November 06, 2023

Risk On Revival As Fed Pauses

Author - Ben McGregor

Gold dips as Fed pauses on rate hikes

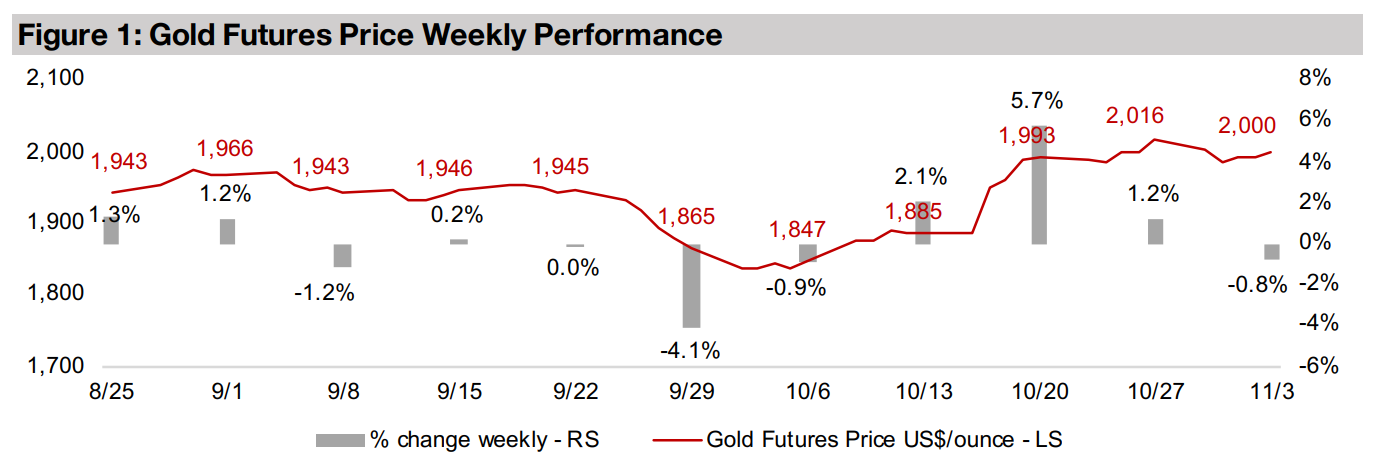

Gold declined -1.8% to US$2,000/oz after a four week rise, as the US Fed’s pause on interest rate hikes revived risk on sentiment and sent equities surging after markets had trended down through October 2023 on the spike in geopolitical risk.

Gold stocks rise, but underperform broader equity indices

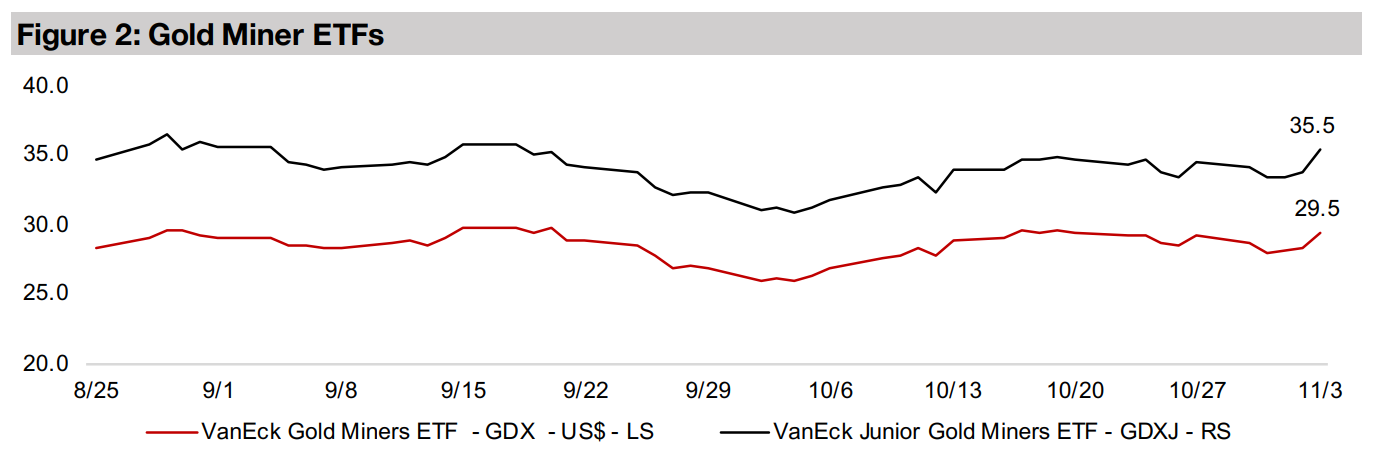

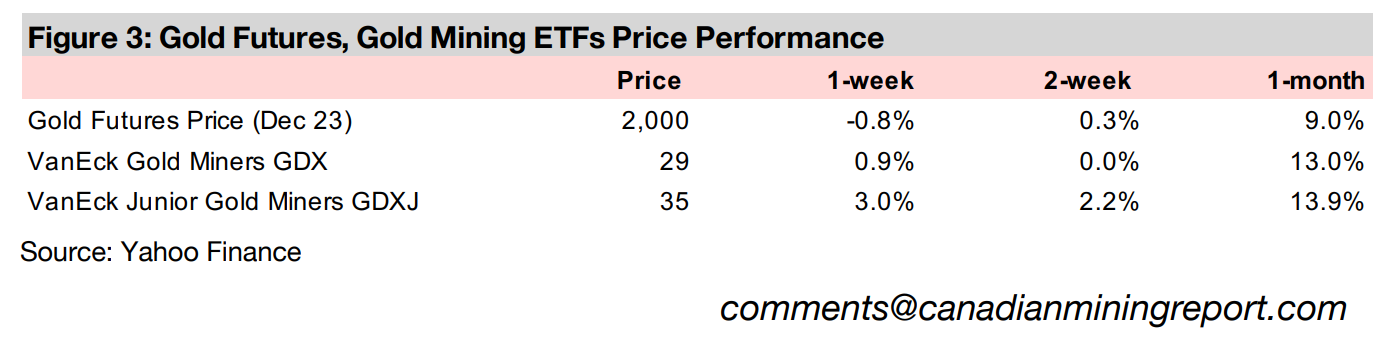

While gold stocks rose, gains were attenuated by the metal’s decline, with the GDX up 0.9% versus a 5.3% gain in the S&P 500, and the GDXJ up 3.0% compared to a 7.0% rise in the Russell 2000, while the TSXV larger gold stocks mostly declined.

Risk On Revival As Fed Pauses

Gold declined -0.8% to US$2,000/oz, after a four week rise, as the US Fed paused its interest rate hikes at its latest meeting, reviving risk on sentiment after markets were weak in October on spiking geopolitical risk. This sent the S&P 500, Nasdaq and Russell 2000 surging 5.3%, 5.7%, and 7.0%, respectively, while gold stocks underperformed on the metal’s decline with the GDX up 0.9% and GDXJ gaining 3.0%. We might have expected a Fed pause to have been good for gold, implying some relief from higher real yields, a rising US$, and a falling money supply, all of which tend to be downward drivers for gold. However, the markets seemed to have been waiting for an excuse to pile back into equities after a three-month downtrend and eased off gold buying after some strong gains in the metal over the past month.

