April 24, 2023

Market's Conservative Forecasts for Gold

Author - Ben McGregor

Gold fighting to maintain breakthrough level

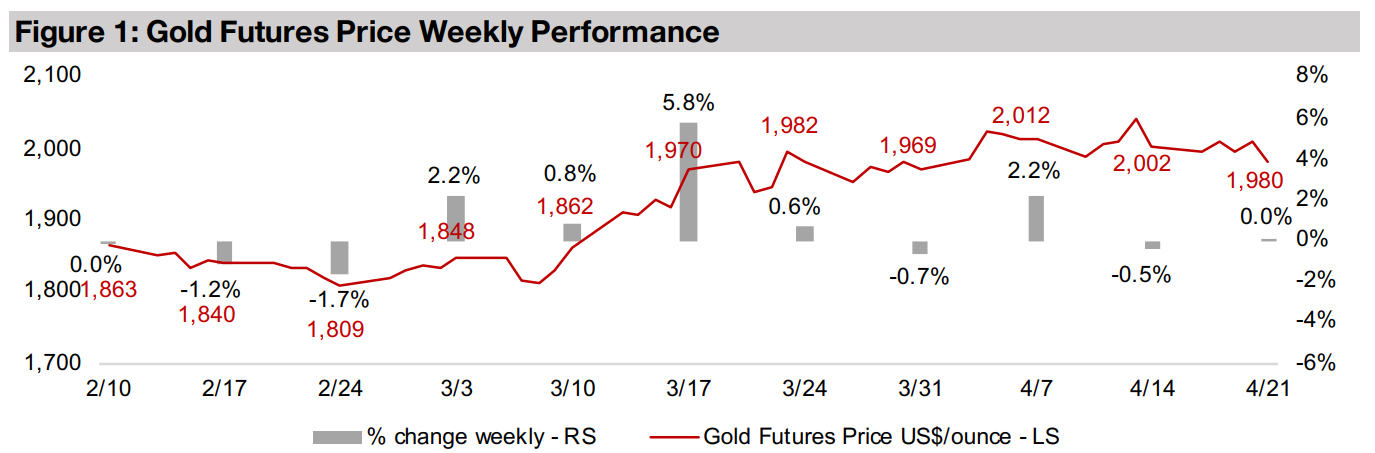

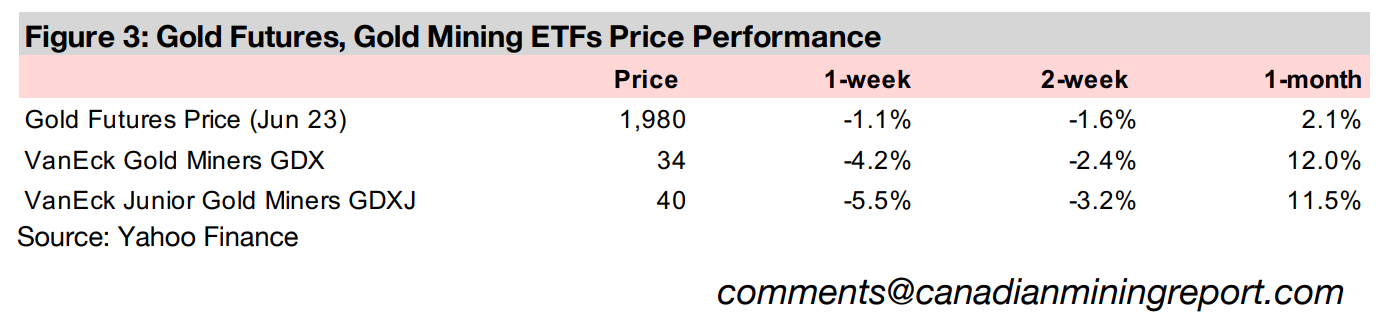

Gold dropped -1.1% to US$1,980/oz and fought through the week to maintain the US$2,000/oz level, with two sessions above and three below, as a lack of major economic news indicating a clear direction for the metal resulted in profit taking.

Market's gold forecasts remain conservative, Mayfair Gold In Focus

This week we look at forecasts for gold in 2023E from a range of financial institutions, which still look quite conservative, and for other metals from the World Bank, while Mayfair Gold, developing the Fenn-Gib project in Ontario, is In Focus.

