July 14, 2025

Gold Up As US Tariffs Hiked

Author - Ben McGregor

Gold rises as US increases tariffs for many countries

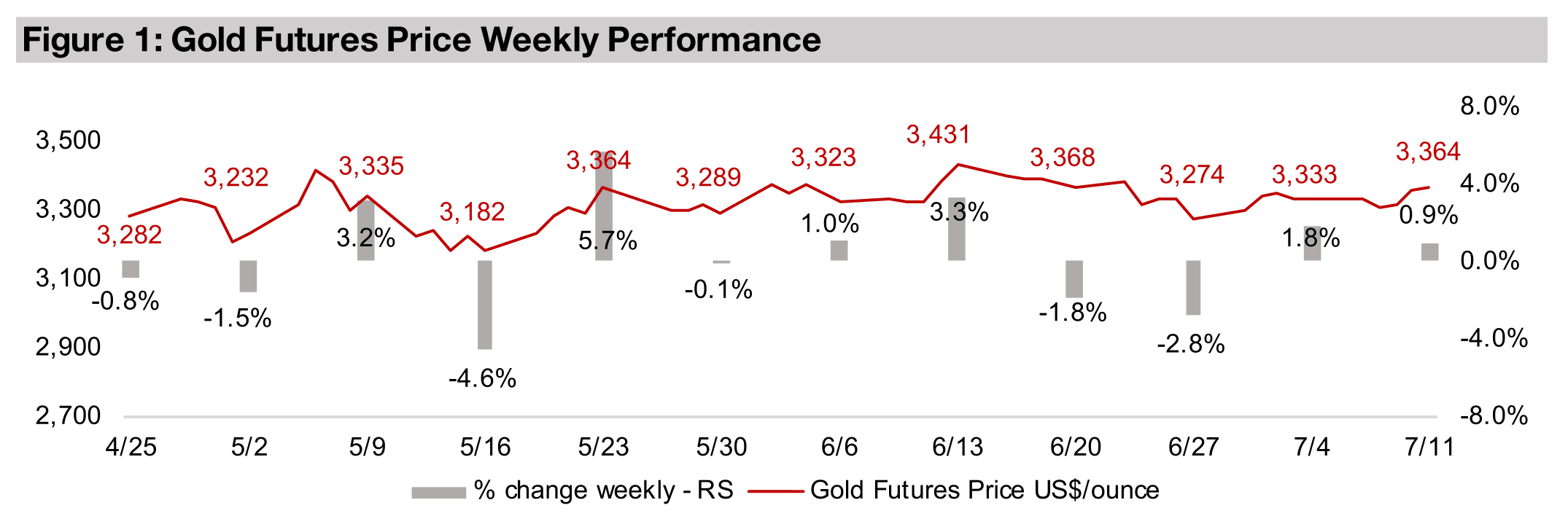

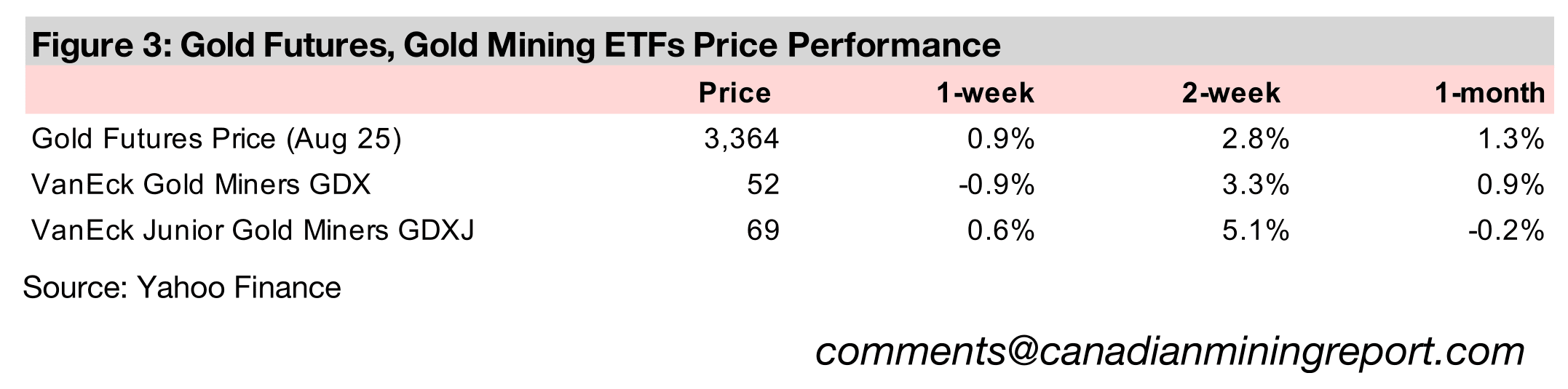

The gold price rose 0.9% to US$3,364/oz as the US sent out its decisions on tariffs to many trading partners, with rates reduced from earlier this year, but still elevated, followed by surprisingly high levels announced for EU and Japan over the weekend.

Ten new entrants to TSXV Top 25 Gold across range of stages

There have been ten new companies entering the TSXV’s Top 25 gold stocks by market cap this year, after major share price gains YTD, including three producers, five developers, two with resource estimates and one still in the exploration stage.

Gold Up as US Tariffs Hiked

The gold price rose 0.9% to US$3,364/oz, as the risk-on rally slowed and the markets

continued to hedge, inline with an overall trend that has persisted for well over a year.

Only the Nasdaq rose, up 0.5%, while both the S&P 500 and Russell 2000 were near

flat for the week. The main economic driver this week was decisions on tariffs to start

August 1, 2025 sent by the US to many trading partners, including 36% and 35% on

Thailand and Indonesia, 25% on Japan, South Korea and Malaysia and 20% on the

Philippines, with tariffs within the 20%-40% range falling on many smaller countries.

