May 06, 2025

The markets are shocked

Contents

- Economic Growth is COLLAPSING

- Is STAGFLATION Coming?

- What Should Investors Turn to If They Quit USD?

- How Should You Position Yourself for the Coming Stagflation?

- Gold Stocks Have Soared—and Could Keep Going Higher

- A Promising Early-Stage Opportunity for Gold Investors

- Takeaway

The markets are shocked.

They started to realize that the United States is no longer the global financial leader it used to be for the past fifty years.

Stocks are dropping… As we speak, the S&P 500 is down 6% year-to-date.

Bond prices are volatile… Treasuries don’t provide the same level of protection they did in the past.

Even the U.S. dollar is no longer the safe haven it used to be. Since the beginning of 2025, the U.S. dollar index is down almost 10%.

This is alarming. And investors want to know what is going on… and how to protect their portfolios against what’s coming next.

That’s what we will talk about. Here at the Canadian Mining Report, we are focused on providing our readers with facts and expertise that will help them navigate the global SHOCK that we see coming.

(We will share the details with you in a moment… For now, however, keep in mind that as stocks and the U.S. dollar were falling, gold has soared by almost 26% and gold mining companies by 40%.)

But first, what caused this chaos in the markets?

Economic Growth is COLLAPSING

This is not a forecast. Real-time data from the Federal Reserve Bank of Atlanta tells us that in the first quarter of this year, the U.S. economy has shrunk by 2.5%.

This is already happening. You may not read about it in the mainstream media, but an economic crisis is already here.

And consumers are feeling it.

The University of Michigan Survey of Consumers paints a gloomy picture…

In March 2025, consumer sentiment was down 32% compared to a year ago… current economic conditions were down 24%...

Finally, consumer expectations declined by almost 38%.

Behind all these numbers is fear.

American consumers aren’t feeling confident at all. On the contrary, they don’t know what is going to happen next.

And in times of uncertainty, people spend less. Which means that the U.S. economy, which relies on consumers, could grind to a halt as soon as this year.

The slowdown has already begun, as we’ve just shown you.

And inflation expectations are rising… way above the Fed’s 2% target.

Right now, consumers expect inflation to hit 6.5% next year.

Don’t underestimate this… this is the highest level since 1981.

Two-thirds of Americans now expect their incomes to fall over the next year. About the same number expect unemployment to rise.

America’s CEOs have been sounding an alarm recently, too.

A survey of 300 CEOs showed that almost two-thirds of them expect a mild or severe recession over the next six months.

CEOs are as pessimistic now as they were during the early months of the Covid pandemic.

They have a reason for this pessimism, and it’s not only about tariffs (though, right now, the effective tariff in the U.S. is at a 100-year high level).

Businesses need to deal with high input costs, which means that consumers will ultimately need to pay more for both products and services.

Higher prices and lower growth mean stagflation. It’s a crisis with no easy solution.

Is STAGFLATION Coming?

You don’t see this word much in the mainstream press. Talking heads on business channels aren’t fond of making bold forecasts. They want to hedge their bets…

But we are focused on helping you navigate the worst. And the worst scenario, stagflation, could start unfolding earlier than many investors expect.

Some of the elements of stagflation are already here.

Growth is slowing down… inflation expectations are picking up… and both consumers and businesses expect unemployment to be higher in the coming months and years.

These are the three components of stagflation. Investors who don’t see the writing on the wall are deluding themselves.

They were scared when the broad market indexes dropped in the aftermath of the tariffs announcements… well, they will be shocked to see what their portfolios and 401(k) accounts do when markets finally wake up to the ugly reality of stagflation.

Tariffs are only one part of it. They have already started pushing producer prices higher. And there is no certainty as to whether these tariffs will go away or be settled at some level higher than where they are now.

But what we know for sure is that the global trade game, as it was played before 2025, won’t be as easy to play in the future.

Price shocks will result in hiring freezes and higher unemployment across the board.

Higher unemployment will stall consumption, which is responsible for more than two-thirds of the U.S. GDP.

So, growth will slow, too.

The Fed won’t be able to do much to address this problem.

If it hikes rates to combat inflation, growth will slow down further. Businesses won’t be able to borrow money to expand or even maintain their operations. Some will go bankrupt.

If the Fed lowers rates, inflation will soar further and potentially spiral out of control.

The post-pandemic inflation spike may seem benign in comparison.

Knowing how slow and inefficient central banks are at handling crises, we won’t be surprised to see a prolonged stagflation. It could last years and erode trillions of dollars of global output and market value in the process.

Investors will be left to their own devices. They won’t get much help from either their financial advisors or the government.

Some will sell stocks and hold on to the U.S. dollars. They are the ultimate safe haven, right?

