May 26, 2025

Silver’s New Era—and How to Profit from It

Contents

- China to Drive the Electrification Trend—and Silver Demand

- Silvercorp Metals: an Established Player in the World’s Highest-Growing Silver Market

- Ying: the District that Keeps On Giving

Silver has entered a new “golden age.”

The demand for metal is surging. In 2024, global silver demand outpaced supply—and industrial consumption hit an all-time record of 680.5 million ounces.

As a result, the global silver market was in a state of deficit for the fourth year in a row.

This soaring demand came mostly from the “clean transition,” or the global switch to renewable sources of energy, and electrification.

Now, silver is both a monetary metal and an industrial one. The recent demand surge was driven mostly by the latter. Industrial demand has hit another record in 2024, according to the Silver Institute.

In 2025, demand for silver should hold up. Silver Institute projects that this year, the world will consume about 1.2 billion ounces of silver.

On the monetary side, the outlook for silver is also improving. As gold has become more expensive, investors are now looking at silver as a substitute. Coin and bar demand in some Western markets is expected to grow.

As a result, the silver market will remain in a state of deficit to the tune of about 118 million ounces.

And silver’s recent performance confirms this dynamic. Over the past 12 months, silver price went up by 19%, while the S&P 500 has delivered a return of only 9%.

While the tech-heavy and extremely globalized S&P 500 continues to suffer from the White House’s sporadic trade policy, silver continues delivering consistent returns.

We believe that this trend could continue in the future. And what makes silver—and some silver mining companies—particularly attractive is their exposure not to the U.S. but to another major global economy: China.

China to Drive the Electrification Trend—and Silver Demand

China has been a green energy champion for a while now.

The country is responsible for most of the world’s industrial demand for silver. In 2024, it grew by 7% year-over-year.

Renewable energy capacity has soared in China—and the demand for silver, which is used in photovoltaic elements, has done so as well.

Back in 2020, it pledged to double its renewable capacity by 2030. It has achieved this target already. By the end of 2026, it could reach as much as one terawatt (1,000 gigawatts) of solar power alone. And each solar power installation of about two square meters uses up to 20 grams of silver.

In 2022, China installed as much solar capacity as the rest of the world combined. In 2023, it doubled that amount, according to the Yale School of the Environment.

During its transformation from a coal-powered economy to a clean tech powerhouse, China became responsible for 80% of the world’s solar manufacturing capacity.

Which means that it became a primary market for silver.

But not only that… Silver is used in electric-vehicle batteries, and China is an EV leader. Its BYD manufacturer is the world’s biggest. In 2023, it produced two-thirds more EVs (including battery EVs and plugin-hybrid EVs) than Tesla.

In 2024, 11.3 million EVs were sold in China. In the U.S., EV sales reached only 1.5 million units.

This year, EV sales in China are projected to reach 12.9 million units. By 2030, this figure could jump to 17 million.

In other words, China has already become the world’s largest consumer of silver and other critical metals needed for its massive electrification push. In the coming years, this trend will likely continue.

This is why we are looking at some of the most exciting silver companies listed in Canada, but exploring for and producing silver in China.

With or without any trade war-related imbalances, the country has become a primary market for silver.

Silvercorp Metals: an Established Player in the World’s Highest-Growing Silver Market

When it comes to China, experience is key. Investors should pay attention to companies with a multi-year track record of operational success.

There aren’t too many options out there from a North American investor’s perspective. And the list is shrinking.

Today, we will look at a company with nearly two decades of production history.

Silvercorp Metals (TSX:SVM, NYSE:SVM) has been producing silver in China since 2006. It has multiple operating mines in the country’s several key mining districts, including the Ying district in Henan province.

