May 05, 2025

TSXV Mining Top 20 See Mixed Performance

Author - Ben McGregor

Gold consolidates around new average high over past month

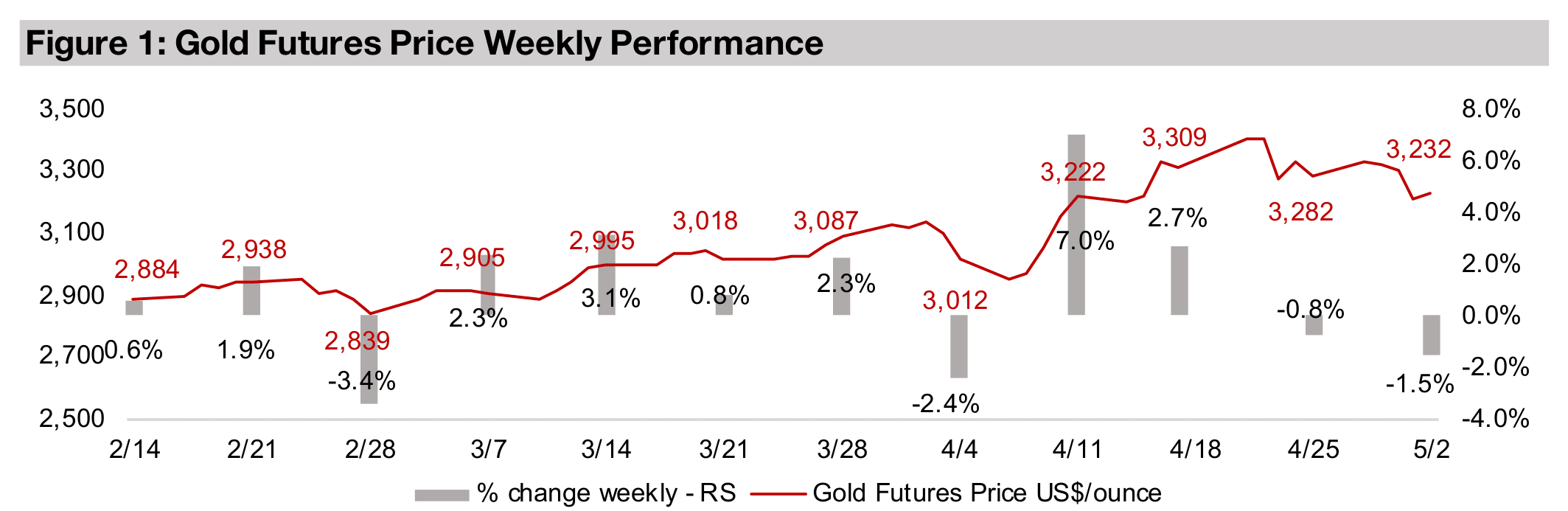

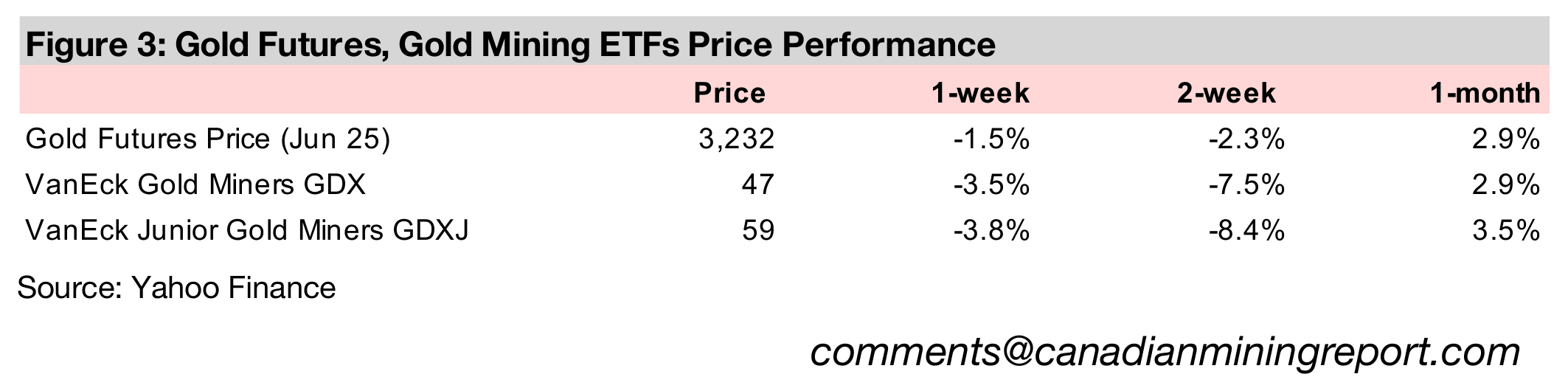

Gold fell -1.5% to US$3,232/oz, pausing for a second week as a risk-on shift continued and consolidating around an average US$3,200 for the past month, which is potentially a good development given that its parabolic move looked unsustainable.

TSXV Mining Top 20 See Mixed Performance

Gold declined -1.5% to US$3,232/oz, down for the second straight week as a major

risk on move in markets continued, seeing the market shift away from safe havens.

