September 11, 2023

TSX Mid-Cap Copper Mixed as Metal Flat

Author - Ben McGregor

Gold down on rising US$ and flat yields

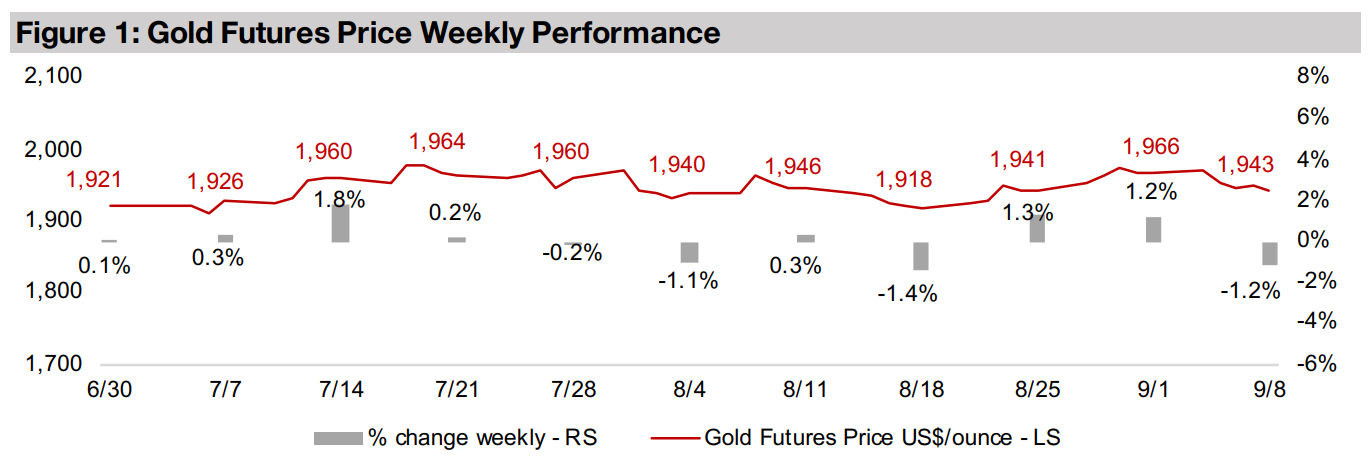

The gold price dropped -1.2% to US$1,943/oz on limited major economic data as the US$ rose and yields held relatively flat while the downtrend for equity markets continued with the S&P declining -1.61% and the Russell 200 off -2.97%.

TSX mid-cap copper stocks mixed as underlying metal price flat

This week we look at the TSX mid-cap copper companies, which have seen a mixed performance over the past year as the copper price has remained flat, with most of the group at the development stage with only two already in full production.

TSX Mid-Cap Copper Mixed as Metal Flat

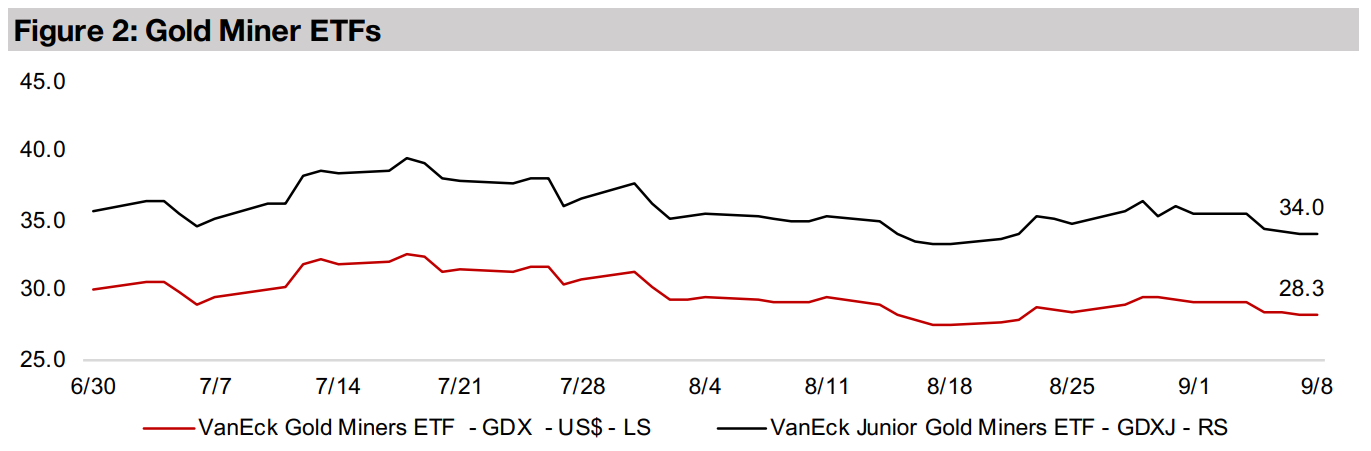

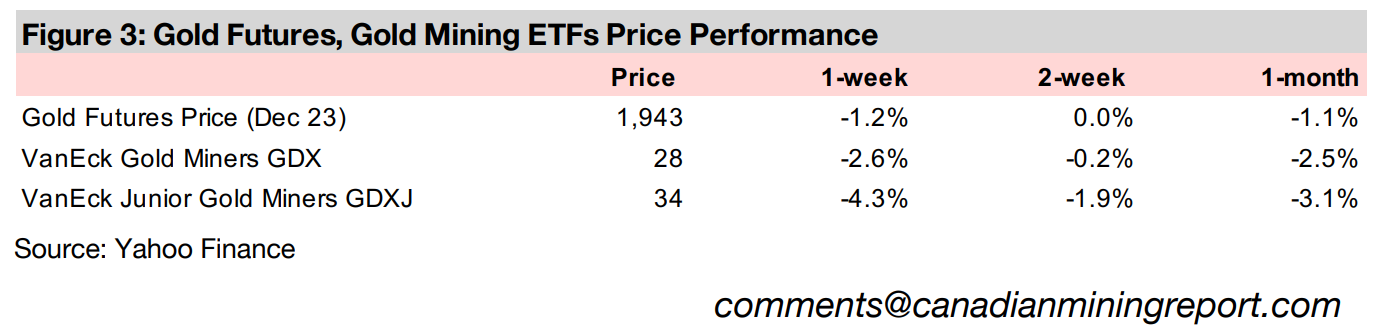

Gold declined -1.2% to US$1,943/oz, pulling back after two weeks of gains, as there was no major economic data released but the US$ rose and yields were relatively flat. Gold stocks were hit as the equity markets fell, with the GDX down -2.6%, significantly underperforming the -1.6% drop in the benchmark S&P 600, and the GDXJ off -4.2%, just under the -4.0% drop in the Russell 2000 small cap index. This continues a trend of overall equity market weakness that started in June 2023, as investors reconsider what will drive markets up further given interest rates at four decade highs, still elevated inflation, and the major global central banks apart from China showing no signs of easing monetary policy anytime soon.