As these tariffs were largely expected by markets and were a reduction from the rates

announced in early April 2025, they did not drive down the equity markets. Tariffs had

previously ranged from 28% to 49%, with the exception of the Philippines, which had

the lowest rate at just 17%. However, a more major trade shock came over the

weekend, with 30% tariffs announced on both Europe and Japan, two of the largest

trading partners with the US. This is above the 25% tariffs announced in February

2025 for its other two major trading partners, Canada and Mexico, which now actually

look relatively low in the context of the announcements over the past week.

These tariffs will likely have a broad and potentially mixed effect on the metals prices.

They have already driven some distortions, as seen in the copper market, with the

imports into the US surging in advance of a decision on tariffs for the metal which is

expected by September. This led to shortages in the rest of the world and jump in

the copper price, with the metal up 11.2% in just the past week and 17.2% from the

from the crash lows on April 9, 2025. However, beyond some short-term increases

on supply issues, over the medium to long-term increased tariffs are expected to

reduce global economic growth and in turn demand for many metals overall.

Some other base metals that were in a slump over the past year partly from weak

steel demand in China, including iron ore and zinc, have also recovered, up 4.6% and

0.5% this week, and 8.0% and 6.0% since April 9, 2025. This has been on some early

signs of a recovery in the steel industry in China, with the government announcing

measures this year for a reduction in output. This has not boosted nickel however,

another metal driven by the steel industry, which is down -0.8% over the past week

and -1.0% since April 9, 2025. This is because any increased demand from China

has been offset by a severe oversupply of capacity in the industry, especially in

Indonesia, the largest global producer.

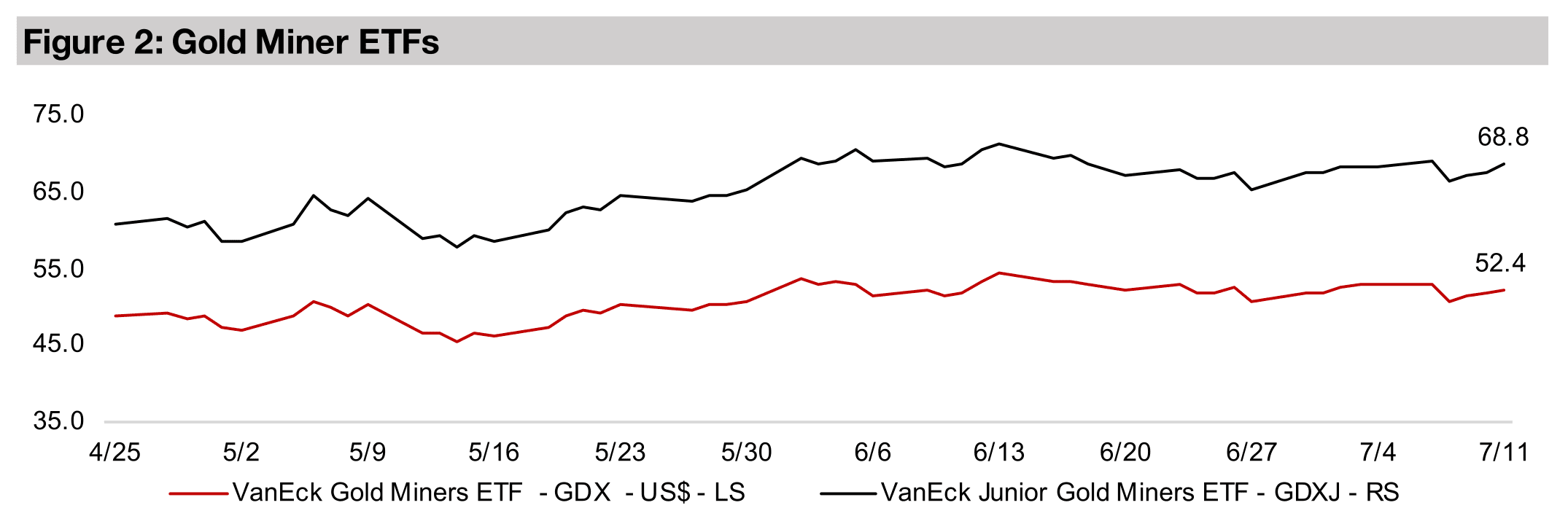

While gold has risen 4.6% from April 9, 2025, it has lagged the other precious metals,

which have boomed, with platinum up 40.5%, palladium rising 26.3% and silver

gaining 13.8%. While platinum has led the sector over the past month, it was up just

0.5% this week, as palladium and silver actually took the lead, rising 6.3% and 4.5%,

with these other precious metals finally starting to close the large gap that had

developed between them and gold over the past year.

