July 07, 2025

Gold Up As US Bill Hits Dollar

Author - Ben McGregor

Gold gains as dollar slides on bill passing, trade concerns

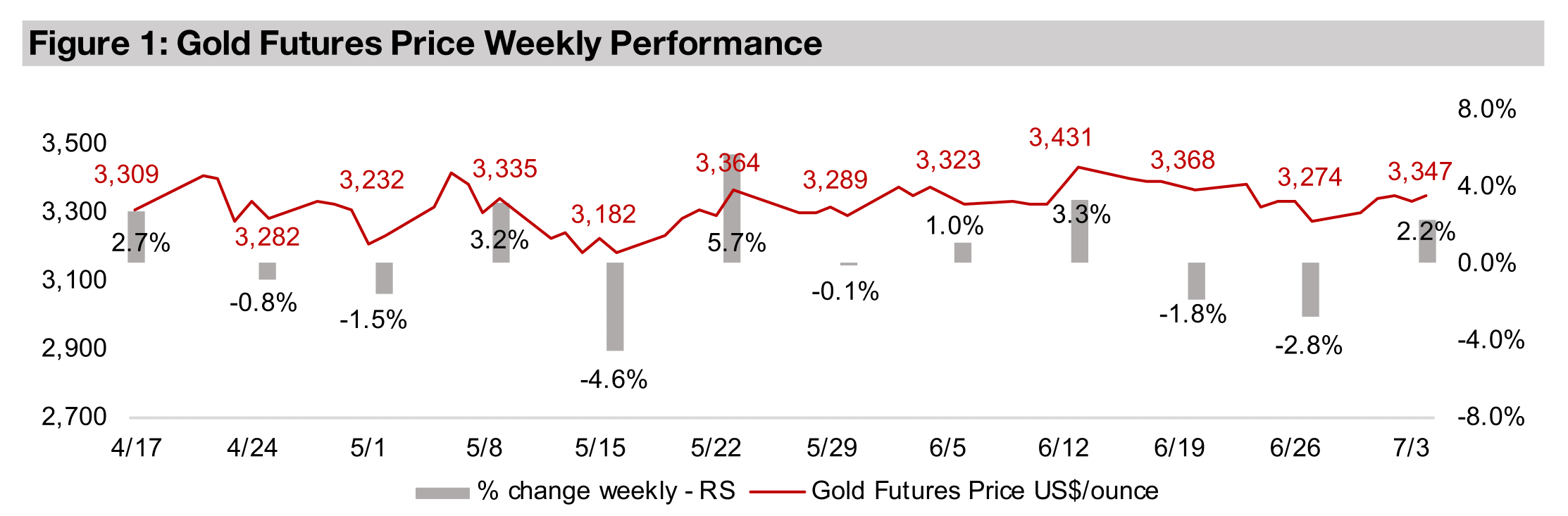

The gold price jumped 2.2% to US$3,347/oz mainly on a rise in the US$ as the country passed a major bill that it is expected to increase its debt, but likely also on the market’s concerns over major US trade deal decisions over the next week.

Gold Up As US Bill Hits Dollar

The gold price rose 2.2% to US$3,347/oz, as the metal completed a full three months

in the new US$3,200/oz-US$3,400/oz range and had its first half ever above

US$3,000/oz, averaging US$3,079/oz since the start of 2025. This was a rebound

from a two-week slide, as the US passed a major new bill which is expected to

increase the country’s debt substantially, putting pressure on the US$ and in turn

driving up the gold price. The equity markets rose on the news, with the S&P 500 up

2.1%, the Nasdaq rising 1.9% and the Russell 2000 gaining 3.3%.

However, there still may have also been a degree of risk hedging in gold’s gain this

week, even as stocks rose, which has been a consistent trend over the past year.

This likely came from rising concerns over global trade as the US is expected to make

their final decisions on several deals by July 9, 2025, and the markets may be bracing

for some negative fallout from these announcements. There have been signs that US

trade negotiations with some major trading partners had already stalled, including

with Japan this week, but also earlier with Canada.