US stock markets an anomaly as global equities struggle

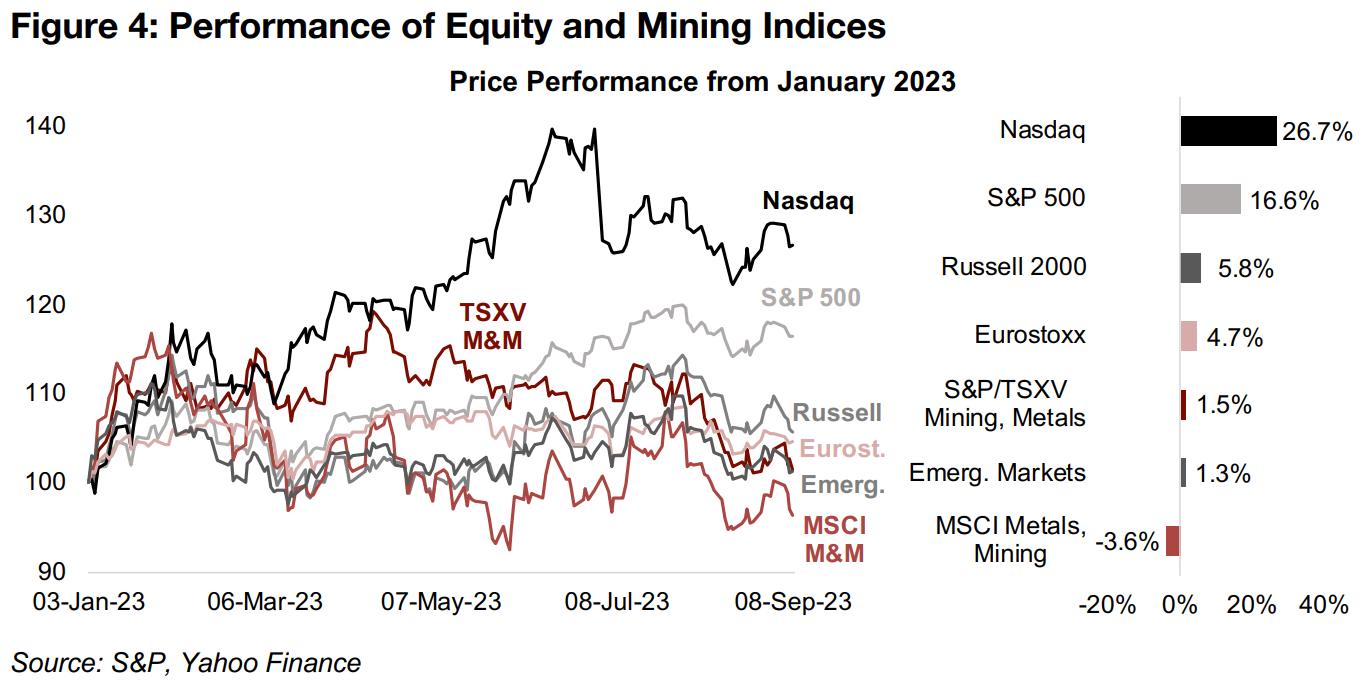

While only considering the Nasdaq and S&P 500 gains year to date of 26.7% and 16.6%, respectively, would suggest a boom year for equities, widening the scope to include US small caps and other global markets indicates a less bullish picture (Figure 4). The jumps in both the Nasdaq and S&P 500 have been driven by a few huge tech stocks, especially involved in artificial intelligence, and most other stocks in these indices have struggled this year. The broader situation for US equities is perhaps more accurately demonstrated by the Russell 2000 small cap index, up only 5.8%.

Shifting the perspective globally shows a similar picture, with a moderate 4.7% gain in the Eurostoxx 600, an index of Europe’s largest stocks, while emerging markets, using the iShares Emerging Market ETF as a proxy, is up just 1.3%. Apart from a boost early in 2023, both the European and emerging market stocks have struggled to maintain gains for the rest of year, and the pressure seems likely to continue.

Mining stocks not significantly underperforming global equities

Comparing the performance of the mining stock indices to the major US markets

obviously shows a severe underperformance. The MSCI Metals and Mining

Producers ETF (MMMPE) is down -3.6%, below the Nasdaq by about 30% and the

S&P 500 by about 20%, while the S&P/TSXV Metals and Mining Index (STMMI), up

1.5%, has a similar wide gap. However, if we consider the S&P 500 and Nasdaq an

anomaly really driven by a boom in a single sector, the mining stock performance is

not so out of line with what is happening with US and global equities more broadly.

The STMMI trails the comparable Russell 2000 small cap index by only 4.3% and is

exactly inline with the performance of emerging markets. This seems justified given

that the STMMI has many pre-production junior mining stocks that could be

considered more risky than the average Russell 2000 stock, while emerging markets

are considered to be quite high risk overall. The STMMI has its exposure

concentrated mainly in gold, copper and lithium stocks, while the MMMPE has

exposure to a much wider range of assets, including energy, and companies only

tangentially related to metals and mining, explaining the latter’s underperformance.