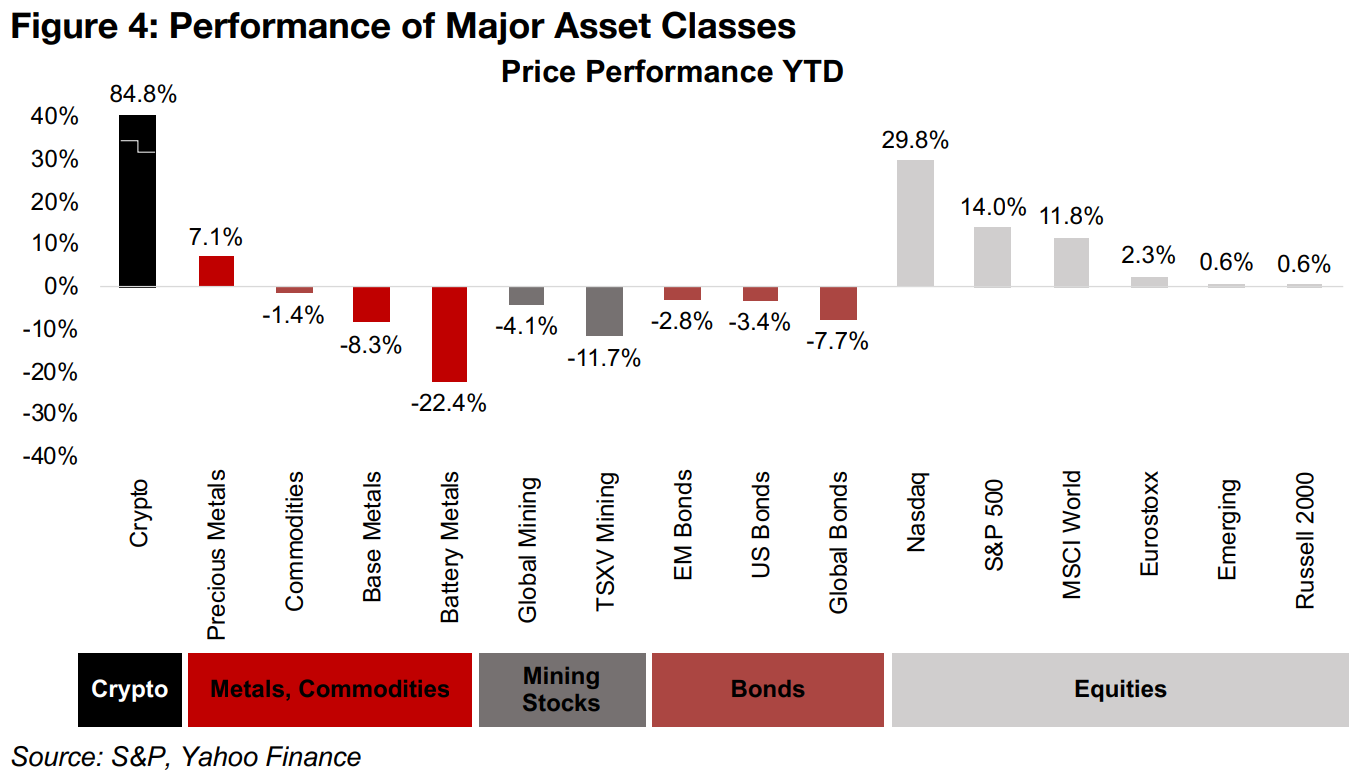

While the US markets have had a strong performance over the past year, they are anomalies, with other markets and assets sluggish. These US gains have also not been balanced, with Nasdaq’s 29.8% jump driven by a few megacap tech stocks, which have also been crucial to the 14.0% rise in the S&P 500, and these US markets weigh heavily in the 11.8% gain in the MSCI World. Looking more broadly, US small caps have barely moved, up just 0.6%, as have European or emerging markets stocks, gaining just 2.3% and 0.6%. Other asset classes have struggled, with emerging market, US, and global bonds down -2.8%, -.3.4% and -7.7%, and commodities losing -1.4%. Metals markets have been mixed, with precious metals up 7.1%, supported by gold, but base metals down -8.3% as several metals pull back from 2022 highs and battery metals are off -22.4% on the sharp drop in lithium.

Crypto surging, but still not a safe haven substitute for gold

The underlying metals price declines have hit the major mining stocks, with the MSCI

Global Mining and Metals Producers ETF off -4.1% and the S&P/TSXV Metals and

Mining Index, comprising mainly junior miners, down -11.7%, given the greater risk

of these stocks. The only huge gainer has been crypto, with the Crypto 200 Index

surging 84.8%, bringing into question once again whether this is a heavy risk asset

or a hedge against risk. In the tech boom to 2022, crypto tended to be correlated with

the Nasdaq, but crypto’s recent rise has occurred even as the tech-heavy index has

declined, and there has been a general risk off sentiment over the past three months.

Regardless, what has been made clear over the past two years is that crypto is not a

real substitute for gold in terms of being a safe haven.

We are not convinced that this equity rally will be sustainable and take the attention

away from gold for too long. The high geopolitical risk currently could prove enough

to keep the gold price elevated alone and if this pause by the Fed starts to give way

to indications of rate cuts into early 2024, it would be a recipe for a significant jump

in gold. However, we would not want to overstate the case for a soon-to-be-dovish

Fed, with such expectations by the market having been repeatedly dashed over the

past two years. Prices remain high, and the Fed has been clear that it would maintain

rates at least at current levels for an extended period, and could still hike further,

apparently preferring to overshoot with rates too high too long than to cut too early.