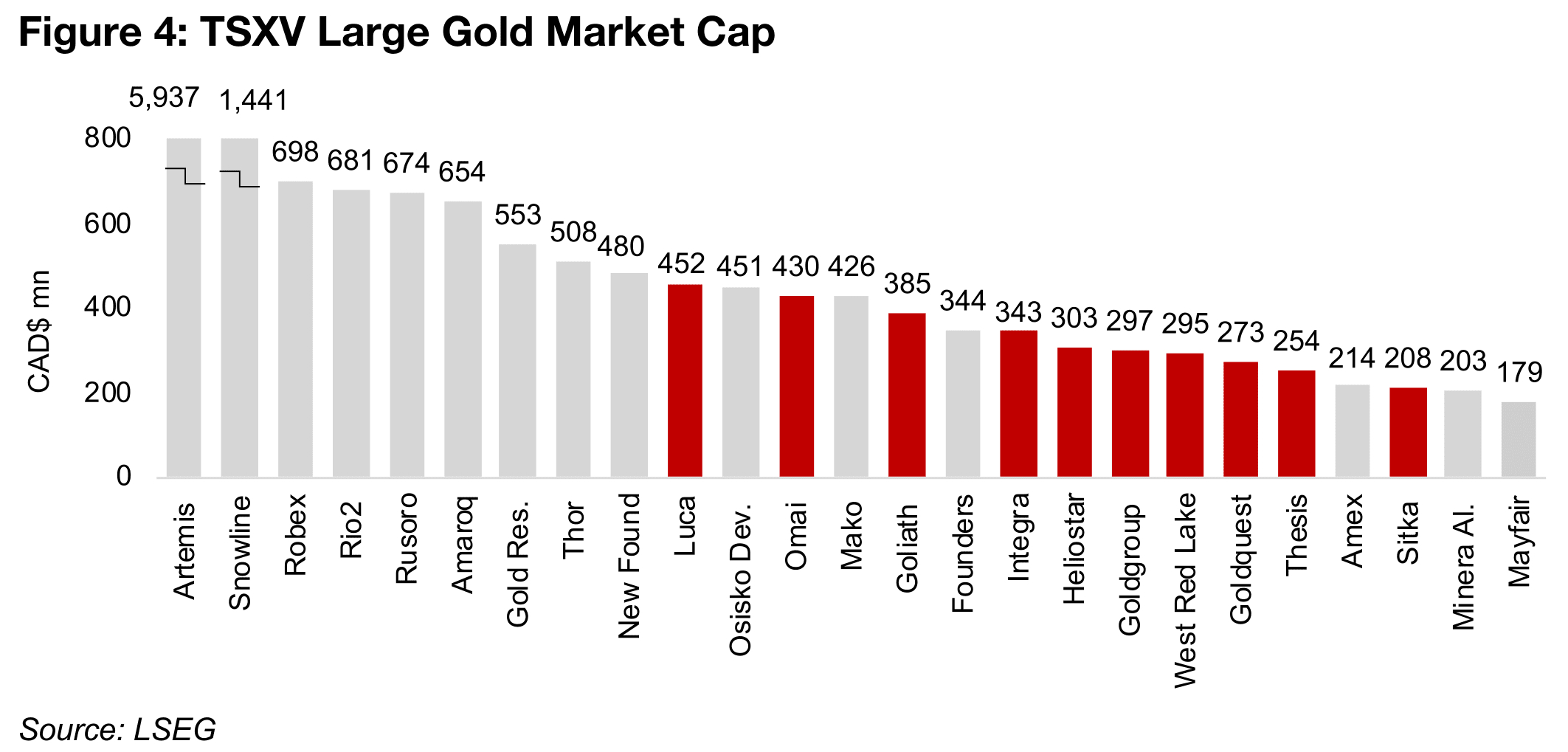

Many new players enter TSXV gold Top 25 by market cap

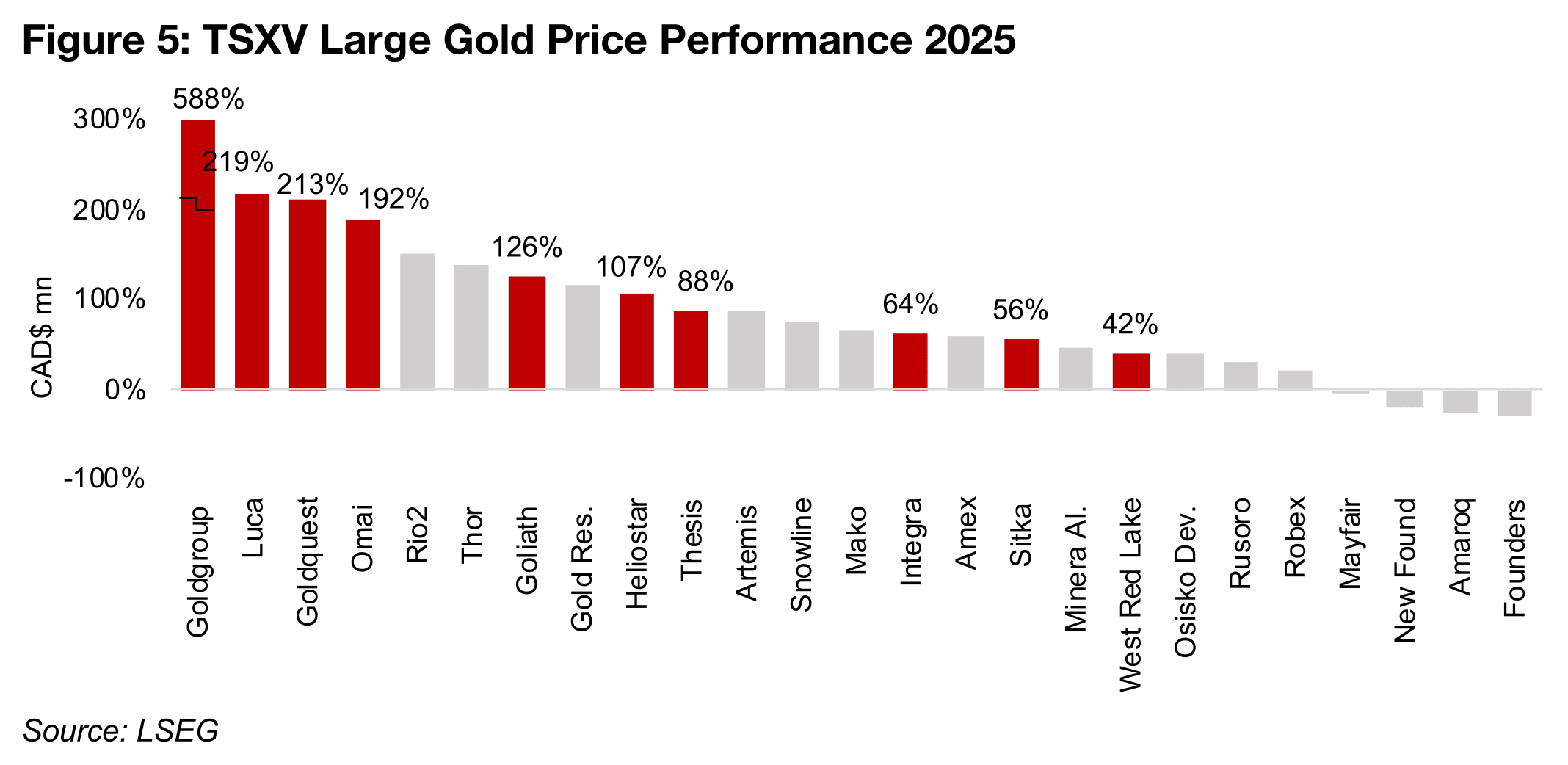

There have been ten new entrants to the Top 25 TSXV gold stocks in terms of market cap this year, in addition to the fifteen names that have already been near the top of the sector for a year or more (Figure 4). These ten stocks have mostly had share price performances towards the top half of the group, including the top four highest gains this year, with half of the group up around 200% or more, and even the weakest still rising 40% (Figure 5). The performance of the other fifteen stocks has been more mixed, with several actually seeing declines this year, even with the major surge in the gold price. For several companies this was a reversal from extremely strong earlier gains, which the market may have viewed as not being supported by the company specific fundamentals, as the macro backdrop remains strong.