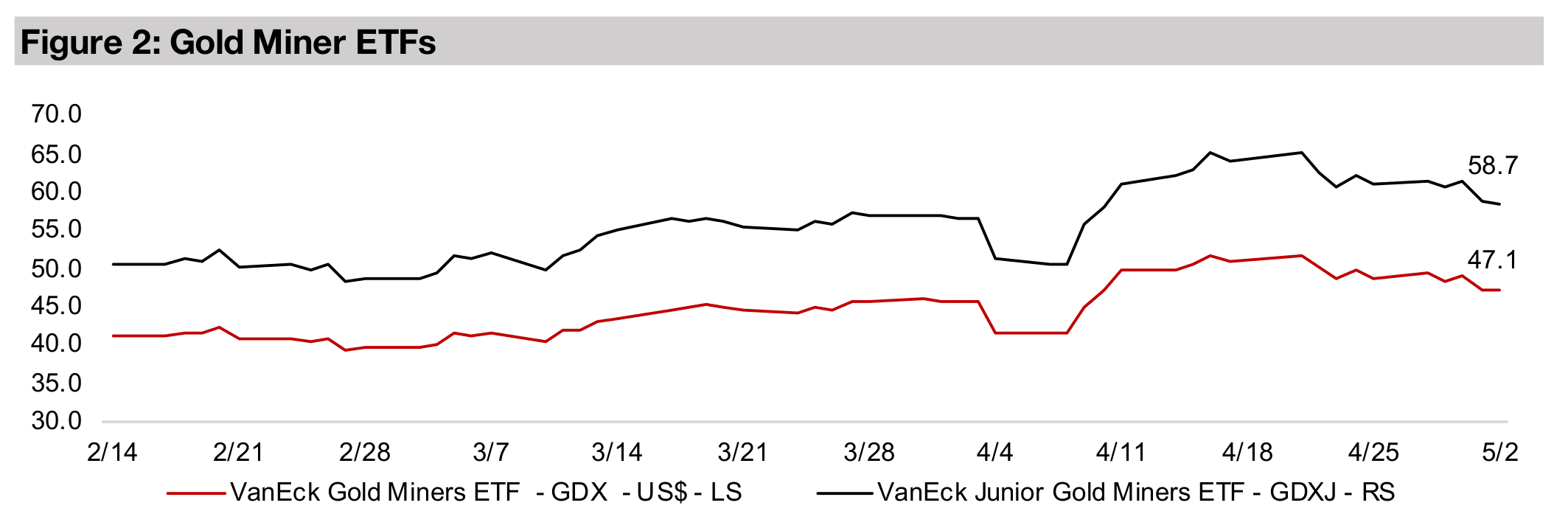

This dragged down gold stocks, with the GDX and GDXJ down -3.5% and -3.8%, far

underperforming the rise in the S&P 500, Nasdaq and Russell 2000 by 2.9%, 3.4%

and 3.1%. We remain wary of the recent rebound in equities, with all three of these

major markets nearly regaining their levels prior to the crash. This is because the main

driver of the decline, rising tariffs, certainly remains, even if there has been relief from

a more apocalyptic scenario being priced in during the depths of the crash. While

there has been an improvement, especially with the possibility of US-China trade

talks, even at lower levels, the tariffs could still have a major negative effect on global

economic activity, making the recent rebound seem somewhat overdone.

The pullback in the gold could actually be viewed as a good development for the

metal, as its parabolic move this year was starting to look increasingly unsustainable

short-term. It had become somewhat untethered from fundamentals with the gold

ratio versus several key assets shooting up to levels well above medium-term

averages, and in several cases reaching all time highs. To bring these ratios to more

reasonable levels, either gold was going to have to decline or these other assets rise.

Both of these shifts have occurred to a degree over the past two weeks with the gold

price down more the decline in silver, copper and the commodities index. While this

relieved some pressure on these gold ratios, they remain historically high.

For now, the market seems content to accept a price near the current level, with an

average US$3,216/oz over the past month. That gold has remained relatively flat even

during this big risk on move, shows markets are still hedging their bets with safe

havens. The average gold forecast by the large investment banks is for US$3,483/oz

this year, which would still leave room for gains over the next several months, but

also allow time for these other assets to rise and bring them more in balance with

gold. A continued short-term surge through to US$3,500/oz might have been a bit

much for the market to handle and precipitated an eventual severe pullback.

The current risk on move could be viewed as the market pricing in global economic

demand not being hit as hard by global tariffs as was initially feared. This has

translated to a rebound in copper, a proxy for global industrial demand, to as high

US$5.0/lb, back near its March 2025 highs of US$5.2/lb, and up from its lows of

US$4.1/lb. As there were certainly no changes on the supply side to warrant such a

move, these recent swings imply changes in expectations on the demand side. A

US$5.0/lb price reflects the robust demand expectations prior to the crash, and

US$4.3/lb to a weaker demand outlook. Interestingly copper has recently declined to

a level almost exactly between these two, at US$4.7/lb, suggesting the market does

expect demand will be lower because of rising tariffs, but no longer sees the

extremely negative scenario implied by the metal’s recent lows developing.

The markets still seem relatively cautious, as they have been really since 2024, and

especially toward the end of last year, as shown by the collapse in the tech bubble

and the rise in more defensive sectors. We expect that this could continue to make

the equity markets and the copper price prone to downward pressure once markets

look past the current euphoria from a moderate improvement in the trade situation

and focus more on the overall difficulties still facing the global economy.

Mixed outlook for resources on new Canadian government

The big news this week domestically was the Canadian election results, with the

Liberal party winning and Mark Carney becoming Prime Minister. The new

government could have a mixed effect on the resources industry. Carney has

emphasized simplifying and speeding up the permitting for mining projects by

combining the federal and provincial approvals into a single process. There is also

expected to be a focus on the development of critical minerals including lithium,

cobalt and nickel, which are likely to see particularly strong government support.