TSX mid-cap copper stocks mixed as metal price flat year-on-year

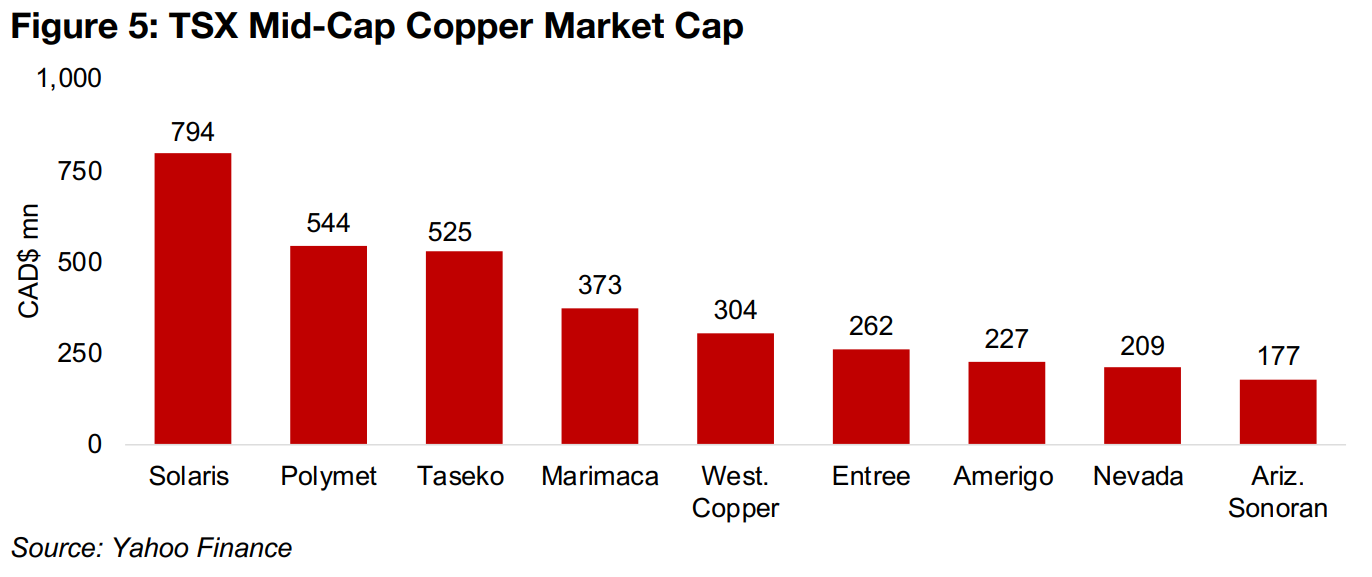

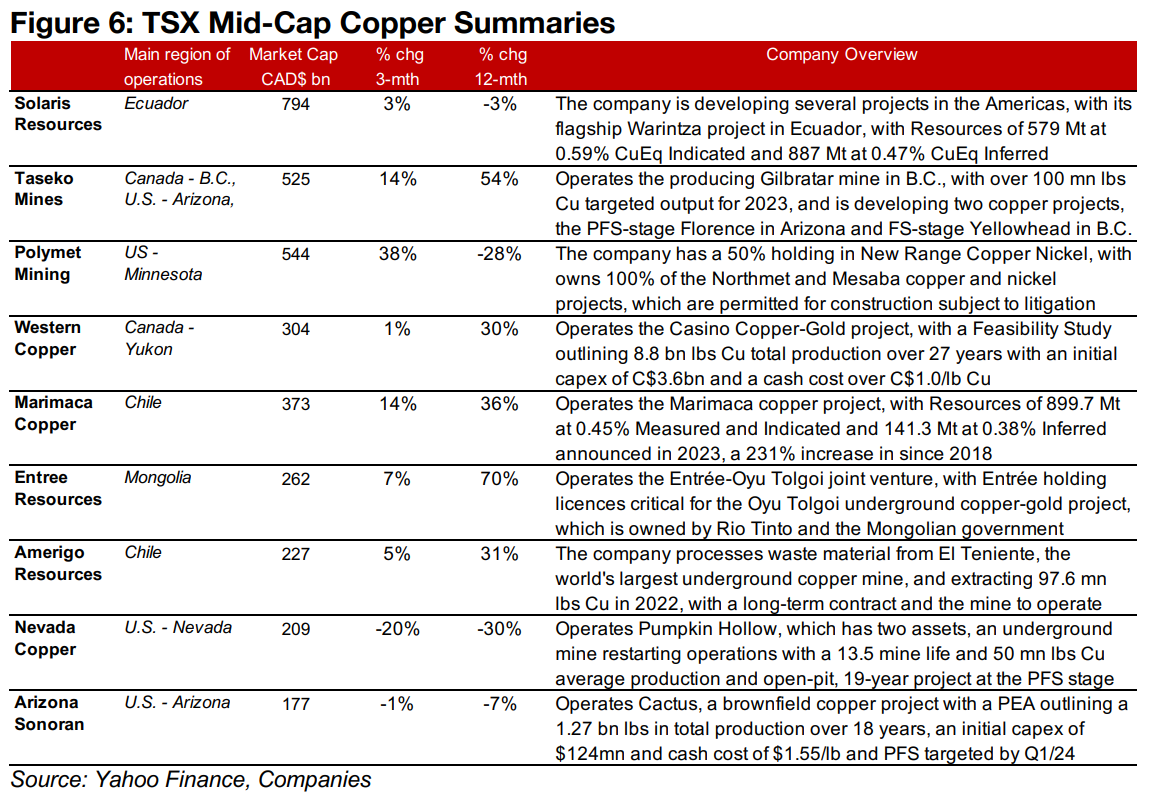

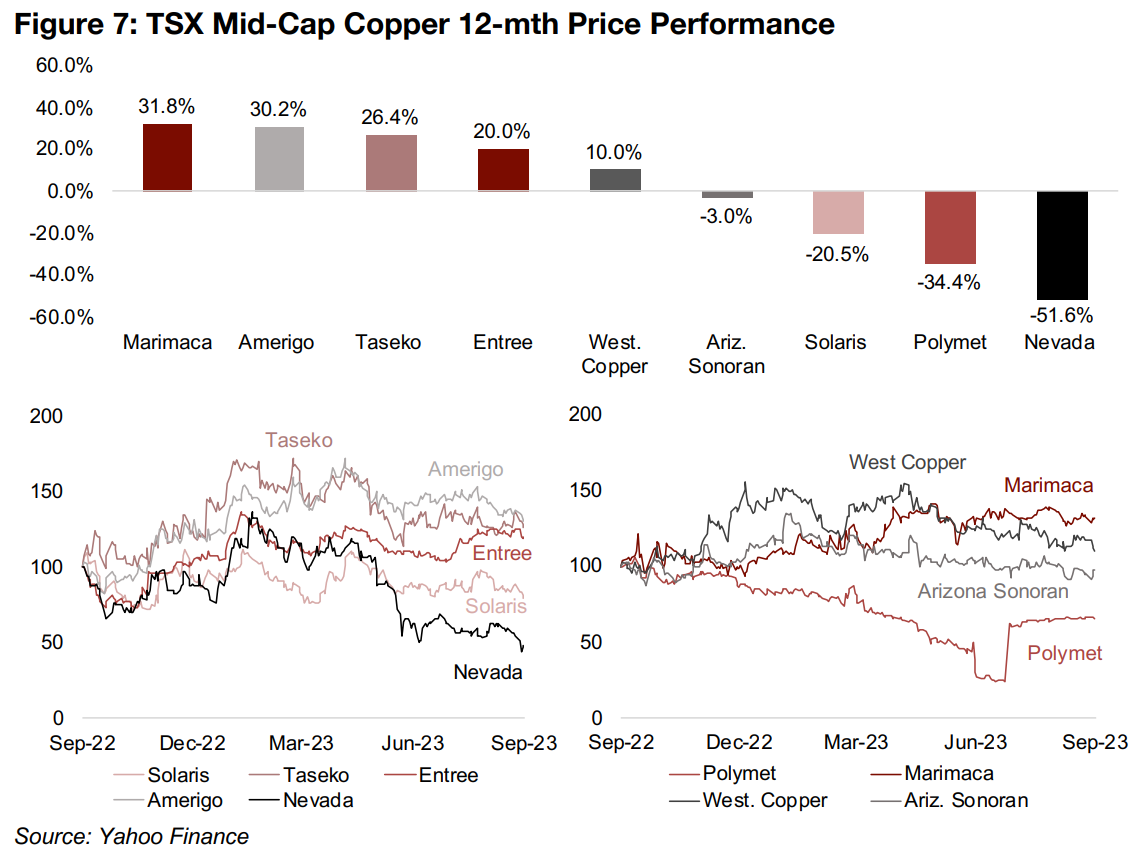

This week we look at the TSX mid-cap copper stocks, which range from a market cap of CAD$794mn to CAD$177, comprising Solaris Resources, PolyMet Mining, Taseko Mines, Marimaca Copper, Western Copper and Gold, Entrée Resources, Amerigo Resources, Nevada Copper and Arizona Sonoran (Figures 5, 6). The group have had a mixed price performance over the past twelve months, with five seeing gains and four losses, even as the copper price has remained relatively flat (Figure 7). Copper is currently trading at US$3.78/lb and has averaged US$3.80/lb since May 2023, up only slightly from the average US$3.74/lb average from November to December 2022, with a clear jump above this level only briefly in first quarter 2023.