Not anymore. Let us explain…

The Coming Demise of the U.S. Dollar

The U.S. dollar is no longer safe to hold.

So far this year, the U.S. dollar index fell by almost 10%. Four percentage points more than stocks…

This should alarm you. The U.S. dollar is supposed to move in the opposite direction. When people are afraid, they sell stocks and buy dollars. Demand goes up and drives the dollar’s value higher.

That’s not what’s been happening.

And here’s why.

First, foreign countries have introduced tariffs in response to the ones levied on them. Usually, when the U.S. puts tariffs on other countries’ goods, the value of the dollar goes up. But in a full-on trade war, the current one included, the dollar suffers.

Second, the U.S. dollar was overvalued before the current trade war began. Some analysts say that at the end of 2024, its value was at a 55-year high. It was due for a correction from those levels, and the correction has begun.

Third, there’s no certainty as to what economic decisions will come out of the White House next. This unpredictability is damaging to the U.S. growth and its currency.

Put simply, the rest of the world doesn’t trust the U.S. as much as it did in the past.

It wouldn’t be a problem if the U.S. was a completely self-sufficient economy whose currency doesn’t have a global status. But it does.

And the value of the U.S. dollar is just as high as the level of trust in the system that businesses within the U.S. and countries outside of it have.

That trust is getting eroded.

The U.S. dollar has already started losing its reserve status. Over the past 11 years, the share of the U.S. dollar in the global central bank reserves fell by five percentage points. This trend could continue over the next decade.

And it’s not only about the currency. Foreign investors hold $19 trillion in U.S. stocks, $7 trillion in Treasuries, and $5 trillion in U.S. corporate bonds.

They also hold about $1 trillion in dollar banknotes…

If they start diversifying away from these dollar-denominated assets and the currency itself, they will put even more pressure on the USD.

And they may do so if U.S. assets keep underperforming as they have done this year. The S&P 500 underperformed the MSCI World Index by four percentage points so far.

U.S. assets could become even less desirable in the future. If they do, we will face a situation that John Connally, Richard Nixon’s Treasury secretary, described as “The dollar is our currency, but it’s your problem.”

In response to this market chaos, the Wall Street whales are reassessing their outlook for the USD. Goldman Sachs has recently downgraded its outlook for dollar vs. euro, for example. It now predicts a further USD weakening to about $1.20 per one EUR. (Right now, the exchange rate is at $1.14 per one EUR.)

Estimates from Eurizon SLJ Capital point to a possible 19% fall in the value of the dollar.

If the U.S. takes further steps to isolate itself from the global financial system (leaving the International Monetary Fund, for example) or tinkering with the Fed’s independence, global trust in the dollar will fall even further.

What Should Investors Turn to If They Quit USD?

The only real alternative to the U.S. dollar (or any other fiat currency) is gold.

As we said in the beginning, gold has soared by more than 25% this year.

This is a direct result of the collapse of the dollar-backed financial system.

Global central banks, for example, have been buying gold in droves.

In 2024, central banks bought over 1,000 t of gold. They have been net buyers for 15 years in a row now.

Global central bank demand for gold hit its highest level ever last year, at 4,974 tons.

Even smaller countries such as Poland and Turkey have been investing in gold at a massive scale. Poland bought 90 tons of gold, while Turkey added 75 tons to its reserves.

They do it because gold is the ultimate hedge against uncertainty—and stagflation.

The analysts at the World Gold Council said that “real assets do well during stagflation, with commodities both fuelling and feeding off inflation.”

This is the side of the trade you want to be on when inflation hits, or economic growth slows. Buying shares of companies that are exposed to tariffs or higher input costs isn’t the answer.

You need to be on the side of the companies selling the expensive “inputs,” such as commodities…

And on the side of the companies exploring for and producing gold, which is the ultimate real asset.

And if a recession happens, investors flock to gold.

Historical analysis done by Forbes showed that gold outperformed the S&P 500 by 37% during six out of the last eight recessions.

If the next recession turns into a stagflation (as we expect), gold could shine even brighter against both risk-on assets, such as equities, and against the U.S. dollar.

How Should You Position Yourself for the Coming Stagflation?

Gold and gold-linked stocks are the best place to be right now, in our opinion.

Yes, gold has appreciated a lot recently while broad markets have been falling. But gold still isn’t expensive.

On the contrary, its price outlook has been changing. Even the gold-cautious Wall Street has been upgrading its gold price forecasts.

For example, Goldman Sachs now projects that gold could reach $3,600 per ounce by the end of 2025 and $4,000 by the second quarter of 2026.

These forecasts could prove conservative. There’s plenty of room for gold to run.

Especially if we see another recession to the tune of the 2008 Great Financial Crisis.