Gold output to jump for Heliostar, Luca and Goldgroup

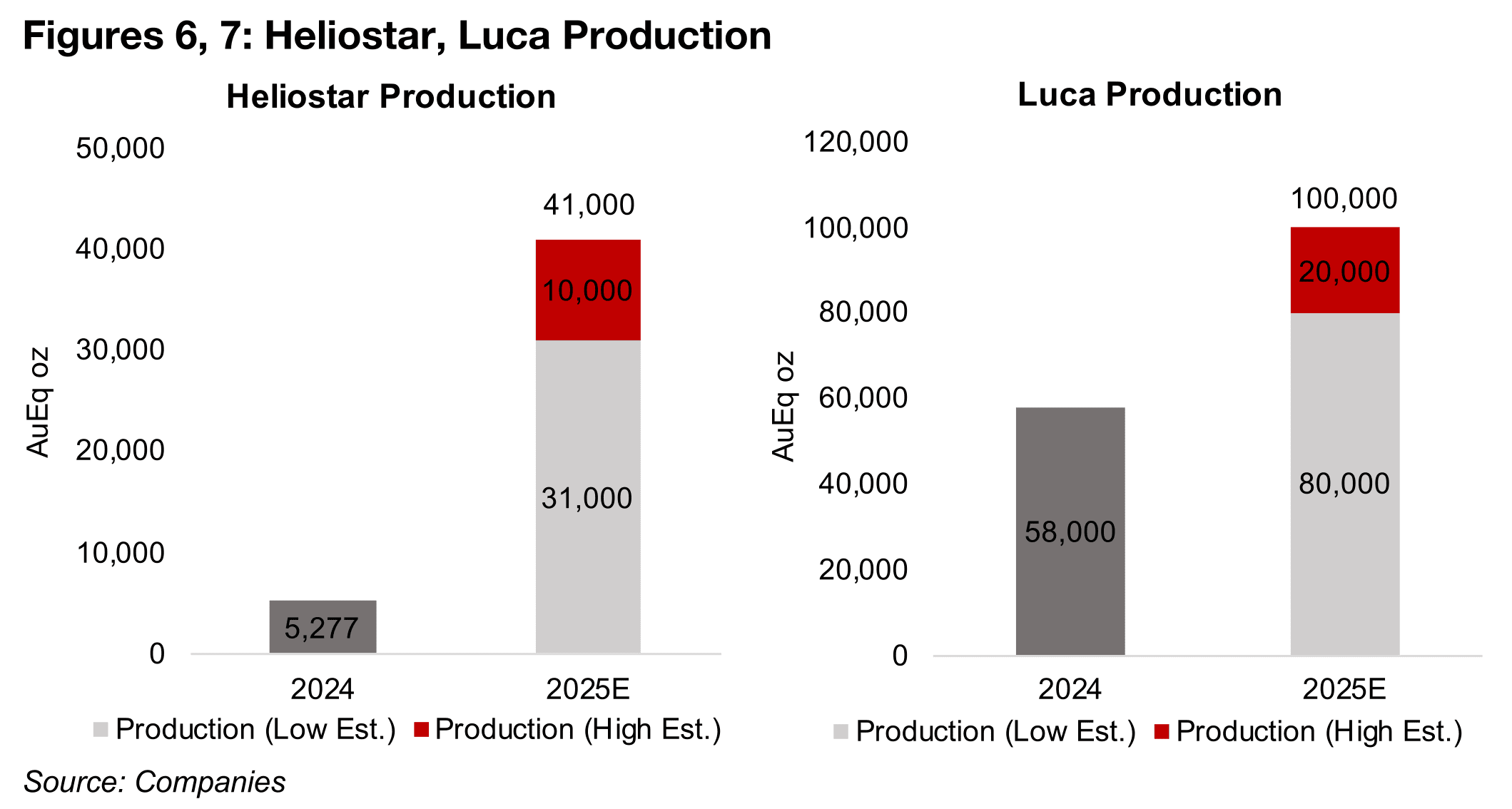

Three of these new entrants into the TSXV Gold Top 25 by market cap are already in

production at their major projects, Heliostar, Luca, and Goldgroup. Heliostar operates

two mines in Mexico, La Colorada and San Agustin, with operations at the former

restarted in January 2025, and for the latter expected to restart in October 2025. The

company had production in 2024 of 5,277 oz AuEq, but this is expected to rise to

31,000-41,0000 oz in 2025, driving up the share price 107% this year (Figure 6). The

company also expects to complete a Feasibility Study for a third project, Ana Paula,

by the middle of 2026. While well over ninety percent of the company’s revenue will

come from gold, there will also be a small contribution from silver.

Luca Mining also operates two mines in Mexico, Camp Morado and Tahuehueto, but

they are more diversified across metals, with both projects producing gold, zinc,

copper, silver and lead. The company’s total production is expected to rise by nearly

40% this year on a conservative estimate to 80,000 oz AuEq, and over 70% to

100,000 AuEq on a more aggressive estimate (Figure 7). The company reports a

revenue split of 34% gold, 24% zinc, 22% copper, 16% silver and 4% lead. This

strong expected output growth has driven up the share price 219% year to date.