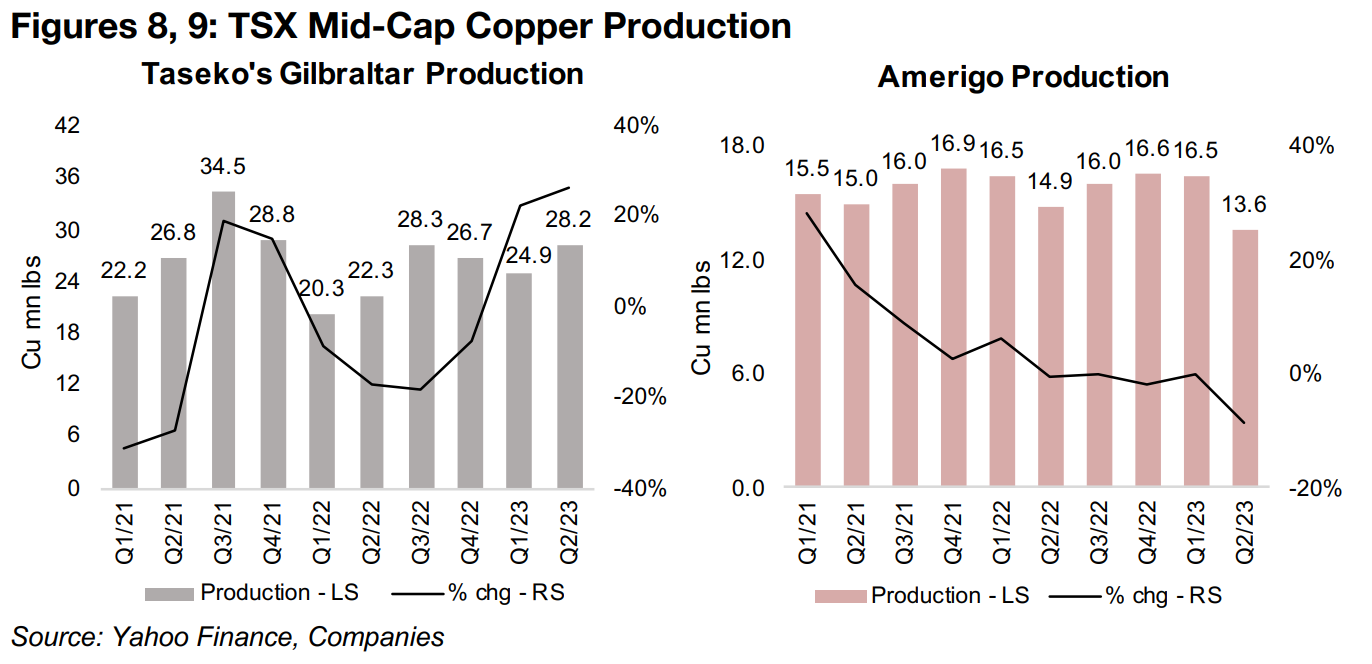

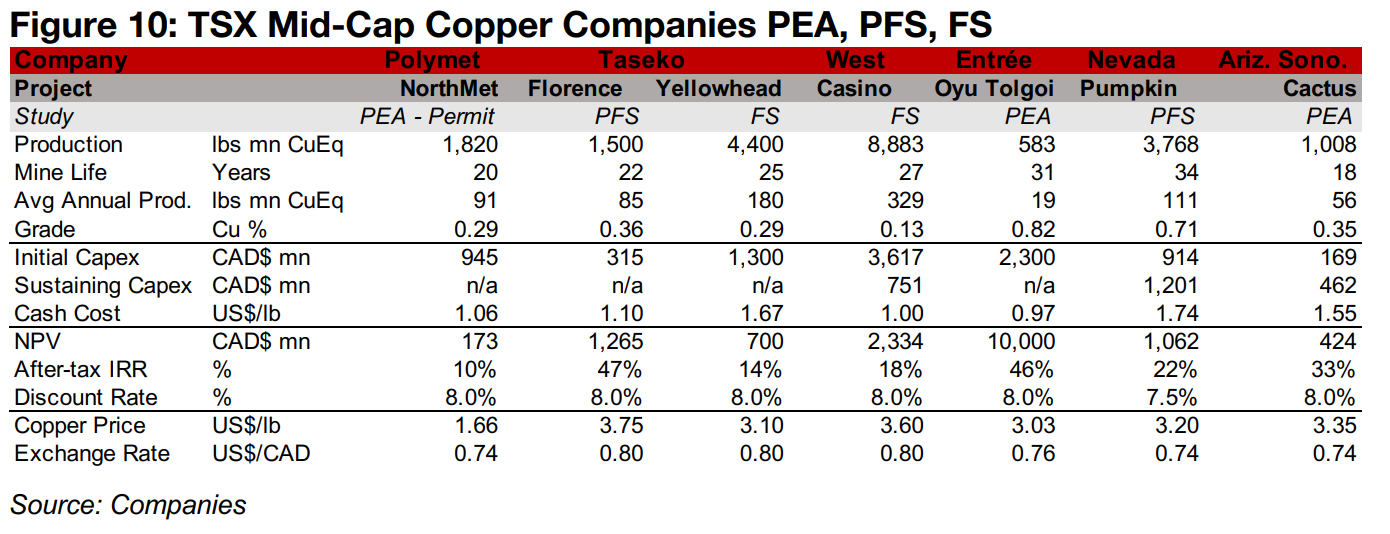

Taseko and Amerigo in production, Nevada on verge of output

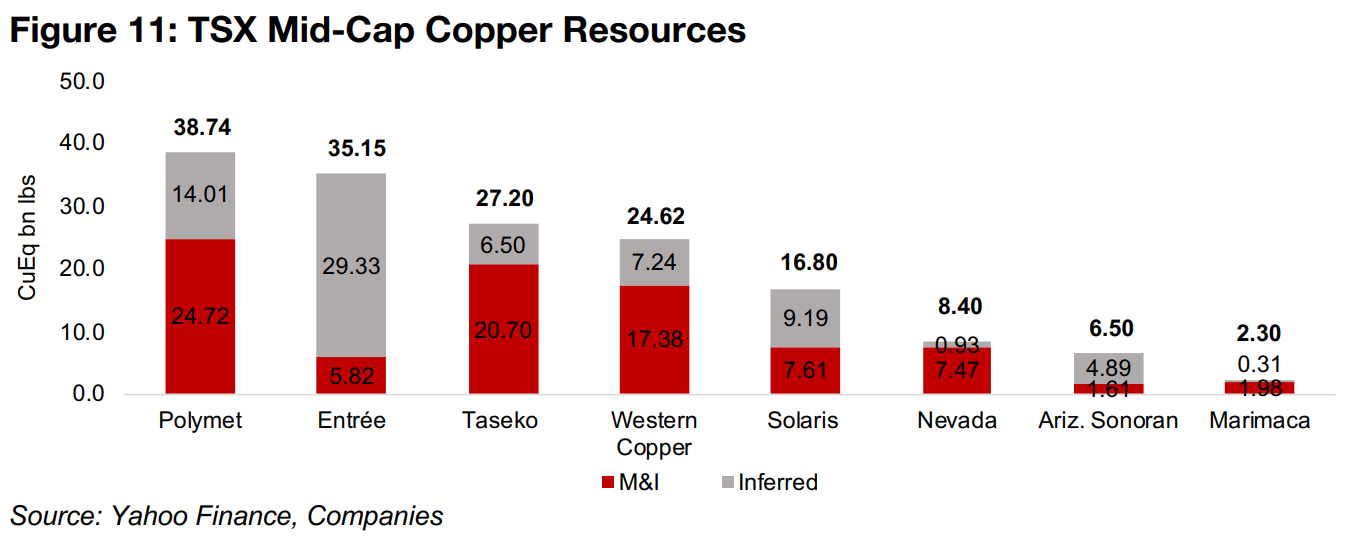

Only one of the group has a mine in full production, Taseko, with its Gilbraltar mine

with output of 53.1 mn lbs Cu over H1/23, up 24.6% (Figure 8), and it also has two

other copper development projects, Florence and Yellowhead (Figure 10), giving it

the third largest Resources of the group, at 27.20 mn lbs Cu (Figure 11). The company

has been one of the stronger performers, up 26.4% over the past year.

Amerigo is also in production, but has no Resources officially, as it has a different

business model from the rest of the group, processing the waste material from El

Teniente, the world’s largest underground copper mine in Chile, and from this

producing substantial copper output, at 30.1 mn lbs over H1/23, down -4.1% yoy

(Figure 9). The company has been the group’s second-best performer, up 30.2% over

the past year, given that the market has generally been in risk-off mode, and

Amerigo’s business model has substantially lower risk that the average junior miner.

Nevada Copper is nearest to production, with the underground part of its Pumpkin

Hollow project expected to restart output in September 2023, with a 14-year mine

life, to be followed by an open-pit part of the project with a 20-year mine life, with an

average output over the lifetime of the project at 111mn lbs Cu per year. However, it

has been the weakest performer of the group by far, down -51.6% over the past year.