Gold stocks decline as gold drops and equity markets are near flat

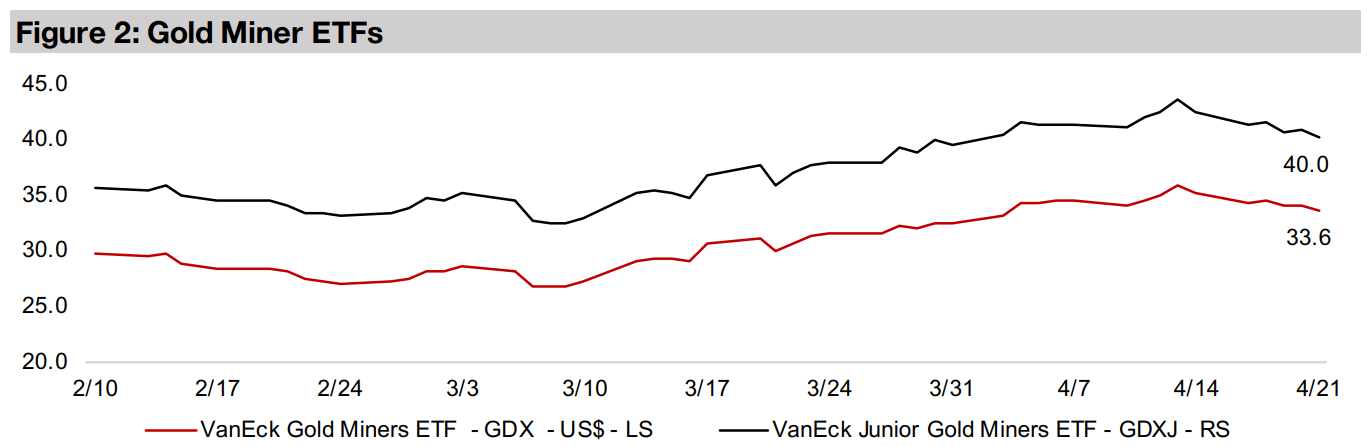

The producing and junior gold stocks declined, with the GDX sliding -4.2% and the GDXJ down -5.5%, and the large TSXV gold juniors were mixed, as gold eased off near record highs and the equity markets were near flat, with the S&P 500 up 0.25%.

Market's Conservative Forecasts for Gold

Gold declined -1.1% to US$1,980/oz, after fighting all week to maintain the key US$2,000/oz level, with two sessions above and three below. There was limited economic data released in terms of big drivers for gold, so the retracement could just be some profit taking after gold's recent run. The metal peaked at highs of US$2,023/oz on April 4, 2023, and is now up 21.7% from a trough of US$1,627/oz as of September 27, 2022, and has yet to breach the most recent highs of US$2,040/oz set in on March 8, 2022, and US$2,052/oz set on August 6, 2020.

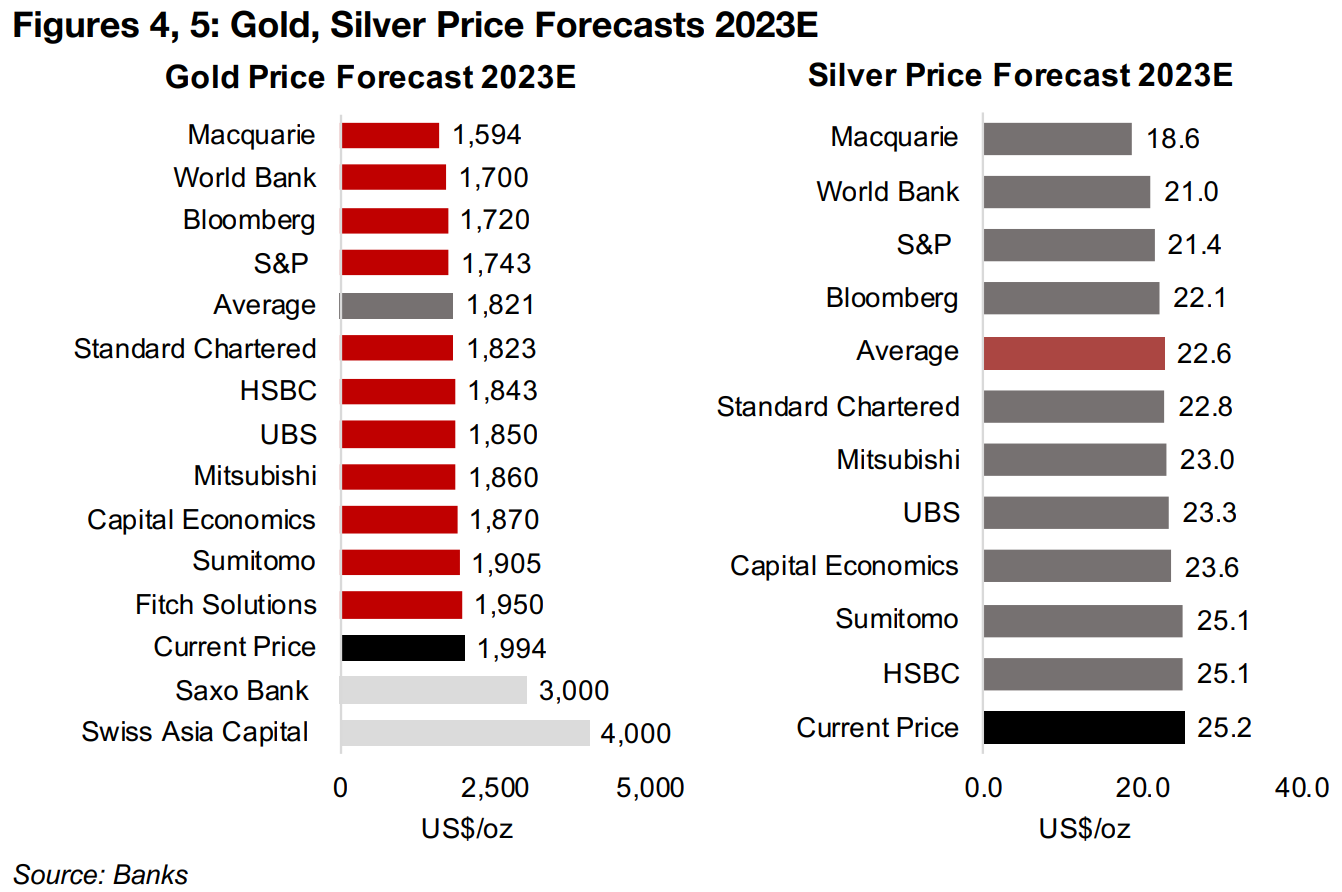

Market forecasting gold to pullback near three-year average...

