November 27, 2023

TSXV Valuations for Lithium Slide, for Uranium Rise

Author - Ben McGregor

Gold breaks through key level for second time in a month

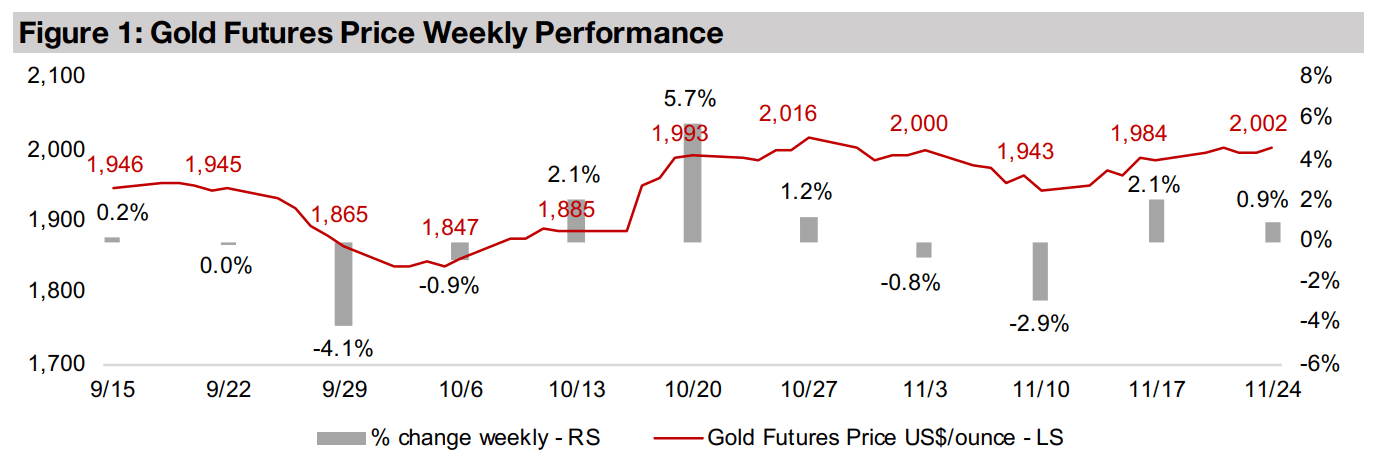

Gold rose 0.9% to US$2,002/oz, breaking through the key US$2,000/oz level for the second time in just under a month, in a subdued week for economic data, with investors adding some protection as the major risk-on rally in equities continued.

TSXV valuations for lithium easing but for uranium rising

This week we look at price to book valuations for the larger cap TSXV lithium stocks, which have declined this year on a plunge in the sector’s metal price, and for the uranium stocks, with multiples at high levels on the gain in the underlying metal.

TSXV Valuations for Lithium Slide, for Uranium Rise

Gold rose 0.9% to US$2,002/oz, breaching the key US$2,000/oz level for the second

time in just a month, as the flow of economic news for the week was relatively

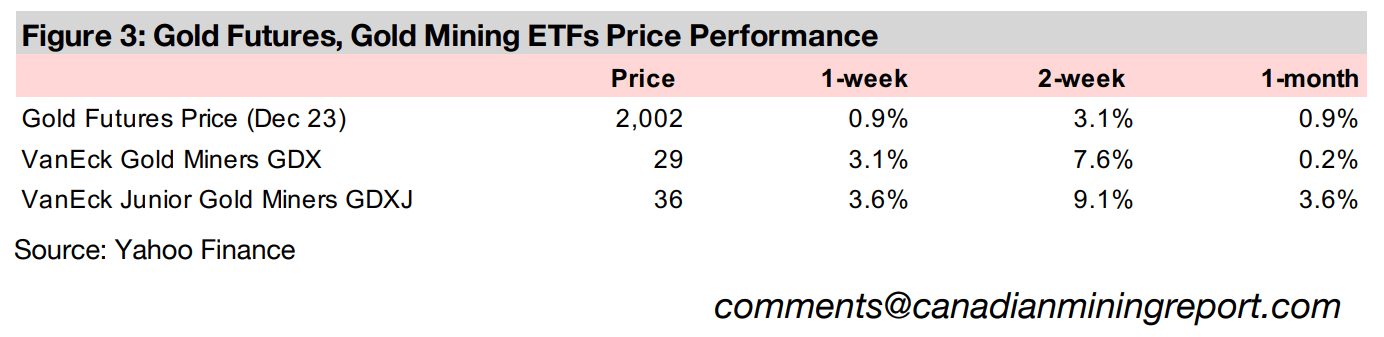

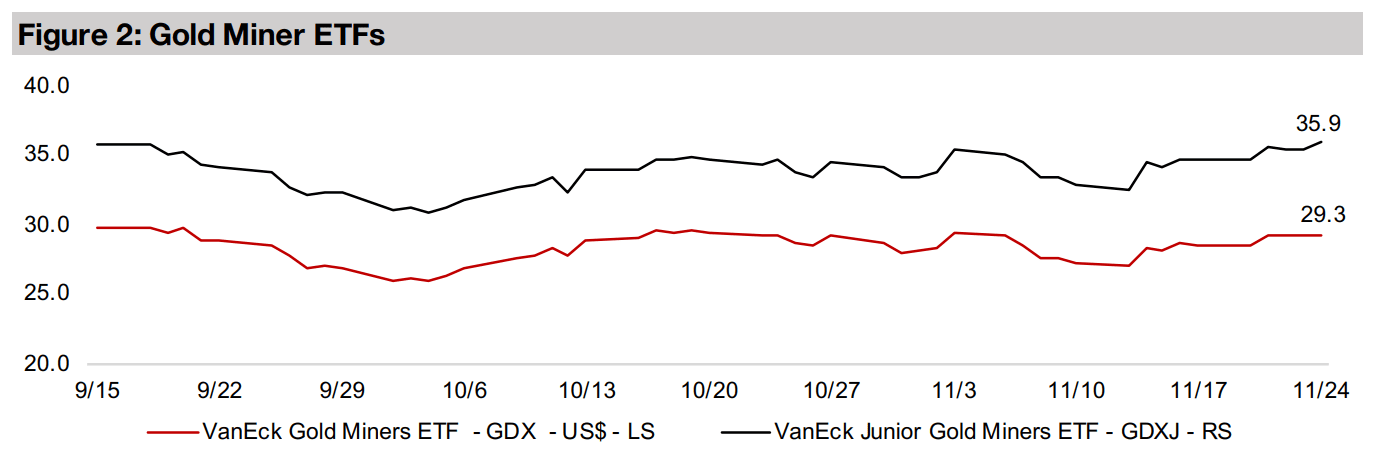

subdued. Gold stocks gained, with the GDX ETF of producing miners up 3.1% versus

a 1.1% rise in the S&P 500 and the GDXJ ETF of junior miners increasing 3.6% versus