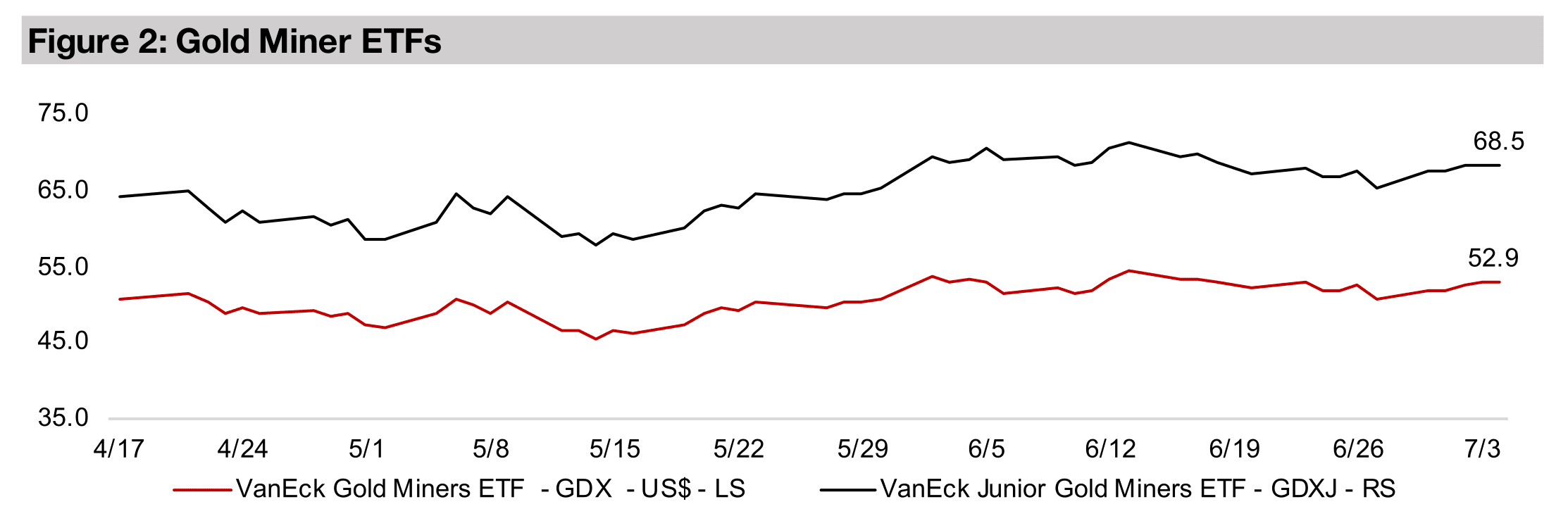

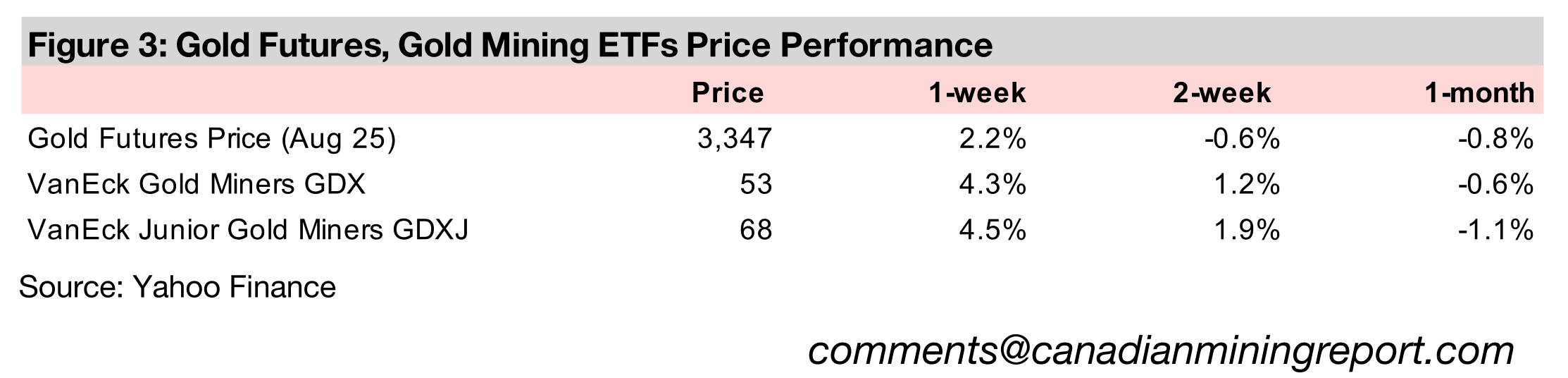

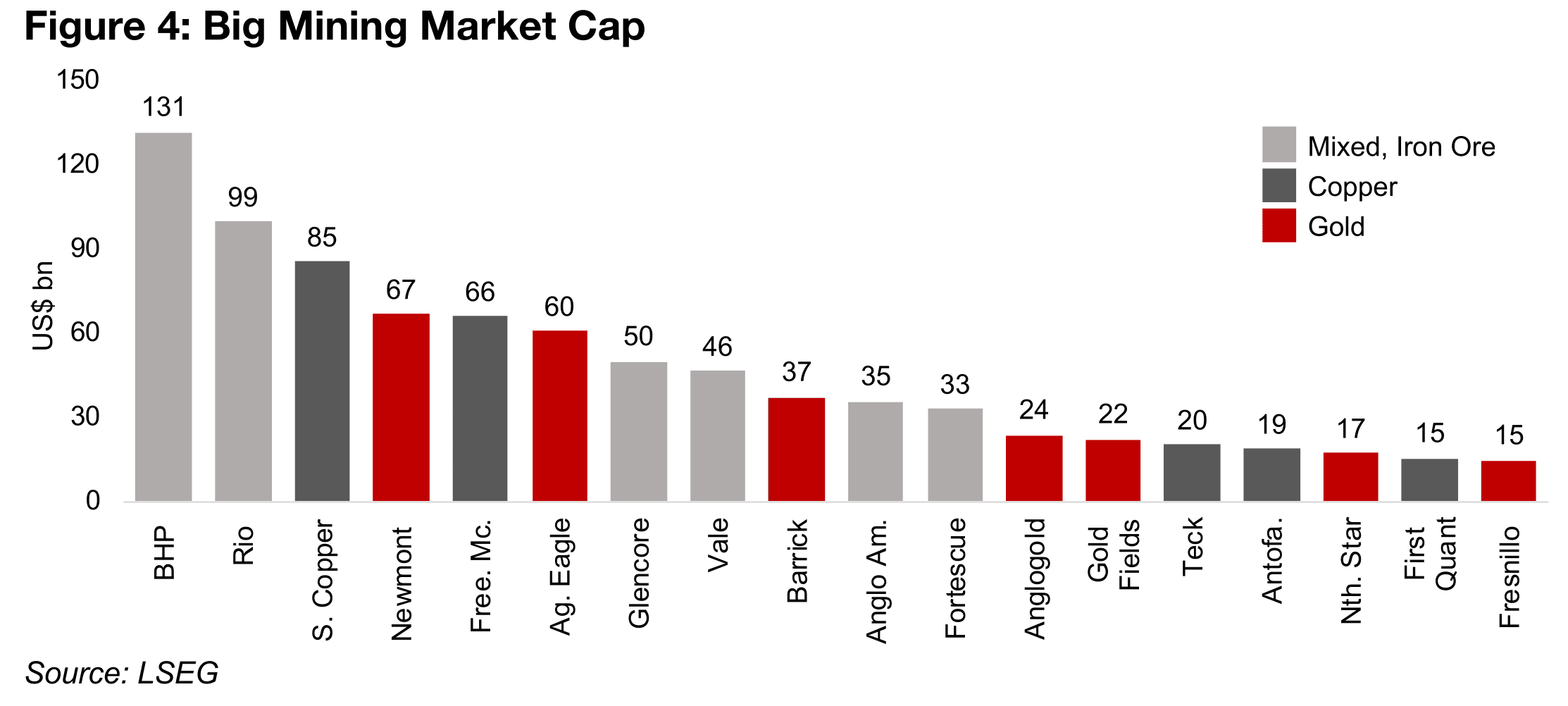

Gold stocks lead the large cap miners by far over H1/25

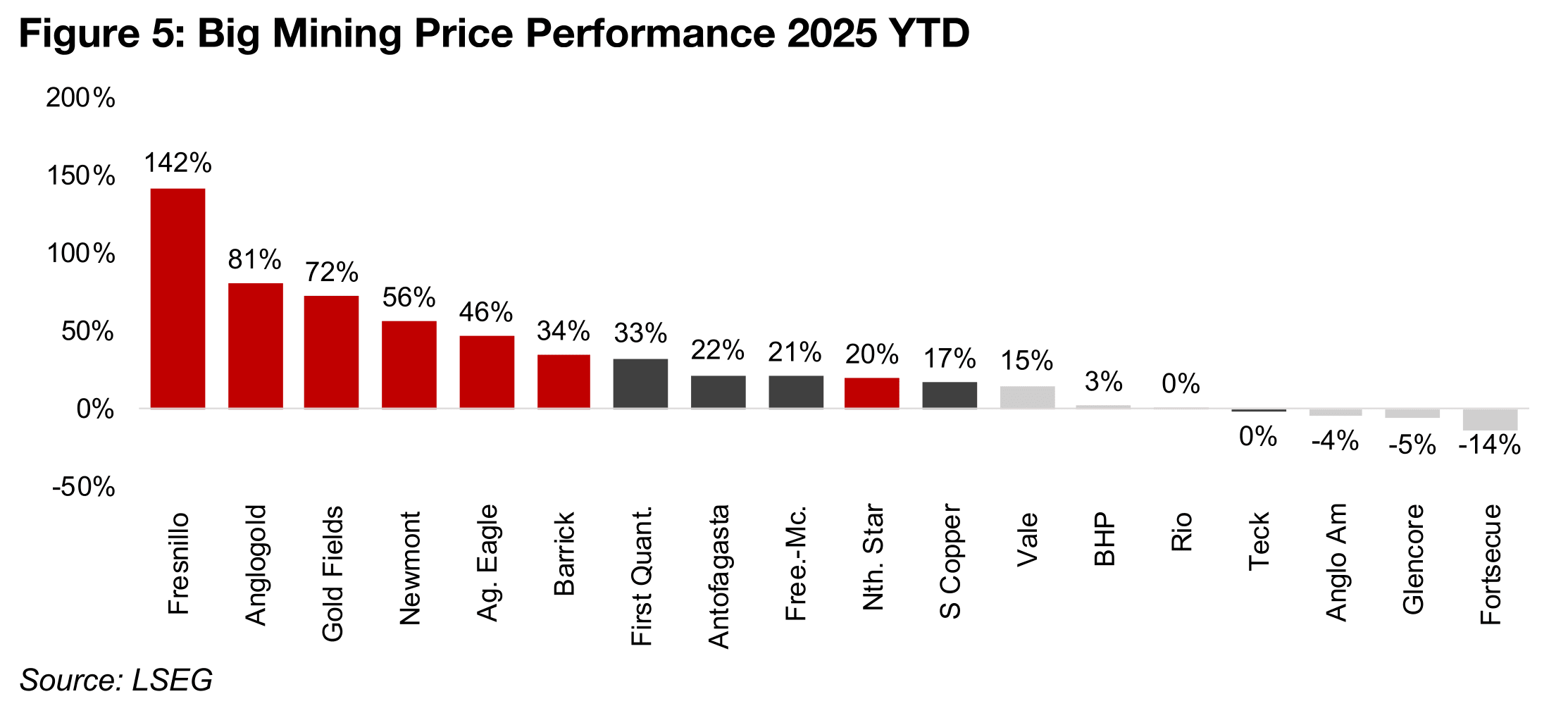

The gold stocks saw major gains this week, with the GDX up 4.3% and GDXJ rising 4.5%, and the sector led the major mining stocks first half of 2025, with all of the largest caps in the sector up at least 20%. The megacap gold leaders Newmont, Agnico Eagle and Barrick have all been extremely strong this year, up 56%, 46% and 34%, respectively (Figures 4, 5). However, the biggest gains have come from the more moderately-sized Fresnillo, Anglogold Ashanti and Gold Fields, up 142%, 81% and 72%. The entire sector has benefited as the gold price has moved so far ahead of production costs that a large degree of operating leverage has been generated especially over the past three quarters.

The large mining stocks with the majority of their revenue from copper have also done

well as the metal price has risen a strong 26%. While this has actually just outpaced

the 25% gain for gold, the copper sector has had more muted share price gains,

implying that the market still sees the risk of a reversal in the metal in the second half

of this year. Similar to the gold sector, more moderately sized companies have made

the largest gains in the sector this year, with First Quantum up 33% and Antofagasta

rising 22%. Sector giants Southern Copper and Freeport McMoran are up 21% and

17% and only one copper company, Teck Resources, has significantly

underperformed the sector, holding near flat since the start of the year.

Some of the mining underperformers have been stocks with a reasonably large

exposure to iron ore, with the metal’s price continuing to slide on sluggish steel

demand, especially from China, which accounts for the majority of global production.

This has seen the two largest global mining cap stocks struggle, with BHP up 3%

and Rio Tinto flat, with iron ore comprising over half of their revenue. However both

have large copper segments, and the latter a high proportion of revenue from

aluminum, which have offset weakness iron ore weakness to a degree.

While Vale also has a large iron ore segment at about 40% of revenue, this is similar

in size to its copper segment, and it earns 20% from other metals, and its share price

has risen 15% in 2025. Fortescue has taken the largest hit this year of all the major

global miners, down -14% as it is the most exposed to iron ore, which comprises 90%

of its revenue. Glencore is down -5% as it also produces iron ore, but this is a

relatively small proportion of its revenue compared energy, mainly coal, where prices

have also dropped this year. Anglo American is down -4, with a large proportion of

its revenue from iron ore, coal and nickel, which have all seen price declines, offset

partly by rising prices for its copper, platinum group metals and manganese

segments.