The average 2023E gold price forecast of US$1,821/oz from a group of major financial institutions indicates an -8.7% drop from the current level (Figure 4). The estimates range from US$1,594/oz from Macquarie to US$1,950/oz from Fitch, and we have excluded the highest targets of US$,3000/oz and US$4,000/oz from the average as outliers far above the rest of the market. The gold bears at Macquarie expect a major recession and a plunge in risk assets to pull down gold, similar to the 2008-2009 crisis. The outlier bulls expect both a major economic decline, resulting in the resumption of a massive monetary expansion and a substantial ramp up in political conflict, including a severe decline in the US$ as substitute currencies gain share.

...but consensus forecasts look quite conservative

Overall, the consensus for gold looks conservative, and targets a reversion to the

average US$1,800/oz price that has held since 2020. However, with gold already

averaging US$1,911/oz for the first four months of the year, it suggests that there

would need to be a considerable pullback for the rest of the year. We do not see

where this downward pressure on gold is going to come from given the current macro

environment. While silver forecasts also look conservative, this could be justified by

a higher exposure to industrial drivers than gold (Figure 5).

There are growing concerns of an imminent global recession, which could see a shift

from monetary tightening to expansion by early 2024, and the market already seems

to be starting to price this into gold. Also, a global recession could further increase

gold's attractiveness as an overall risk hedge, not to mention rising geopolitical risk,

which could further boost the metal. The current gold price forecasts seem to assume

that the Fed will continue to hike rates, curb inflation, and maintain growth without

any more extreme fallout like the recent banking crisis. We are not convinced that

such a combination of rosy scenarios remains a high probability.

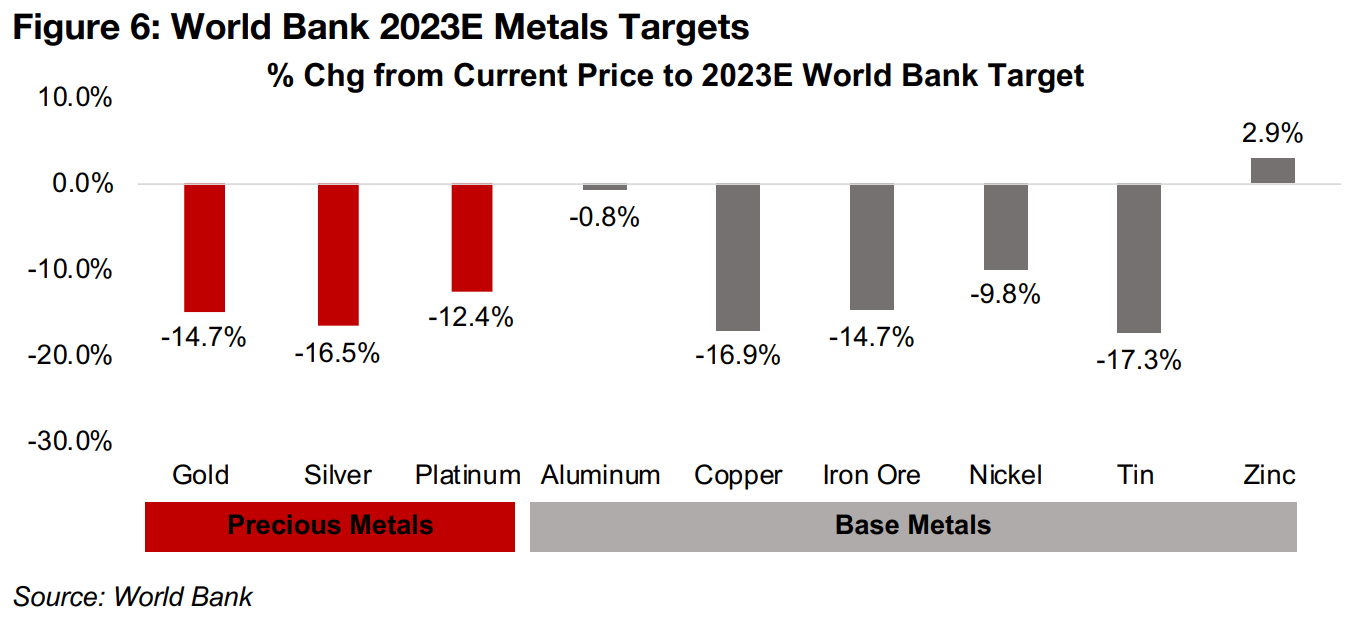

World Bank expecting significant declines for most major metals this year

Beyond gold and silver, and World Bank is looking for a significant decline for most major metals from current levels based on their 2023E targets, with only aluminum, down less than -1.0% and zinc, up 2.9%, expected to remain unscathed (Figure 6). The copper, iron ore, nickel and tin prices forecasted by the World Bank seem to indicate a weakening global economy. While the World Bank expects this bearish scenario to also drag down the prices of gold and silver, we would counter that the market could actually move into these two precious metals in a downturn as safe havens. Also, the economic decline implied by the base metals drop hints at a return to monetary easing, which should be supportive especially of gold, but also silver.

