yields, and bond yields continue to trend down, lowering the opportunity cost of holding gold (Figure 4). While physical gold faces storage costs and gold ETFs do have fees, if yields on bonds continue to go more negative, eventually the negative yield will match gold storage costs, but with gold not having the risk of default.

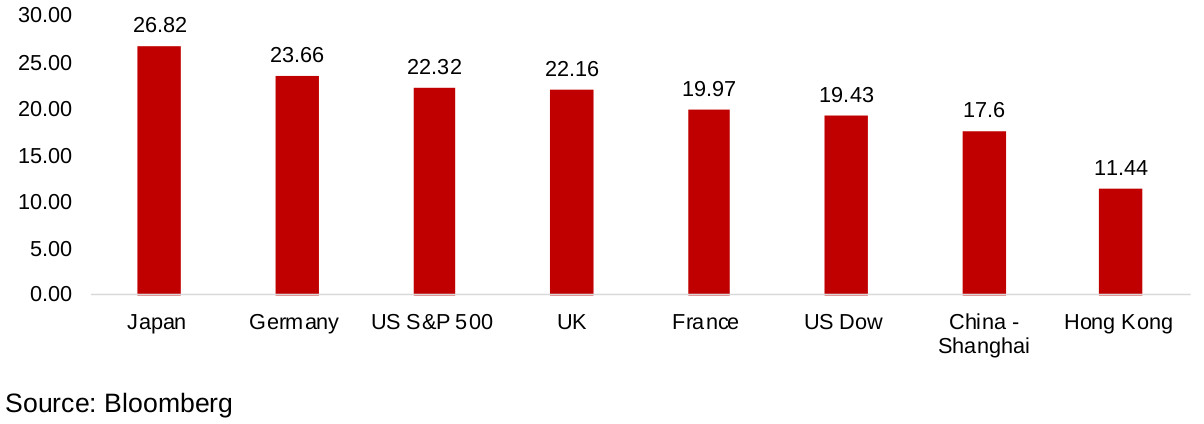

Figure 4: Government bond yields for major markets

Equities didn't get particularly cheap even during the crash: The raging equity bull market that ran over the past few years while gold was relatively flat surely made equities a better bet than the metal. However, the crash of March 2020 demonstrated that equities do eventually correct, especially given historically high valuations just prior to the crash. However, even during the crash, valuations still did not get particularly inexpensive for most markets, and equities having now regained much of their losses. This has pushed valuations back to very high multiples, with many markets trading above a 20x PE (Figure 5), and these multiples could go even higher if earnings results weaken because of the ongoing global economic crisis. It seems unlikely that given the current global economic risks that equity returns of certainly this year, and likely 2021, will match the strong returns of the past several years. With gold now soaring through major resistance levels over the past three months, it has surpassed equity returns for many markets considerably so far in 2020.

Figure 5: PE ratio of major global equity markets

Real estate still at elevated levels: Like equities, global real estate has been extremely strong over the past several years. However, with prices in many markets at highs versus income, and the global economic crisis giving a severe and abrupt cut to the regular cash flow vital to support the property market, we believe that the days of excessive valuations for property could rapidly be coming to an end. We could see gold outpace this asset, and unlike cash or bonds, real estate is similar to gold in that it tends to maintain its real value over very long periods of time. We could thus consider gold a more direct substitute for real estate under this criteria.