US equity gains very concentrated in a few megacap tech stocks

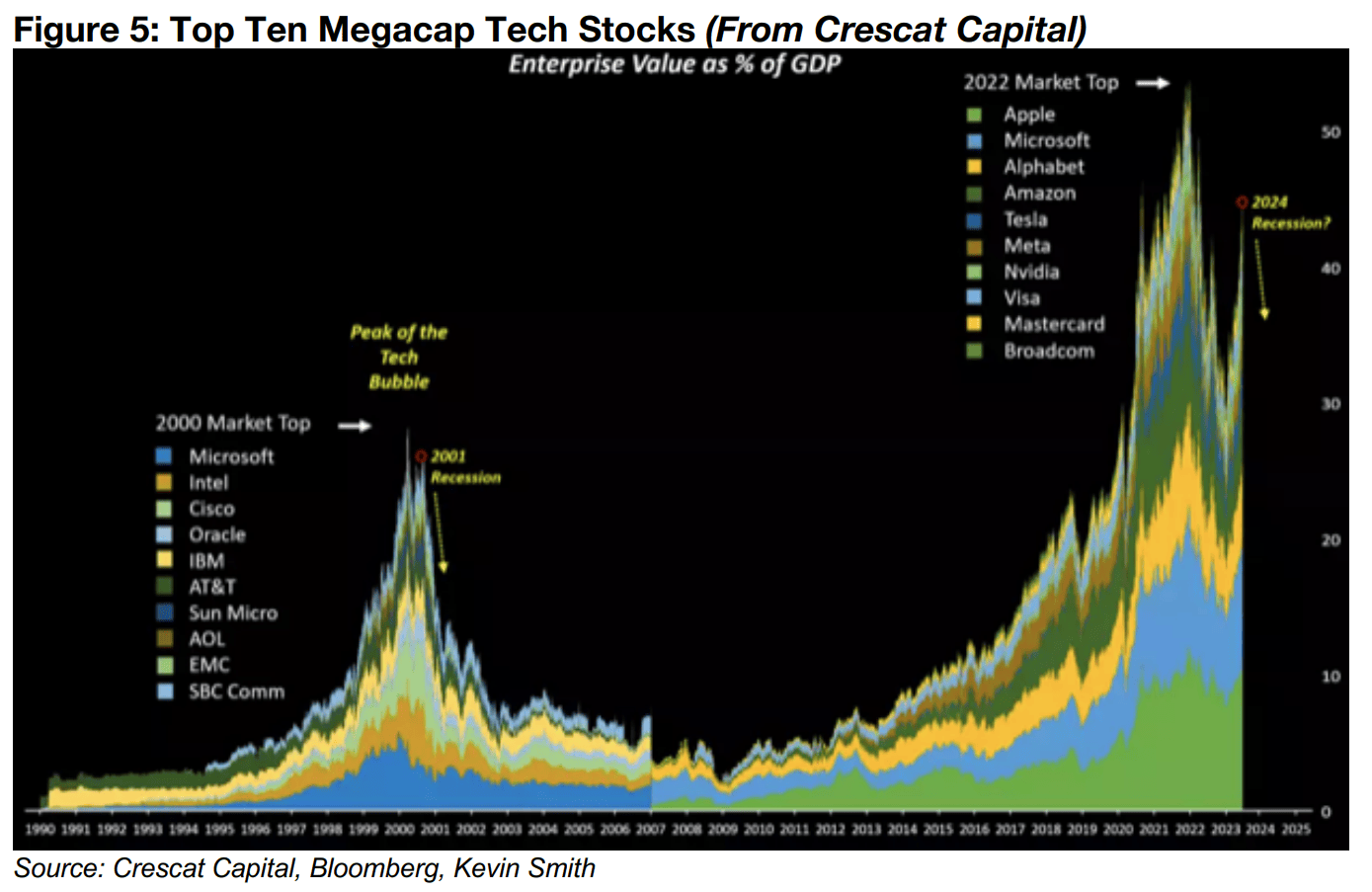

Crescat Capital provides insight on just how skewed these gains in large cap US

equity indices have become, in a recent report showing the extremely heavy

concentration of the market in a few tech stocks with historically extremely high

valuations. Figure 5 shows Crescat’s calculation of the enterprise value (the market

cap plus net debt for a company) to US GDP for the top ten megacap tech stocks for

two periods, from 1990 to 2006 and from 2007 to 2023. The ratio of the enterprise

value to US GDP of these top ten tech stocks combined is currently at around 40%,

dramatically up from below 10% from 2008 to 2015.

While this is down from a peak well over 50% at the market top in 2022, it is still

extreme in historical terms, with the enterprise value for the previous top ten megacap

tech stocks peaking at only around 30% of GDP, even during the tech-stock

excesses of early 2000. This ended with the dot.com crash later that year and a

recession into 2001. Crescat questions whether a recession in 2024 could drive a

similar decline in these megacap stocks, and sees them as having the most potential

for a fall. There is clearly a disconnect between the Nasdaq and S&P 500 and the rest

of global equity markets, bond markets and commodities, and it remains

questionable how long this can persist. If there is a major drop in these megacap tech

stocks, this could well be accompanied by a move into gold on a flight to safety.