Camp Morado is the larger project and expected to produce between 54,000-64,000

oz AuEq this year, with output from Tahuehueto estimated at 31,000-36,000 oz AuEq.

Both projects are expected to operate for at least ten years and the company sees

expansion potential for both, with exploration at Tahuehueto ongoing since Q4/24,

and to start at Camp Morado this year, for the first substantial operation in ten years.

The company has already reduced its debt by half and expects it to be paid off entirely

by mid-2026.

Goldgroup operates the Cerro Prieto project in Sonora, Mexico, which had production of 8,803 oz Au in 2024, with current annual production at 11,500 oz Au. However, the company expects production to rise to 24,0000 oz Au after an expansion that is close to completion. The company also completed the acquisition of the Pinos project this month, a PEA-stage project in Zacatecas, Mexico. It is a relatively small project with 86,000 oz Au of total resources with seven years of operations expected, with a grade of 2.2 g/t Au. The share price increased relatively consistently from January 2025 to May 2025, and while it has been flat since, it is up 588% this year, by far the highest gains of the TSXV Top 25 gold new entrants.

Four companies at the PEA/PFS stage

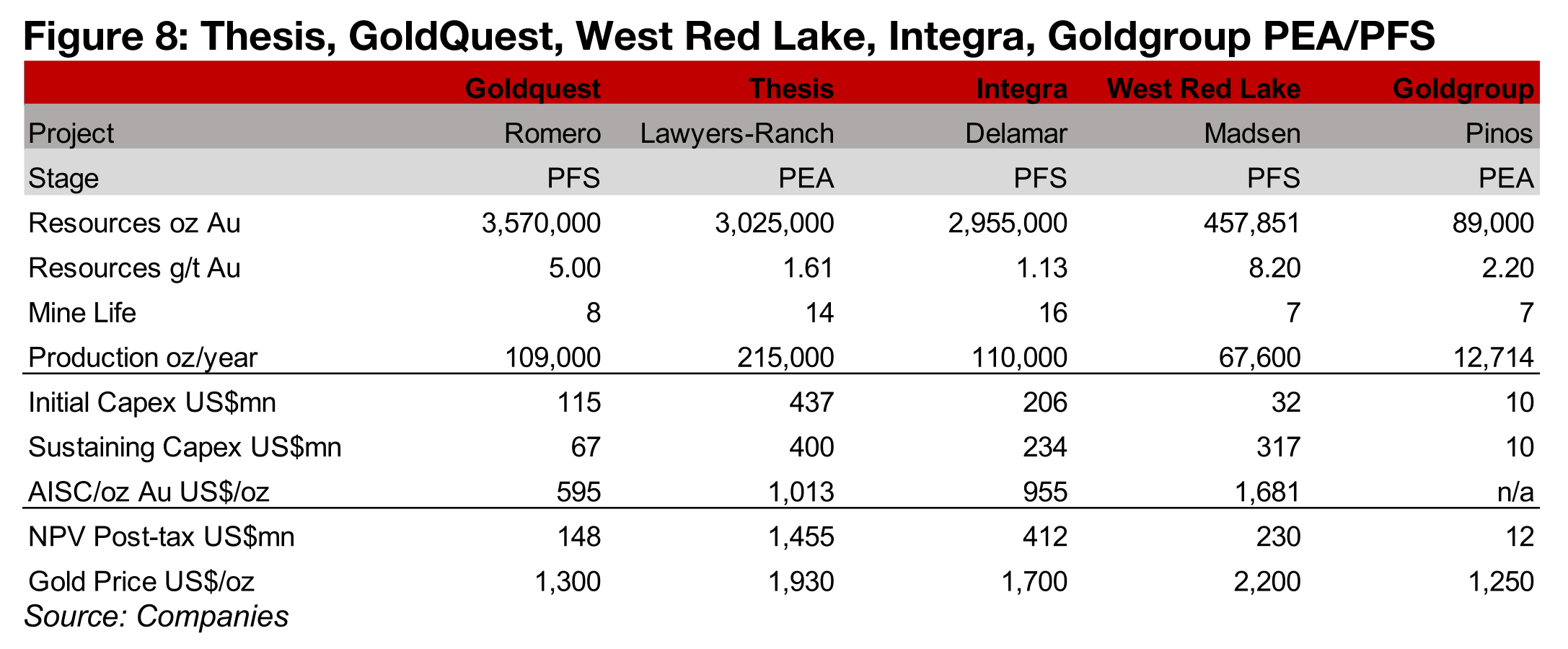

Four of the companies, Thesis, GoldQuest, West Red Lake and Integra and are at the

PEA/PFS stage (Figure 8). Goldquest’s Romero project in the Dominican Republic

has the largest total resources, with a PFS from 2016 outlining 3.57mn oz Au and

operations over eight years at a high 5.0 g/t Au grade. While the shares gained

steadily in early 2025 along with gold, is it now up 212% YTD, especially from a jump

from late May to mid-June 2025. This was just in advance of the company announcing

it had received its Environmental Terms of Reference for Romero, a key permit for a

full environmental study, with the target of obtaining an environmental license. The

company also closed C$16.2mn private placement last week.

The second largest project is Thesis Gold’s Lawyers-Ranch in British Columbia, with

a PEA last year indicating 3.03mn oz Au in Resources, at a moderate 1.61 g/t Au

grade, with operations over 14 years. While the shares have trended up overall for an

88% gain this year, there have been four jumps followed by significant pullbacks.

These moves have not been correlated with major new releases, including the start

of a PFS in early January, announcement of new management in mid-January,

Centerra’s purchase of an 9.9% stake of the company in late April, the start of the

2025 exploration in early June or the closing of a C$27.5mn placement last week.