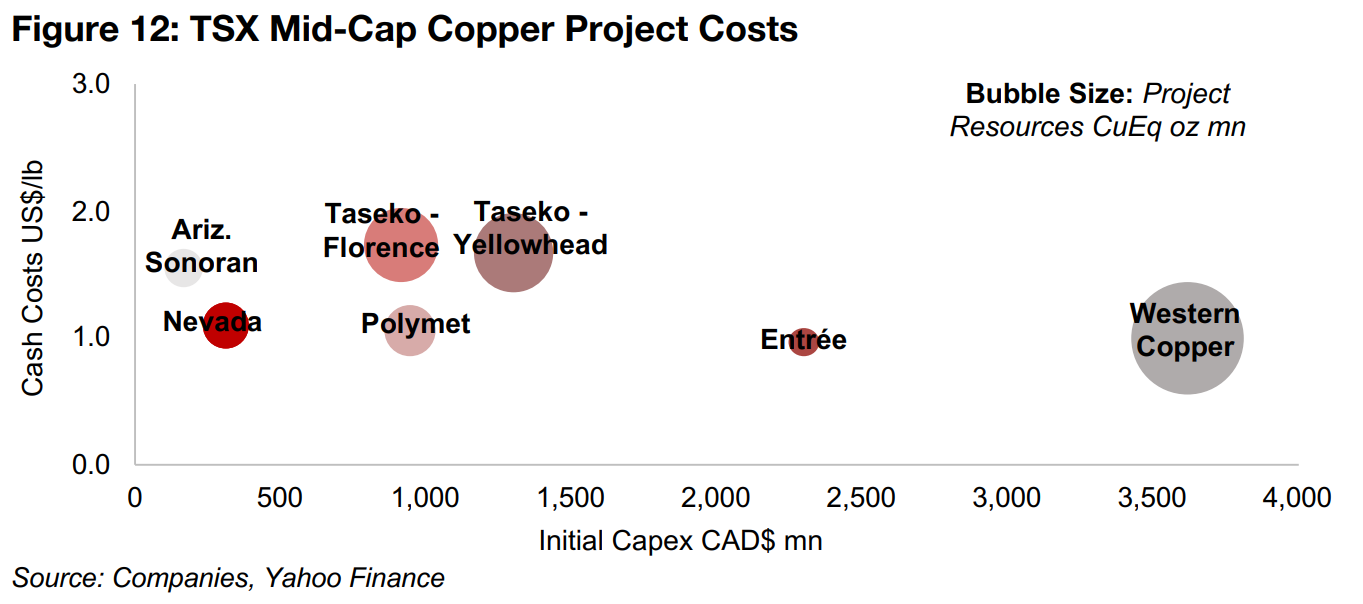

Polymet in litigation, Western Copper at FS-stage

Polymet has indirect ownership of its main project, holding 50% of New Range Copper and Nickel, which in turns holds 100% of the adjacent Northmet and Mesaba copper and nickel projects in Minnesota in the U.S. While these projects have by far the largest resources of the group at 38.74 mn lbs Cu and are permitted, they face ongoing litigation regarding environmental issues, which has likely been the key factor behind its -34.4% 12-month decline, the second weakest of the group. Western Copper operates the FS-stage Casino project, which stands out for by far the largest output of any project in the group, at 8.8bn lbs CuEq. However, this corresponds also to the largest initial capex of any project in the group, at CAD$3.6mn (Figure 12).

Entree holds Oyu Tolgoi licenses, Arizona Sonoran operates brownfield Cactus

Entrée is part of the Entrée-Oyu Tolgoi joint-venture, which holds licenses critical to

the development of Oyu Tolgoi project in Mongolia, with is operating by Rio Tinto and

the Mongolian government. The project has the highest grade of the group at 0.82%

CuEq, and a relatively low cost, at US$0.97/lb CuEq, which combined with the

backing from a global mining giant, has supported a 20% gain in its share price.

Arizona Sonoran operates the brownfield Cactus copper project, with a moderate

grade, a relatively low total output and mine life and a higher cash costs per lb Cu but

a very low initial capex, which has seen the stock near flat over the past year, down

just -3.0%.

Solaris and Marimaca at Resource Estimate Stage

The largest stock of the group by market cap, Solaris and fourth largest, Marimaca, are still at the Resource Estimate Stage, with no PEA or FS for their major projects yet. Solaris is developing several copper projects in the Americas, including its flagship Warintza, in Ecuador, and it has had a relatively weak performance over the past year, declining -20.5%. Marimaca, developing its eponymous flagship in Chile, in contrast, has seen the strongest performance of the group, up 31.8%, as it has significantly increased its Mineral Resource Estimate this year.

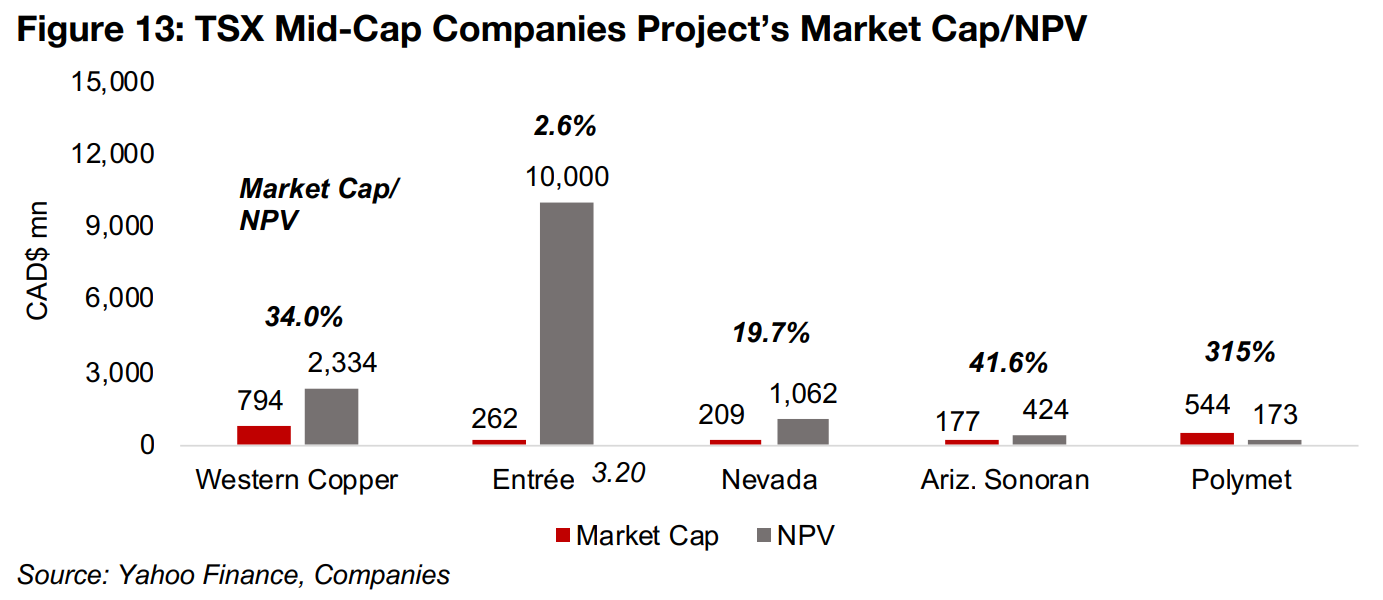

For valuation levels, the market cap to NPV for the flagship projects of Western

Copper and Gold, Nevada Copper, and Arizona Sonoran, at 34.0%, 19.7% and

41.6%, are within the standard range of market averages (Figure 13). Entrée stands

out with a market cap to project NPV of just 2.6%, but this is because the company

only holds a small proportion of the project, which is owned by Rio Tinto and the

Mongolian government. Polymet is another exception, with the market cap at 315%

of the NPV because only the first phase 20-year phase of the entire project is included

here, and the market is pricing in the later stages of the project also.