If you recall, in 2008, the S&P 500 fell by 48% from its peak, while gold appreciated by 37%.

Gold is a solid candidate for your portfolio, given the gloomy outlook.

But the story doesn’t end with gold. After all, investors need diversification—and upside potential.

Gold Stocks Have Soared—and Could Keep Going Higher

So far this year, gold has appreciated by more than 25%. But an ETF tracking gold mining companies has increased its value by 46%.

It outperformed the metal itself by a factor of 1.8. It delivered a return almost twice that of gold.

This is what we mean by diversification…

Yes, gold has traditionally been a safe haven.

But gold stocks have been acting as a “safe haven plus growth” asset so far this year.

And there’s no reason for them to stop.

Gold-linked equities, including resource juniors, are leveraged to the price of gold. They outperform it during bull markets and may fall deeper in a bear one.

Right now, in our view, we are in the middle of one of the most powerful gold bull markets in history.

So, investors should focus on this often-overlooked sector.

And specifically, they should pay attention to junior gold stocks. While gold mining majors may seem like a safer bet, gold mining juniors could (for those who have the guts to tolerate some risk) deliver hockey-stick-like returns.

(Disclaimer: past performance of gold stocks or any other assets doesn’t indicate future results. Investment involves risk. Consult your financial advisor before making investment decisions. Read our full disclaimer here.)

A potential candidate for your watchlist that has recently landed on our desks is this junior gold company: Volcanic Gold Mines Inc. (TSXV:VG).

A Promising Early-Stage Opportunity for Gold Investors

Volcanic Gold is part of the powerful Gold Group that discovered, developed, and sold multiple world-class deposits in Mexico and Central America.

The group’s successful track record includes the Cerro Blanco deposit in Guatemala, the Pavon deposit in Nicaragua, the San Martin deposit in Honduras, and, finally, the San Jose deposit in Mexico, which was sold to Fortuna Silver Mines.

Right now, Volcanic Gold Mines Inc. (TSXV:VG) is focused on two projects: Holly, a high-grade gold-silver deposit in Guatemala and an earlier-stage gold target in Nevada.

The company has successfully found several high-grade gold and silver targets at Holly, for which Volcanic completed a 60/40 earn-in last August. These gold occurrences are part of a low-sulfidation gold-silver system.

The project itself is in an area in Guatemala that hosts world-class gold and silver mines and deposits, such as the Escobal Mine with its 264.5 million ounces of silver in the Proven and Probable reserves and Cerro Blanco Deposit. Based on a 2022 feasibility study, Cerro Blanco could produce 2.7 million ounces of gold over its 14-year mine life.

Drilling at Holly has been successful so far, but even early-stage surface sampling work delivered high-grade gold and silver results. They included samples with up to 396 g/t gold and 7,092 g/t silver.

Historical drilling delivered results up to 6 meters of 43.56 g/t gold and 1,617 g/t silver.

More recent results delivered assays of up to 4.6 meters of 79.84 g/t gold and 5,053 g/t silver.

Based on the recent drill results, the company has announced an Inferred resource at Holly that includes 410,000 ounces of gold equivalent (AuEq) at 9.6 g/t AuEq.

Keep in mind that this resource only includes one vein, La Peña. It remains open in all directions.