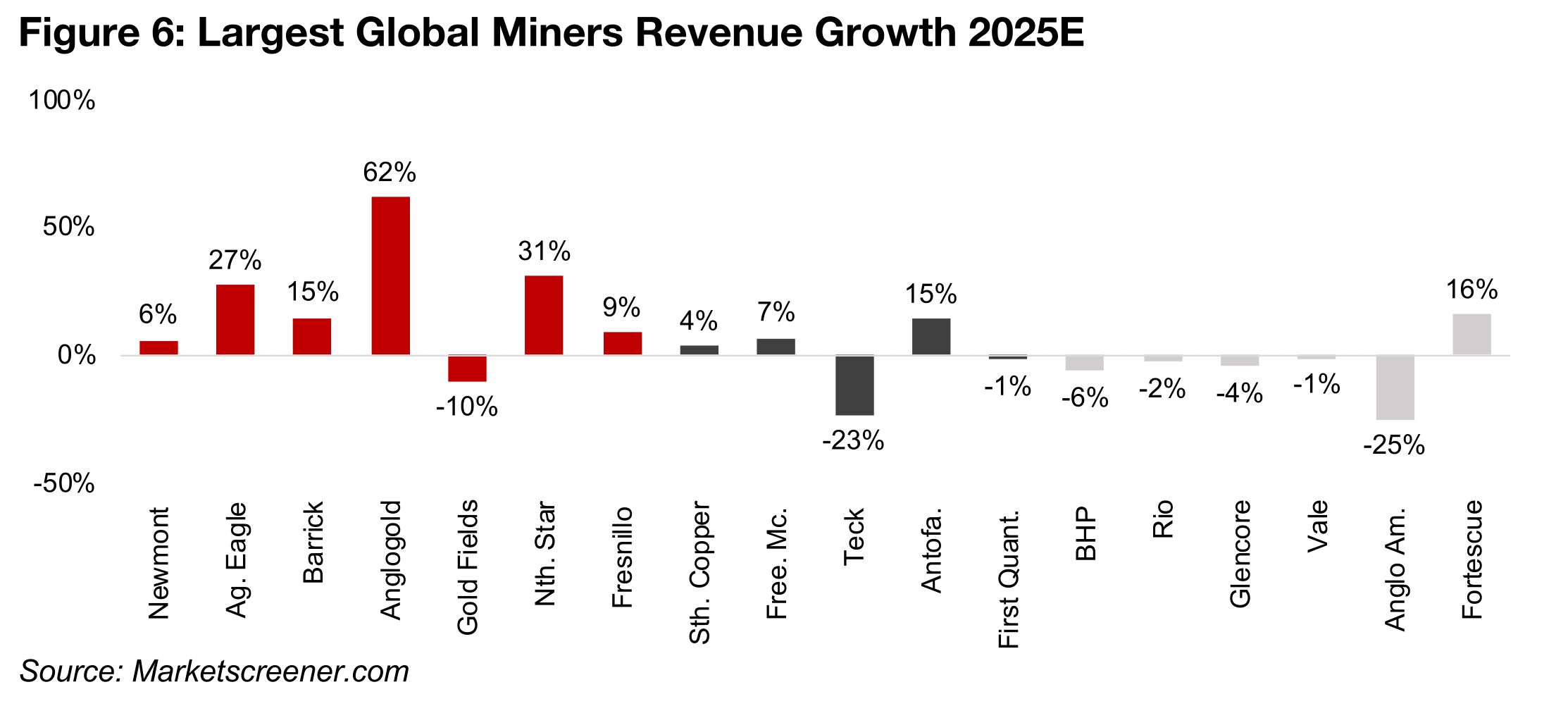

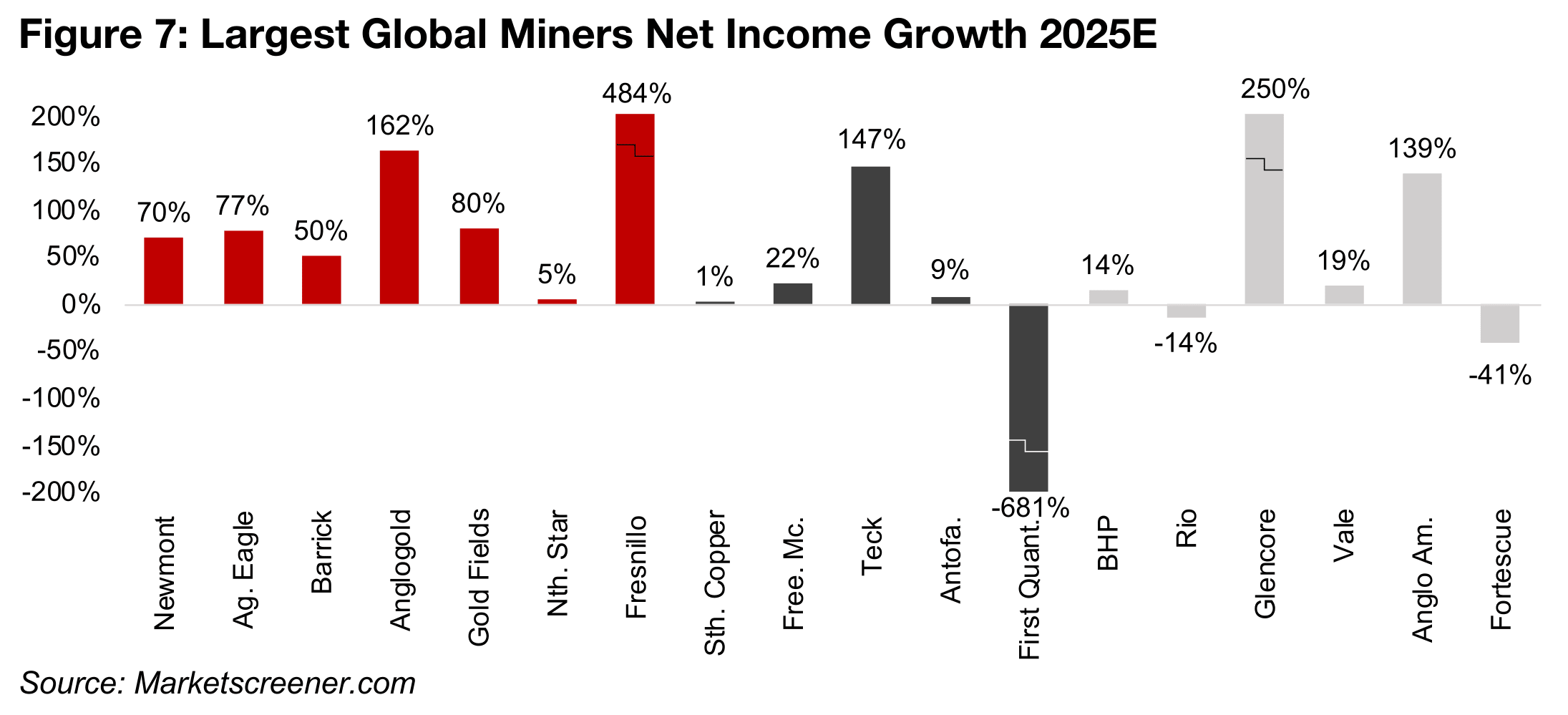

Gold sees highest revenue growth expectations for 2025

The gold companies have by far the highest revenue growth expectations for 2025,

with especially strong increases forecast for Agnico Eagle, Anglogold Ashanti and

Northern Star (Figure 5). Newmont and Barrick are expected to see more moderate

gains, with a decline only for Gold Fields. However, net income is expected to surge

for nearly the entire group, by 50% of more, with only Northern Star lagging with a 5%

rise (Figure 6).