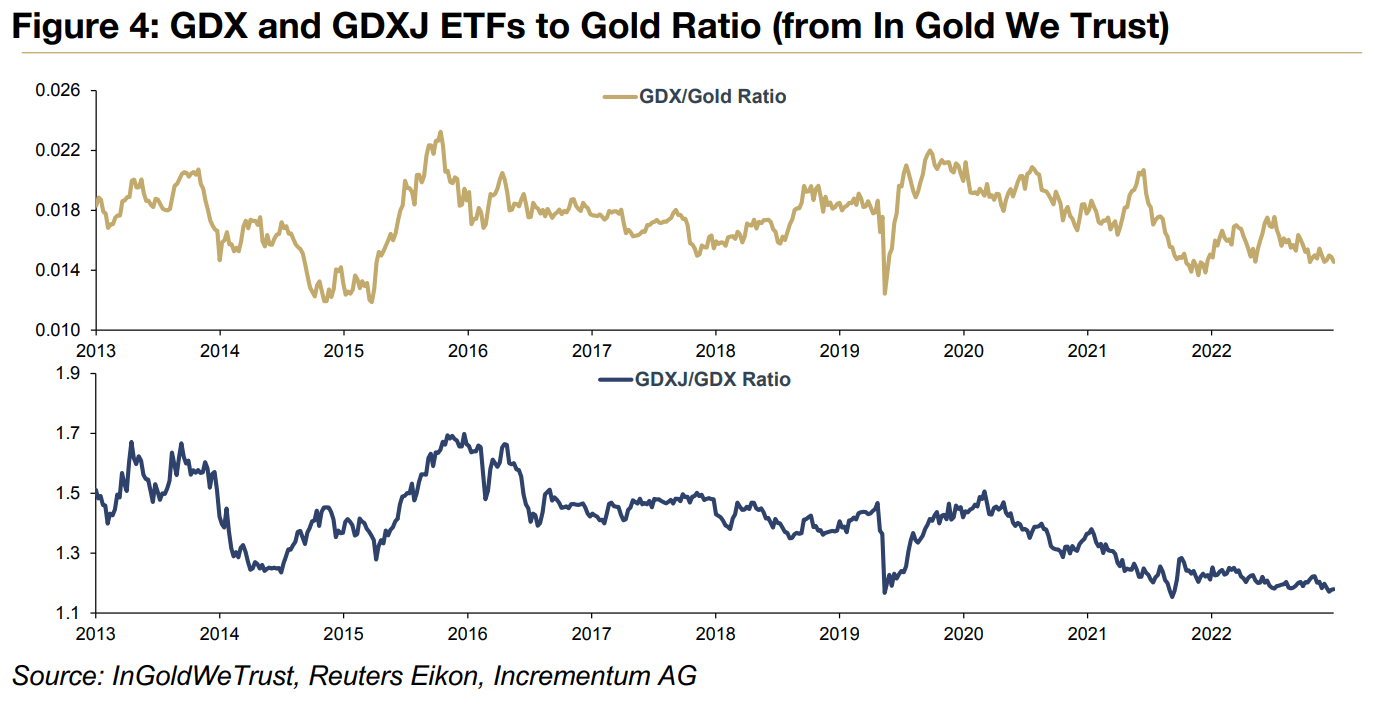

the 1.3% rise in the Russell 2000. The rise in gold this year has not been met with a

commensurate rise in the GDX and GDXJ, and the ratio of these ETFs to the

underlying metals has trended down overall this year (Figure 4).

This is part of a longer-term down trend that started after the peak of the gold miner

boom in 2020, when a surging gold price was accompanied by a jump in gold stocks.

While gold has held up reasonably well since, gold stocks have declined, pushing the

GDX to gold ratio down to just moderately above the 2014-2015 lows of the past

decade while the GDXJ to gold ratio is actually below its 2014 trough. This is in

keeping with a number of indicators we have looked at in recent weeks showing that

both gold and gold stocks are trading towards the bottom of historical ranges.

Valuations for TSXV larger cap lithium stocks decline on plunging metal price

Continuing our series on valuations for larger cap TSXV stocks, this week we look the

changes in price to book (P/B) for the lithium and uranium sectors in recent years.