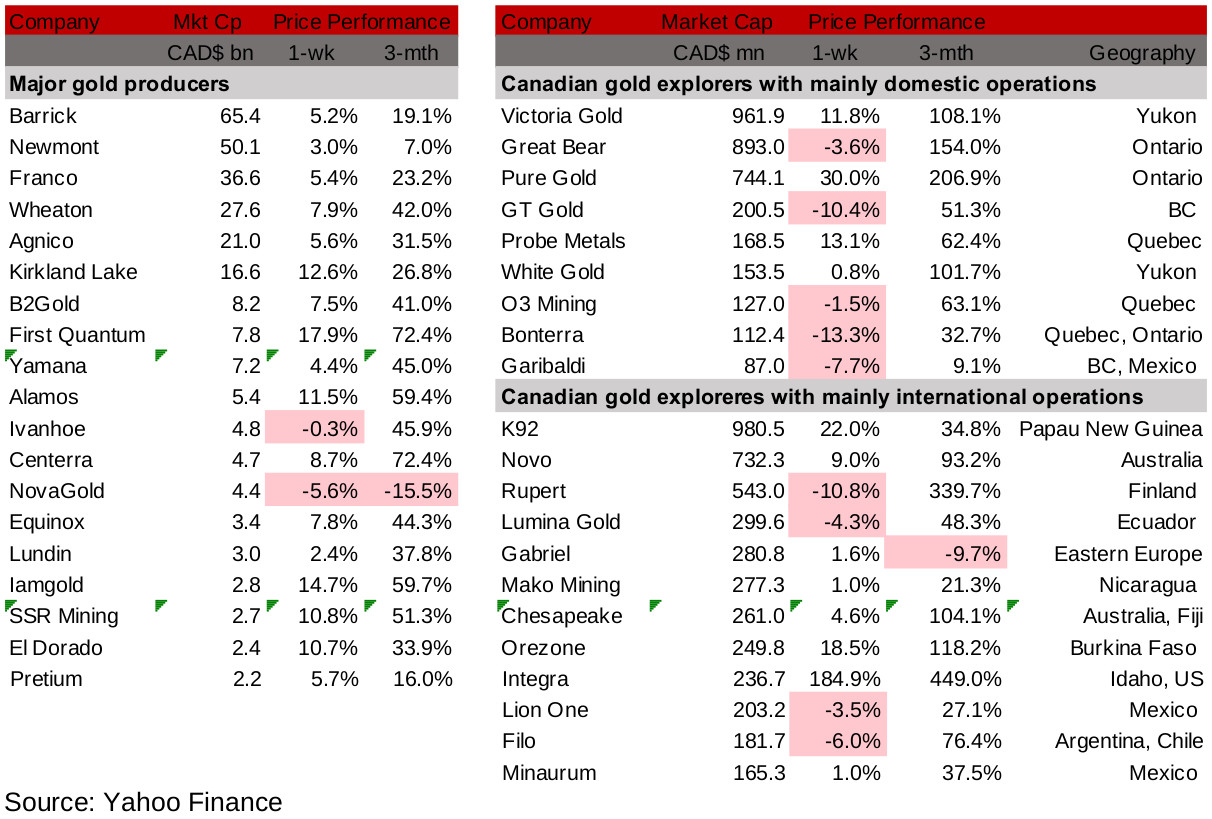

Figures 6, 7: Major producing gold mining stocks and Canadian juniors

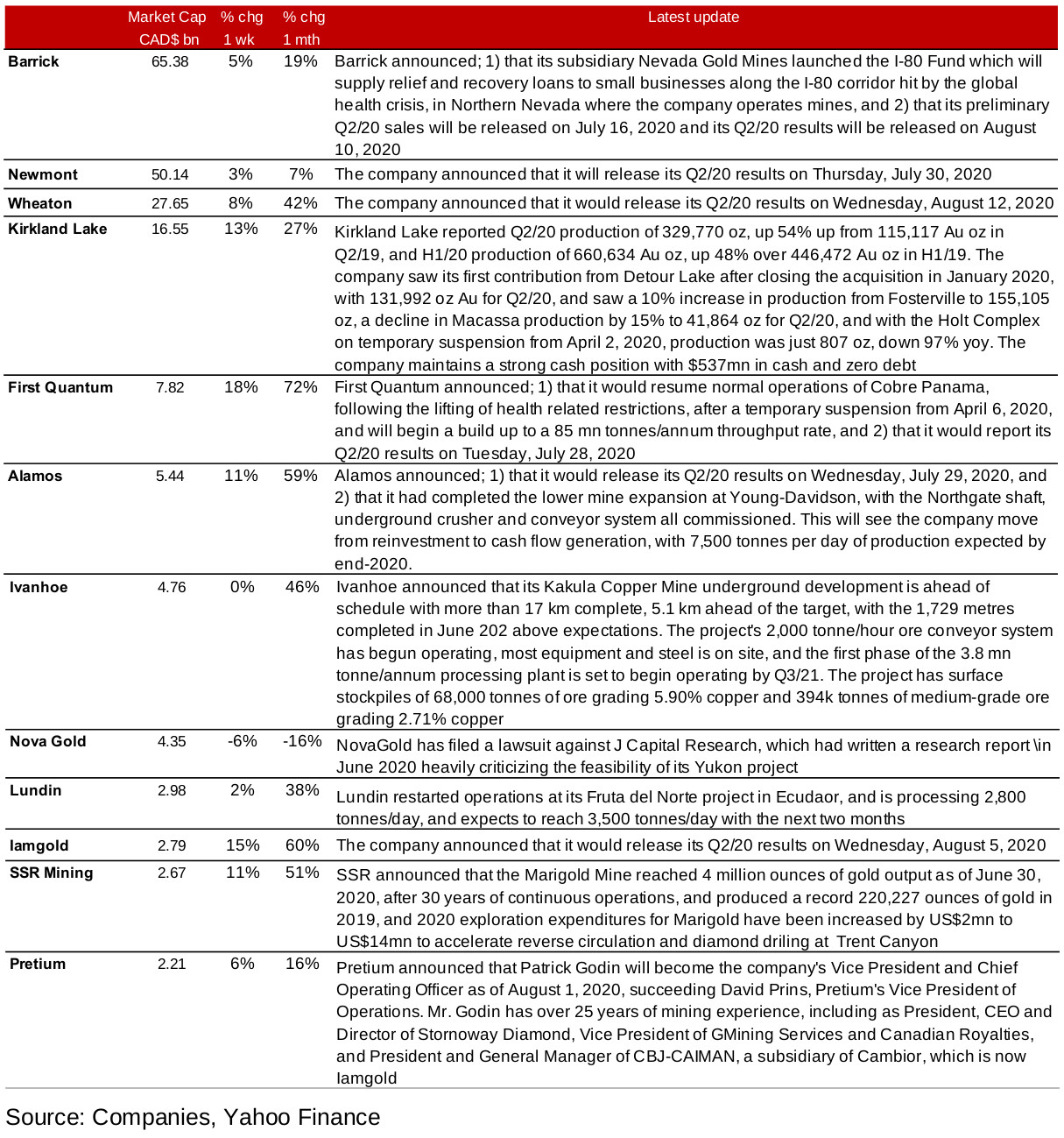

Producers miners see gains on gold price rise and news flow

The major producing miners were mainly up this week on the rising gold price and company specific news, with many firms issuing press releases (Figure 6). Material gains were made by Kirkland Lake on Q2/20 production results, First Quantum, which restarted its Cobre Panama operations, Alamos, which completed a mine expansion, and SSR, which reported a gold output milestone at its Marigold mine (Figure 8). Pretium announced executive management changes and Barrick, Newmont, Wheaton and Iamgold all announced release dates for Q2/20 results.

Ivanhoe and Lundin saw limited share price movement on announcements of ahead of schedule mine development at the Kakula copper mine, and the restart of operations at Fruta Del Norte, respectively, and NovaGold declined after it reported that it filed a lawsuit against a research firm that released a report in June 2020 heavily critical of its Yukon project.