For the copper companies, Southern Copper, Freeport McMoran and Antofagasta

are expected to see moderate revenue gains, with First Quantum near flat, and Teck

Resources down significantly. The net income growth expectations vary, with

Southern Copper near flat, Freeport McMoran and Antofagasta seeing decent gains,

Teck up significant off a low base, and First Quantum’s far down, but only because

the absolute level of net income is very low in both periods, near zero.

Most of the other majors BHP, Rio, Vale and Glencore are seeing expectations for a

slight decline in growth, Anglo American a significant slump and Fortescue actually

decent revenue gains. However, net income growth varies widely for this segment,

with BHP and Vale up, Rio down moderately, and Fortescue declining substantially.

The huge gains for Glencore and Anglo American are a reversal into profitability after

significant losses were generated last year.

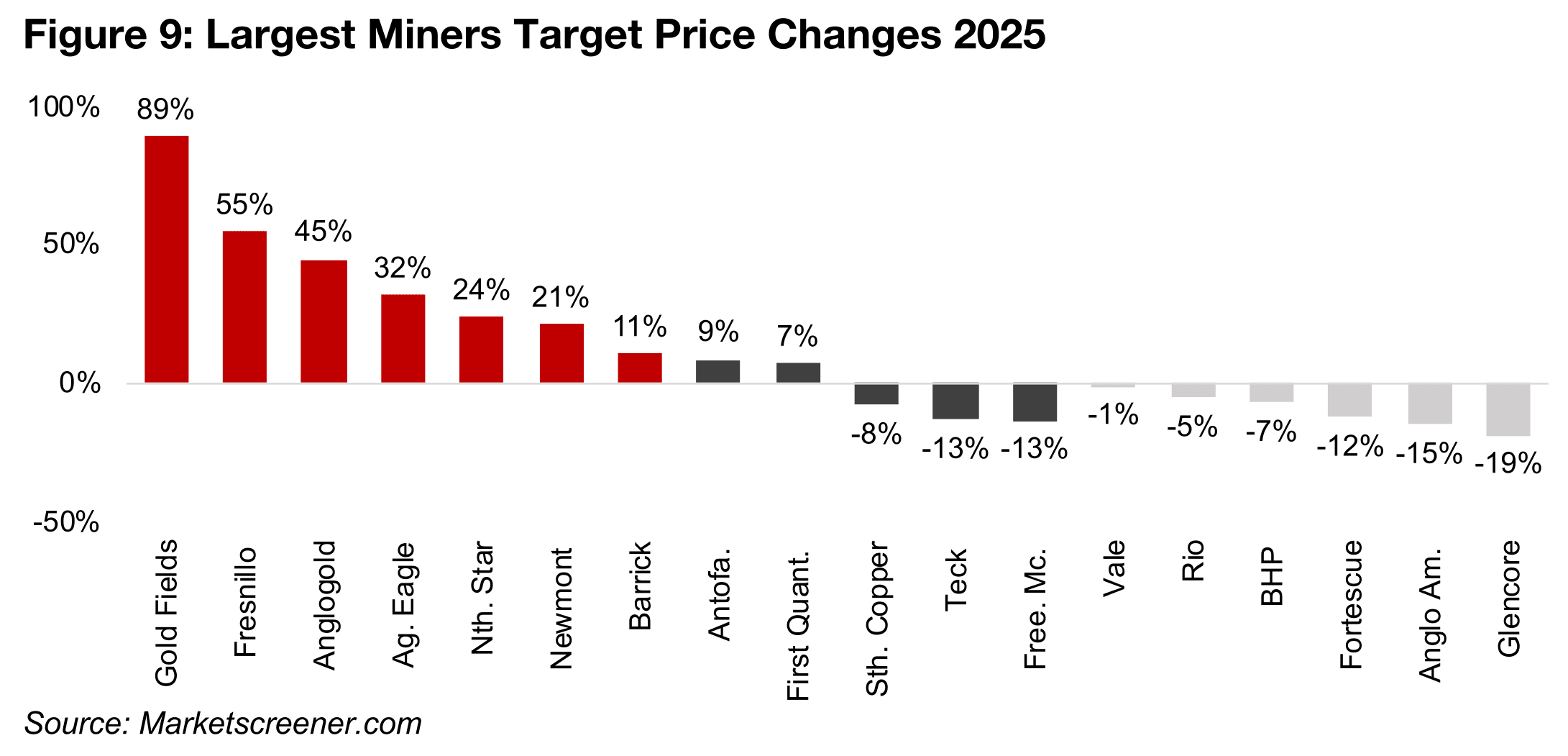

Major upgrades to gold company target prices, others mostly downgraded

The market has become much more bullish on the gold companies this year, with

upgrades of target prices ranging from 11% to 89% this year (Figure 9). The targets

of Newmont, Agnico Eagle, Anglogold Ashanti, Fresnillo and Gold Fields have all seen

major upgrades on the strong earnings expectations for 2025. This implies that the

market may have been playing catch up earlier this year as strong Q4/24 and Q1/25

results were announced. Barrick has seen only an 11% upgrade, even given

reasonably strong revenue and net income growth expectations.

The strong gain in copper price has not driven major upgrades in targets for the sector,

with even the highest increases for Antofagasta at 9% and 7% for First Quantum

relatively muted, especially in contrast to the gold target upgrades. Southern Copper,

Teck and Freeport McMoran have actually all seen their target prices reduced this

year. All of the majors, which all have some degree of exposure to iron ore production,

have seen target price reductions, with the weak outlook for this metal apparently

offsetting any strength in their other divisions. Many of these companies also have

large copper divisions, but as seen with the more pure play companies in this sector,

the rise in this metal price has not necessarily supported upgrades to targets.