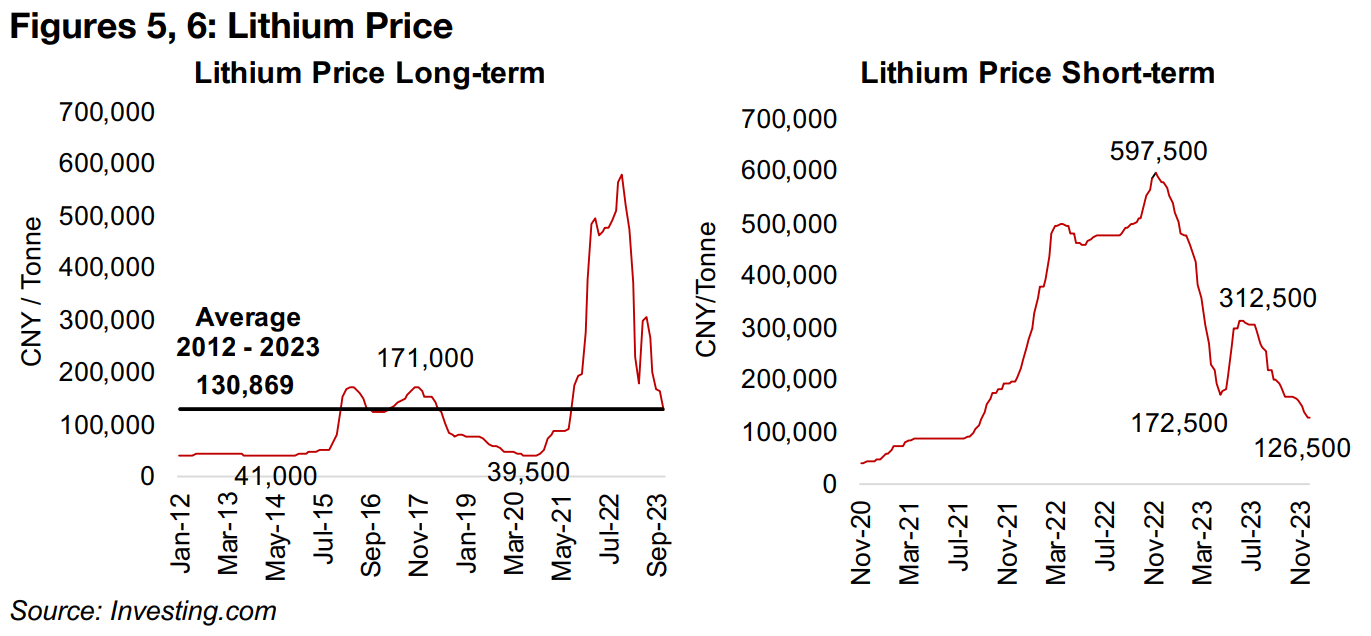

The P/B multiples for the lithium sector have dropped considerably in 2023 on a

plummeting metal price, down from a high of CNY597,500/tonne peak in November

2022 to just CNY126,500/tonne currently (Figures 5, 6). The lithium price surge in

2021 in 2022 was mainly driven by a rise in electric vehicle demand far above

expectations, which overwhelmed the capacity for lithium chemical production.

With the majority of this capacity in China, the supply constraints were exacerbated

by lockdowns in the country. However, the lithium price has retreated with lockdowns

long over, significant new lithium chemical production having come online in China in

2023, and EV demand starting to cool. The collapse of this bubble can mask what is

still a strong underlying secular trend, with the price only having retreated to near its

three-year average of CNY 130,869/tonne average from 2012-2023, and up three

times from just CNY39,500/tonne in mid-2020.

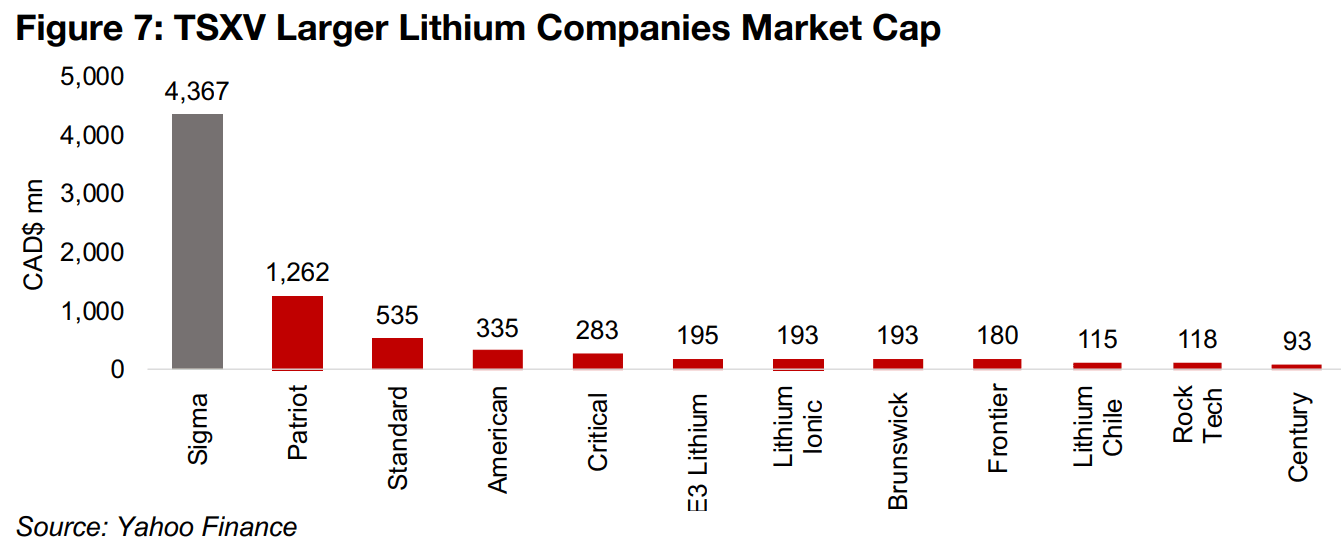

The decline in the lithium price decline has brought down the aggregate P/B valuation for the largest market cap TSXV lithium companies, including Sigma Lithium, Patriot Battery Metals, Standard Lithium, American Lithium, Critical Elements Lithium, E3 Lithium, Lithium Ionic, Brunswick Exploration, Rock Tech Lithium and Century Lithium (Figure 7). One issue with this aggregate is the heavy weighting of Sigma, with a market cap larger than the rest of the group combined. In Figure 8 we exclude Sigma so that it does not overshadow what is occurring in the rest of the sector.