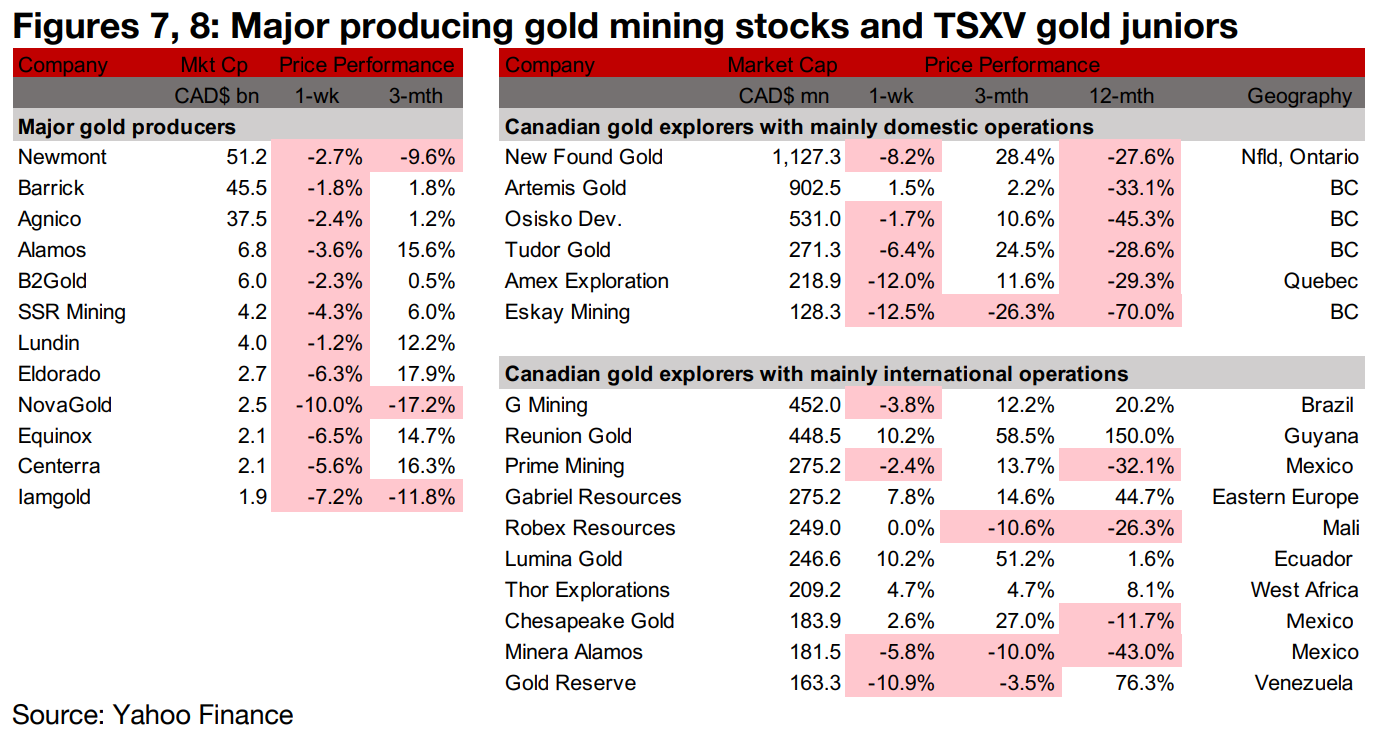

Producers all down and TSXV large gold mixed on lower gold and stocks

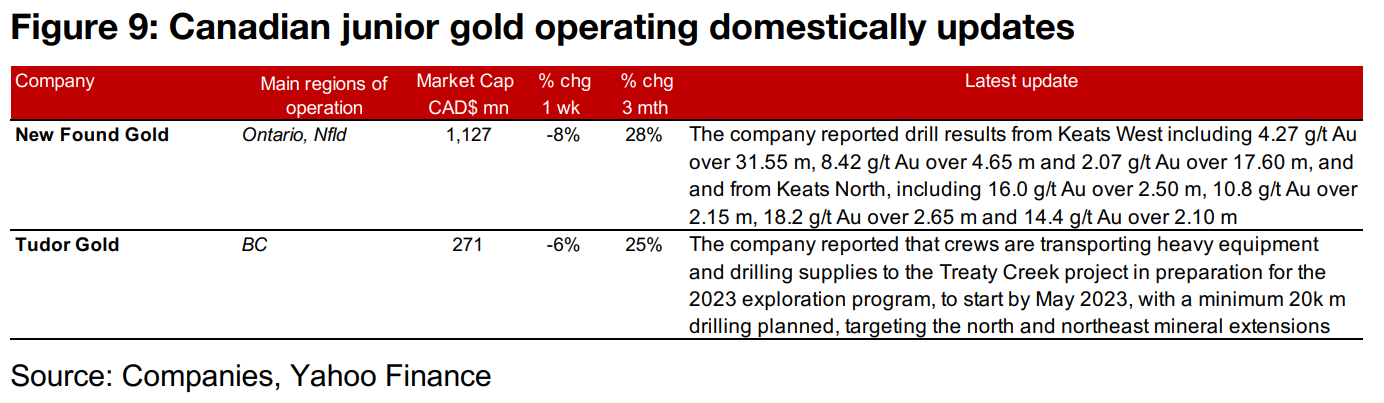

The producing gold miners were all down and TSXV large gold was mixed as gold

declined, likely on profit taking, and equity markets edged down. For the Canadian

gold juniors operating mainly domestically, New Found Gold reported drill results

from Keats West at Queensway and Tudor Gold reported that crews are preparing

for its exploration program at Treaty Creek to start in May 2023.