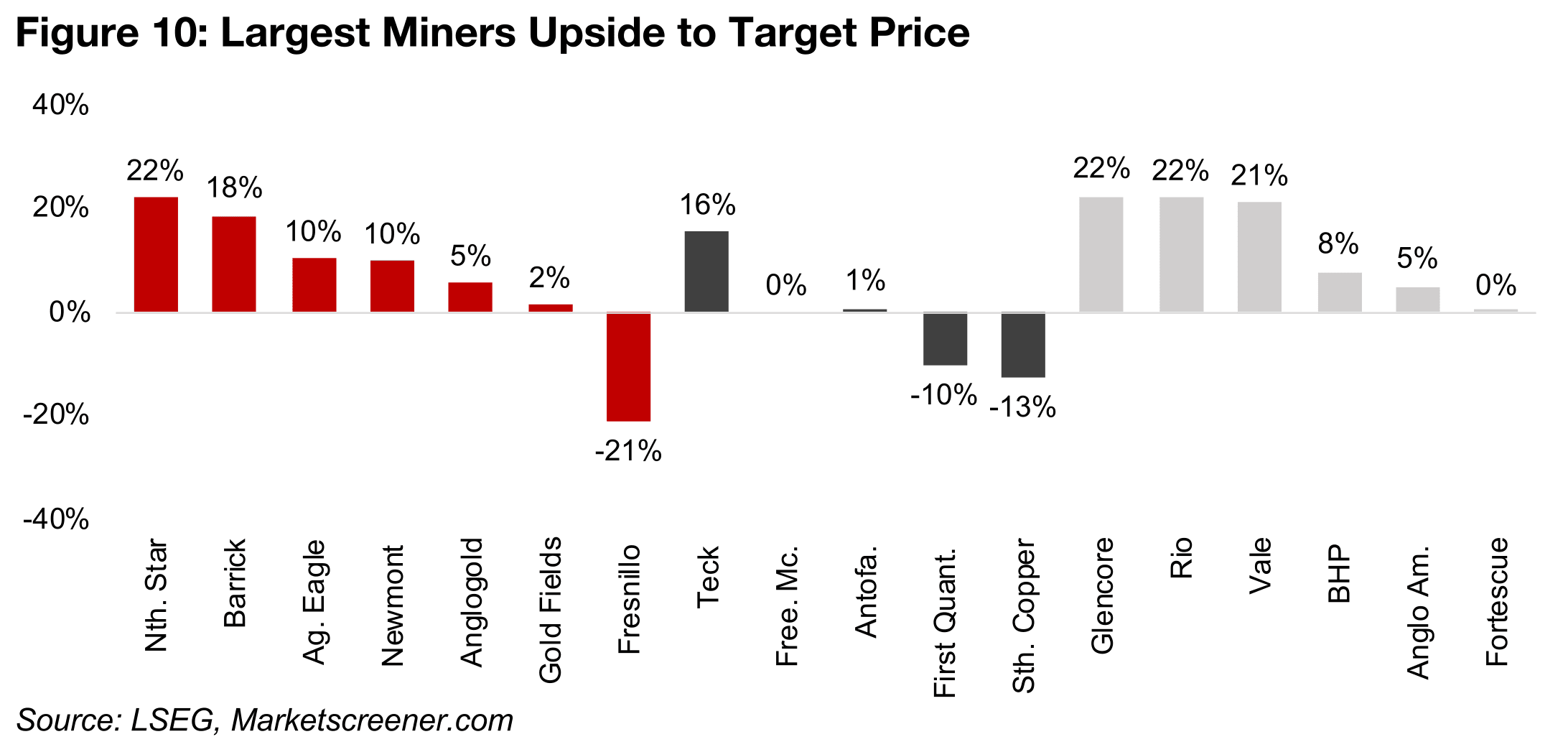

Even after upgrades for the gold sector, the market’s targets still indicate upside for

all of the companies except Fresnillo. The outperformance of Gold Fields and

Anglogold Ashanti this year have seen them converge with their targets, with only 2%

and 5%, upside, respectively, indicating that they are near full value (Figure 10). For

the copper companies the market is bearish overall, seeing substantial upside only

for Teck, putting Freeport McMoran and Antofagasta almost exactly at their fair value,

and expecting downside to the targets for First Quantum and Southern Copper.

For the iron ore companies, the market apparently views the major share price

declines and target price downgrades as having priced in a significant amount of

short to medium-term negative news for the sector. This has led to over 20% upside

for Glencore, Rio and Vale, and more moderate potential gains for BHP and Anglo

American, with only Fortescue at its consensus fair value.