However, there are questions of how supportive the new government will be in

practice of the oil and gas industry, given its heavy focus on carbon neutrality, which

could increase tensions with Alberta, where much of this industry is concentrated.

The Liberal party also does not have a very amicable relationship with the Trump

administration, and this could exacerbate trade tensions between the countries.

However, the new government does not have a majority, winning 168 seats, below

the 172 seats required of a total 343. Some of their plans may be tempered by the

conservative party, which was close behind, winning 144 seats.

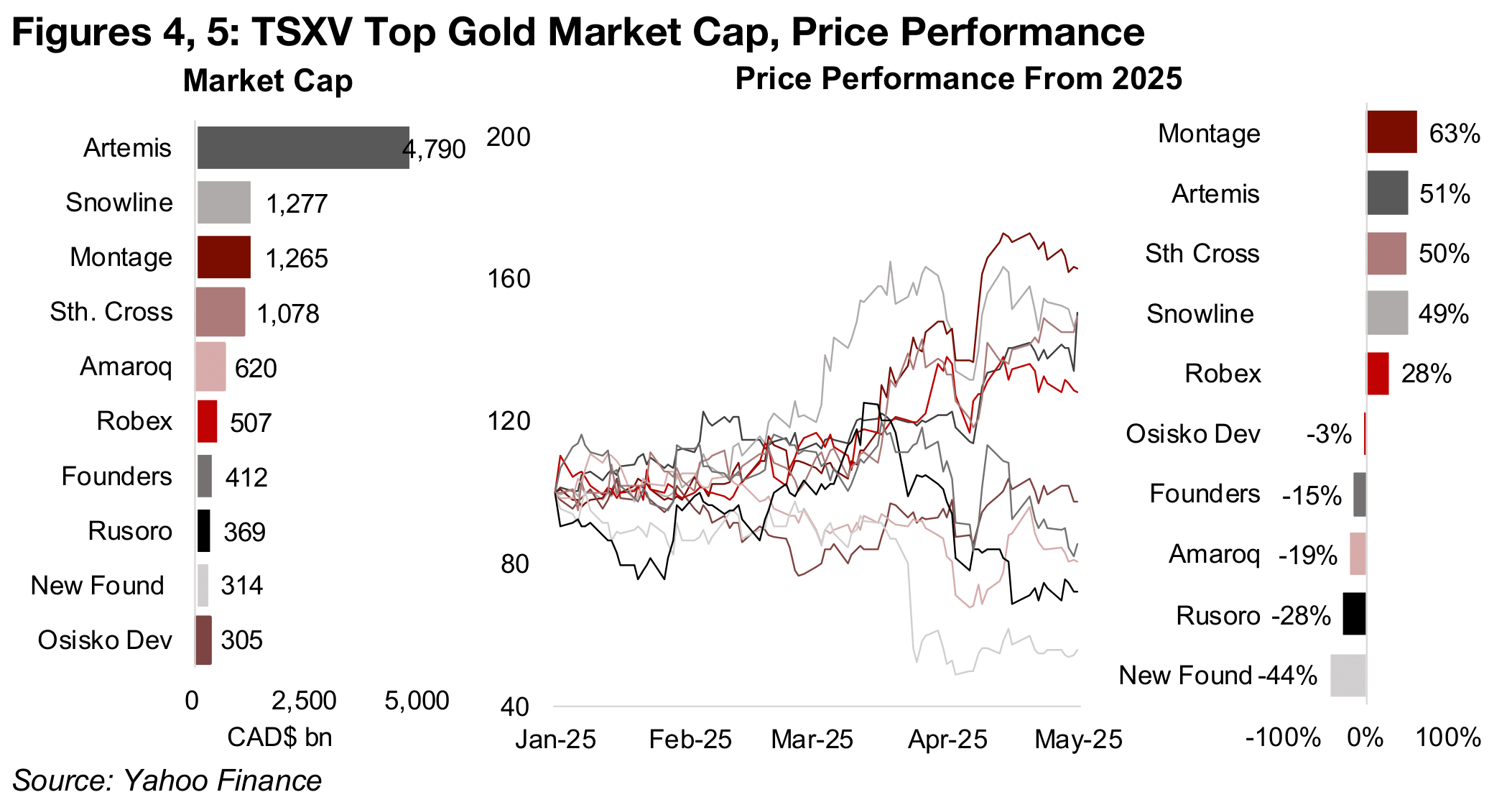

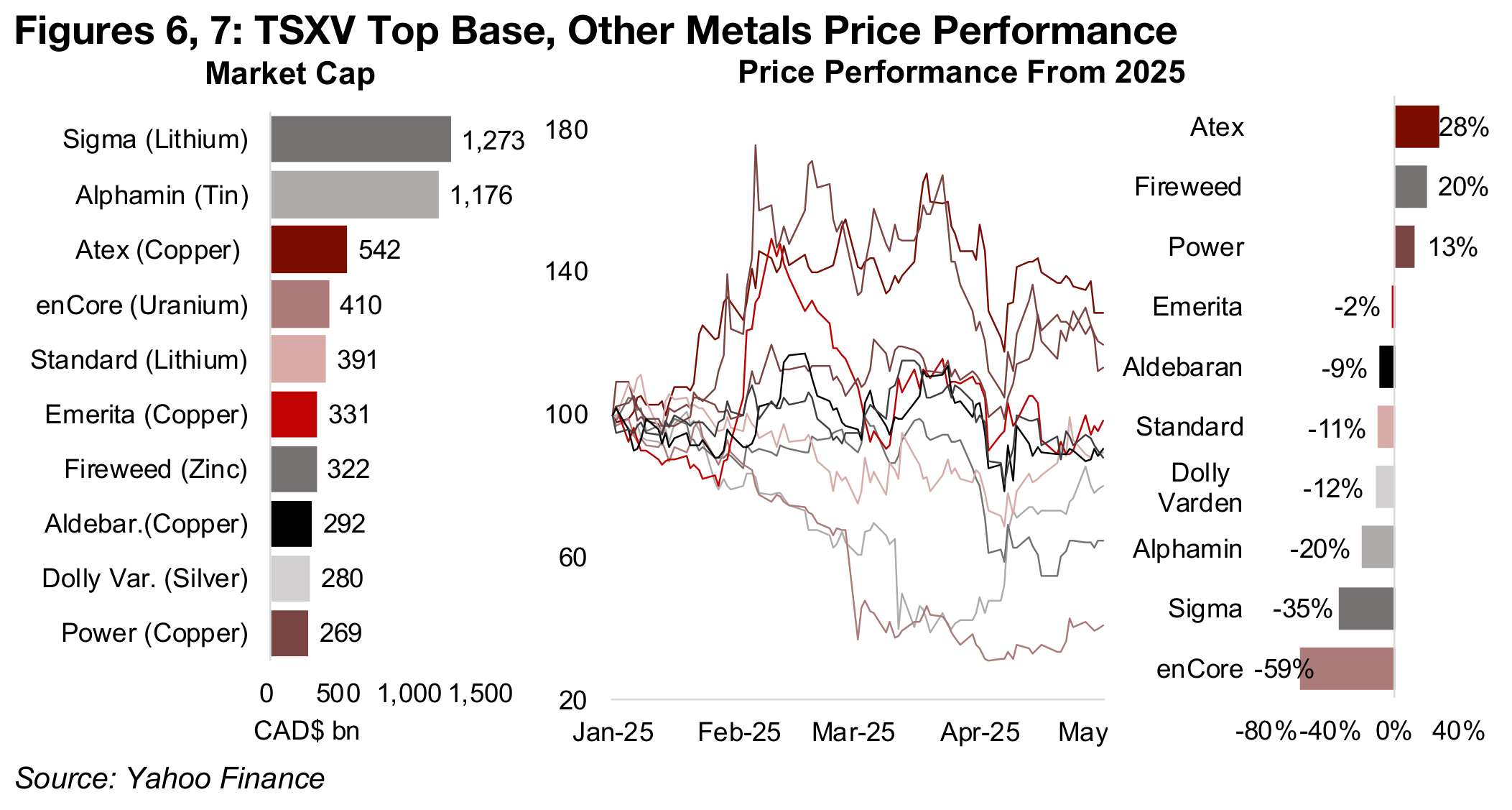

TSXV Mining Top 20 performance mixed, with more strength from gold

This week we look at how the TSXV Mining Top 20 have fared in the relative market

chaos this year, with the performance mixed overall. While half of the top ten gold

stocks have performed exceptionally well, as would be expected given the huge

surge in the metal price, the rest have seen declines. The majority of the base and

other metals stocks have declined, with seven of the top ten down, and the three

gainers up only by around half the level of the top performing gold stocks.

The biggest gainer for gold has been Montage, up 63%, driven by the strong progress

in the construction of its Kone project in Cote D’Ivoire which started in December

2024 (Figures 4, 5). The company also announced an investment in African Gold,

partnering with the company to develop the Didievi project in Cote D’Ivoire, and it