Integra Resources operates two main projects, the producing Florida Canyon mine in

Nevada and the DeLamar project in Idaho, at the PFS stage. The company acquired

Florida Canyon in 2024, which produced 72k oz Au last year and has six more years

of estimated operations. This mine will provide cash flow for continued development

of Delamar, which has a PFS from 2022 indicating a 2.96mn oz Au resource,

operating over 16 years, with a relatively low grade of 1.13 g/t Au. The price is up 64%

this year, with a significant move in January after the release of strong drill results

from DeLamar, and then in early April, although there was no major news release at

the time, with the next material development in early June 2024 being the receipt of

approval of its Mine Plan of Operations from the US Bureau of Land Management.

West Red Lake’s share price has been driven by announcements related to the

Madsen project in Ontario, including the restart of production in late May 2025. The

project is relatively small with a PFS in January 2025 indicating a 0.46mn oz Au

resource, operating over 7 years, although it has by far the highest grade of the group,

at 8.20 g/t Au. While the share price rose substantially on an announcement of new

targets from regional surface sampling at Madsen in late January 2025, by March

2025, it had returned to around its levels from the start of the year. There was then a

jump in the share price in early April but without a correlated major news release, a

rise in early May on news of a bulk sample results and gold sales, and then in late

May on the restart of the mine, and it is up 42% this year.

Omai and Sitka at Resource Estimate stage, Goliath sees strong drill results

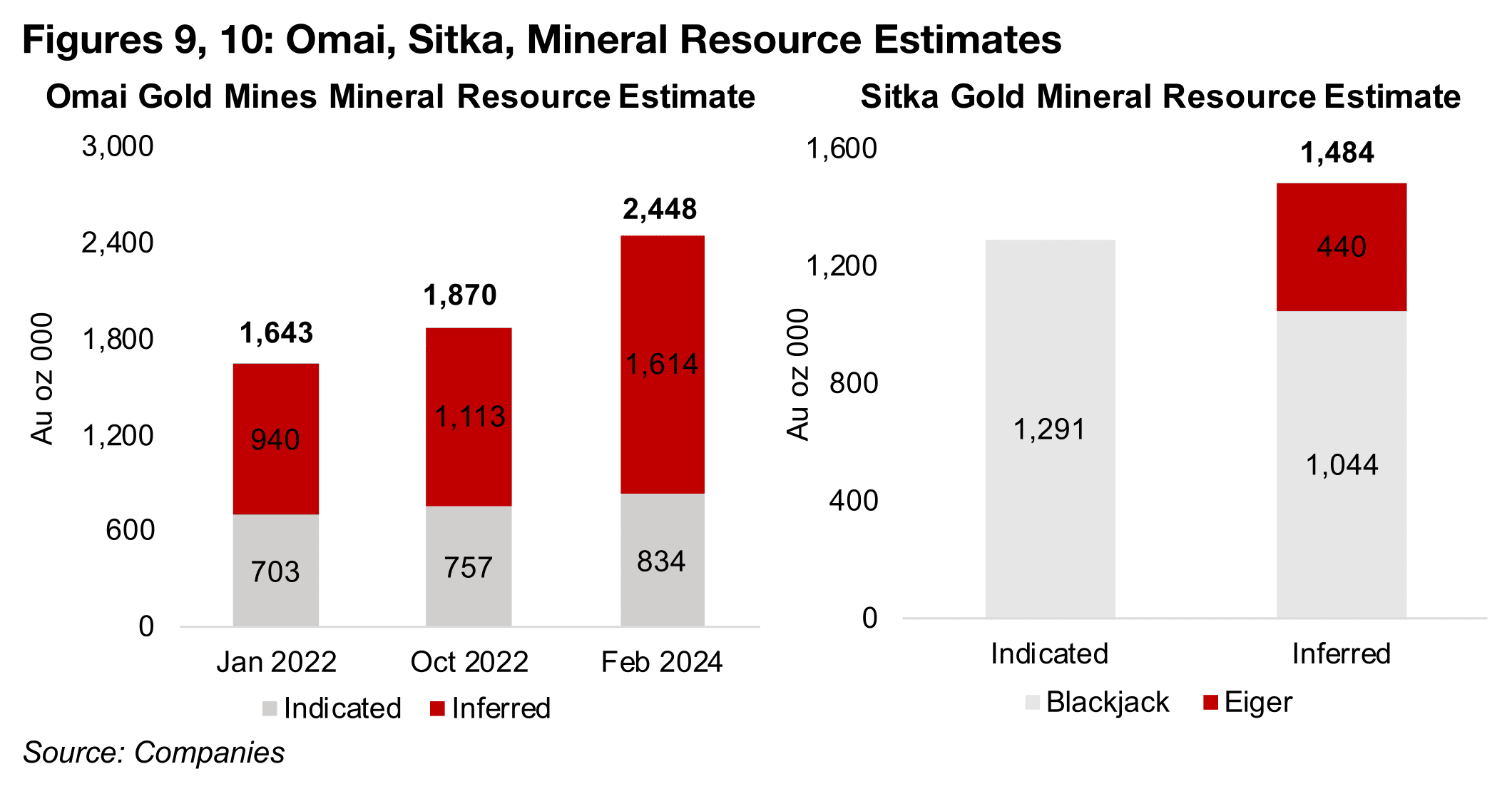

Both Omai Gold Mines and Sitka Gold are at the mineral resource estimate stage.

Omai operates the Wenot project in Guyana, which is a past producing mine with

output of 3.8 mn oz Au from 1993 to 2005. The company has increased its Resource

estimate twice in recent years, to 1.87 mn oz Au in October 2022 from 1.63 mn oz Au

in January 2022 and again in February 2024 to 2.45mn oz Au, and it expects to

announce another updated resource soon (Figure 9). The major news flow this year

has been drill results each month from Wenot, a completed $25.3mn placement in

February 2025, and permitting progress announced in June 2025. The shares have

trended upward this year, with brief pullbacks and is near its highs, with a 192% gain.