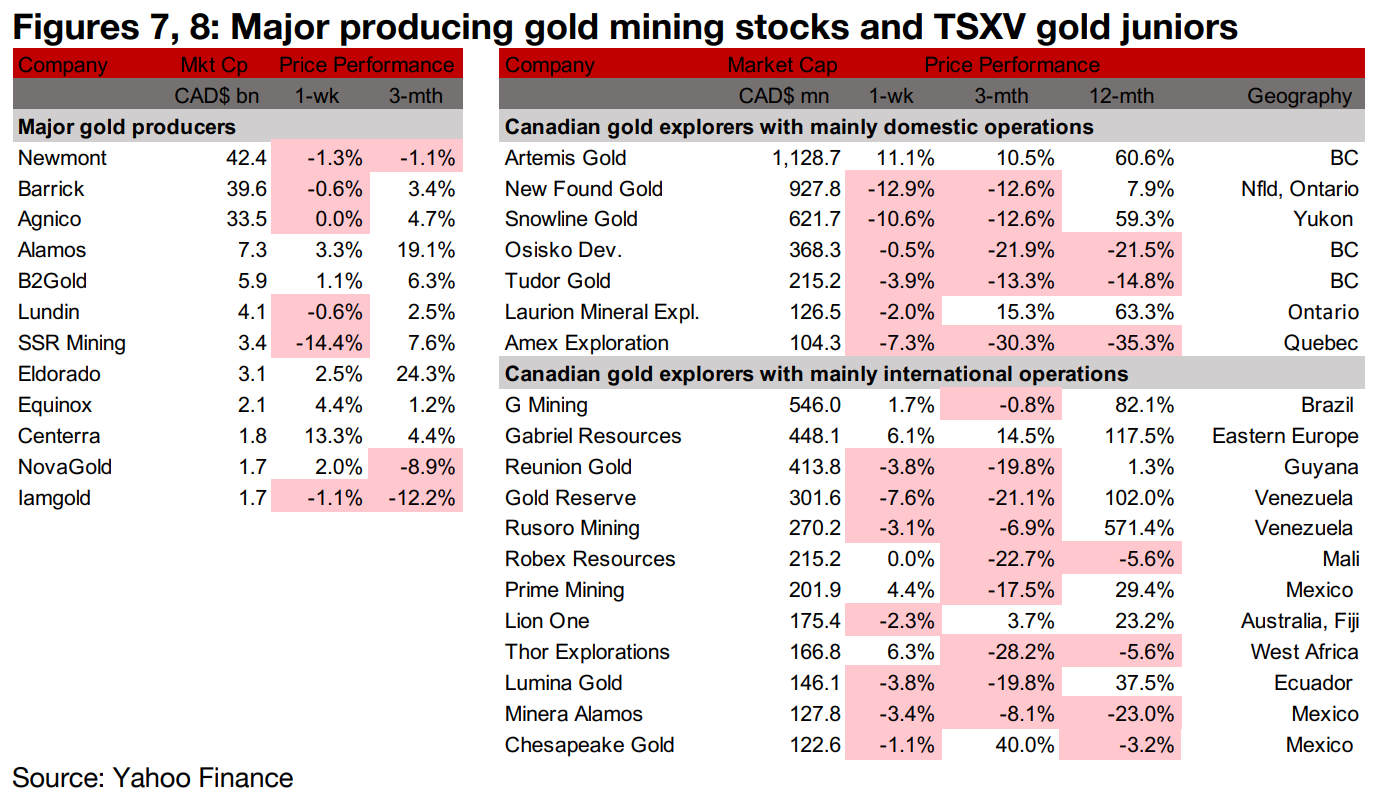

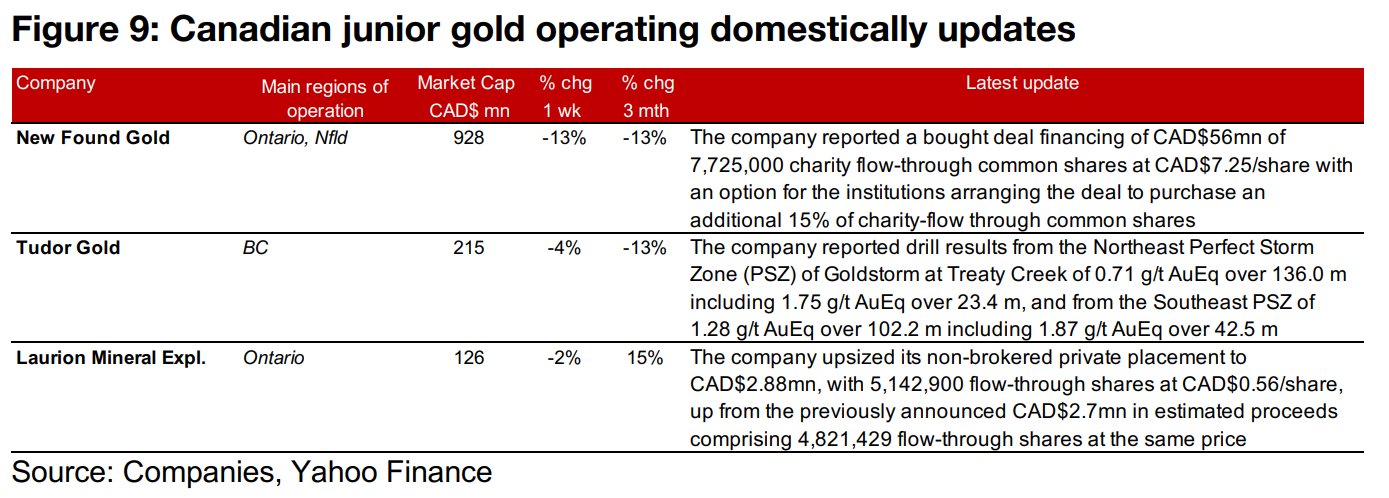

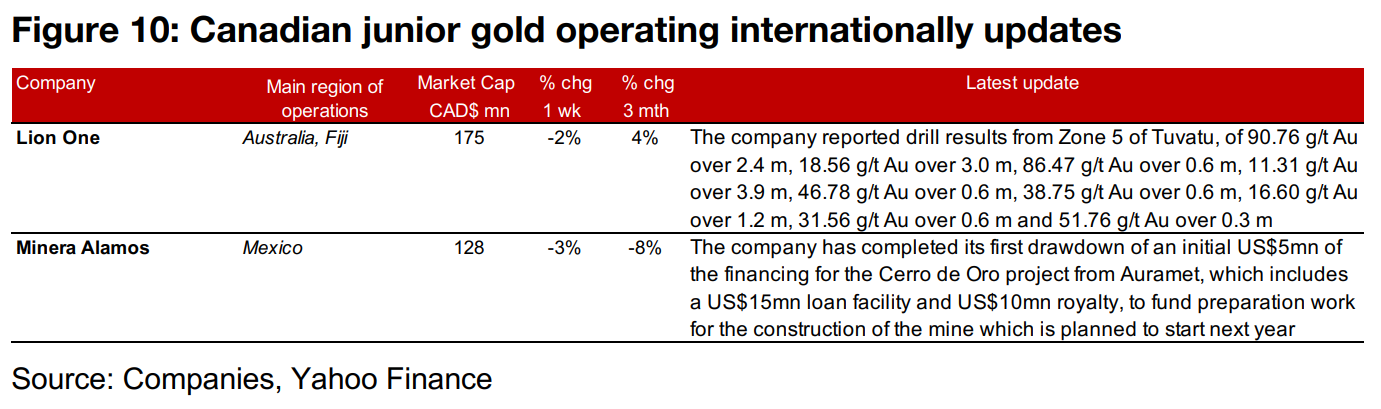

Gold producers mixed and TSXV gold mostly down

Gold producers were mixed while most of the TSXV gold stocks were down as the decline in the metal offset the broader jump in equities (Figures 7, 8). For the TSXV gold companies operating domestically, New Found Gold announced a CAD$56mn bought deal financing, Tudor Gold reported drill results from the Perfect Storm Zone of Goldstorm at Treaty Creek and Laurion Mineral Exploration upsized its private placement to CAD$2.88mn from CAD$2.70mn (Figure 9). For the TSXV gold companies operating internationally, Lion One reported drill results from Zone 5 of Tuvatu and Minera Alamos completed the first drawdown of an initial US$5mn in financing for Cerro de Oro from Aurament (Figure 10).