has received approval to move from a TSXV to TSX listing. Artemis is up 50% this

year and has become by far the largest market cap stock on the TSXV, at CAD$4.8bn,

having reached commercial production over the past month at its very large

Blackwater project, with 11.7mn oz Au of M&I resources. Artemis also seems likely

to eventually move to a TSX listing and could be an acquisition target.

The much earlier stage Southern Cross is up 50%, based on outstanding recent drill

results for its Sunday Creek project, which is still pre-resource estimate. Snowline

Gold is up 49% on continued strong drill results from its Rogue project in the Yukon,

with an initial resource estimate released for the project in mid-2024. Robex

Resources is up 28% and in January 2025 announced the extension of the life of its

already producing Nampala gold mine in Mali. It also released an updated Feasibility

Study in January 2025 for its Kiniero project in Guinea, which is under construction,

with a major financing package from Sprott announced in March 2025.

Osisko Development has been near flat this year, with its main driver to be the

development of its Cariboo project in British Columbia, with an updated Feasibility

Study recently released. Founders Metals is down -15% year to date, after it

quadrupled in 2024 on very strong drill results from its Antino project in Suriname.

Amaroq is down -19%, also after strong gains in 2024 with the share price doubling,

as the company reached first gold pour for its Nalunaq project in Greenland in

November 2024 and is progressing towards full commercial production.