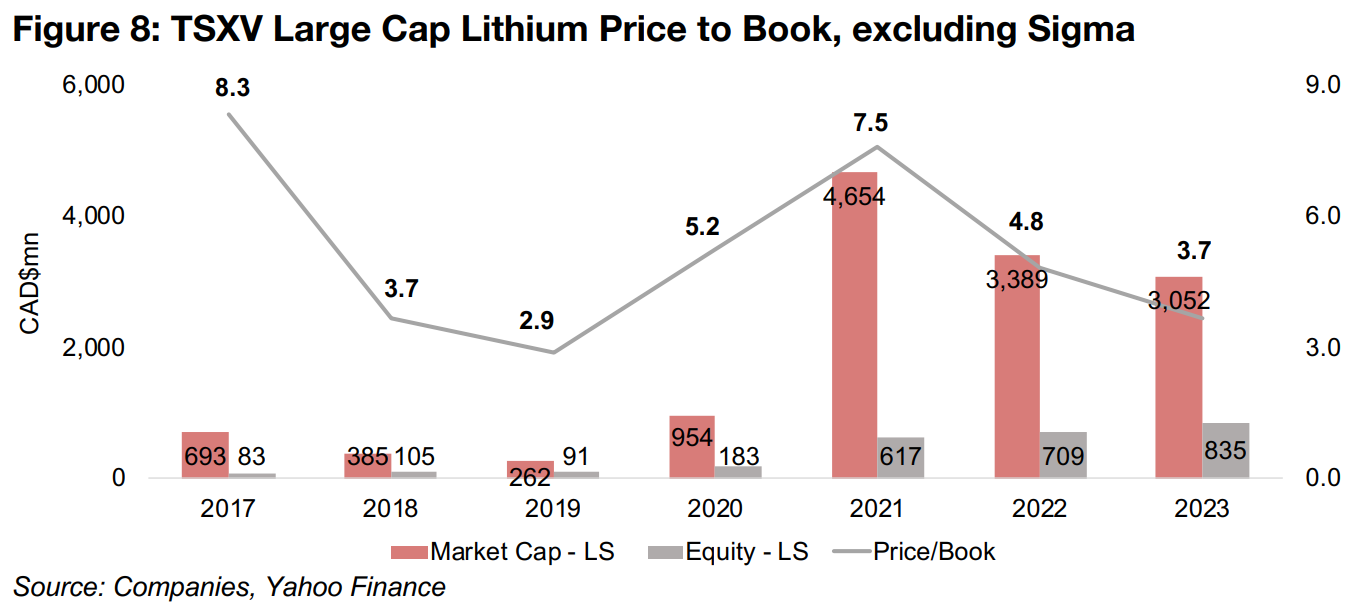

The P/B reached as high as 7.5x in 2021, but dropped to 4.8x in 2022, and further to

3.7x in 2023, the same level as 2017. However, the peak multiple for the period is

interestingly not in 2021, but rather 2017, at 8.3x, prior to the EV boom. Including

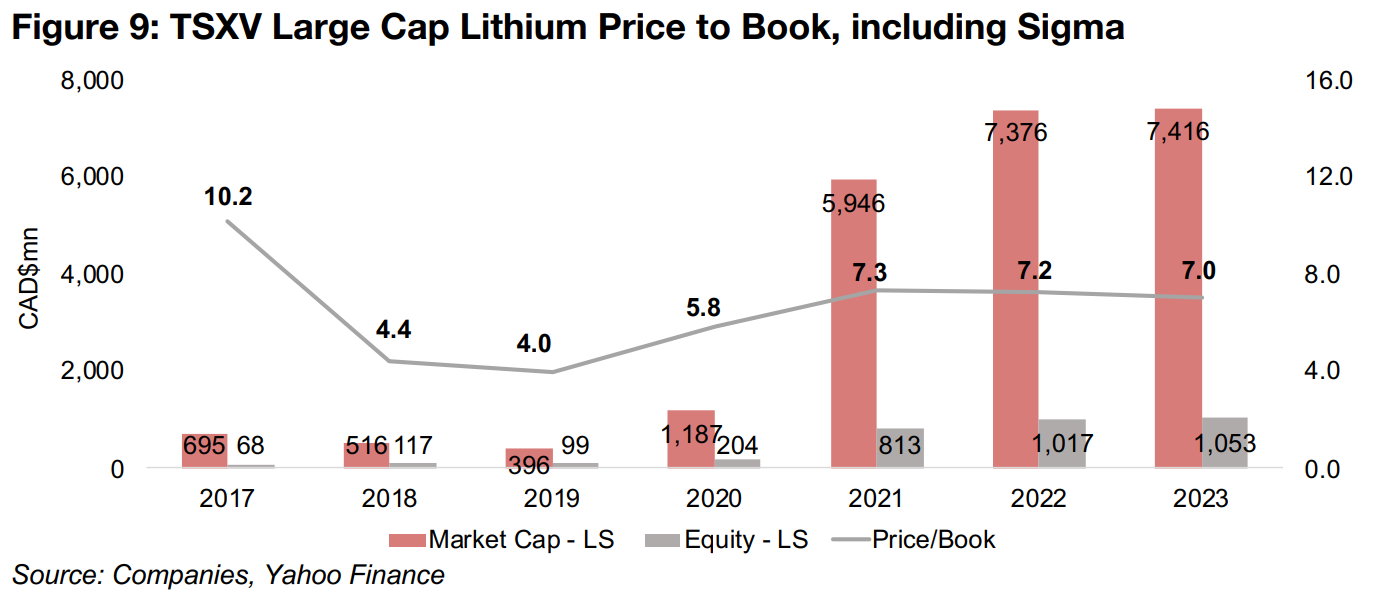

Sigma in Figure 9 shows a considerably different picture, with the P/B multiples for

the aggregate holding just above 7.0x for the past three years, although again the

peak multiple is actually in 2017, not 2021, at 10.2x.