In Focus: Minsud Resources

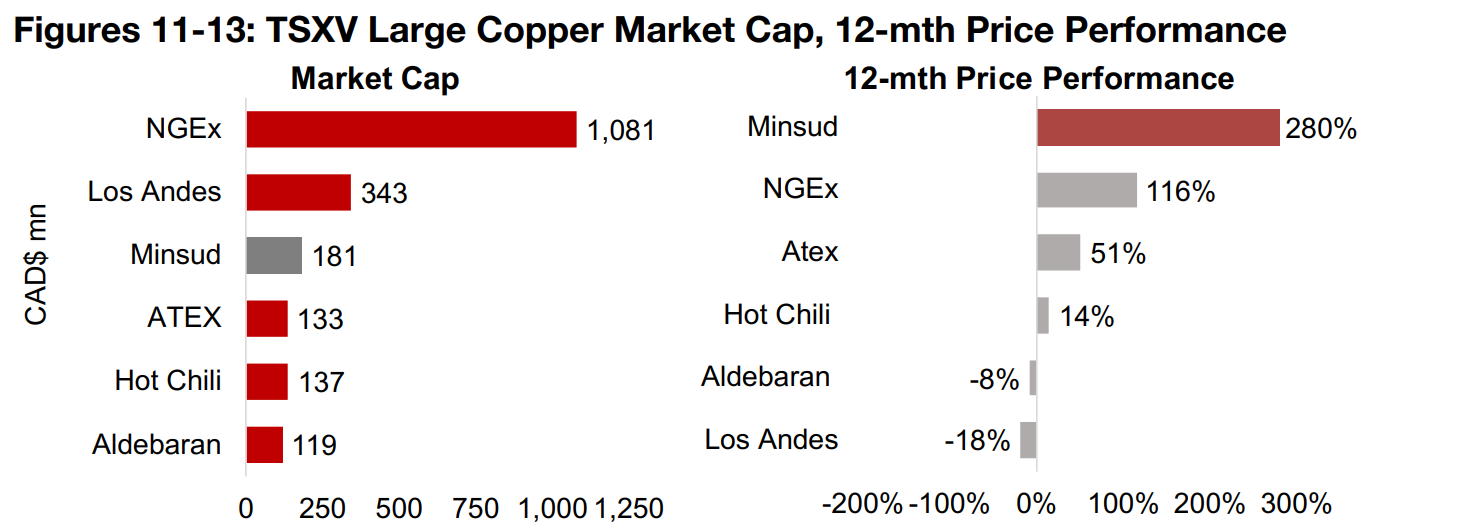

Minsud has strongest 12-mth gain of large TSXV copper, on light volume

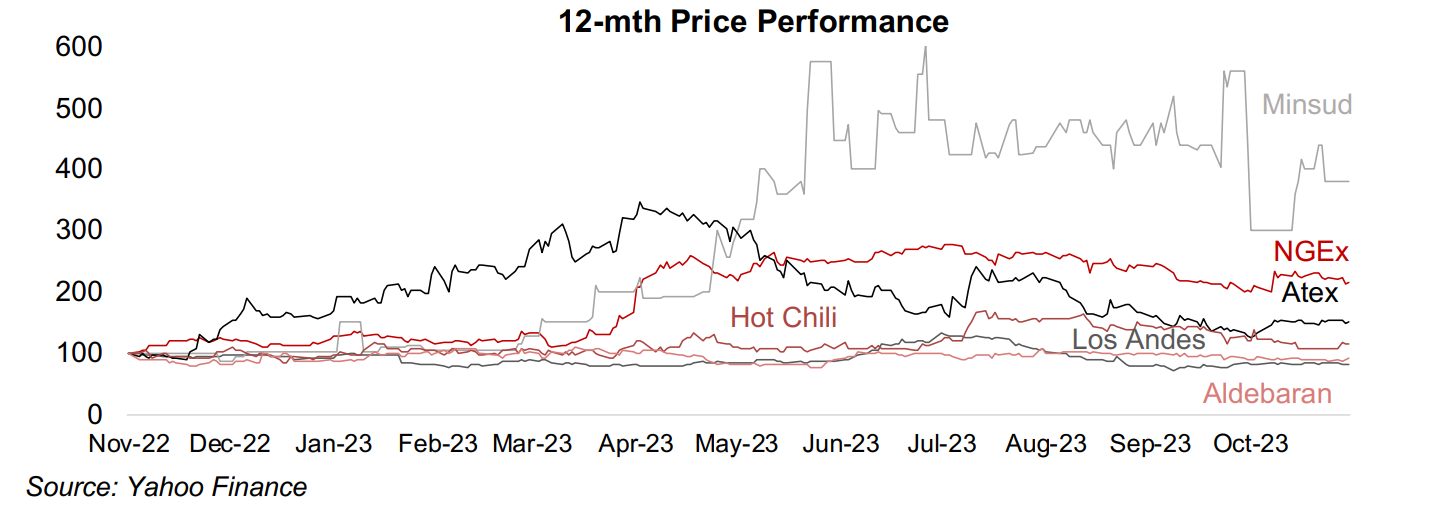

Minsud Resources, a copper and gold exploration company operating in Argentina,

has had the strongest performance of the larger TSXV copper companies. It has

gained 280%, double the 129% gains of the next highest, NGEx, and far outpacing

the rest of the top six by market cap (Figures 11-13). This has seen its market cap

reach CAD$181mn, putting it ahead of mid-cap TSXV copper names clustered

around the CAD$120mn-CAD$130mn level including ATEX, Hot Chili and Aldebaran.

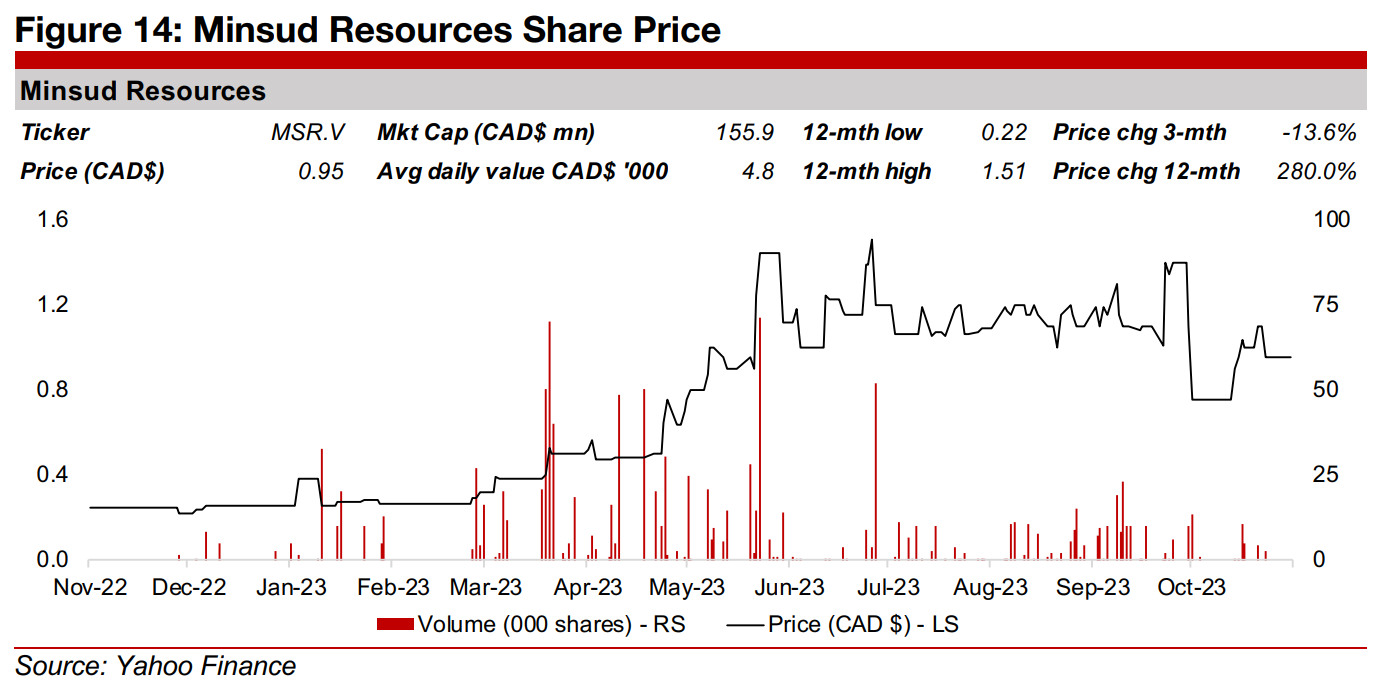

The gains have been on very low volume compared to what is commonly seen for

larger TSXV mining stocks. Minsud continues to have several day periods with no

trading activity, leading to a very small average daily trading value of CAD$4,000/day

over the past year (Figure 14). While we would not expect Minsud’s volume to be as

high as a much larger cap like NGEx, stocks similar in size like Los Andes, ATEX, Hot

Chili and Aldebaran, traded an average daily value of CAD$154.8k, CAD$549.4k,

CAD$17.2k, and CAD$22.7k, respectively, over the past year. Such low volume

would obviously make rapidly exiting a moderately large position in the stock difficult.