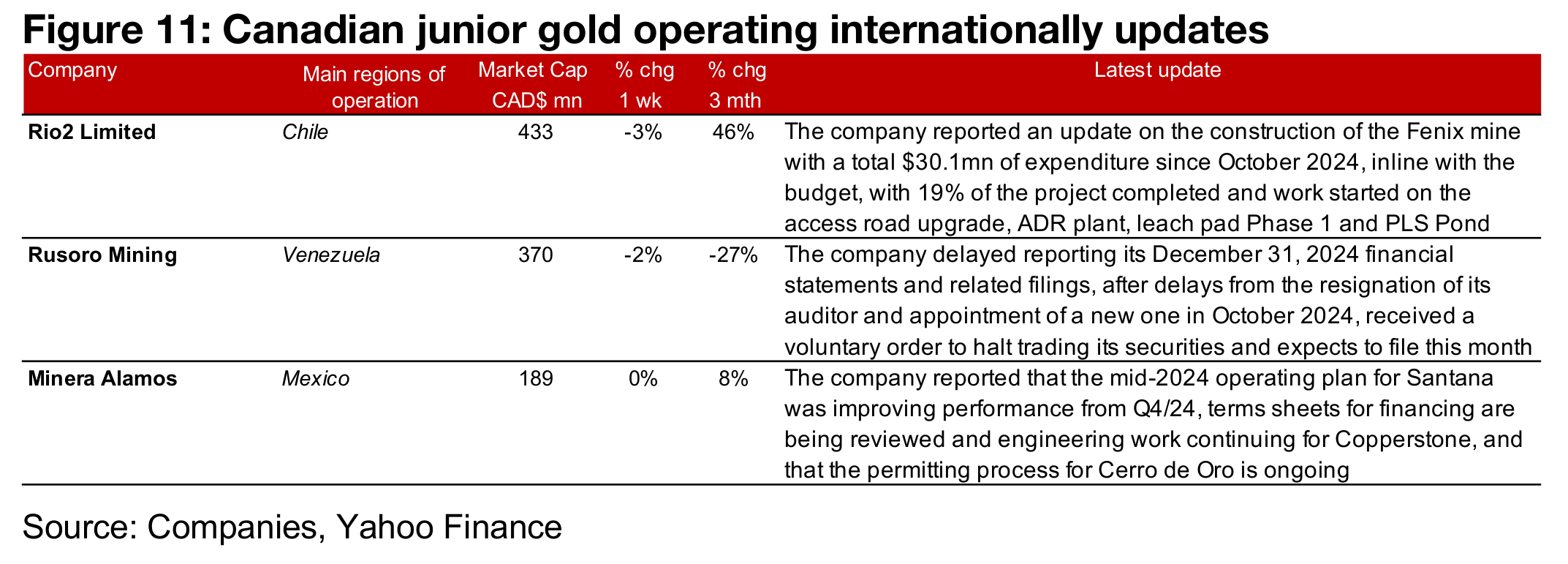

Rusoro has lost -28%, with its main value from the potential payout from legal

proceedings related to holdings of Venezuelan companies. The company recently

delayed the filing of its December 2024 financial results which was caused by the

resignation of its previous auditor and appointment of a new one in October 2024.

The company expects to file its financial statements this month. New Found Gold has

declined -44%, with its market cap down to just CAD$314mn from a peak around

CAD$1.5bn in 2021, and did not see a significant rise after the long awaited Initial

Resource Estimate for its Queensway project was released in March 2025.

The largest rise for the base metals and other stocks has come from Atex Resources,

up 28%, on continued strong drill results from the Valeriano copper-gold project in

Chile, with a Mineral Resource Estimate released in 2023 (Figures 6, 7). The second

largest gains are from Fireweed Metals, up 20% as drill results remain strong from its

exploration-stage MacPass zinc project in the Yukon. Power Metallic Mines has risen

13%, on continued strong drill results from its polymetallic NISK project in Quebec,

with copper, nickel and PGE metals.

Emerita Resources has been near flat, down -2%, on strong drill results from its

Iberian West copper project in Spain, with an upgraded resource estimate released

in March 2025. Aldebaran is down -9%, with it announcing a delay last month in the

release of its PEA for the Altar copper-gold project in Argentina to Q3/25. Standard

Lithium has declined -11%, with its Southwest Arkansas project near production, but

the lithium price still under pressure. Dolly Varden has dropped -12%, as there have

been decent drill results from its Mineral Resource Stage Dolly Varden and

Homestake Ridge projects but only been muted gains in the silver price.

Alphamin has lost -20% on political issues with its Bisie tin mine in the Democratic

Republic of Congo. Insurgents in the area of the mine had driven an evacuation and

shutdown of production in March 2025, although operations were restarted in April

2025 after insurgents withdrew. Sigma Lithium has dropped -35% this year to a

market cap of US$1.3bn, down from around US$5.0bn at its peak in 2023, on the

plunge in the lithium price. The company currently produces lithium oxide

concentrate and construction that will double its capacity is ongoing. EnCore,

operating multiple uranium projects in the US, has plunged -59% on the drop in the

metal price, with its CAD$410mn market cap well below half of its peak last year.