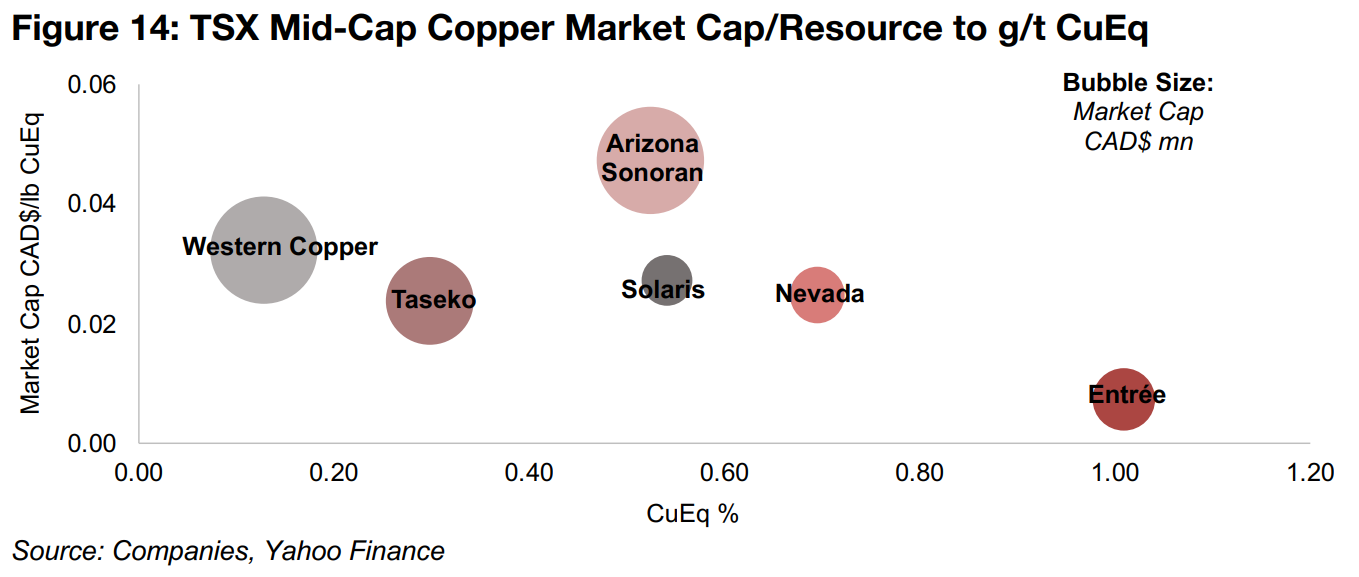

On a Market Cap/Resource basis versus CuEq %, a higher grade generally tends

towards a higher valuation per lb for the group, as expected (Figure 14). Nevada looks

slightly undervalued and Entree’s low figure is again because it does not hold the

entire project (Marimaca has been excluded given its very high Market Cap/Resource).

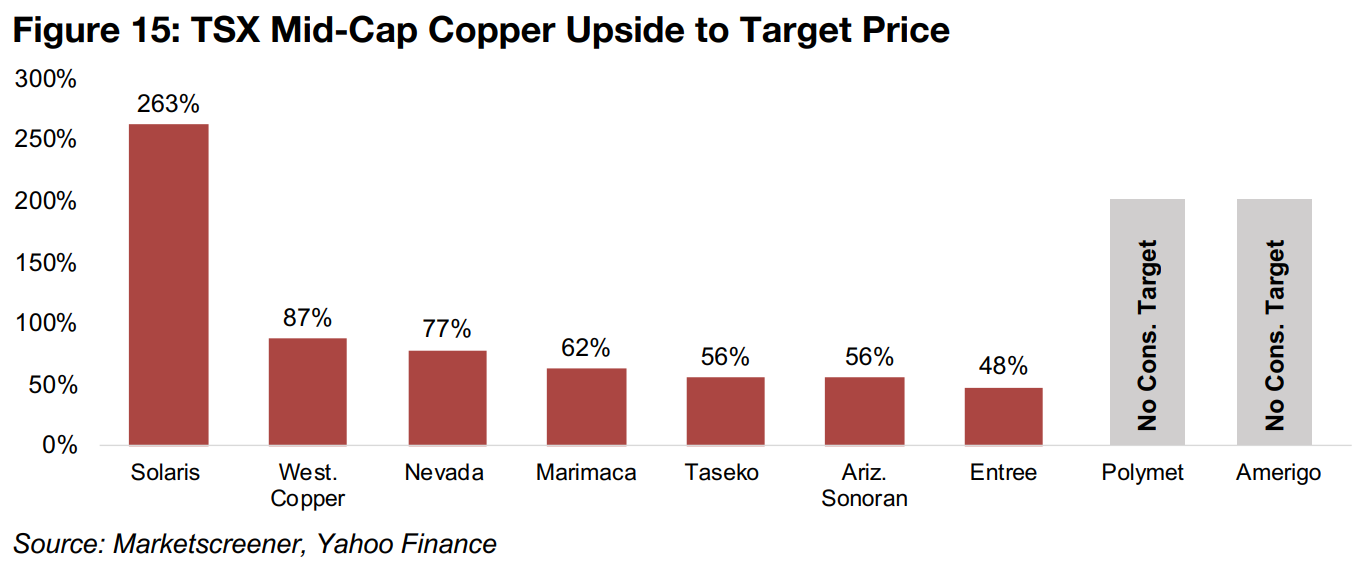

The upsides to target prices are in a reasonably tight range for the group from 87%

to 48%, expect for Solaris, with by far the highest upside at 263% (Figure 15).