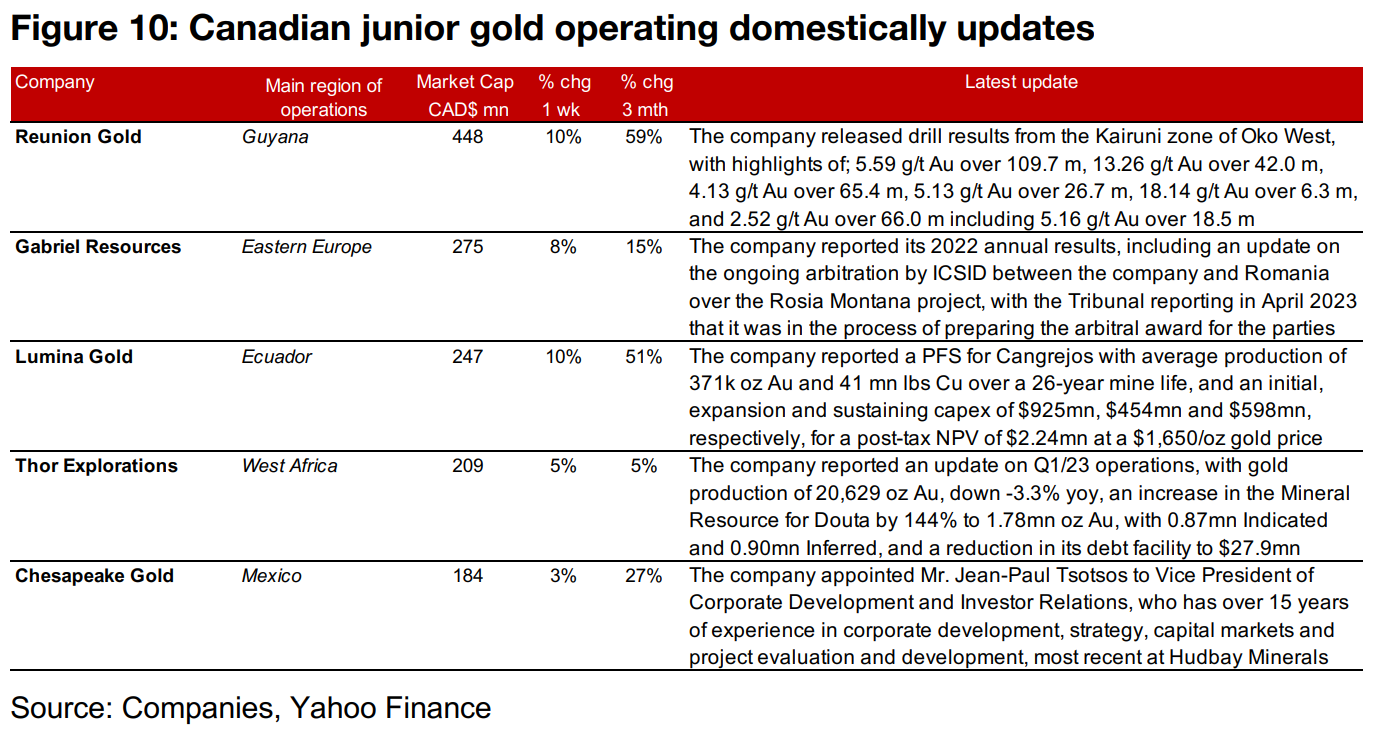

For the Canadian gold juniors operating mainly internationally, Reunion Gold released

drill results from the Kairuni Zone of Oko West, Gabriel Resources reported its 2022

annual results, including progress towards an arbitral award in its ICSID arbitration

with the Romanian government over the Rosia Montana project, Lumina Gold

reported a PFS for Cangrejos, Thor Explorations announced an update on its Q1/23

operations and Chesapeake Gold appointed Mr. Jean-Paul Tsotsos to Vice President

of Corporate Development and Investor Relations.