Figure 8: Producing gold miners updates

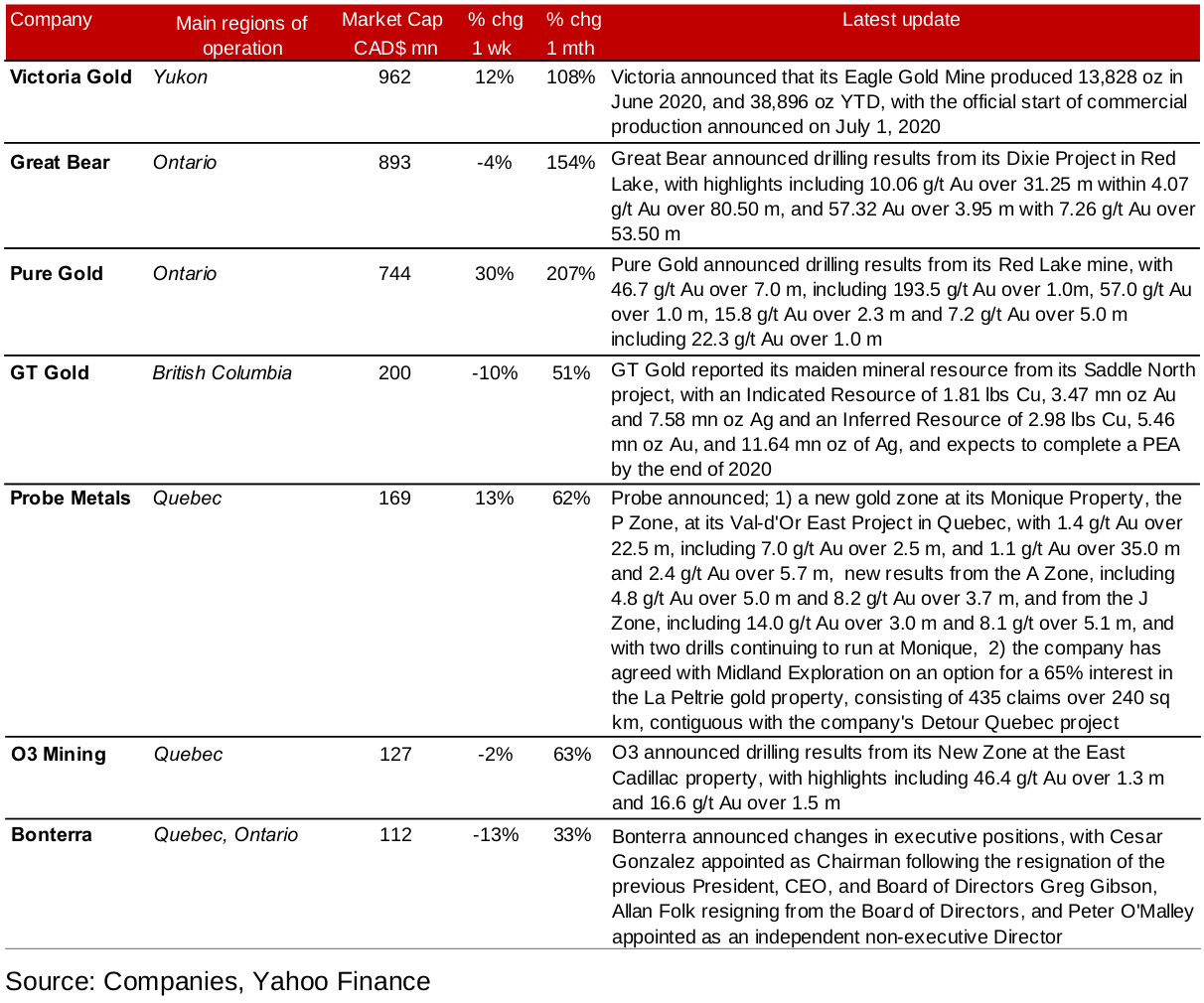

Figure 9: Canadian junior gold miners operating in Canada updates

Canadian domestically operating juniors see mixed performance

The Canadian operating junior gold mining stocks saw a mixed performance in a week where investors seemed as focused on company specific drivers as the gold price, where in the previous two weeks, the ramp in gold price had driven nearly across the board gains for the Canadian junior miner stocks (Figure 7). Victoria was up on a production update from its Eagle Mine, Pure Gold jumped on drilling results, and Probe Metals rose on the report of resource expansion including a new gold zone at one of its properties. However, Great Bear and O3 Mining were down on drilling results, GT Gold dropped after reporting its maiden mineral resource from its core project, and Bonterra was down after announcing changes in executive management (Figure 9).