Strong drill results this year from Chita Valley Project

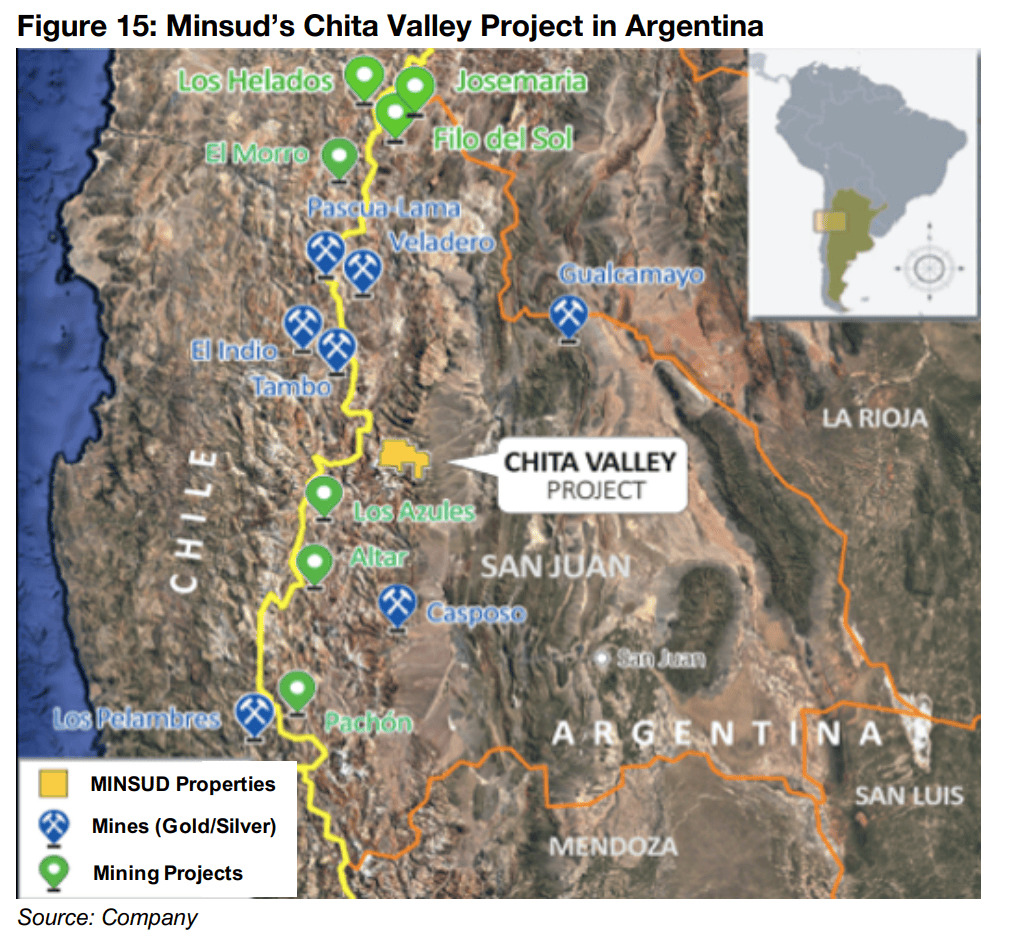

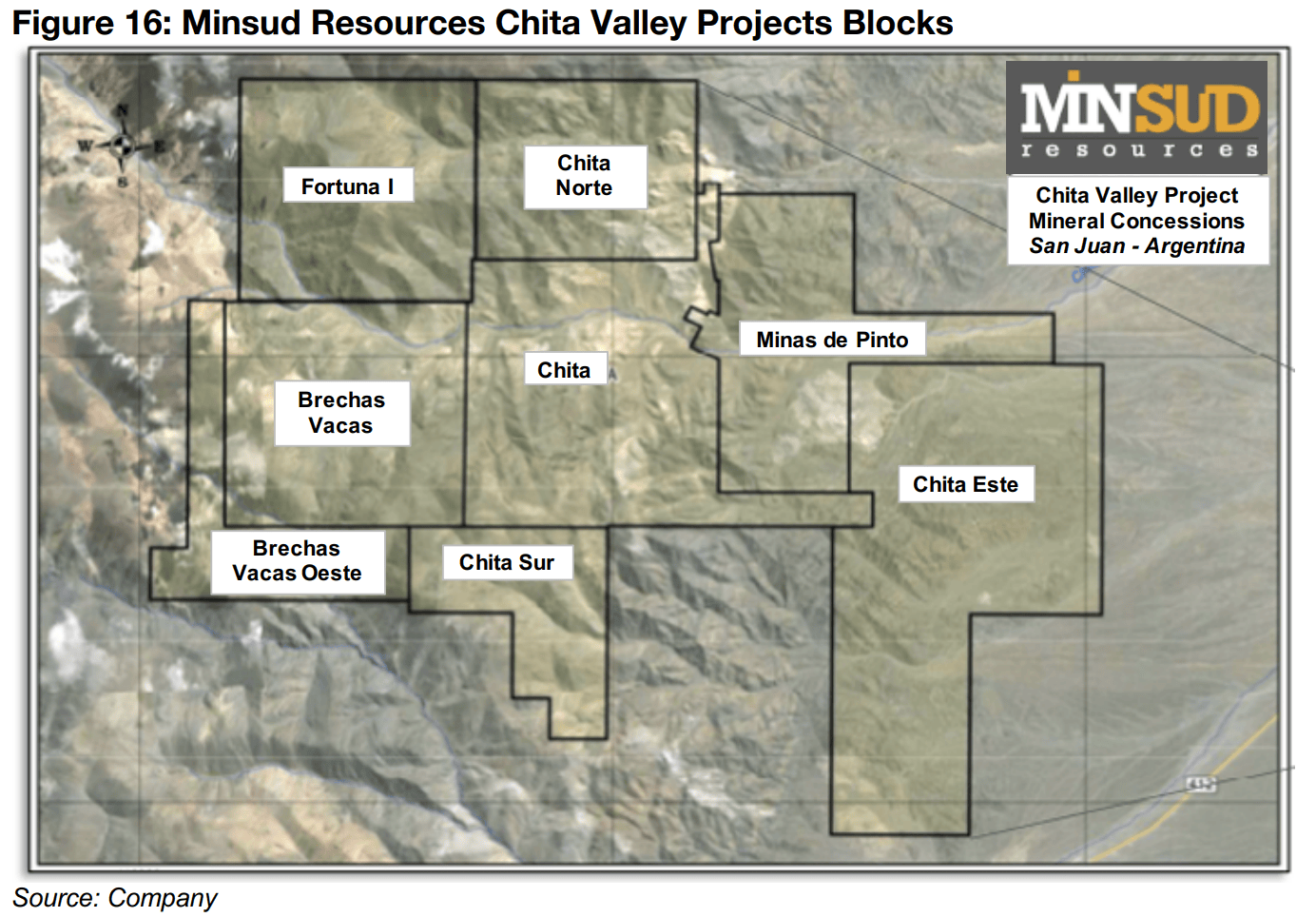

The company’s main project is Chita Valley, in San Juan, Argentina, focussed on

copper but also including molybdenum, gold, silver, lead and zinc, and it also holds

the La Rosita gold and silver project in Santa Cruz, Argentina (Figure 15). The

northwest of San Juan province and just across the border into Chile have a strong

mining history with several operating mines and projects being developed. The three

main properties of the Chita Valley project are Chita, Brechas Vacas and Minas de

Pinto, and there are an additional five properties, Fortuna I, Chita Norte, Brechas

Vacas Oeste, Chita Sur and Chita Este, which are all adjacent (Figure 16).