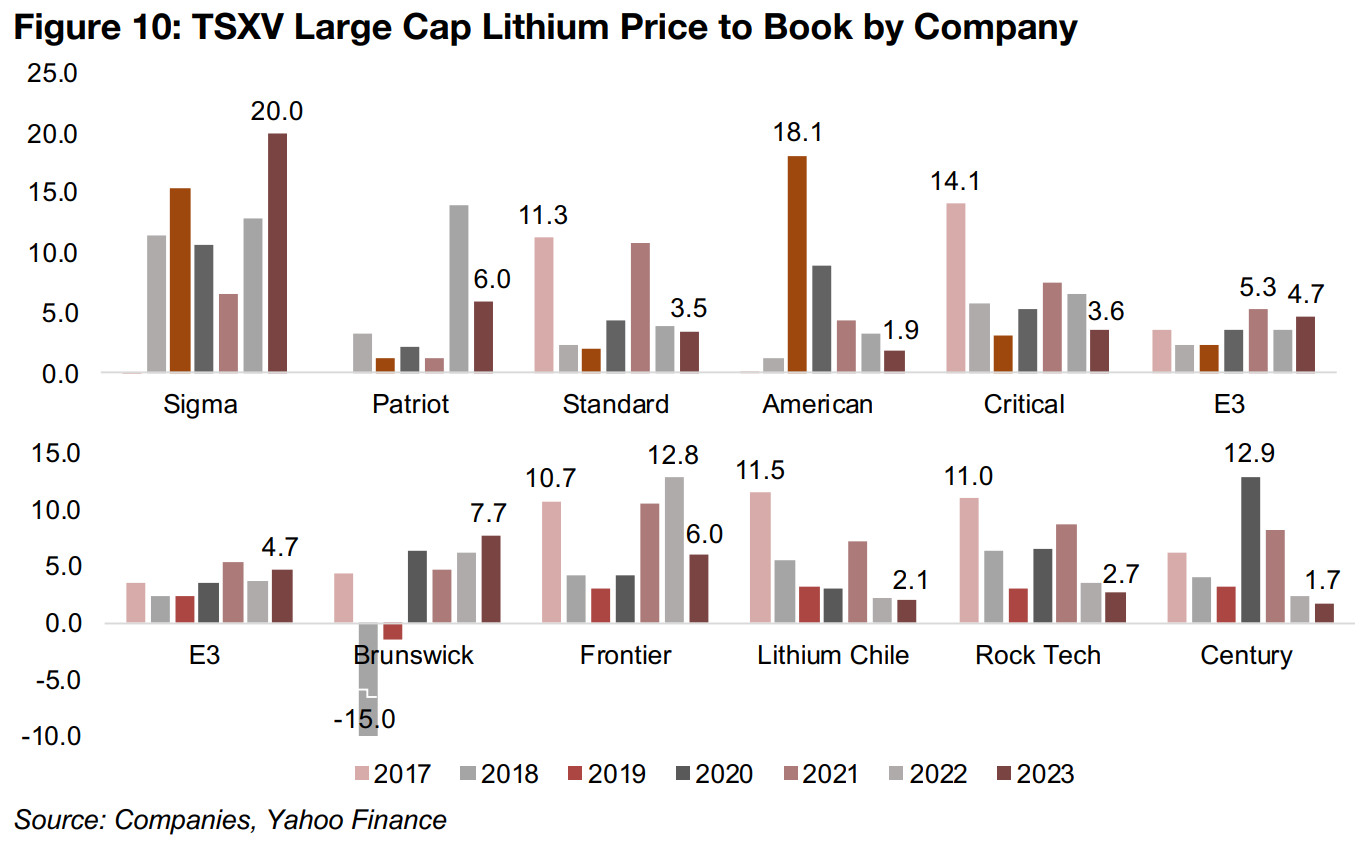

Figure 10 shows the price to book multiples for the individual companies, with Sigma

Lithium remaining generally above the group since 2017, and reaching a peak 20.0x

this year, also the highest multiple of any of the companies over the past seven years.

Several companies had their peak or near peak P/Bs in 2017, including Standard,

Critical Elements, Frontier, Lithium Chile and Rock Tech, and Sigma also had a high

multiple that year, explaining the peak P/B for the group in that year.

Valuations for TSXV larger cap uranium stocks rise on surging metal price

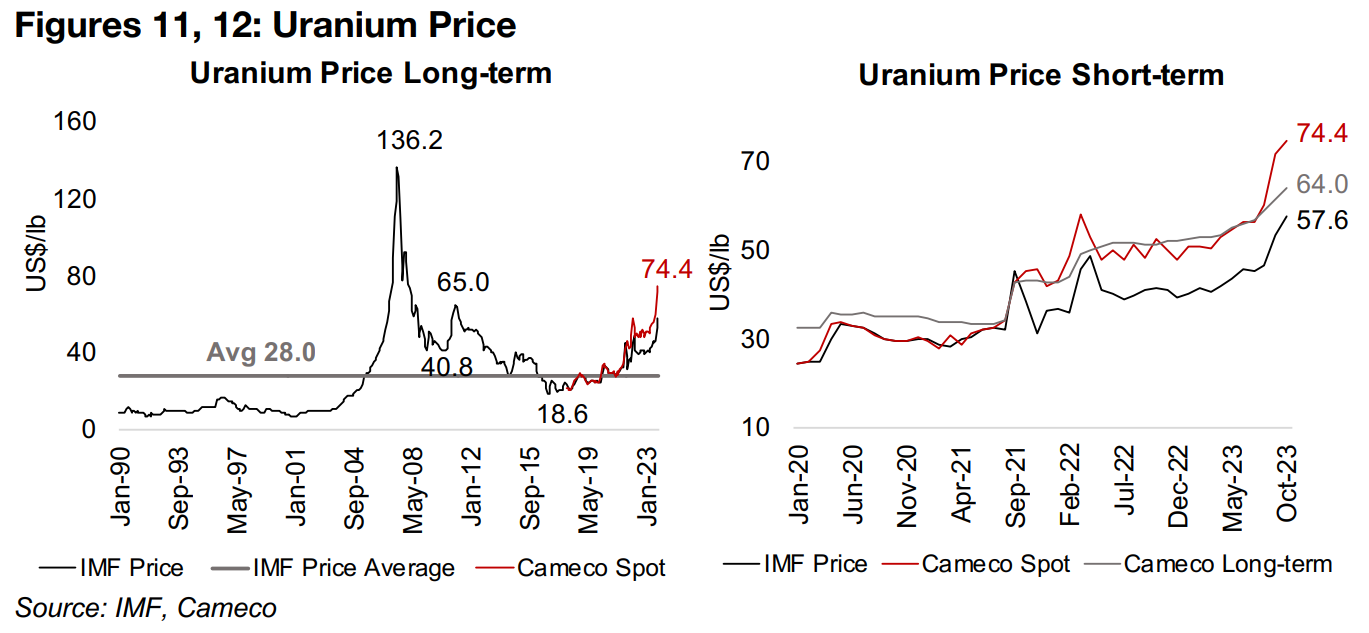

In contrast to lithium, the uranium price has surged in 2023, and more than doubled over three years, from US$30/lb in 2020 to US$74.4/lb, based Cameco’s spot price (Figures 11, 12). The price is now above a US$65/lb cyclical high reached in early 2011 before Japan’s Fukushima disaster drove a major pullback in global support for the industry, sending the price plummeting to a low of US$18.6/lb in November 2016. However, it is only at about half the all-time high of US$136.4/lb hit in June 2007, when the flooding of a major Canadian mine caused uranium supply concerns.