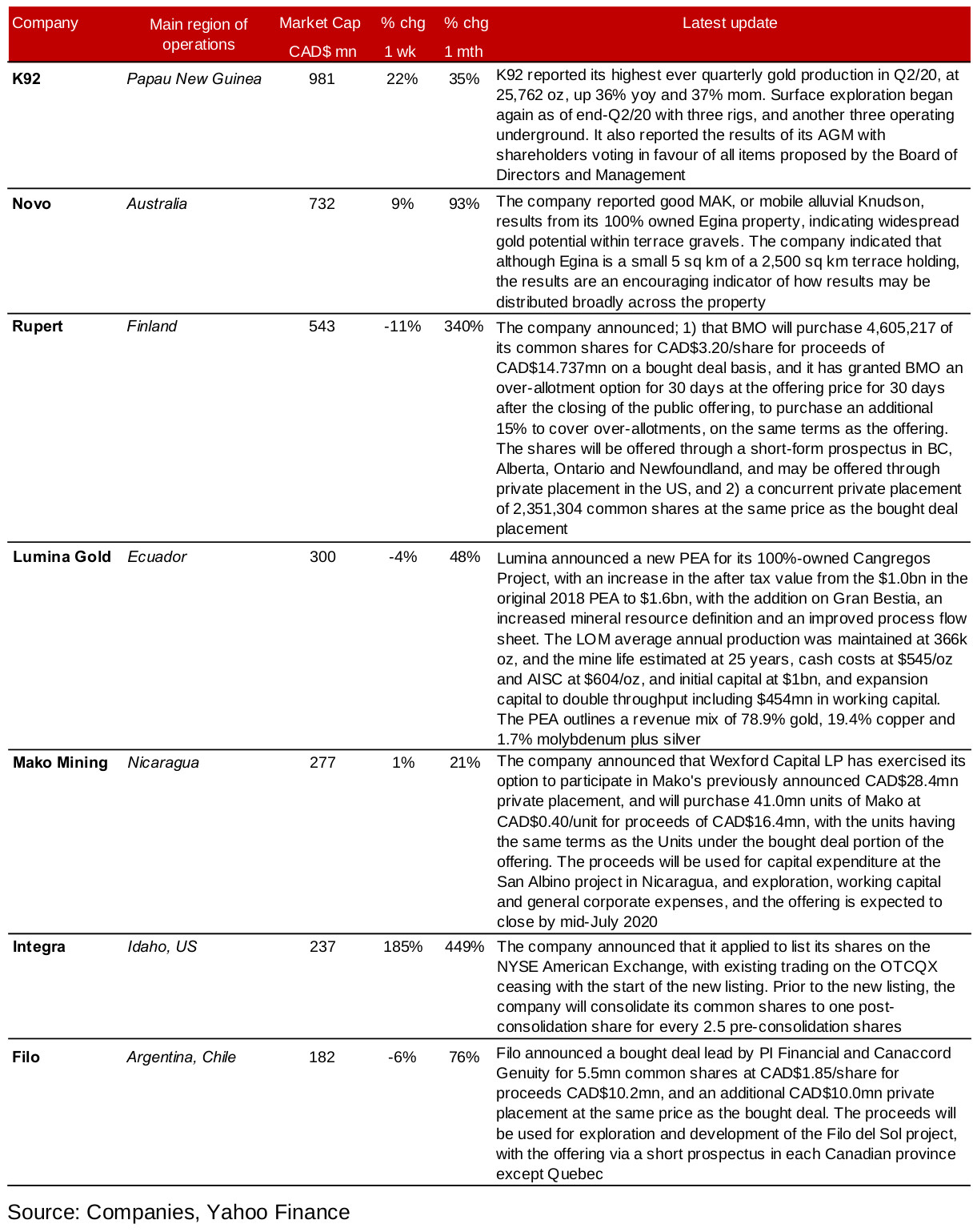

Figure 10: Canadian junior gold miners operating mainly internationally updates

Canadian internationally operating juniors also mixed

The Canadian internationally operating junior gold mining stocks also had a mixed week, similar to the domestic focused juniors (Figure 7). K92 was up on its highest ever quarterly gold production, Novo rose on good exploration results, and Mako was near flat on the exercise of an option by a firm to participate in its previously announced private placement (Figure 10). Integra saw a 185% share price gain, but this was not from major operational news, but rather a technical issue from consolidating its number of shares in advance of a listing on the NYSE American Exchange. Rupert Resources and Filo Resources were down after they both announced bought deal private placements, and Lumina Gold dropped after releasing an updated PEA.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.