September 2022

How to Play the BROKEN Energy Market for Profit

- The Most Efficient Source of Clean Power

- Case Study: Blue Sky Uranium (BSK.V, OTC:BKUCF)

- Gearing Up for Expansion

- The URGENT Opportunity

The energy market is falling apart. The prices of crude oil and natural gas are at levels not seen in years.

Oil prices breached $120 per barrel in early summer and remained elevated. They haven't been this high since the Financial Crisis of 2008-2009.

Natural gas in Europe went from €48 per megawatt hour to over €250 in a matter of just 12 months.

Millions of consumers and businesses are feeling the pain from higher utility bills, gas prices, and overall inflation fueled by the broken energy market.

There is no quick fix for that. The prices of carbon-based fuels will remain high as long as the world tries to replace Russian supplies of oil and gas. And it's not an easy task, as the country controls 14% of the global crude and condensate market.

This winter, we may see record prices at the pump. Heating bills will hurt.

Global governments are alarmed, and Europe went so far as to limit energy use for both businesses and households.

The European Union and others are trying to switch to alternative energy sources and stop using fossil fuels in the long term.

This is bad. But every crisis presents a unique opportunity.

And the difficult energy situation the world found itself in can drive the price of a specific commodity to an all-time high.

This energy commodity could be at the center of the next secular bull market.

It's time to protect your portfolio from the energy crisis and position it for profit.

The Most Efficient Source of Clean Power

When most investors think about renewable energy, they mostly envision solar panels, wind turbines, and hydropower plants.

There is a problem. These sources of energy are clean, yes, but they are not stable enough to power the grid 24/7. Also, they often can't provide enough power to feed the grid in densely populated areas.

The world needs another solution. And the only source of energy that is safe, clean, and stable is nuclear power.

You might not know this. But nuclear energy has lower carbon emissions than hydropower, geothermal power, and solar photovoltaics.

It's one of the cleanest sources of energy there is. And it doesn't rely on sunlight or wind, which can be unpredictable due to weather changes. A power plant can run nonstop for decades.

In fact, nuclear power is the "hardest working" and efficient source of energy.

Nuclear plants have a 92% capacity factor, which means they can produce maximum power 92% of the time during the year. Solar and wind can deliver maximum power 25% and 35% of the time, respectively.

You cannot power an economy with installations that can provide 100% output just one-fourth or one-third of the time.

Nuclear plants will power the future, and the companies that will supply nuclear fuel are best-positioned to profit from the global shift toward renewable and clean sources of power.

It's time to position your portfolio to benefit from this trend NOW.

Case Study: Blue Sky Uranium (BSK.V, OTC:BKUCF)

Blue Sky Uranium could be poised to become a major player in the clean energy market. It's working on a massive uranium project in Argentina called Amarillo Grande.

In 2019, Blue Sky released a preliminary economic assessment (or PEA) for Amarillo Grande. The study describes a 13-year mine life and an after-tax net present value (NPV-8%) of $135.2 million.

For reference, the company's current market capitalization is around $26.7 million.

Nikolaos Cacos, the company's President and CEO, describes it as a project that has "the potential to rank among the largest uranium deposits in the world and have the lowest operating costs."

If built, the Amarillo surface mine would have a maximum depth of just about 30 meters. Processing this mineralization is likely to be extremely cheap.

It is a promising discovery done by one of the most experienced teams working in Argentina: Grosso Group.

The group was founded by Joseph Grosso, Chairman and director of Blue Sky. Mr. Grosso is a mining veteran. His group has worked in Latin America since the early 1990s and built a strong reputation among investors and peers. The team he assembled to advance Amarillo Grande has been working in the area for over 15 years.

In 2007, Blue Sky found the first uranium anomaly at the property and developed it into a project valued at over one billion dollars at the current uranium prices.

There could be more value there, however.