Sitka Gold’s main project is RC Gold in the Yukon, with 1.29mn oz Au in Indicated

Resources and 1.04mn oz Au in Inferred Resources from the Blackjack deposit and

0.44mn oz in Inferred Resources form the Eiger project (Figure 10). The company

announced an upgrade of its resource estimate in January 2025, and began its drilling

program for the year at Wenot in February 2025, with drill results reported in April,

May and June 2025. An $11.8mn financing was closed in April 2024 and the company

started the first ever drill program at the Coppermine River project in Nunavut with

grab samples showing high grades of copper. The share price rose from January

2025 to April 2025 highs, pulled back in May 2025, and while it has recovered since,

it has not regained its peak, and is up 56% this year.

Goliath is at the earliest stage of the new entrants to the TSXV Top 25 Gold stocks,

operating the Golddigger property, which is still in the exploration stage. The

company reported strong drill results from the project and a strategic investment in

from MacEwen in January 2025 and additional strong drill results in February 2025

which drove the share price up to its highs for the year. While it declined through

March and into early April, it has gradually recovered since and is up 126%, with a

major drill program started at the Surebet zone of the project started in May and

further drill results reported in June and July 2025.

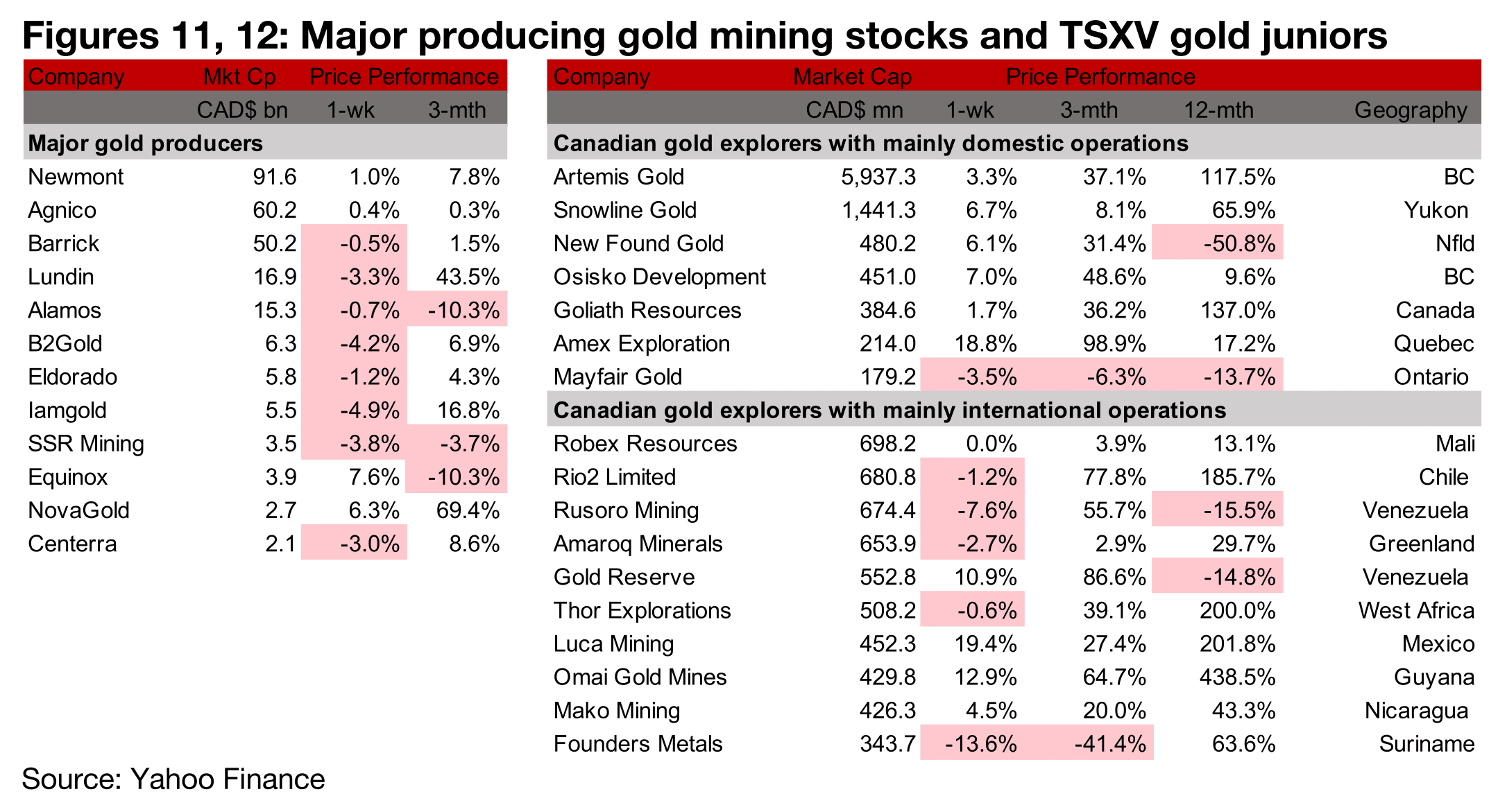

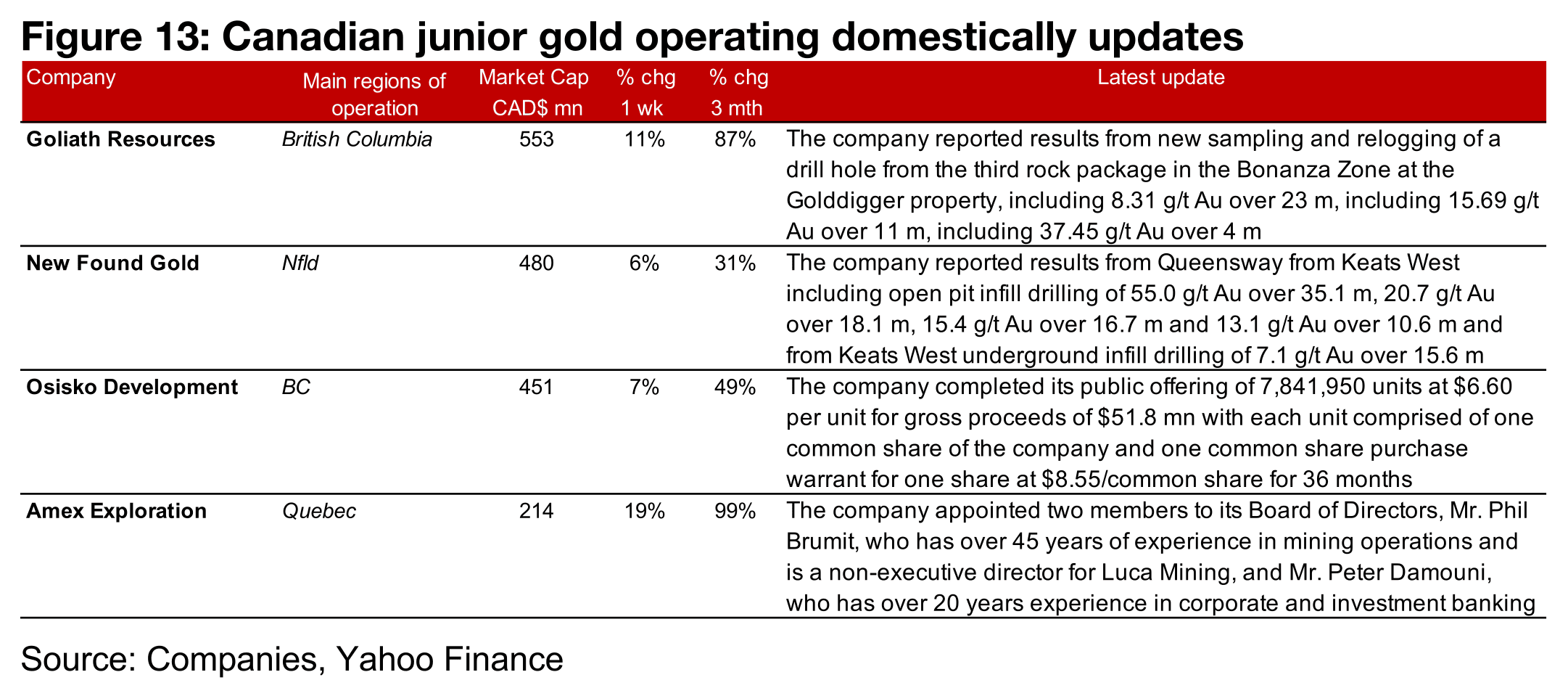

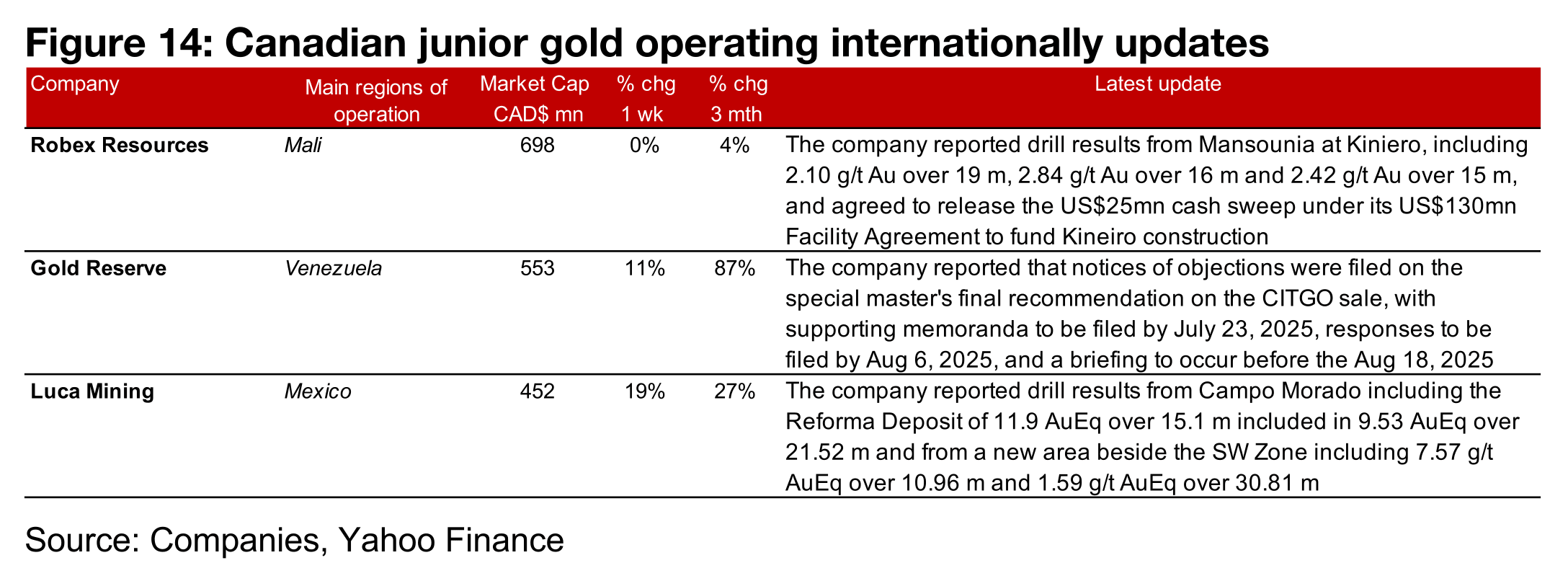

Major producers mainly drop and TSXV large gold mixed

The major producers mostly declined and the TSXV large gold were mixed (Figures 11, 12). For the TSXV gold companies operating mainly domestically, New Found Gold reported drill results from the Keats West Zone of Queensway, Osisko Development completed its $51.8mn public offering, Amex Exploration appointed two members to its Board of Directors and Goliath Resources reported drill results from the Bonanza Zone of the Golddigger project (Figure 13). For the TSXV gold companies operating mainly internationally, Robex Resources reported drill results from Mansounia at Kiniero, Gold Reserve announced that notices of objections had been filed on the special master’s final recommendation on the CITGO sale and Luca mining reported drill results from Campo Morado (Figure 14).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.