While the recent rise in uranium will have a cyclical component to it, the gain has mainly been driven by longer-term secular shift towards increased acceptance of the use of uranium-driven nuclear power as a part of sustainable energy plans. This has seen even green political parties in Europe, historically in opposition to nuclear power, start to become more accepting of the industry. Even the government of Japan, previously very cautious on nuclear expansion after the Fukushima disaster, has recently shifted to a policy more supportive of the industry.

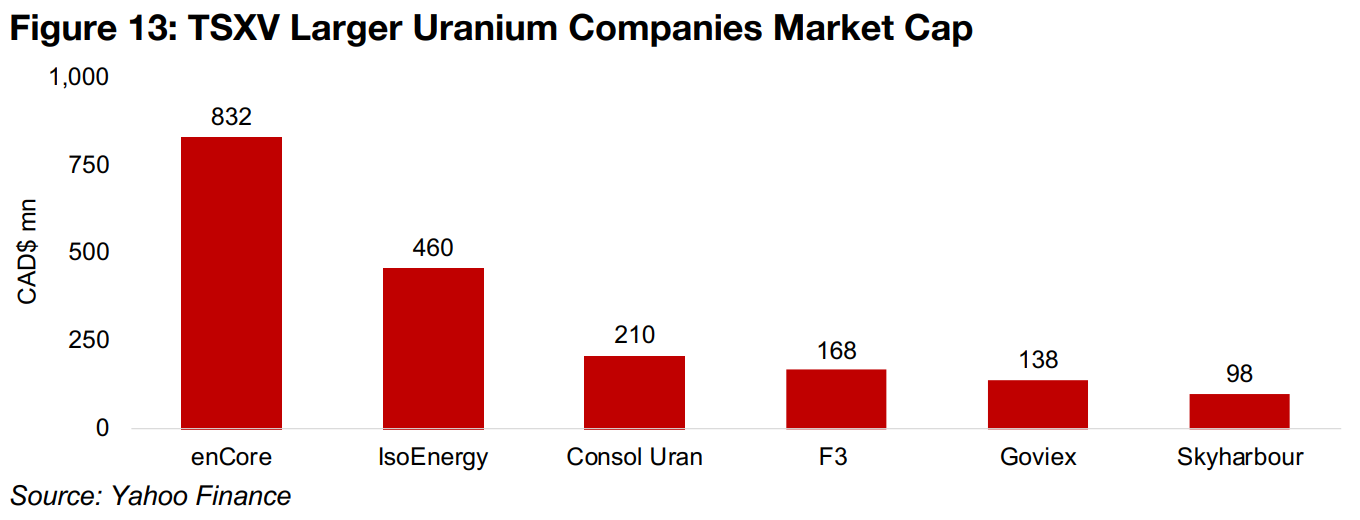

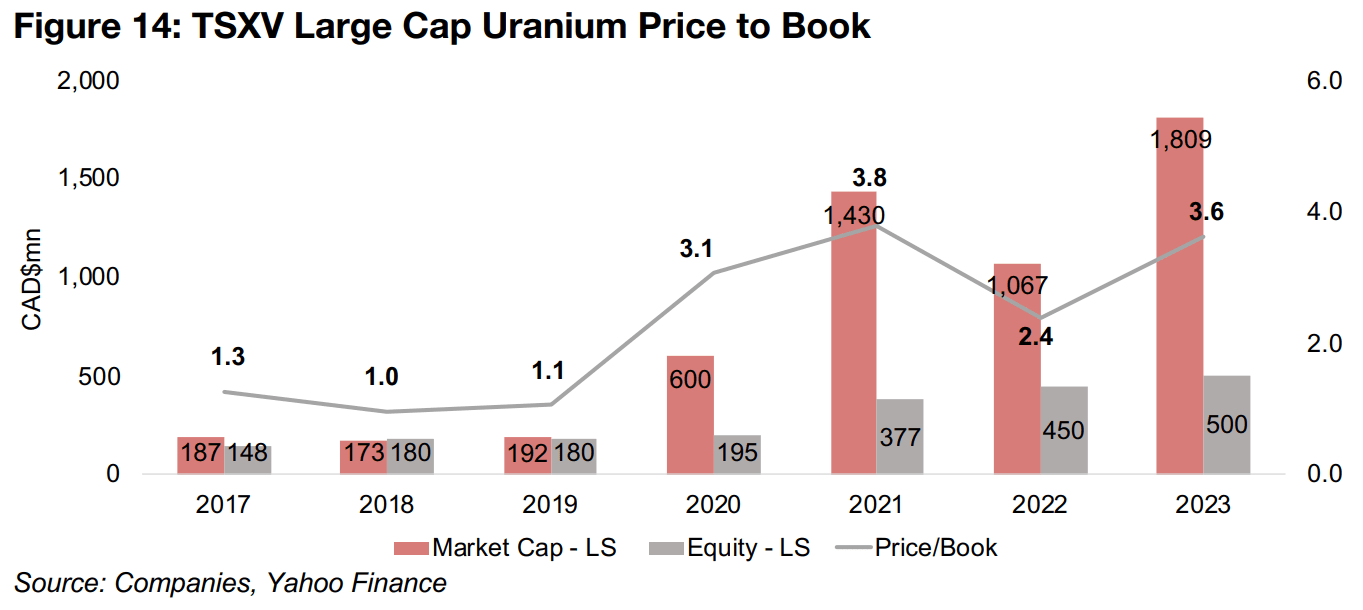

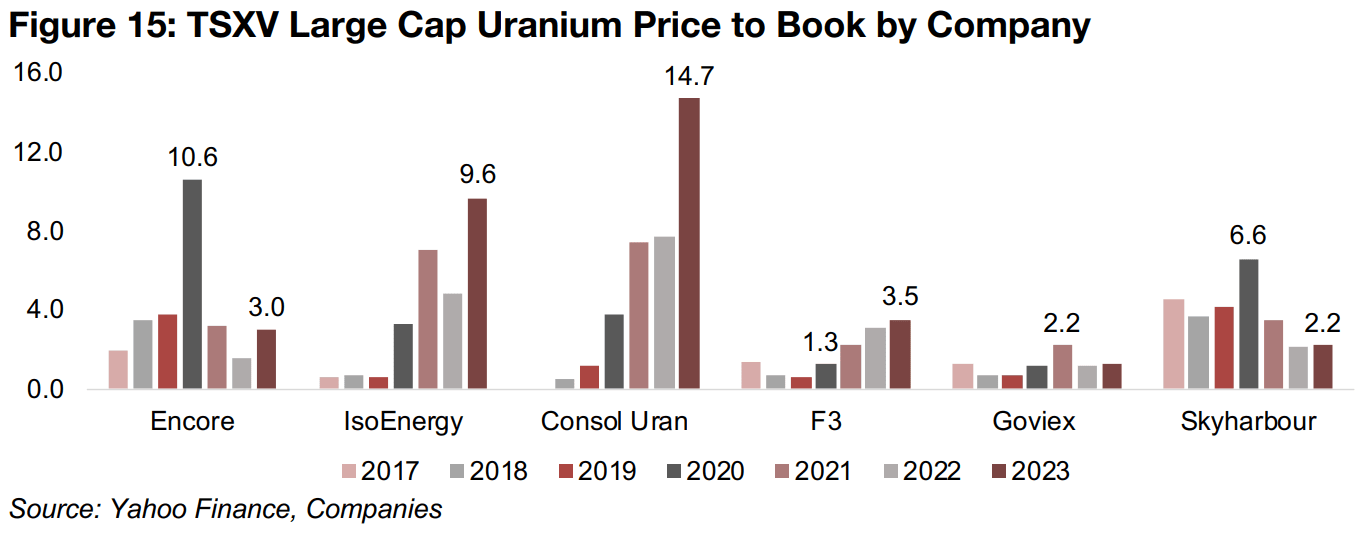

There is a relatively small group of larger TSXV uranium stocks, including enCore Energy, IsoEnergy, Consolidated Uranium, F3 Uranium, Goviex Uranium and Skyharbour Resources (Figure 13). The price to book of the group was low from 2017 to 2019, at just over 1.0x, but started to increase in 2020, reaching 3.1x, and peaked at 3.8x in 2021, with the rise in the uranium price and broader upswing in TSXV mining stocks (Figure 14). While the P/B dropped to 2.4x in 2022, it has rebounded to 3.6x in 2023, near its previous highs, driven by the jump in the uranium price.

The P/Bs for half the group, including IsoEnergy, Consolidated Uranium and F3 Uranium have peaked this year, at 9.6x, 14.7x and 3.5x, respectively, with the latter two seeing high multiples for the past three years (Figure 15). Encore was a major driver of the high 2020 sector multiple, with its P/B spiking that year to 10.6x, and it has had the largest market cap of the group since 2021. Skyharbour, with the smallest market cap of the group, also had a peak multiple in 2020 at 6.6x, but this has declined to 2.2x in 2023. Both F3 Uranium and Goviex have consistently had relatively low multiples versus the group.