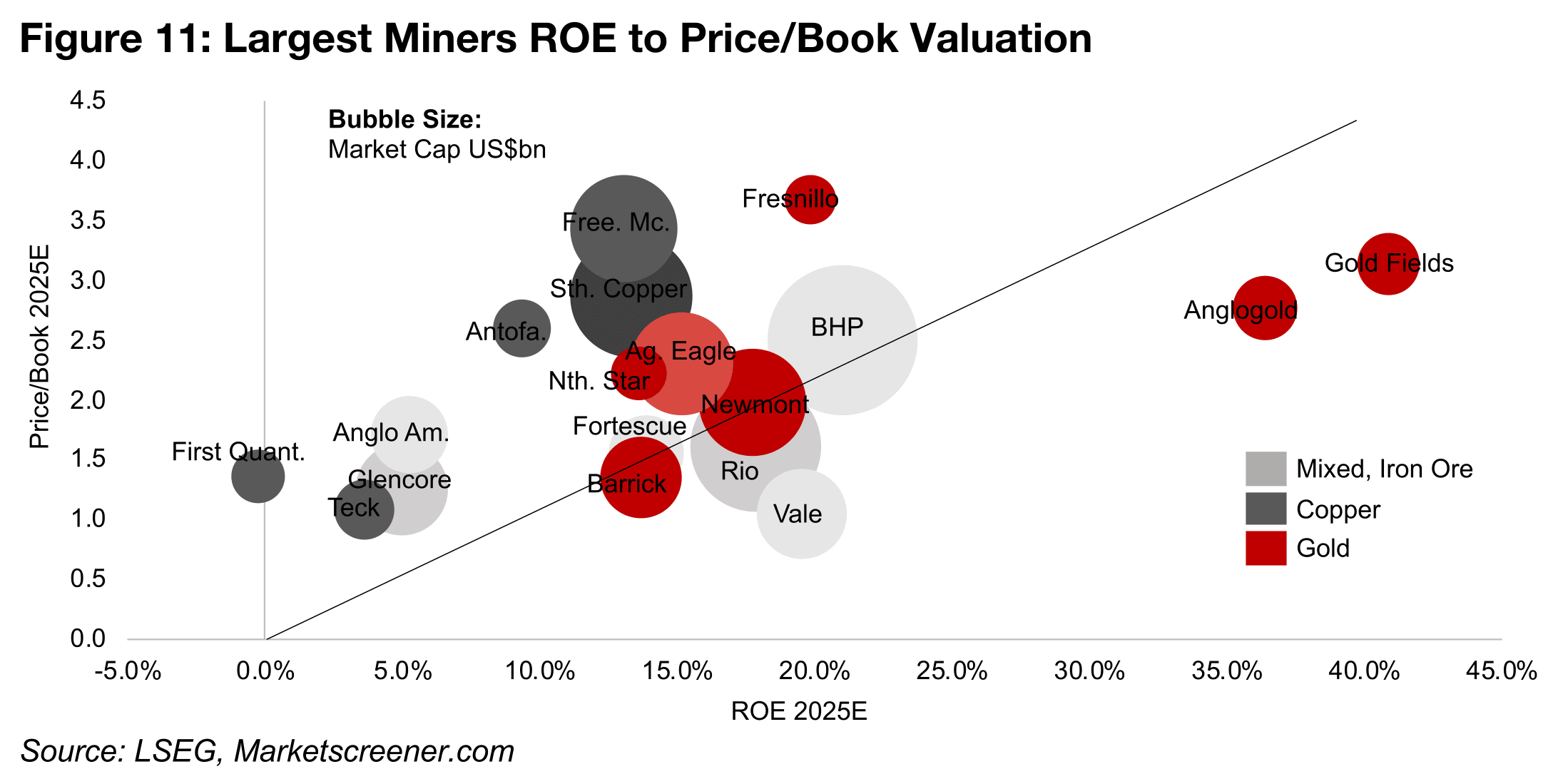

Copper stocks appear high on ROE to P/B valuation

Another method to show relatively levels of valuation is Return on Equity (ROE) to

Price to Book (P/B). As ROE rises, we would expect to pay a higher multiple of P/B

for a given company, which forms a ‘valuation line’ as a rough indicator, shown in

Figure 11. The companies below the line potentially indicate some undervaluation,

and above the line a degree of overvaluation, all other things equal.

For the gold companies, Newmont and Barrick trade near the line, while Agnico Eagle

and Northern Star trade moderately above the line, not implying severe over or under

valuation. Anglogold and Gold Fields trade below the line even given very high ROEs

while Fresnillo trades far above the line. The copper stocks all stand out for trading

well above the line, especially Freeport McMoran, Southern Copper and Antofagasta,

as do First Quantum and Teck, even with the lowest ROEs of the group.

The other miners are mixed, with BHP trading moderately above the valuation line

and Rio below, which seems to correspond with what we see from upside to target

prices, with less upside for the former than the latter. Vale also trades significantly

below the line, possibly reflected in the relatively strong upside to its target price.

Anglo American trades significantly above the line, and has a relatively low upside to

its target price, and Glencore is slightly below it at a similar level of ROE. Overall the

copper sector stands out as trading above the line, with the gold sector and other

large miners not showing signs of major under or overvaluation based on ROE to P/B.