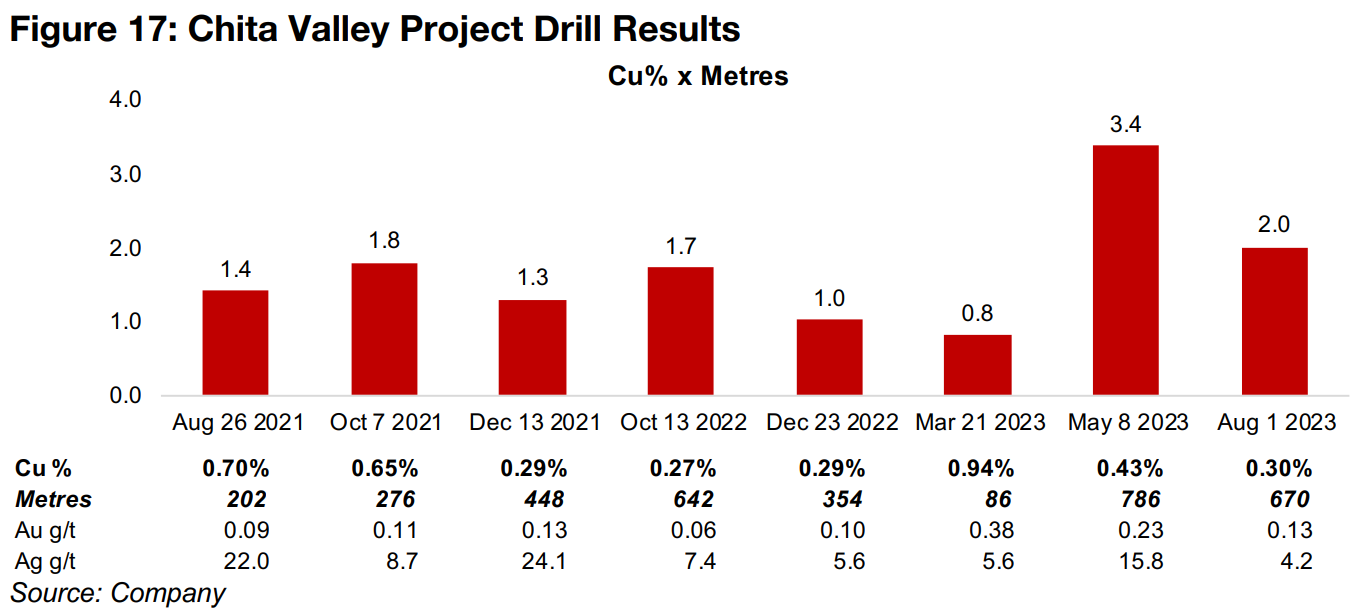

While the company had been drilling at Chita since 2008, with a resource estimate

released for Chita Sur in 2018, the focus since 2020 has been on the Chinchillones

area. The company completed 11,970 m of drilling in 2021 and 19,058 m in 2022, and

28,674 m has been drilled this year as of August 2023. Decent results were produced

from 2021 into early 2023, with a CuEq % X metres ranging from 0.8 to 1.8, and a

CuEq % between 0.27% and 0.94% (Figure 17). However, by far the strongest drill

results so far were announced in May 2023, with 0.43% CuEq over 786 metres, for a

CuEq % X metres of 3.4, followed by 0.30% CuEq over 670 metres in August 2023.

The May 2023 results especially were correlated with the bulk of the rise in the share

price over the past year, and the stock has held onto to most of the gains since.