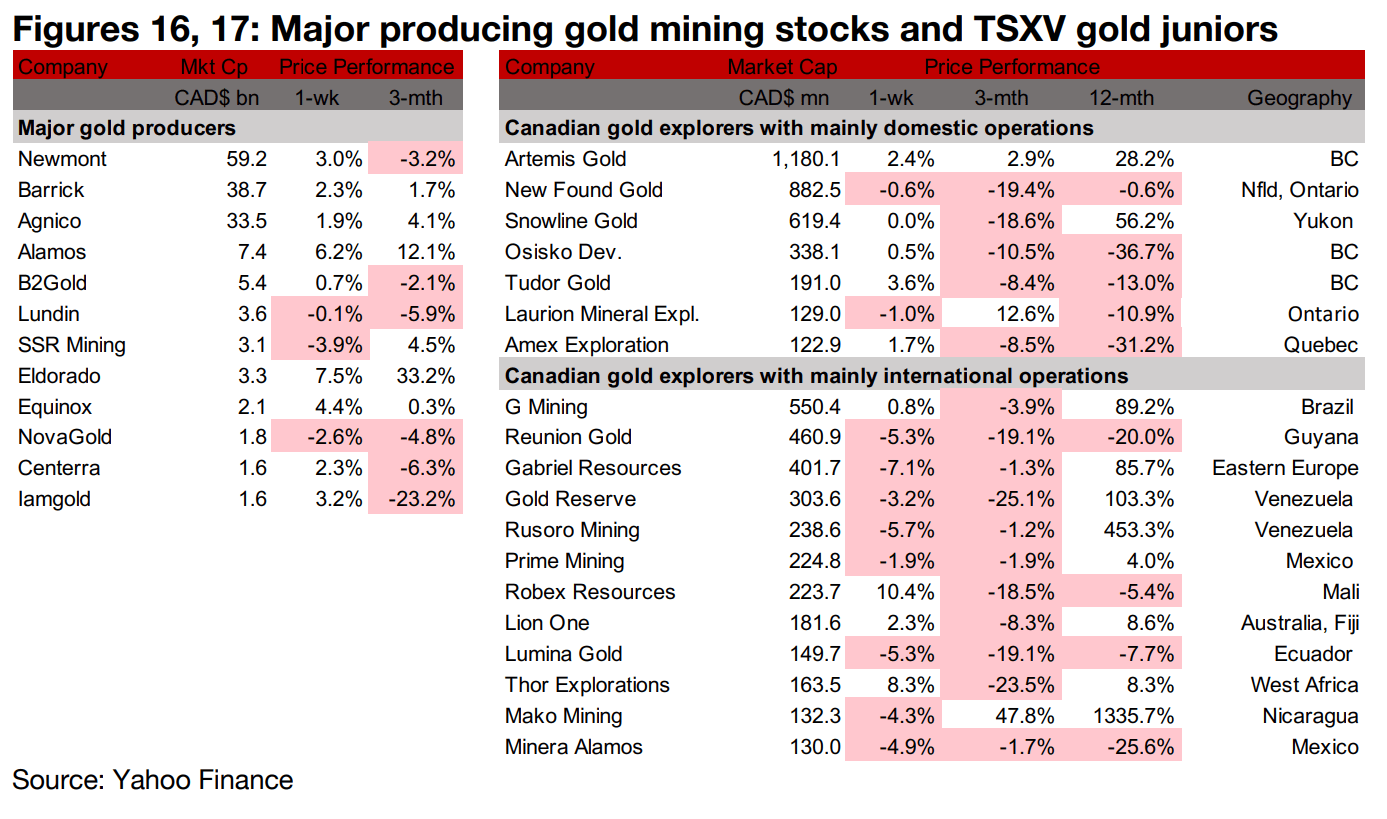

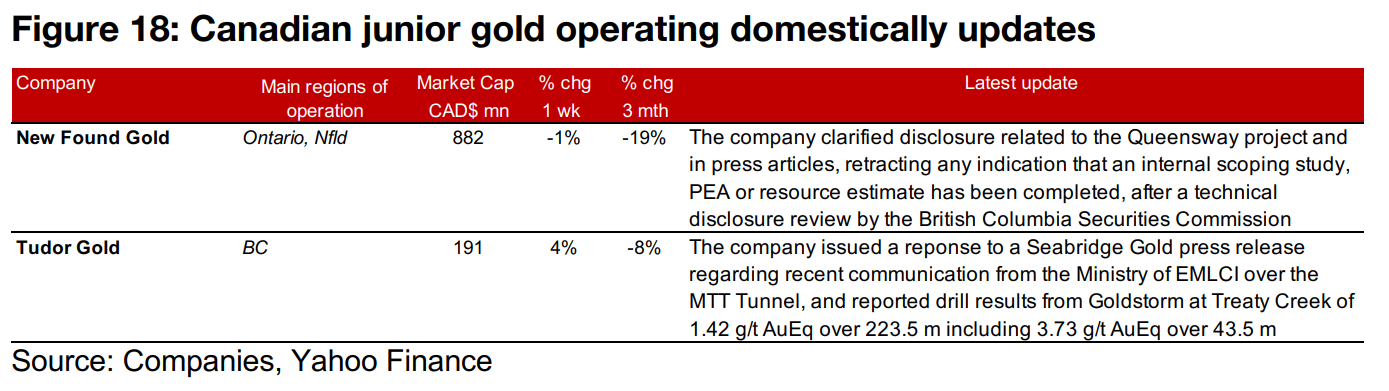

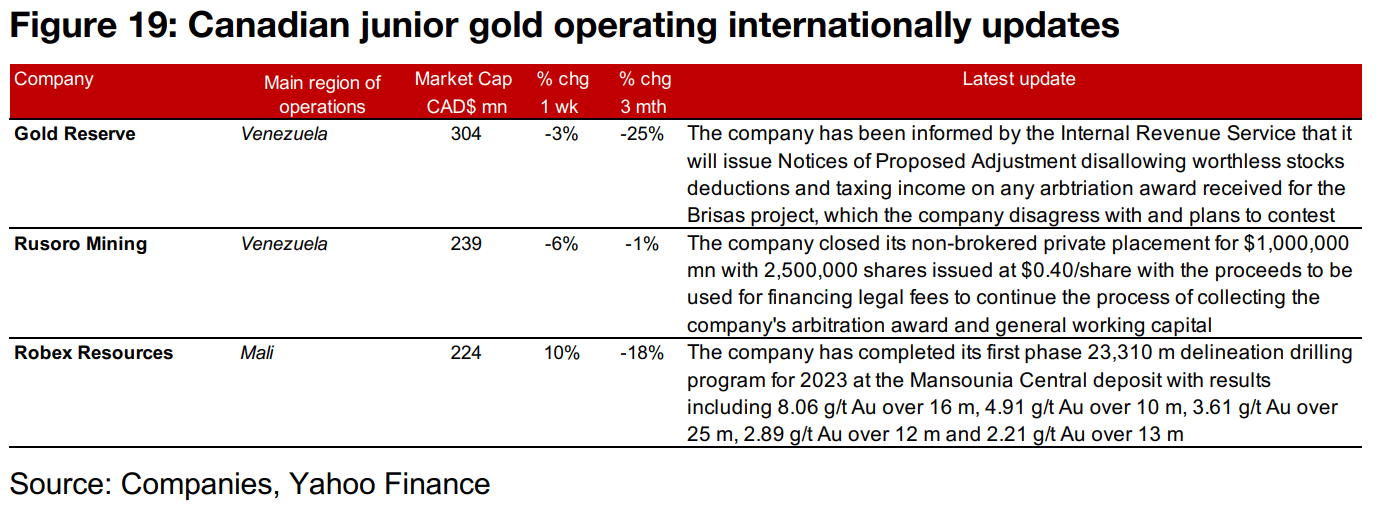

Major gold producers mostly rise while TSXV larger cap gold mixed

The gold producers were mostly up and TSXV larger cap gold was mixed as the metal and equity markets increased (Figures 16, 17). For the TSXV gold companies operating domestically, New Found Gold clarified disclosure related to the Queensway Project and Tudor Gold issued a response to a Seabridge Gold press release regarding communication from the Ministry of EMLCI over the MTT Tunnel (Figure 18). For the TSXV gold companies operating internationally, Gold Reserve was informed of IRS proposed adjustments related to potential payments for the Brisas project which it plans to contest, Rusoro Mining closed a $1.0mn private placement and Robex Resources reported drill results from the Mansounia Central deposit. (Figure 19).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.