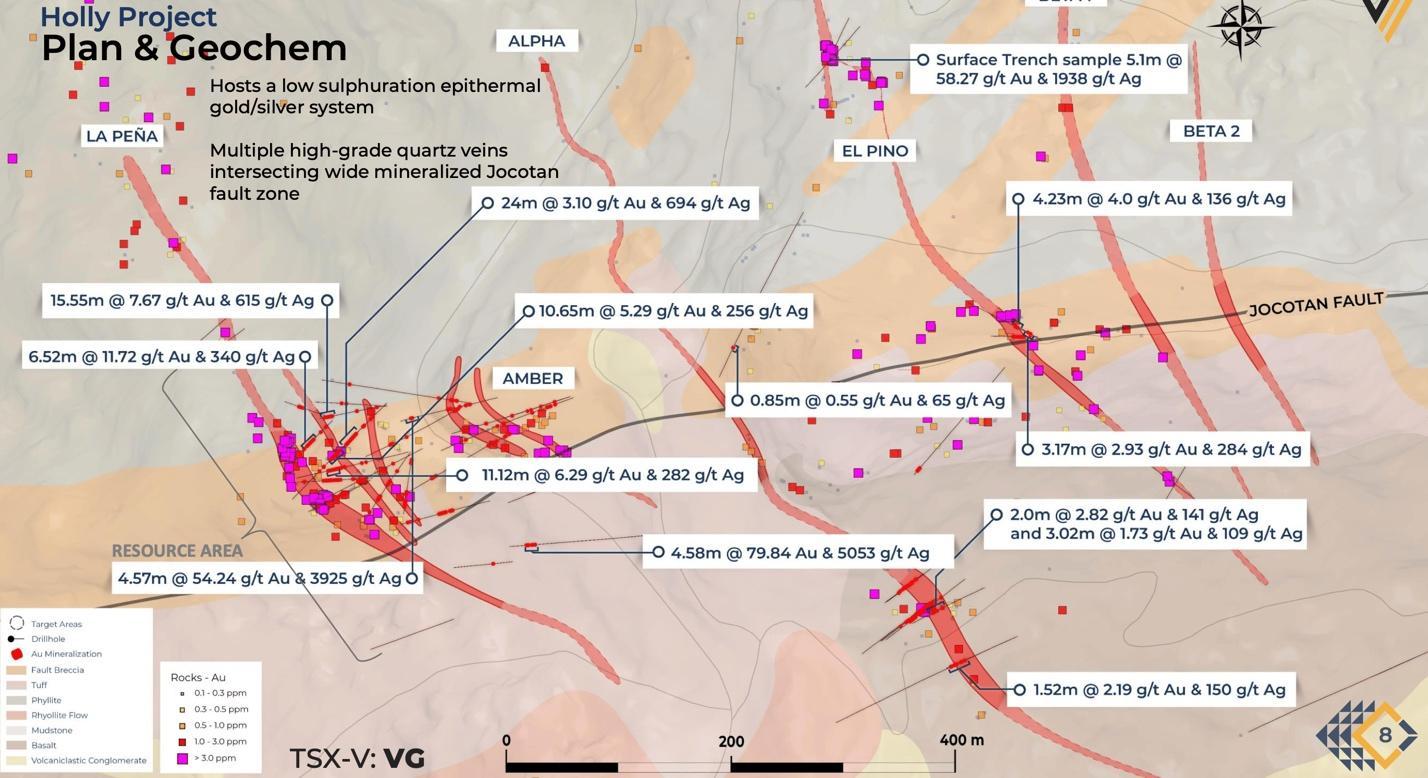

The resource area is at the bottom left in the map below. Notice that the company has outlined multiple other veins (Amber, Alpha, El Pino, Beta 2, and others).

This tells us that as Volcanic Gold Mines Inc. (TSXV:VG) continues exploration at Holly, it is likely that its mineral resource will grow. At El Pino, for example, the company has delivered the following intercepts:

• 4.2 meters of 4 g/t gold and 136 g/t silver;

• 3.17 meters of 2.9 g/t gold and 284 g/t silver.

This March, Volcanic Gold and its joint venture partner announced that they would continue their exploration at Holly.

Holly has access to all the necessary infrastructure. It’s also located just 60 kilometers north of the Cerro Blanco gold development.

In other words, Volcanic is making progress in growing Holly into a well-defined system of high-grade mineralization.

The company has also been working to acquire a second project associated with the historic Sleeper gold deposit in Nevada. We expect Volcanic to share more information about its second project soon.

Driving Volcanic’s progress at its projects is a team of some of the best-in-class professionals in the mining space.

At the helm of the company is Mr. Simon Ridgway. He is the founder, director, CEO, and President of the company. He is an experienced prospector, financier, and the recipient of industry awards. He and his teams made multiple discoveries in Honduras, Guatemala, and Nicaragua.

His companies have raised over C$450 million, which tells us that Volcanic should be able to successfully fund its exploration and development activities at Holly and other properties.

The company’s technical team, which includes Mr. Rodrigo Matias and Mr. Alex Vaides, has been responsible for some of the highest-profile discoveries in Central America, including Escobal, Cerro Blanco, Navidad, and Fortuna Silver’s San Jose mine.

The company has a tight share structure with 45.6 million issued and outstanding shares, 7.8 million warrants, and 4.5 million options.

Management holds 8% of the shares outstanding, which tells us that the company’s leadership has plenty of skin in the game.

Silvercorp, a strategic investor, holds a 19% stake in Volcanic.

Takeaway

Volcanic, in our view, is one of the most attractive early-stage opportunities in the resource sector.

It’s backed by a team experienced in both discovery and financing. The team’s track record includes some of the highest-profile discoveries in Central America.

At the company level, we see a lot of upside potential as it continues working to explore its Holly project with its joint venture partner. We will be expecting more drill results shortly.

Beyond that, Volcanic is leveraged to the price of gold. And as the gold bull market continues, we will expect Volcanic Gold Mines Inc. (TSXV:VG) to benefit from the potential upside it can deliver.

Investors should put Volcanic on their watchlists. It is one of the most exciting early-stage opportunities that have come across our desk in a while.

Sign up to receive our future articles and updates.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More