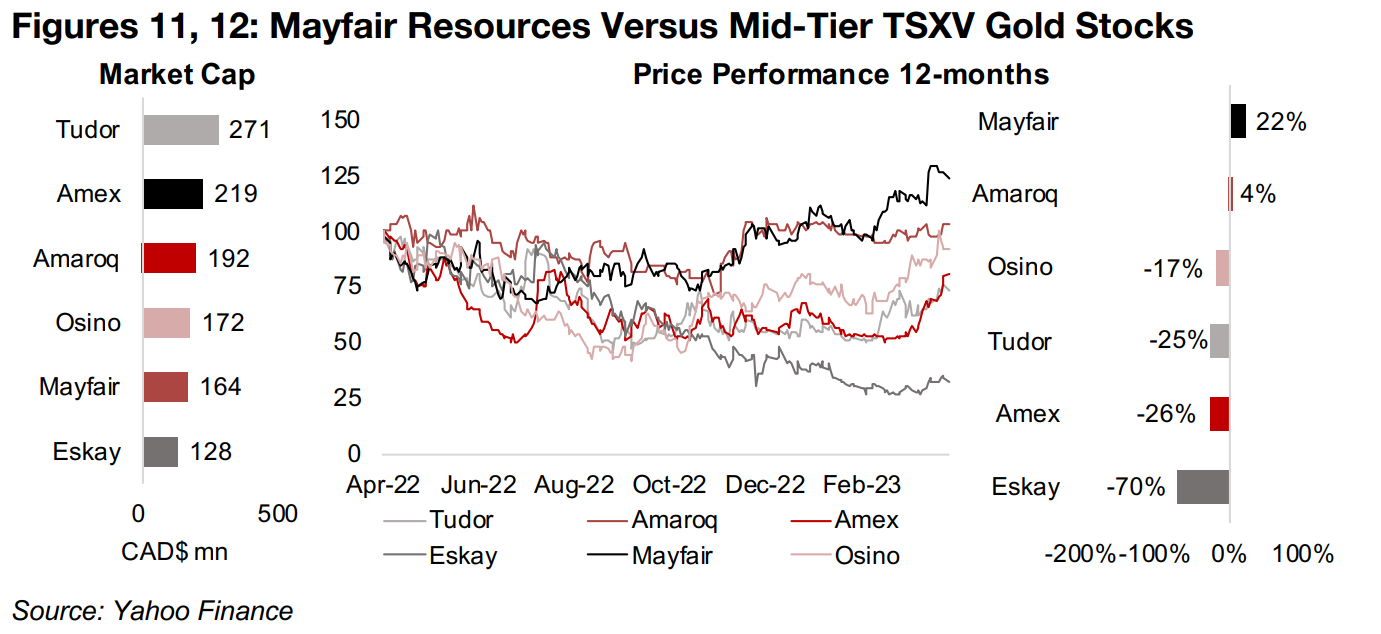

In Focus: Mayfair Gold

Strongest performing TSXV mid-tier gold stock over past 12-months This week Mayfair Gold is in Focus, part a group of mid-tier, earlier stage, TSXV gold developers and explorers, that have either reached the Mineral Resource Estimate stage, including Tudor Gold, Amaroq Minerals, Osino Resources, or have already done extensive drilling at their projects, including Amex Exploration and Eskay Mining. The stock has seen the strongest performance of the group over 12-months, up 22%, with the second highest increase from Amaroq, edging out a 4% gain. The rest of the group is down over -15%, including Osino Resources, Tudor Gold, Amex Exploration and Eskay Mining, declining -17%, -25%, -26% and -70%, respectively (Figure 12).

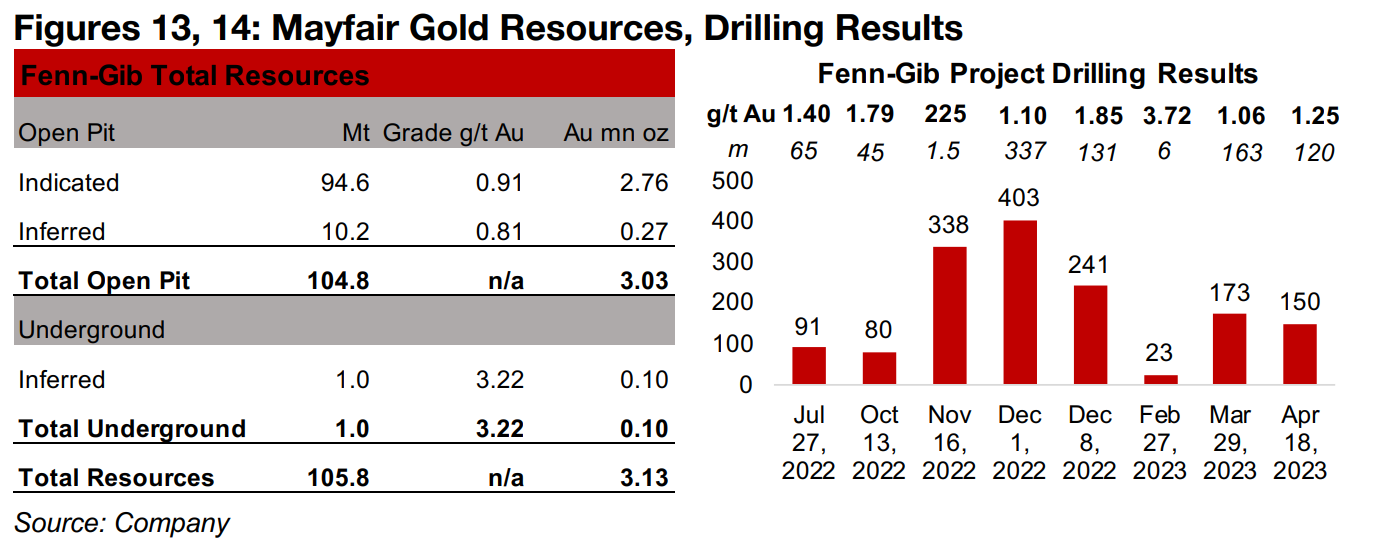

Strong drill results from Fenn-Gib driving stock price

The company operates the Fenn-Gib gold project in Ontario, Canada, which is almost

entirely open pit, with an open pit Mineral Resource Estimate of 2.76mn oz Au

Indicated and 0.27mn Inferred, for a total 3.03 mn oz Au, with a small proportion of

underground Resources, at just 0.10mn oz Au Inferred (Figure 13). The company's

strong gains versus its close comparables have been driven by very strong drill results

from Fenn-Gib (Figure 14), with a high grams-thickness highlighted especially in

results from near the end of 2022.

On November 16, 2022, the company reported a grams-thickness of 338, comprising

225 g/t Au over 1.10 m, and on December 1, 2022, a grams-thickness of 403, with

1.10 g/t Au over 337m. Although subsequent results have not been as outstanding

as these, they have still been reasonably strong, including a grams-thickness of 241

on February 27, 2023, with 1.85 g/t Au over 131 m, a grams-thickness of 173 on

March 29, 2023, with 1.06 g/t Au over 163 m and a grams-thickness of 150, with 1.25

g/t Au over 120 m on April 18, 2023.