In 2007, the price of uranium surged to $136 per pound. And a junior mining company working in the uranium space, Paladin Energy, returned 133,667% in less than four years. This gain would turn a $1,000 investment into $1,337,667.

Gearing Up for Expansion

However, Blue Sky is not just sitting and waiting for higher uranium prices. It keeps advancing the project and exploring the massive land package.

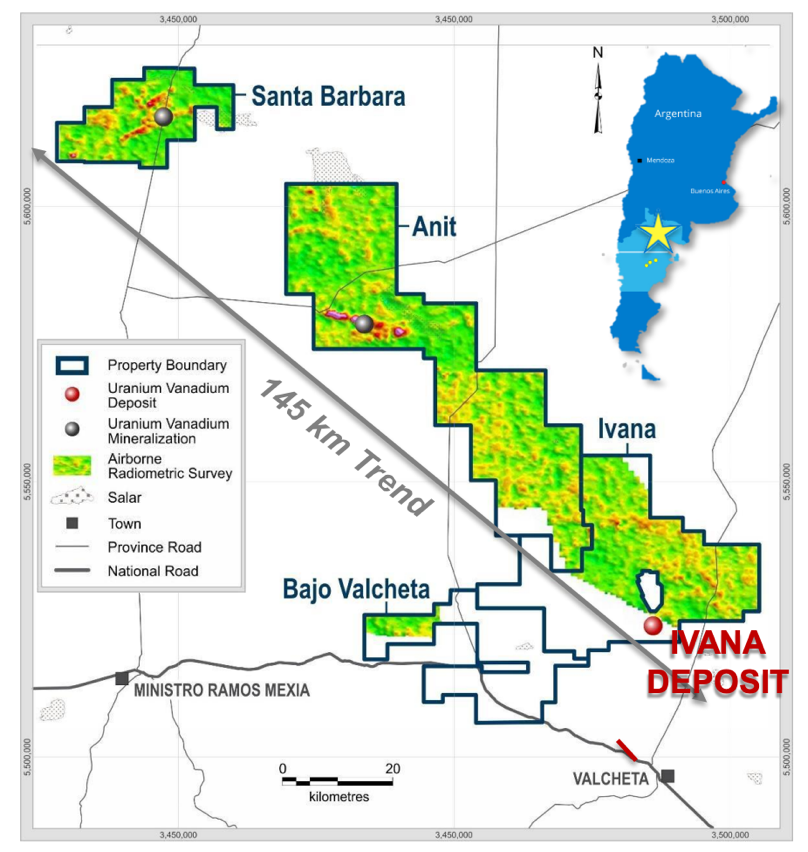

Its surface mapping program outlined a 145-kilometer-long trend of prospective targets.

Take a look at the project's map below. It looks vastly underexplored with the potential to host multiple deposits like Ivana.

In April, Blue Sky announced that it would resume a 4,500-meter drill program at the property. In the past, surface sampling delivered excellent results, such as 1.1 m of 1.40% U3O8, including 0.5 m of 2.74% U3O8.

But this project hosts more than one metal. In addition to uranium, Amarillo Grande has a vanadium component. This metal is used in large-scale industrial batteries to store energy.

Blue Sky has an ideal mix of two metals for producing and storing clean power.

The URGENT Opportunity

The energy industry is on the edge of collapse and Blue Sky Uranium is working to address this crisis. Uranium and vanadium hosted at its Amarillo Grande project are essential solutions for the world starved of energy.

With the exploration results coming, Blue Sky is well-positioned to deliver significant progress in the near term.

Regardless of where oil and gas go this winter, uranium is here to stay. Make sure to position your portfolio to profit from this broken energy market-and profit from the fix.

Go to BlueSkyUranium.com to learn more.

Sign up to receive our future articles and updates.

Disclaimer: This report is for informational use only and should not be used as an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.

The preceding Article is PROMOTED CONTENT sponsored by Blue Sky Uranium and produced in cooperation with CanadianMiningReport.com.