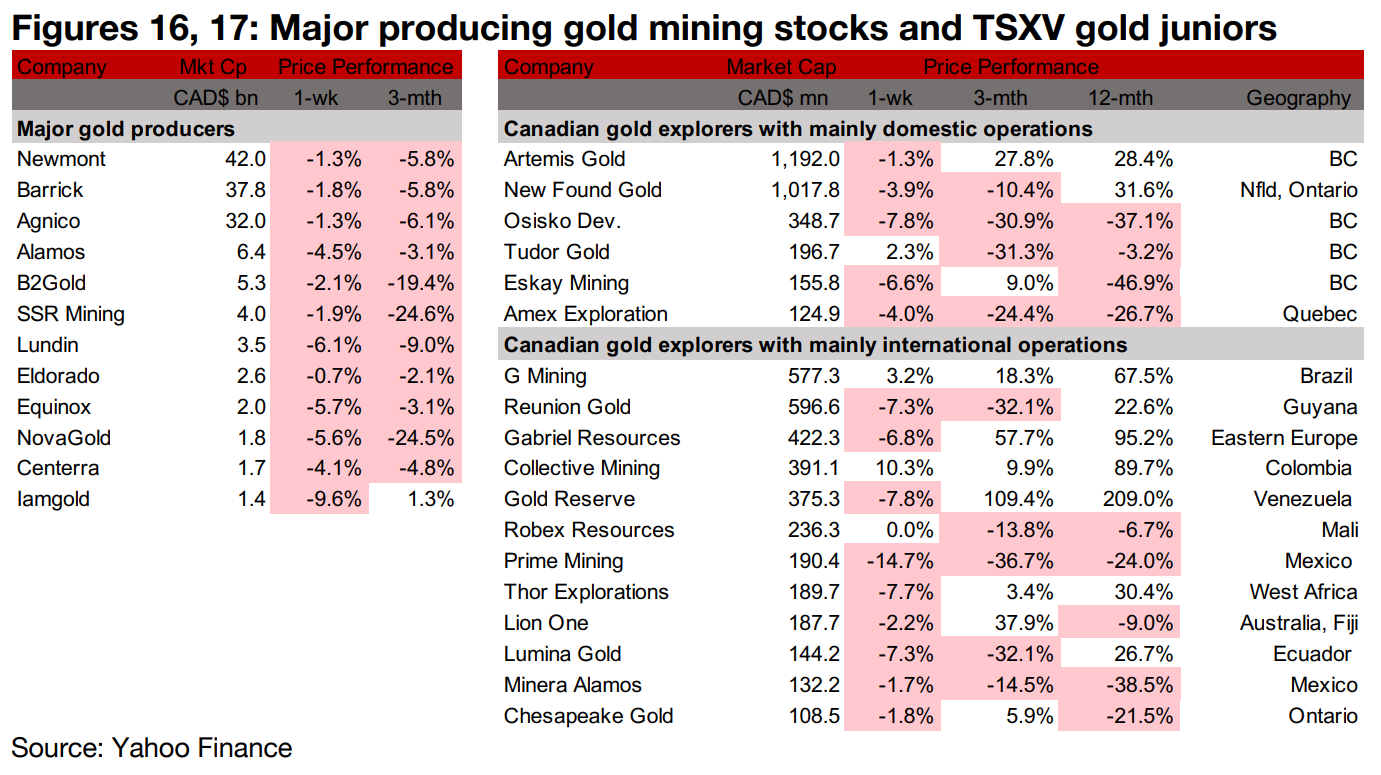

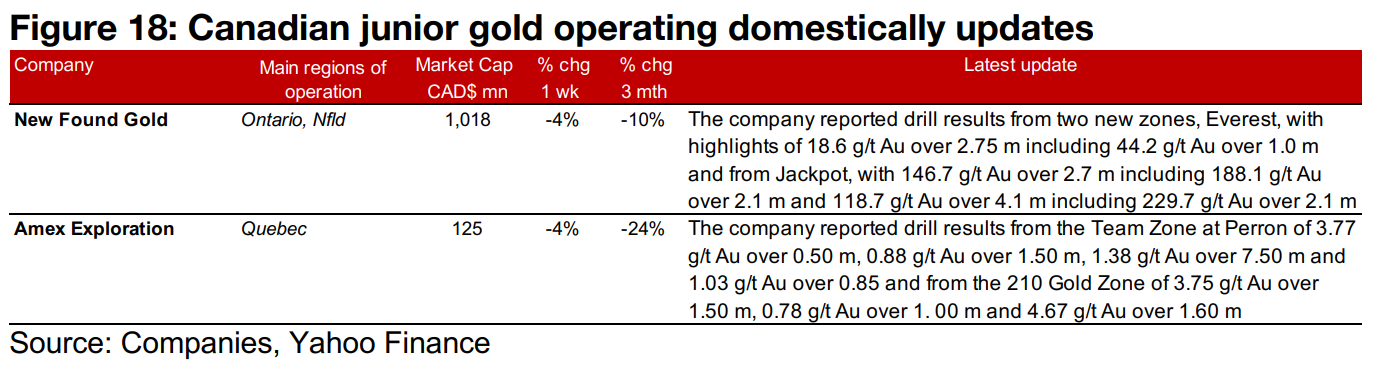

Major gold producers all down and most large TSXV gold juniors decline

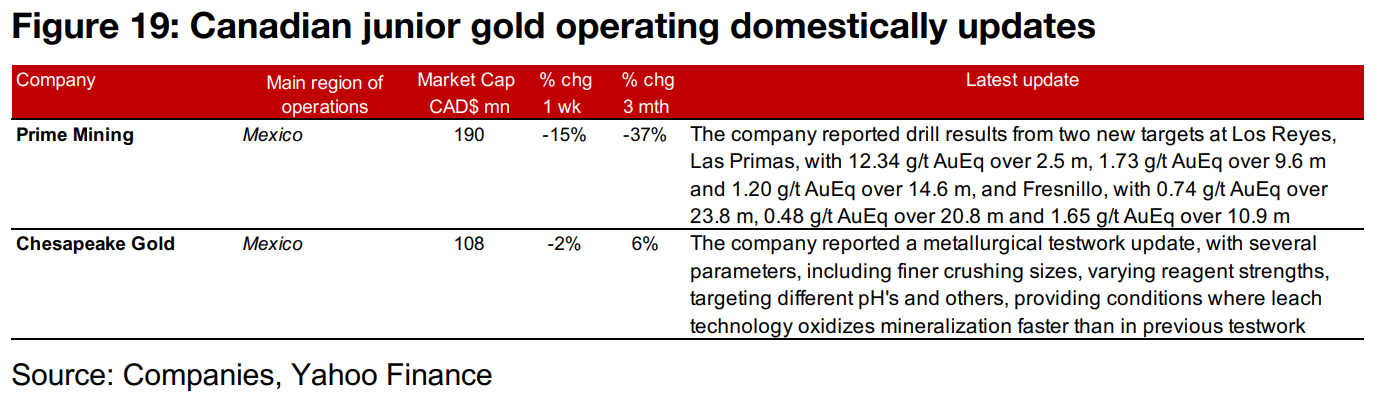

All the major gold producers declined and most of the TSXV larger cap gold stocks were down on a decline in the gold price and equity markets (Figures 16, 17). For the TSXV gold companies operating domestically, New Found Gold reported drill results from two new zones at Queensway, Everest and Jackpot, and Amex Exploration released drill results from the Team Zone and 210 Gold Zone at Perron (Figure 18). For the TSXV companies operating internationally, Prime Mining announced drill results from two new zones at Los Reyes, Las Primas and Fresnillo, and Chesapeake Gold reported a metallurgical testwork update for Metates (Figure 19).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.