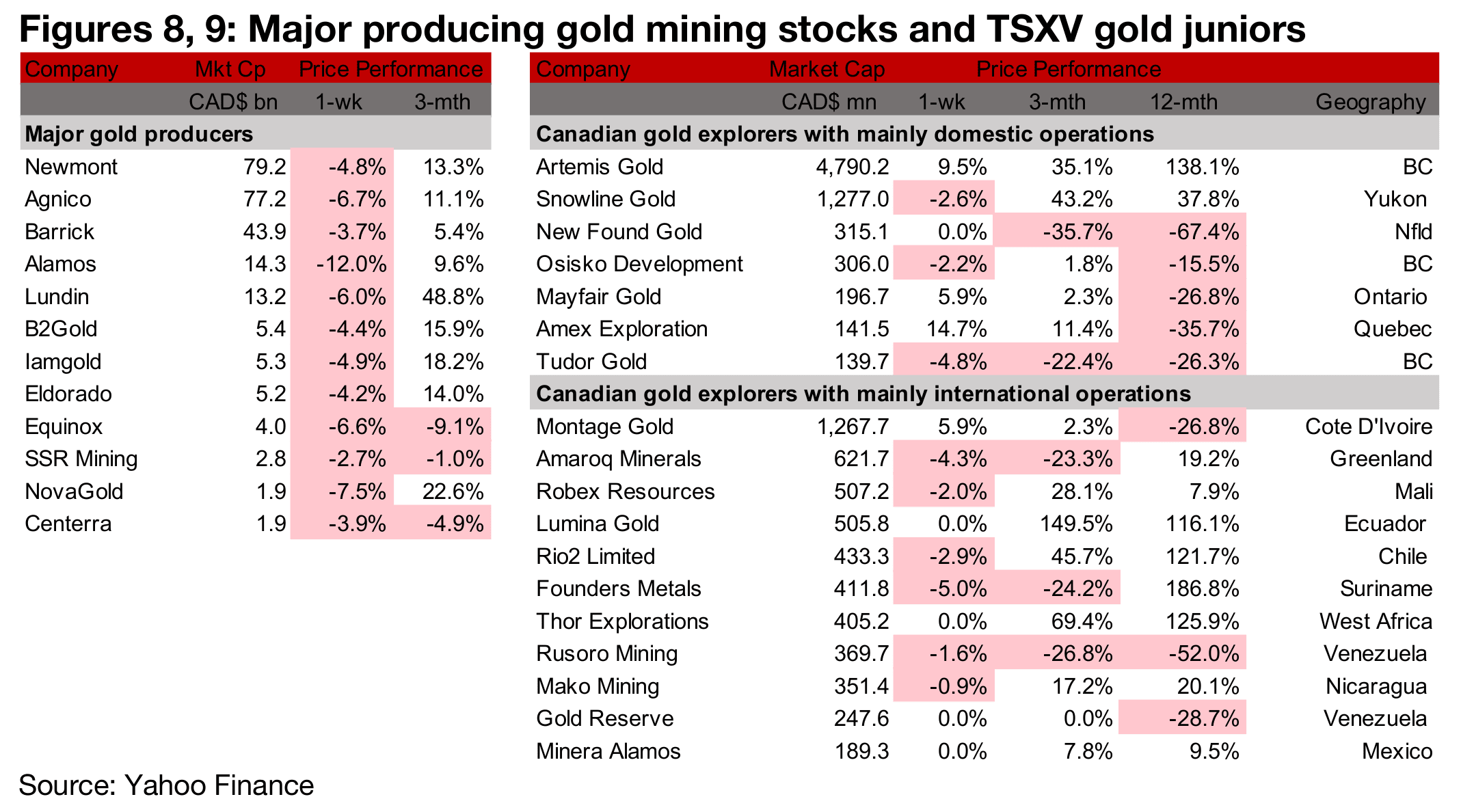

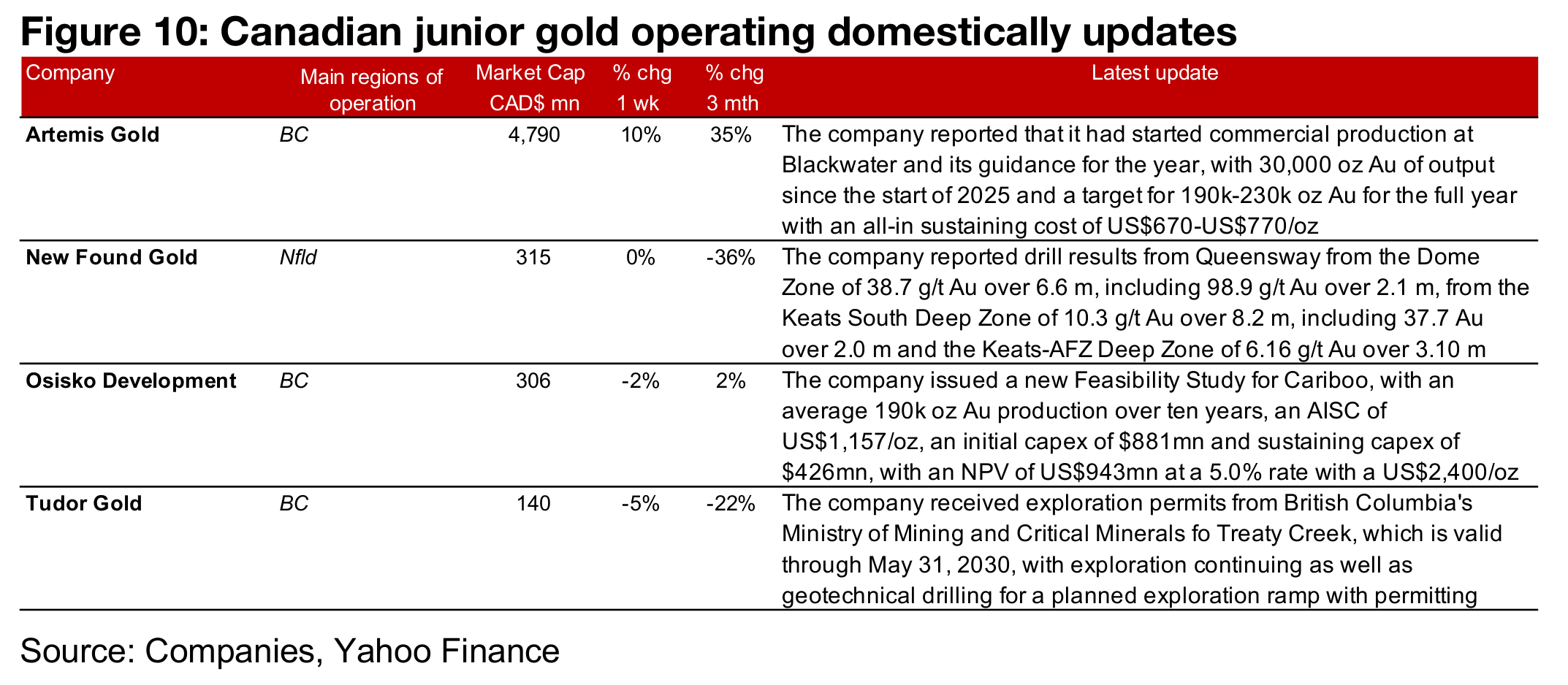

Major producers all slide while TSXV large gold mixed

The major producers all declined on the drop in the metal price and on a pullback after strong gain in recent months, while the large TSXV gold stocks were mixed (Figures 8, 9). For the TSXV gold companies operating mainly domestically, Artemis reported the start of commercial production, New Found Gold announced new drill results from Queensway, Osisko Development released a new Feasibility for Cariboo and Tudor Gold received an exploration permit for Treaty Creek (Figure 10). For the TSXV gold companies operating mainly internationally, Rio2 Limited provided an update on construction at Fenix, Rusoro Mining delayed reported its financial results and Minera Alamos gave an operational update on its three projects (Figure 11).

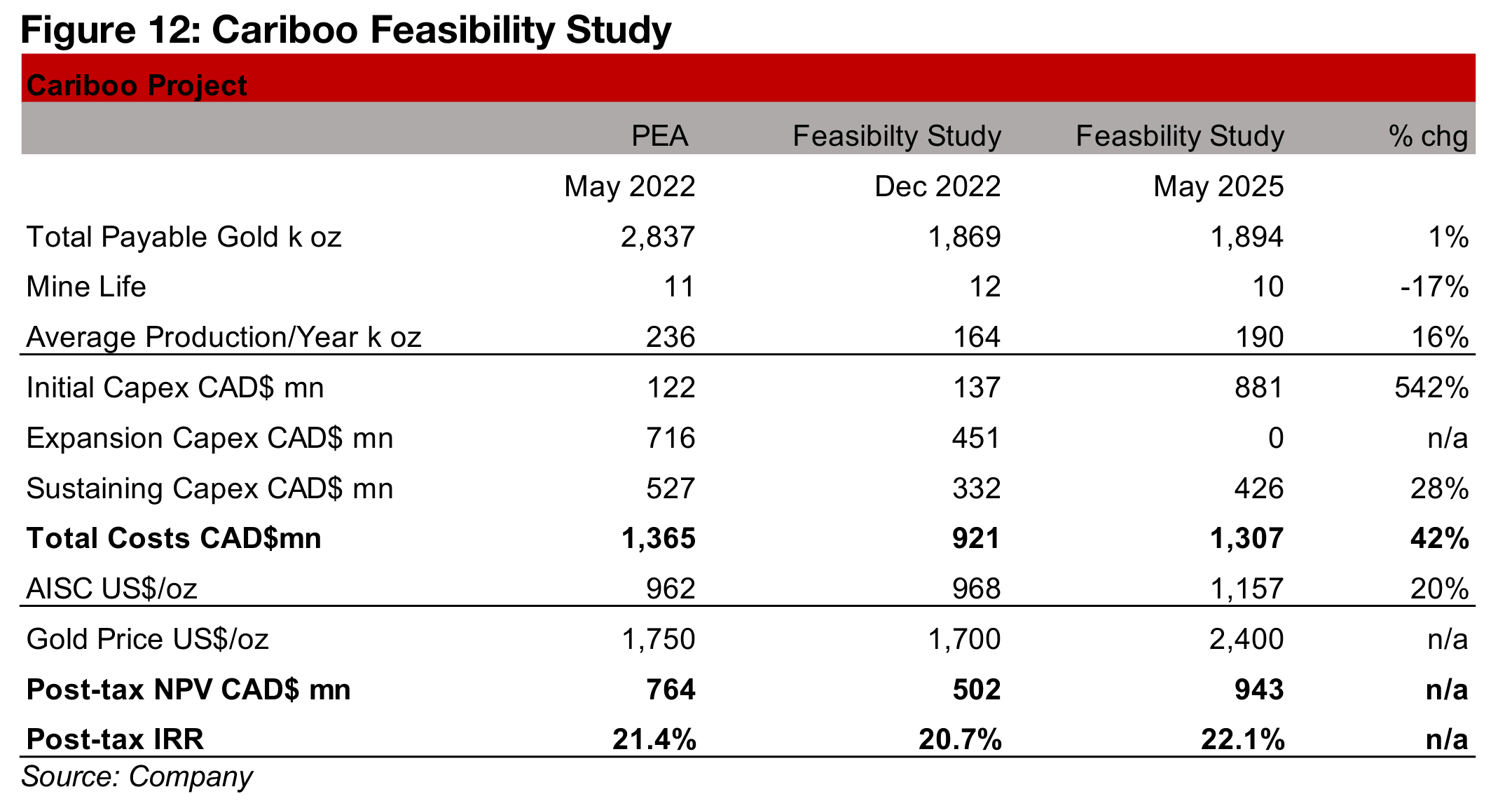

Updated Cariboo FS shows rise in NPV, initial capex, and gold price

The updated Cariboo Feasibility Study (FS) from Osisko Development included a considerable rise in the NPV for the project to CAD$943mn, up from CAD$502mn in the FS from December 2020 (Figure 12). Total payable gold for the project rose just 1% to 1,894, with the average output up 16% to 190k oz/year on a reduction in the years of operation from 12 to 10 years. One of the largest changes was an increase in the initial capex to CAD$881mn by over five times to just CAD$137mn. However, much of this was a shift of the expansion capex from the Dec 2022 FS to initial capex in the May 2025 FS. While the AISC also rose 20% to US$1,157/oz from US$968/oz these increase in costs were more than offset by the rise in the gold price assumption to an average US$2,400/oz. Given a current gold price that could be verging on US$1,000/oz above this estimate, it seems that this long-term average is achievable.