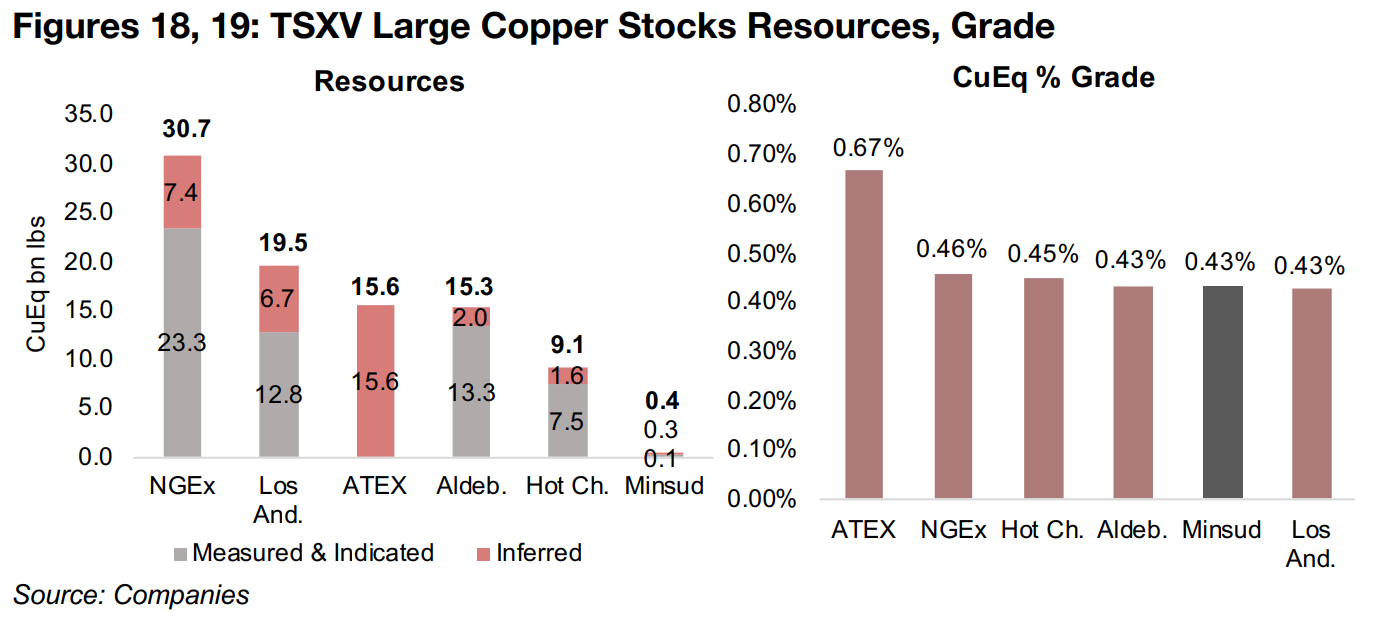

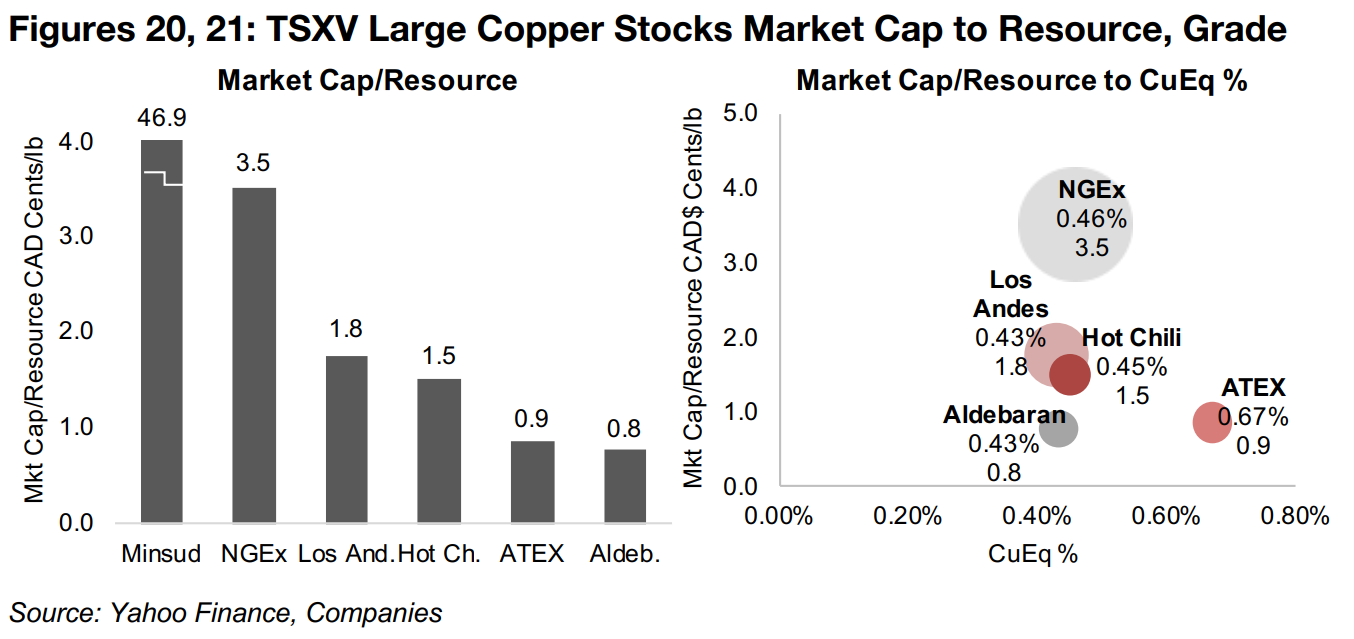

Market pricing in significantly more than small Chita Sur resource

The Chita Sur resource is small, at just 386mn lbs of copper, compared to the other large TSXV copper stocks, from Hot Chili at 9.1 bn lbs up to NGEx at 30.7 bn lbs (Figure 18), but its 0.43% CuEq grade is inline with the group, ranging from 0.43% to 0.46%, with ATEX the outlier at 0.67% (Figure 19). However, Minsud’s CAD$181mn market cap implies that the market is pricing in a much larger resource, given a clearly overstated market cap to resource of CAD46.9 cents based only on Chita Sur (Figure 20). Assuming instead a market cap to resource in a similar range to Minsud’s peers between CAD0.8 cents and CAD1.8 cents, implies a resource between 10.3bn lbs and 23.3 bn lbs. Figure 21 plots the market cap to resource versus the grade for the group, with a higher grade theoretically expected to lead to a higher market cap per resource. However, with most of the companies clustered near the same grade, but the market cap to resource valuation still ranging widely, it shows that factors other than this relationship are having a significant effect on the valuations.

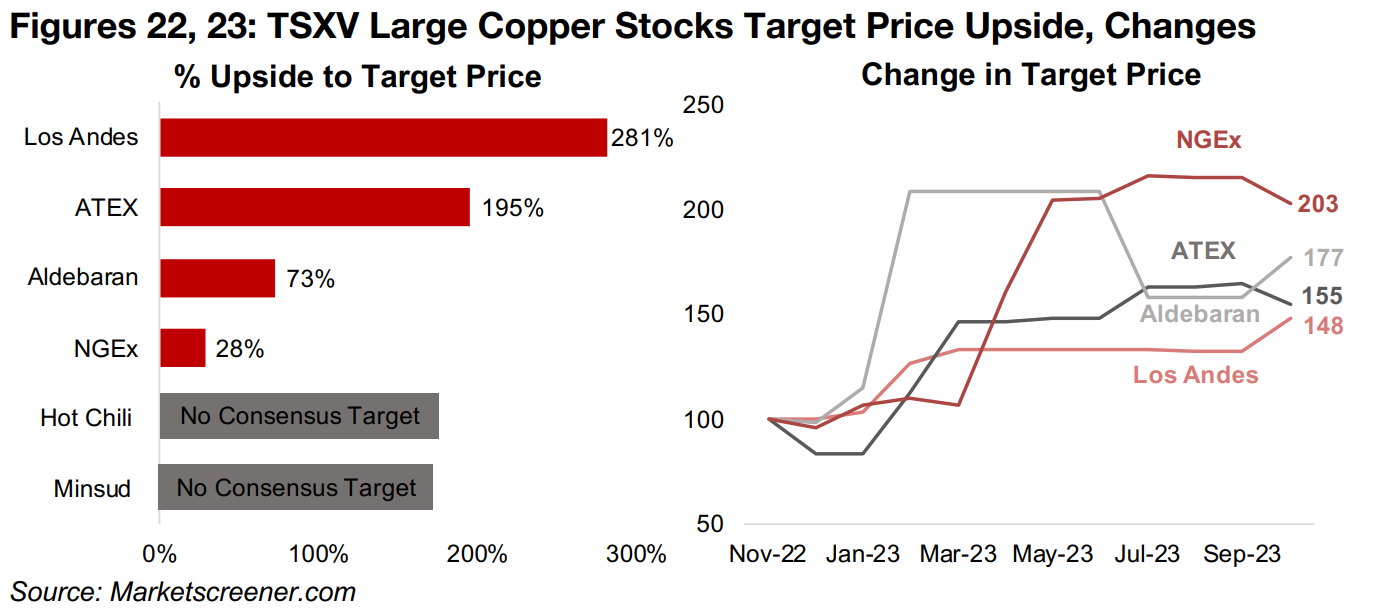

Significant target price upgrades for larger TSXV copper stocks

Given that it has only recently moved near the top of the TSXV copper stocks, Minsud is not widely covered by analysts and has no target price, along with Hot Chili. The market expects substantial upside of 281%, 195% and 73%, to the targets of Los Andes, ATEX and Aldebaran, respectively (Figure 22). NGEx’s strong performance over the past year has seen it converge towards its target, with only 28% upside, and it has chased analysts’ 103% upgrade of the target (Figure 23). ATEX, Aldebaran and Los Andes have all seen major target upgrades, of 77%, 55% and 48% respectively. With the copper price near flat over the past year, this indicates the offsetting strong operational progress demonstrated to the market by the group.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.