Two financings so far in 2023, funded for six months at 2022 spending rate

Mayfair Gold had $6.8mn in cash as of end-December 2022, and closed a financing

of $3.45mn in January 2023, which was the second tranche of a private placement,

with the first $4.98 mn tranche closed in December 2022. The company announced

another private placement in April 2023, for gross proceeds of $6.0mn, comprising

2.42mn flow-through common shares at a $2.42/share.

The company's expenditure was $18.2mn over 2022 and adding the two financings

to the year-end 2022 cash balance totals $16.3mn. Assuming spending has

continued at the $4.5mn average per quarter rate that was seen in 2022, the

company's cash balance would be around $11.8mn near the end of Q1/23. This

would leave it funded for around half a year of expenditure at a similar rate to that of

2022.

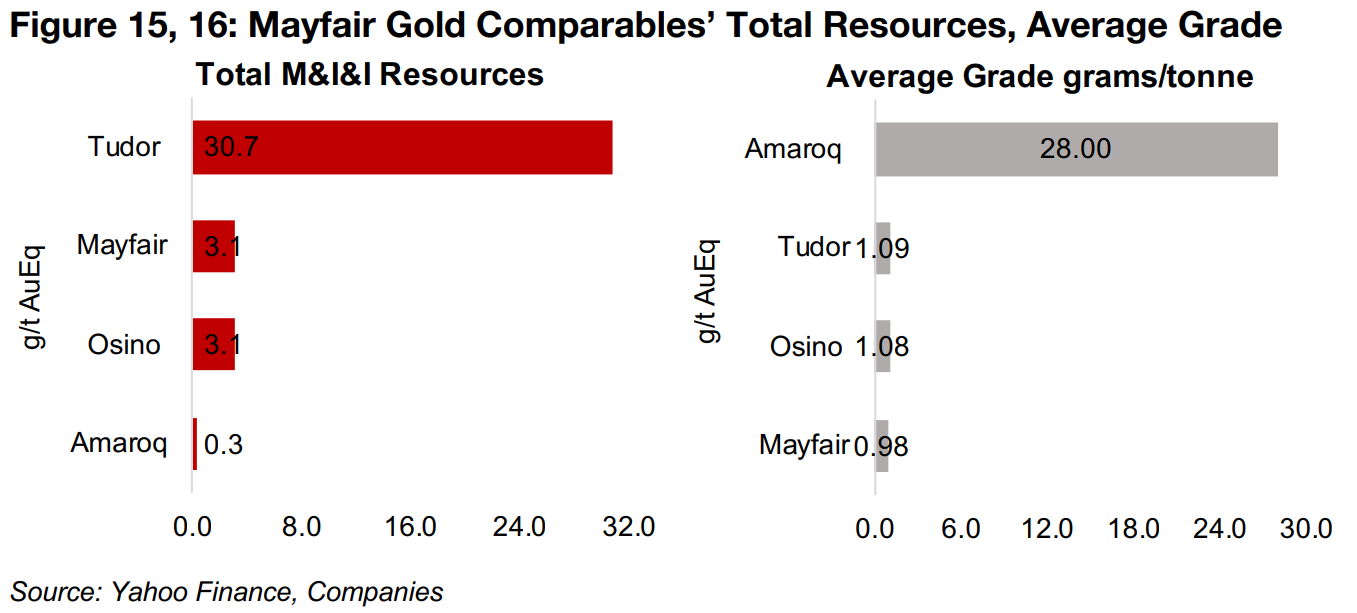

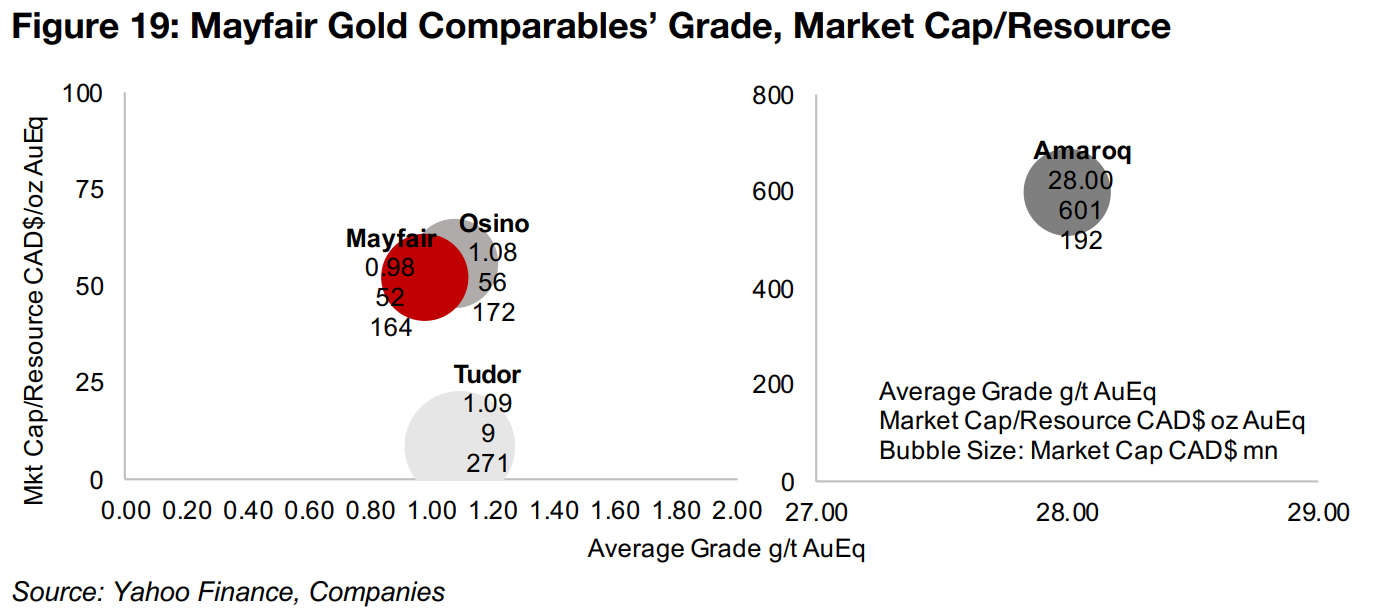

Large spread in resource size and grade of Mayfair comparables

There is a wide spread in the Resource size and grade of the TSXV mid-tier, earlier stage, explorer and developer group. For the Resource size, this is driven by Tudor, which with 30.7mn oz AuEq for Treaty Creek, is nearly ten times the size of the 3.1mn oz Au for both Mayfair's Fenn-Gibbs and Osino Resources' Twin Hills projects, and 100x the level of Amaroq's Nalunaq project (Figure 15). The spread in grade is driven by Amaroq's Nalunaq, which has an extremely high average grade of 28.0 g/t Au for its small project (Figure 16). This compares to almost exactly the same average grade for Tudor Gold's Treaty Creek, at 1.09 g/t Au, and Osino's Twin Hills, at 1.08 g/t Au, while the grade for Mayfair's Fenn-Gib comes just below this, at 0.98 g/t Au.