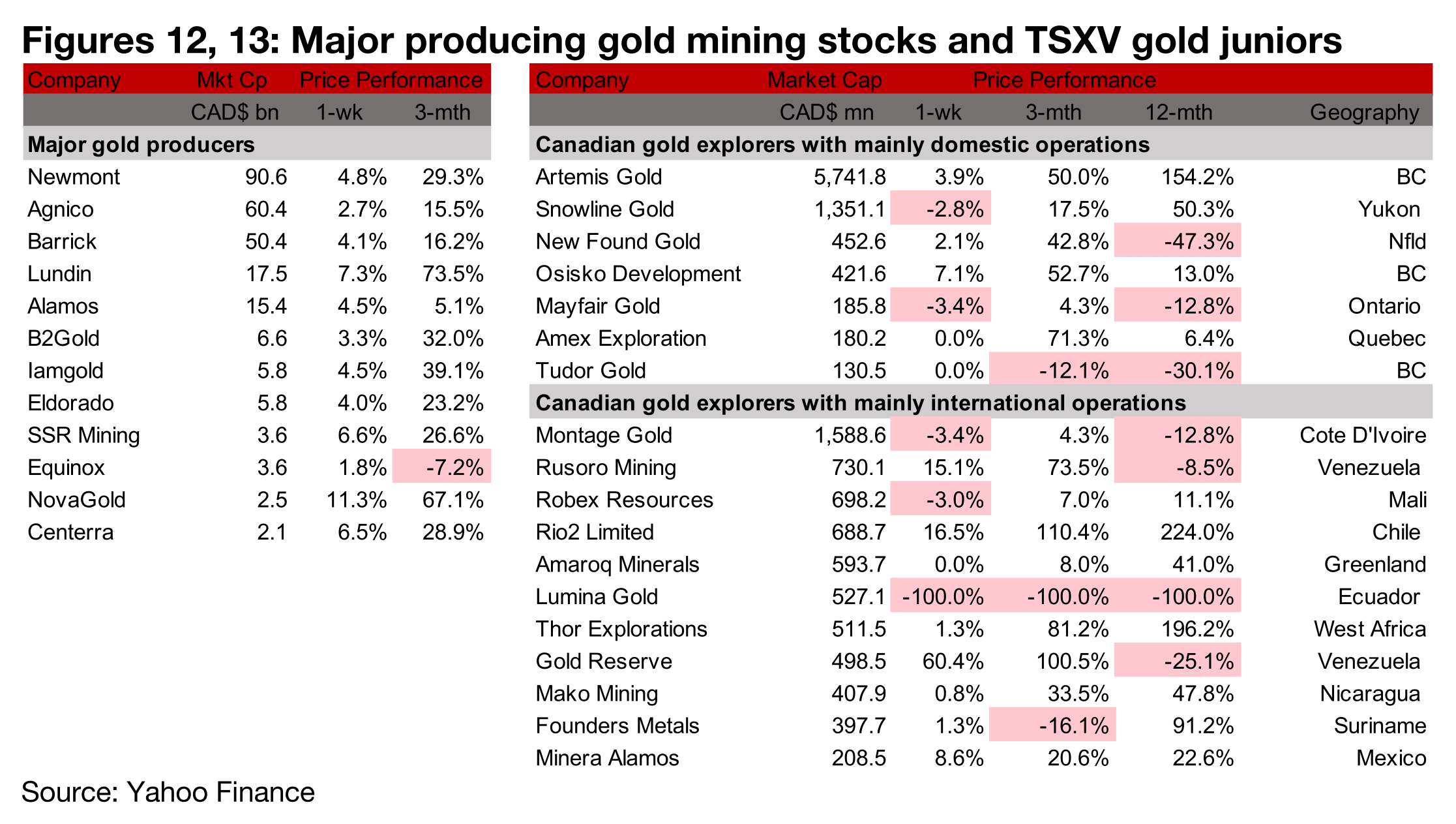

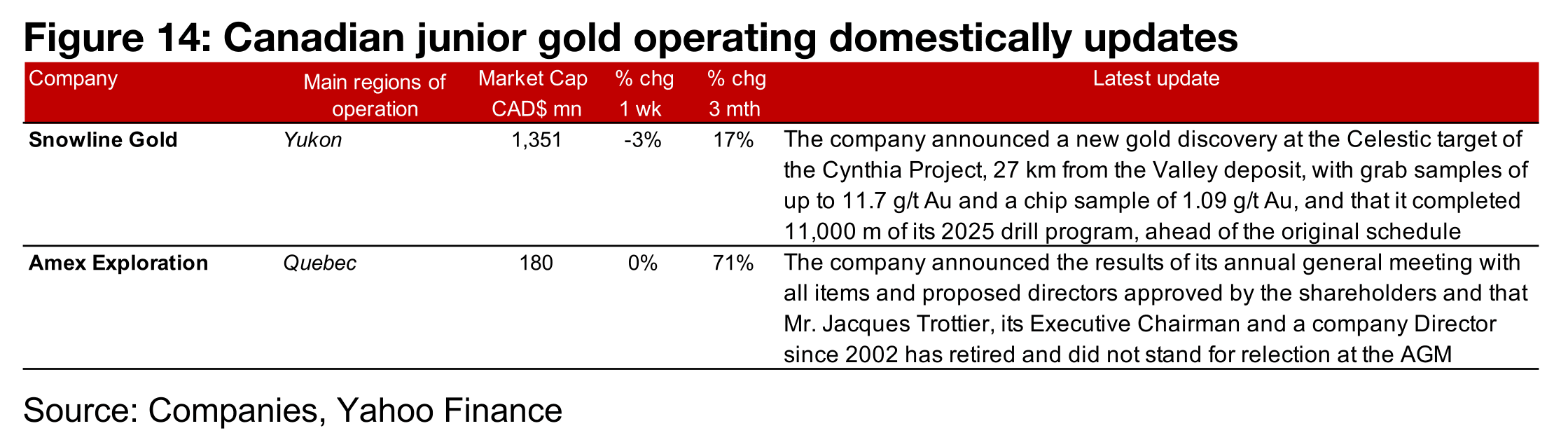

The major producers and most TSXV gold gain

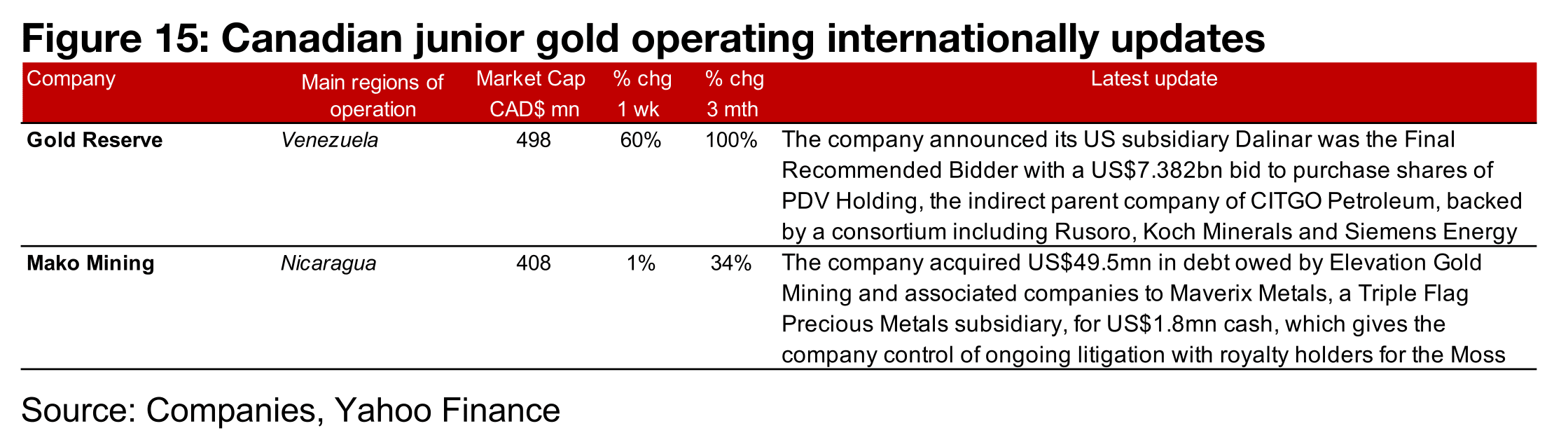

The major producers and most of TSXV gold rose on the increase in the metal and equities markets (Figures 13, 14). For the TSXV gold companies operating mainly domestically, Snowline Gold reported a new discovery at the Celestic target of the Cynthia Project, and that it had completed 11,000 m of its 2025 drill program, which is ahead of schedule, and Amex Exploration announced the results of its AGM (Figure 14). For the TSXV gold companies operating mainly internationally, Gold Reserve reported that it was the Final Recommended Bidder with a US$7.382bn bid through its US subsidiary Dalinar to purchase the shares of PDV Holding, the indirect parent company of CITGO Petroleum. This was around double the bid earlier this year of US$3.7bn bid from Red Tree investments, was supported by a consortium including Rusoro Mining, Koch Minerals and Siemens Energy and marks the end of a 15-year legal process. Mako Mining acquired US$49.5mn in debt owed by Elevation Mining to Triple Flag Precious Metals subsidiary Maverix Metals for US$1.8mn, which will give it control of ongoing litigation with royalty holders for the Moss Mine, which it acquired at the end of 2024 (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.