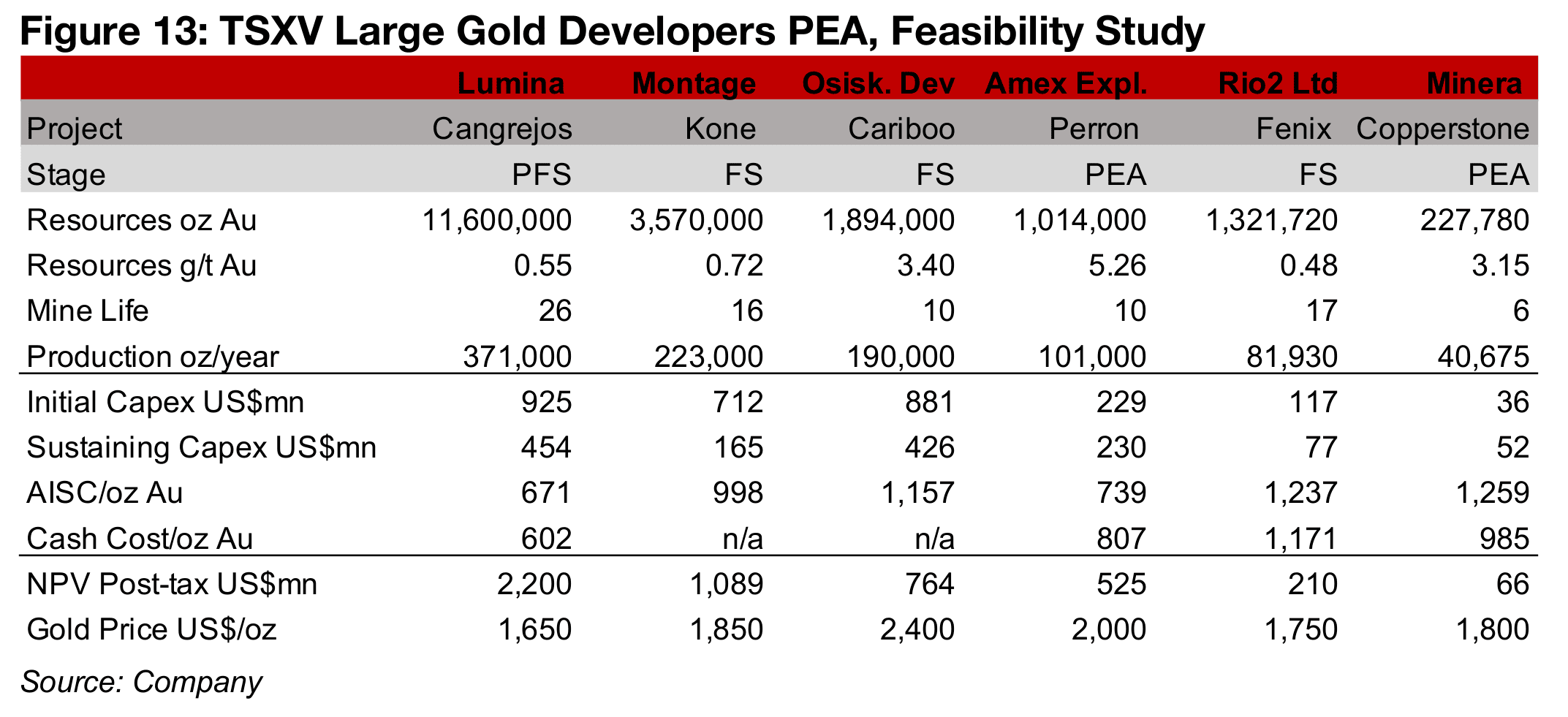

The PFS puts Cariboo toward the middle of the projects of the TSXV gold developers,

with its 1.9mn oz Au well below Lumina’s Cangrejos at 11.6mn and Montage’s Kone

at 3.57 mn oz, but above Rio’s Fenix at 1.3 mn oz, Amex’s Perron at 1.0mn oz and

Minera Alamos’ Copperstone at 0.3mn oz (Figure 13). However, CMOC has

announced recently that it would acquire Lumina, and Montage Gold will soon to list

the TSX. This will shift the Cariboo project to the largest of the TSXV development

stage gold projects in terms of resource size.

The grade of the project is reasonably high, at 3.40 g/t Au, with the grades for Lumina,

Montage and Rio2’s projects far lower at just 0.55 g/t Au, 0.72 g/t Au and 0.48 g/t Au.

Only Amex’s Perron has a higher grade, at 5.26 g/t Au, with Minera’s Copperstone

similar to Cariboo at 3.15 g/t Au. The Cariboo project stands out as reasonably high

cost, with a high initial capex given its size, at nearly the same level Lumina, which

has a six times larger resource, and high AISC at 1,157/oz. The post-tax NPV for

Cariboo is US$764mn, although this is not wholly comparable with the other projects.

This is because the Cariboo Feasibility Study is the newest of the group and includes

a far higher gold price assumption that the other projects at US$2,400/oz.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.