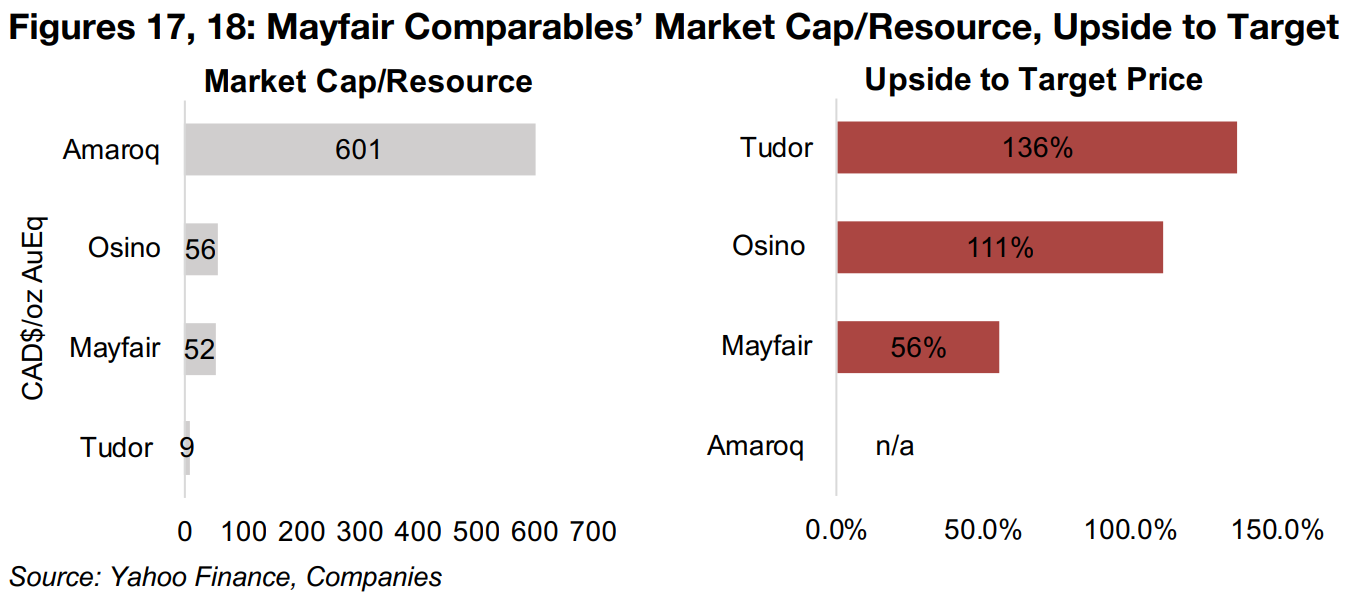

Mayfair Gold priced similarly to Osino Resources

On a market cap to resource multiple of $52/oz, Mayfair Gold is priced similarly to

Osino Resources, at $56/oz, with the projects having nearly exactly the same level of

Resources, while Mayfair has a slightly lower grade, accounting for its slightly lower

multiple (Figure 17, 19). Amaroq Minerals is priced far above the rest of the group, at

$601/oz, over ten times the level of Mayfair and Osino given its much higher grade.

Its grade is so high that the scale for both axes had to be changed for the second

half of Figure 19 to include Amaroq, which would otherwise literally go 'off the chart'.

Tudor Gold's valuation looks quite low versus the rest of the group, at just $9/oz,

about a fifth the level of Osino and Mayfair, even though its grade is similar,

suggesting that the market is expecting higher difficulty in recovering Treaty Creek's

Resources. The market is targeting 56% upside to Mayfair Gold's target price after

its recent run, with the relative stock price underperformance of Osino and Tudor

leaving them with 111% and 136% upside to their target prices, respectively, and

Amaroq Minerals still has no consensus target price (Figure 18).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.