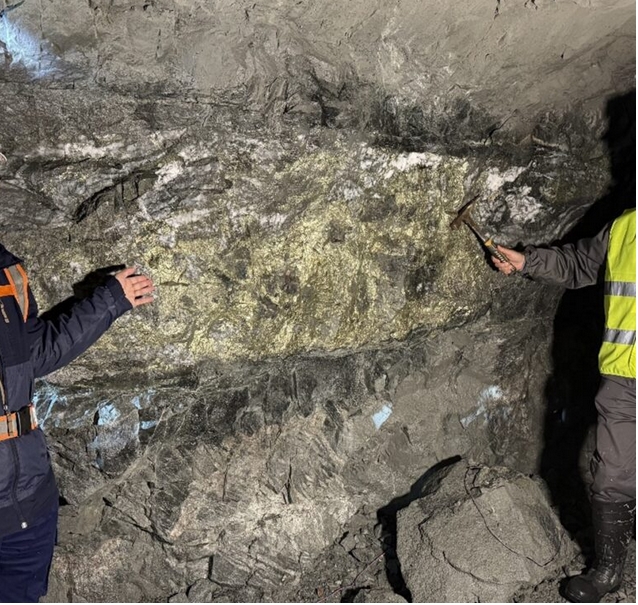

Underground mining at the Ying Mining District

Silvercorp Metals (TSX:SVM, NYSE:SVM) has been enjoying a stable regulatory environment and proximity to customers and suppliers. This is why it focused its efforts on developing and growing its presence in China.

So far, the company has produced over 100 million ounces of silver. In China, it has over 100 million ounces of silver in its Proven and Probable reserves and over 200 million ounces of silver in the Measured and Indicated, as well as Inferred categories.

It has been producing silver for decades, and it has been doing it profitably. The company’s all-in sustaining cost in the most recent financial year was just about $12 an ounce. As a reminder, silver is now trading at $32.35 an ounce. This leaves the company with a wide profit margin.

In the fiscal year ended in March 2025, Silvercorp produced 6.9 million ounces of silver, a new record, along with 7,577 ounces of gold, 62 million pounds of lead and 23 million pounds of zinc.

It is China’s largest primary silver producer—and its growth story continues…

Ying: the District that Keeps On Giving

Exploration has been central to Silvercorp’s growth at Ying. Silver has been mined there for centuries, but modern exploration only began in the 1950s.

Seeing the opportunity, Silvercorp acquired an interest in the district in 2004, backed by approximately US$10 million raised in Canada.

Since then, the company has drilled 2.6 million meters and developed over 860 kilometers of exploration tunnels…

This helped the company increase its production from less than 2 million ounces in 2007 to 6-7 million ounces over the past nine years.

Today, the company operates seven underground mines and two mills.

Silvercorp will, in our view, remain China’s largest primary silver producer.

Newly expanded Ying milling facility

Best of all, drilling continues uncovering new styles of mineralization.

The most recent campaigns discovered many gently dipping, gold- and copper-bearing veins at the LMW mine—such as the LM50 gold vein.

It was discovered in 2020 and brought into production in 2023.

LM28 copper-gold vein, where drilling intersected 34 g/t gold and 4.45% copper over 0.8 m.

Silvercorp Metals (TSX:SVM, NYSE:SVM) also continues to explore and upgrade the more “traditional” high-grade silver-lead-zinc veins that have supported Ying’s production.

To date, the company discovered over 500 major veins.

This work could extend existing mine life beyond the current 13-year plan based on Proven and Probable resources.

The company continues developing new veins. And it has expanded its mill capacity from 2,500 to 4,000 tonnes per day. We won’t be susprised to see its production increase in the future.

Importantly, the company explored less than half of Ying’s nearly seventy-square-kilometer land package. This leaves significant potential for new discoveries to contribute to Silvercorp’s growing production profile.

In 2026, Silvercorp plans to drill over 250,000 meters with a budget of US$7.5 million (70 drill rigs on site right now).

It also plans to add 67,700 meters to its tunneling exploration activities. It’s committed US$24.8 million to that.

Notably, the company is developing new tunnels west of the LMW mine, where no mining currently exists, as well as in shallow areas between the SGX and HPG mines, and between SGX and LMW—zones with a history of local mining.

Mining these shallow areas is likely to be much cheaper than the deeper areas.

In other words, Silvercorp Metals (TSX:SVM, NYSE:SVM) is investing tens of millions of dollars in maintaining its position as China’s number one primary silver producer.

It is one of the most well-established and low-risk names operating in China and available to North American investors.

As the clean transition trend continues and as China cements its position as the global leader in the electrification race, companies exposed to both clean energy and China should be on every investor’s watchlist.

Sign up to receive our future articles and updates.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More